Industrial Metrology Market Size

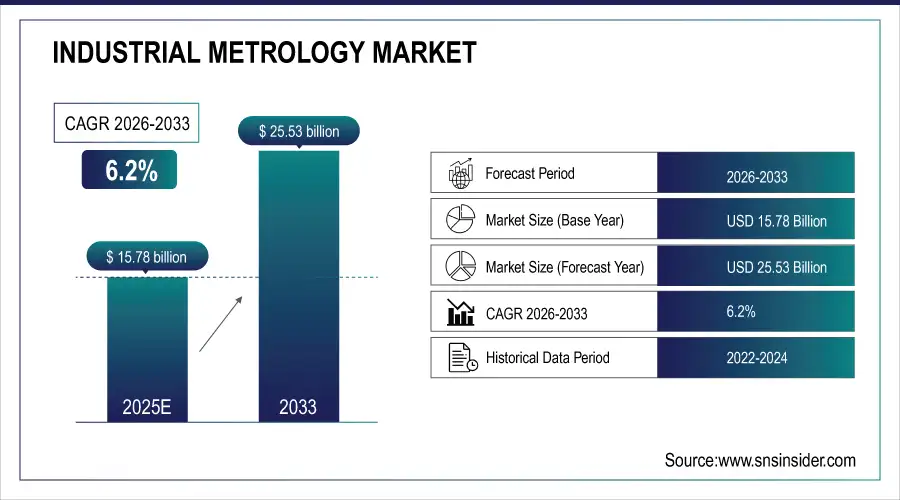

The Industrial Metrology Market size was valued at USD 15.78 billion in 2025E and is expected to reach USD 25.53 billion by 2033 and grow at a CAGR of 6.2% over the forecast period 2026-2033

The industrial metrology market is growing at an increasing rate because of the high demand for accurate measurements and quality control in various industries. The industrial metrology is directly linked to the application of measurement sciences for the process of manufacturing and so on. The rising number of stringently controlled markets, such as automotive, aerospace, and defense, predisposes the use of innovative metrology equipment is mainly driving the market. The growing popularity of electric vehicles enhances the demand for complex battery systems, which aggravates the growth of the niche for specialized metrology solutions.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 15.78 Billion

-

Market Size by 2033 USD 25.53 Billion

-

CAGR of 6.2% From 2026 to 2033

-

Base Year 2024

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Get More Information on Industrial Metrology Market - Request Sample Report

Key Industrial Metrology Market Trends:

-

Growing complexity in manufacturing is driving demand for precise industrial metrology to ensure quality and safety.

-

Adoption of Coordinate Measuring Machines (CMMs) and 3D scanning technologies for accurate component measurement and reproduction.

-

Increased automation in production necessitates precise calibration of robots and accurate tool positioning.

-

Integration of cyber-physical systems and IoT in Industry 4.0 relies on high-accuracy measurements for data collection.

-

Predictive maintenance and production optimization are enabled by metrology-driven sensor data, reducing downtime and improving efficiency.

The U.S. Industrial Metrology market size was valued at an estimated USD 6.05 billion in 2025 and is projected to reach USD 9.75 billion by 2033, growing at a CAGR of 5.9% over the forecast period 2026–2033. Market growth is driven by increasing demand for precision measurement and quality control across manufacturing sectors such as automotive, aerospace, electronics, and heavy machinery. Rising adoption of advanced metrology solutions, including coordinate measuring machines (CMMs), optical digitizers, and 3D scanning systems, is accelerating market expansion. Additionally, advancements in automation, integration of metrology with Industry 4.0 initiatives, and growing focus on reducing production errors and improving product quality further support the steady growth outlook of the U.S. industrial metrology market during the forecast period.

Industrial Metrology Market Growth Drivers:

- Growing Emphasis on Quality Control to Meet the Industry Standards

Modern manufacturing processes are becoming more complicated with an increased focus on quality and safety. For this reason, modern production requires proper quality control to ensure the efficiency of the process. In this way, industrial metrology is the framework allowing for exact measurement with the help of proper tools and methods. As it provides manufacturers with an exact image of the degree to which a product does not meet the set standards, it helps to define problems and eliminate them in the early steps of production. This ensures reduced waste and rework needs, as well as negligible costs associated with defective products. For instance, in the automotive industry, it ensures exact component fit and function for engines, transmissions, and safety systems. Even minor deviations from the parameters may lead to a decrease in safety or malfunction.

-

Rising demand for Industry 4.0 to Automate the Manufacturing processes

Another important driver for the manufacturing tendency towards automation is the industrial metrology required for this process. It implies measurements and measuring objects in a controlled environment to achieve a certain goal. Thus, there is a necessity for applying the appropriate tools for these purposes. Industrial metrology demands are driven by the need for the proper calibration of robots, the purpose of tool positioning accurately, and the assessment of the performance of a machine. These objects should be within close tolerances allowing their automated uses for ensuring the production’s repeatability and predictability as well as facilitating the minimum human presence and engagement. In addition, cyber-physical systems and the IoT implementation for Industry 4.0 require accurate measurements.

Industrial Metrology Market Restraints:

-

Complexity of Technology and Limited Technical Knowledge for Integration

Integration of industrial metrology systems with the existing manufacturing infrastructure and software systems can be quite challenging as both coordinate measurement systems and optical scanning systems frequently generate a large amount of data. To ensure that it is integrated seamlessly into the existing data platform and does not create data silos, companies require data management expertise. At the same time, compatibility issues may arise when integrating metrology equipment with different manufacturing software or hardware systems. This, in turn, requires customization or installation of additional equipment which raises the cost of the equipment and makes it more difficult to implement. Furthermore, the operation of advanced metrology equipment frequently requires specific expertise and training. The biggest issue is the lack of a qualified workforce or workers who can operate new equipment. As a result, equipment implementation is slowed down, it takes place in a highly inefficient manner, and companies take high risks of errors.

Industrial Metrology Market Segment Analysis:

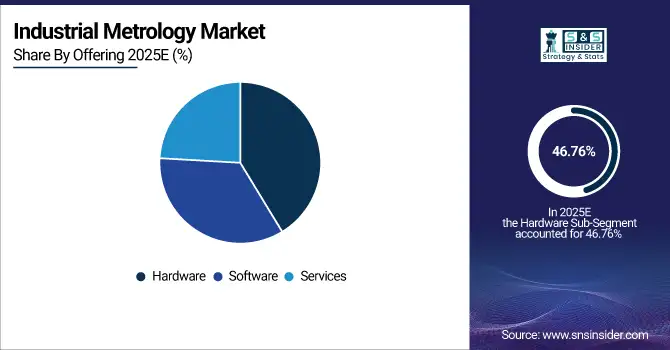

By Offering

The hardware segment is continuously rising with a market share of more than 46.76% in 2025E. Hardware such as coordinate measuring machines, optical digitizers and scanners, and X-ray and computed tomography systems provide increased precision and accuracy in surface separations, which enhances the quality of a product. The demand for the hardware segment in the industrial metrology market is also driven by the increasing adoption of 3D metrology equipment for quality control and the need for automation in the industry. The hardware segment plays a critical role in automated manufacturing processes that demand high quality and reliability.

By Application

The quality control & inspection segment became the dominant segment with a market share of around 40.16% in the Industrial Metrology Market in 2025E. Due to the need to increase production and achieve precision, the demand for high-precision metrology and inline inspection has expanded over numerous industries. Growing competitiveness and the desire to enhance product safety are contributing factors that have aided in the adoption of quality control and inspection systems in numerous businesses like automotive, aerospace & defense, and semiconductors. In these businesses, maintaining and boosting a product’s quality is required.

By End-User

The automotive segment is a dominating segment with a market share of more than 49.56% in 2025E. Currently, automotive makers are using 3D technologies and optical inspection methods. Production groups scan a part or sub-assembly and receive an accurate picture of the source of quality concerns with 3D measuring technologies, making it very beneficial to the automotive industry. As a result, even at the earliest stages of the design process, including product development, reverse engineering, as well as quality control, and assurance, may benefit from 3D scanning solutions. In the automobile sector, the most popular industrial metrology tool is the CMM, which is especially popular for quality control or inspection-oriented applications.

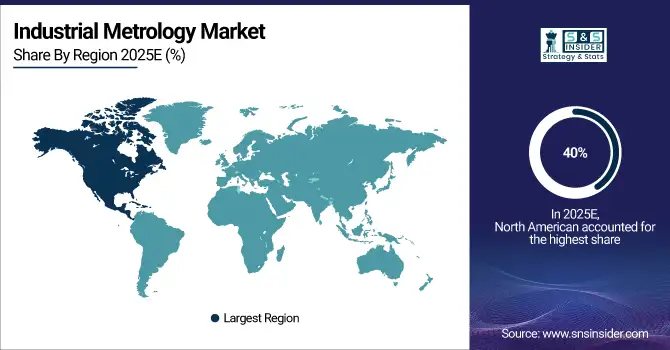

Industrial Metrology Market Regional Analysis:

North America Industrial Metrology Market Insights

The North American industrial metrology market has dominated in 2025E with a market share of around 46.10%. There is an increase in the demand for automation through consistent and long-term application of industrial metrology in the North American region. Besides, the U.S. industrial metrology market recorded the largest share in the industrial profile, while the Canadian industrial metrology market was the leading and fastest-growing market within the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia Pacific Industrial Metrology Market Insights

In the Asia Pacific region, there is an increasing adoption and application of industrial metrology. The first reason is the high rate of industrialization and manufacturing growth in major producers of manufacturing products mainly in China, India, Japan, South Korea, and Taiwan. As these nations and many more other Asian nations continue to adopt additional automation in the manufacturing sector, a need to develop accurate means and appropriate tools and systems of measuring and inspection for maintaining or preventing the production and supply of substandard products as per the world market requirements.

Europe Industrial Metrology Market Insights

The European industrial metrology market is expanding due to advanced manufacturing sectors, rising automation, and stringent quality standards. Adoption of 3D scanning, CMMs, and precision measurement tools in automotive, aerospace, and electronics industries drives growth. Government support for Industry 4.0 initiatives, high R&D investment, and the integration of IoT and cyber-physical systems further strengthen market demand across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Industrial Metrology Market Insights

The LATAM and MEA industrial metrology market is witnessing steady growth driven by industrial modernization, increasing adoption of automated production, and rising focus on quality and safety. Expansion in automotive, aerospace, and electronics sectors, coupled with investments in smart factories and Industry 4.0 technologies, is boosting demand for precision measurement tools and 3D metrology solutions.

Industrial Metrology Market Key Players:

Some of the Industrial Metrology Market Companies are

-

Hexagon

-

Nikon

-

FARO Technologies

-

Carl Zeiss

-

Jenoptik

-

KLA Corporation

-

Renishaw

-

Mitutoyo Corporation

-

KEYENCE CORPORATION

-

Creaform

-

Perceptron

-

Automated Precision Inc.

-

Applied Materials Inc.

-

AccuScan

-

CARMAR Accuracy

-

Baker Hughes

-

Cyberoptics

-

Cairhill

-

ATT Metrology

-

Trimet

Competitive Landscape for Industrial Metrology Market:

Cognex is a leading provider of industrial metrology solutions, offering advanced machine vision systems and barcode readers that ensure precision, quality, and efficiency in manufacturing. Its technologies support automated inspection, measurement, and process control across automotive, electronics, and industrial sectors, driving adoption of Industry 4.0 practices globally.

- In April 2024, Cognex Corporation developed the In-Sight L38 3D Vision Systems. This system is dependent on the combination of AI, 2D, and 3D vision technologies. One of the most important advantages of this system is enhanced training. Another advantage of the In-Sight L38 3D Vision System is that it offers reliable solutions for inspection and measurements due to the inclusion of AI for the identification of features and 3D measurement based on a rule.

Hexagon is a global leader in industrial metrology, providing advanced measurement technologies, 3D scanning solutions, and software for precision manufacturing. Its offerings support quality control, process optimization, and automation across automotive, aerospace, and electronics industries, enabling accurate production, reduced waste, and enhanced efficiency in modern manufacturing environments.

- In March 2024, Hexagon’s Manufacturing Intelligence division developed the SmartScan VR800, a high-productivity structured light scanner. The main advantage associated with this system is that it is fitted with a motorized zoom lens. This lens may be adjusted to provide data with different degrees of resolution and cover a larger part of an item to be measured.

| Report Attributes | Details |

| Market Size in 2025E | USD 15.78 Billion |

| Market Size by 2033 | USD 25.53 Billion |

| CAGR | CAGR of 6.2% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Equipment (Coordinate Measuring Machine (CMM), Optical Digitizer and Scanner (ODS), Measuring Instruments, X-ray and Computed Tomography, Automated Optical Inspection, Form Measurement Equipment, 2D Equipment) • By Application (Quality Control & Inspection, Reverse Engineering, Mapping and Modelling, Others) • By End-User (Aerospace & Defense, Automotive, Semiconductor, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Hexagon, Nikon, FARO Technologies, Carl Zeiss, Jenoptik, KLA Corporation, Renishaw, Mitutoyo Corporation, KEYENCE CORPORATION, Creaform, Perceptron, Automated Precision Inc., Applied Materials Inc., AccuScan, CARMAR Accuracy, Baker Hughes, Cyberoptics, Cairhill, ATT Metrology, Trimet. |