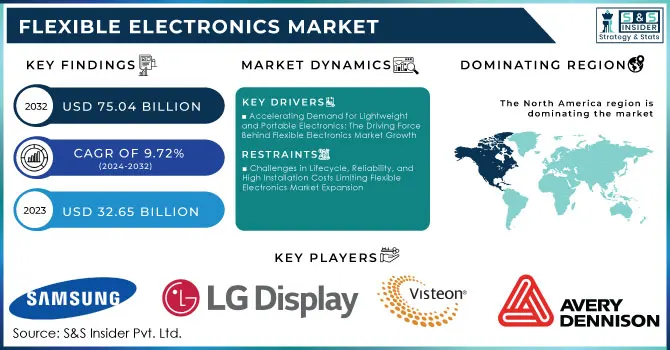

Flexible Electronics Market Size & Overview:

The Flexible Electronics Market Size was valued at USD 32.65 Billion in 2023 and is expected to reach USD 75.04 Billion by 2032 and grow at a CAGR of 9.72% over the forecast period 2024-2032. Flexible electronics market is growing rapidly due to upward trends toward light and portable electronics stimulating demand for more applications of flexible electronics in wearables and smart textiles. Growing consumer electronics businesses, especially tablets and smartphones, pave the way for the widespread uptake of flexible displays thanks to their full flexibility toward design features and functionality improvements.

Get More Information on Flexible Electronics Market - Request Sample Report

Trends of advancements in manufacturing technologies, such as direct printing techniques, roll-to-roll processing techniques, etc., have made production cheaper and more efficient. Therefore, there is a growth in these rates. The increasing interest of people in energy efficiency helped in building up solar cells, which can be used as an integrated surface producing energy from renewable sources.

The adoption of smart technologies in the automotive industry to integrate flexible sensors and displays will also propel the market growth. Healthcare innovation, where the focus has been more on biosensors used for health condition monitoring, is also a critical driver. A combination of technological advancements, how consumers are evolving, and a progressively high need for sustainability in general is fueling strong growth in the flexible electronics market. Sales of flexible OLED displays in the USA reached 62 million units in 2023, with projections indicating an increase to 72 million units in 2024. The growth trajectory of this flexible OLED market appears pretty strong. However, the rise in demand for OLED technology has helped escalate flexibility among smartphone and consumer electronics end-users. Flexible OLED smartphone panels will hold 76% of the total shipments of OLED panels in 2023. Such trends mirror technological advancement and a changing preference of customers toward more flexible display solutions.

Flexible Electronics Market Dynamics

Key Drivers:

-

Accelerating Demand for Lightweight and Portable Electronics: The Driving Force Behind Flexible Electronics Market Growth

Customers are seeking functionality and convenience above all else, while applying this flexibility to a very wide range of uses, from wearables to smart textiles to flexible displays. These innovative products yield multiple benefits to users, enhancing their usability and integration into everyday objects, such as clothing and accessories. This can be more clearly understood by the trend of miniaturization of technology, wherein flexible electronics may be developed to occupy lesser space with an equal performance level. As the evolution of consumer electronics becomes part of the fast lane within the industry, the demand for versatile and compact solutions is bound to continue leading the charge forward in the given market

-

Transformative Manufacturing Innovations is Fueling the Expansion of the Flexible Electronics Market

Advances in manufacturing technologies have emerged as a critical driver of the growth momentum of the flexible electronics market. Techniques related to printing and roll-to-roll processing of the flexible electronic component alone revolutionize the production process, thereby bringing in a different cost model that becomes scalable. The capability for producing high volume with a nearly waste-free material condition brings more efficiency into overall production. The manufacturing complexity further improves the possibility of complex flexible devices at a lower cost, which encourages widespread applications in areas like consumer electronics, automotive, and healthcare. In this context, advancements must be made constantly in the manufacturing capabilities to fulfill the increasingly growing demand for flexible electronics and realize their integration into new applications.

Restrain:

-

Challenges in Lifecycle, Reliability, and High Installation Costs Limiting Flexible Electronics Market Expansion

Flexible materials may wear out after some time, leading to decreased product lifecycles and performance, which are detrimental for some applications. Its installation cost for advanced manufacturing technologies is high, thus limiting its access to smaller companies and new firms that seek to enter the market. This might hinder innovation as well as the speed at which flexible electronics get entered into new sectors.

Flexible Electronics Market Segmentation Overview

By Component

The displays segment held the largest revenue share of more than 54% in 2023 and is expected to witness the highest CAGR over the forecast period. A significant factor that will accelerate the growth of the flexible display market is the high demand from consumers for hi-tech displays offering bending, rolling, or flexible features. In addition, flexible displays are also more energy-efficient compared to traditional ones as they consume less power.

The batteries segment is expected to experience a significant growth rate during the forecast period, with a projected CAGR of 11.13%. In the batteries segment, ease in the implementation/integration into any products, including flexible or wearable electronics, is causing growth. Furthermore, these products are flame retardants, waterproof, and undergo bending, folding, and stretching, which are factors increasing their demand in electric vehicles.

By Application

The consumer electronics segment has the largest share of 62% in 2023. Increased demand for lightweight products with extended battery life, such as laptops and smartwatches, is boosting this growth. Higher usage of flexible batteries, displays, and sensors by manufacturers to enhance the quality of a product indirectly supports the use of smart components.

The automotive segment is also expected to witness high CAGR growth at 11.38% in the forecast period. Auto manufacturers are moving toward smart electric vehicles, which would propel demand for flexible batteries as well as for those displays that improve the driving experience of a vehicle. With high electrical conductivity and strength in mechanics, flexible electronics seem to find their place and applicability in the automotive industry as well, leading to additional growth in the segment. In 2023, almost 1.2 million electric vehicles were sold in the United States, a record high, accounting for 7.6% of the total vehicle market. So, the number represents a massive increase from 5.9% in 2022.

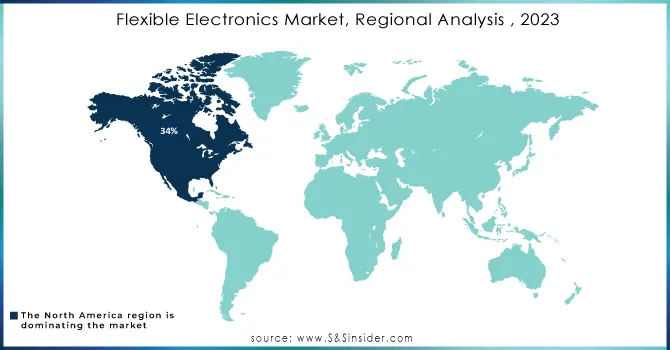

Flexible Electronics Market Regional Analysis

North America dominated the market for flexible electronics, acquiring almost 34% of the revenue in 2023. Increasing demand for wearables and smart devices that provide better user experiences is the most significant factor driving the growth of the market forward. Customers are increasingly demanding products that neatly fit into their daily lives. This upsurge forces manufacturers to design flexible electronics such that they will not disturb the human body but rather work comfortably through them. In this context, there is interest in usability-based solutions on fit neatly into consumers' routines.

The Asia Pacific will have the highest CAGR of 10.89% over the forecast period. This is because the demand for smart electric vehicles increases and consumer electronics are widely used in the automotive sector. In addition, growing consumer demand for innovative and portable devices will further lead to the growth of flexible electronics in the Asia Pacific. Region consumers now seek very light and versatile devices with greater functionality that do not have to compromise aesthetics.

Need Any Customization Research On Flexible Electronics Market - Inquiry Now

Key Players in Flexible Electronics Market

Some of the major players in the Flexible Electronics Market are:

-

Samsung Electronics (Flexible OLED Displays, Printed Circuit Boards),

-

LG Display (Flexible OLED Panels, Touch Sensors),

-

Apple Inc. (Flexible Displays for Devices, Flexible Batteries),

-

Bendable Electronics (Flexible Sensors, Wearable Devices),

-

Visteon Corporation (Flexible Displays, Advanced Cockpit Electronics),

-

Nokia (Flexible Wearables, Smart Textiles),

-

3M (Flexible Adhesives, Conductive Ink),

-

Avery Dennison (Flexible Labeling Solutions, RFID Tags),

-

Sony Corporation (Flexible Displays, Wearable Cameras),

-

Fujifilm (Flexible Printed Electronics, Organic Photodetectors),

-

Novotech (Flexible Circuit Boards, Bioelectronics),

-

FlexEnable (Flexible Displays, Organic Thin Film Transistors),

-

PragmatIC (Flexible Integrated Circuits, NFC Tags),

-

E Ink Holdings (Flexible E-Paper Displays, Smart Labels),

-

Samsara (Flexible Sensor Solutions, IoT Devices),

-

Thin Film Electronics (Flexible NFC Tags, Smart Labels),

-

Rokid (Flexible Displays, AR Glasses),

-

Shenzhen JET Technology (Flexible Solar Panels, LED Displays),

-

Aurora (Flexible Robotics, Wearable Electronics),

-

Synaptics (Flexible Touch Controllers, Display Drivers)

Recent Trends

-

In June 2024, A team of researchers at the Institute for Basic Science (IBS) in South Korea developed a novel dry transfer printing method for flexible electronic devices. This breakthrough enables the transfer of high-quality electronic materials without causing damage.

-

In January 2024, the Consumer Electronics Show featured a range of advancements in flexible and printed electronics, highlighting increased interest from various industries, including the automotive and medical sectors. Notable innovations included transparent OLED displays and indoor solar cells capable of harvesting ambient light for low-power devices.

-

In January 2024, A review highlighted several remarkable flexible electronics products, such as ASSA ABLOY's VingCard Novel electronic door lock, which integrates multiple technologies for enhanced functionality. Another notable innovation was Canatu's wire-free carbon nanotube film heater technology, aimed at de-icing LiDAR systems for autonomous vehicles

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 32.65 Billion |

| Market Size by 2032 | USD 75.04 Billion |

| CAGR | CAGR of 9.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Displays, Batteries, Sensors, Memory Devices, Others), • By Application (Consumer Electronics (Television, Wearable Devices, Smartphones, Others), Automotive, Healthcare, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, LG Display, Apple Inc., Bendable Electronics, Visteon Corporation, Nokia, 3M, Avery Dennison, Sony Corporation, Fujifilm, Novotech, FlexEnable, PragmatIC, E Ink Holdings, Samsara, Thin Film Electronics, Rokid, Shenzhen JET Technology, Aurora, Synaptics |

| Key Drivers | • Accelerating Demand for Lightweight and Portable Electronics: The Driving Force Behind Flexible Electronics Market Growth • Transformative Manufacturing Innovations is Fueling the Expansion of the Flexible Electronics Market |

| RESTRAINTS | • Challenges in Lifecycle, Reliability, and High Installation Costs Limiting Flexible Electronics Market Expansion |