Small Signal Transistor Market Size Analysis:

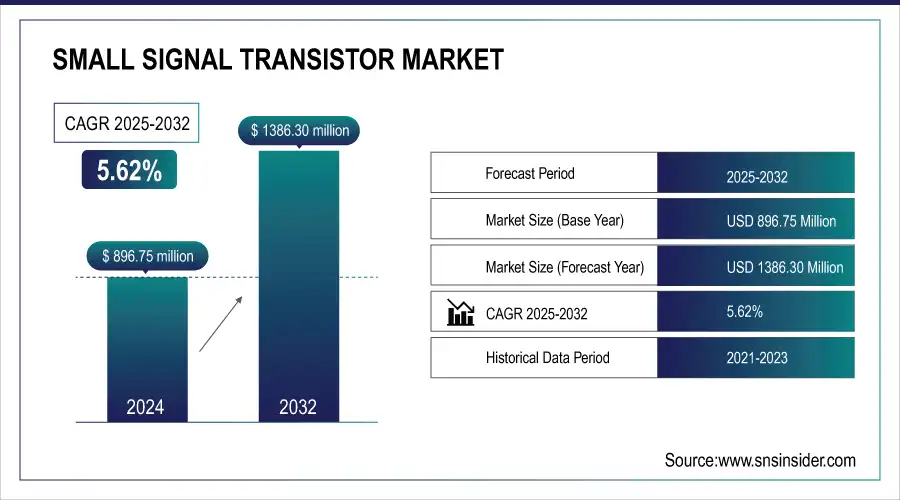

The Small Signal Transistor Market size was valued at USD 896.75 million in 2024 and is expected to reach USD 1386.30 million by 2032, growing at a CAGR of 5.62% over the forecast period of 2025-2032. Increasing demand for smaller electronics, growing penetration of EVs, and industrial automation. The trends also include the replacement of BJT with FETs for energy-efficient applications in IoT devices, ever-increasing investments in high-speed, low-voltage FETs for future generation communication and automotive systems, among another purpose.

To Get more information On Small Signal Transistor Market - Request Free Sample Report

The growth of the Small Signal Transistor market is driven by the rising demand for compact and energy-efficient electronic components in consumer electronics, industrial automation, and automotive applications. Transistors with advanced performance are necessary for the rise of EVs, IoT-enabled devices, and 5G infrastructure. Market growth is also driven by the microphones continue to be advancing in applications such as semiconductor manufacturing and smart technologies. Additionally, rapid adoption of small signal transistors in the world is strengthened by the miniaturization trend, low cost, and high switching speeds.

-

In 2024, smartphones globally used an average of 20.29 GB of mobile data per month, up from 17.27 GB in 2023. This figure is expected to reach 23.78 GB in 2025 and 42.38 GB by 2029, highlighting the increasing demand for efficient signal processing in mobile devices.

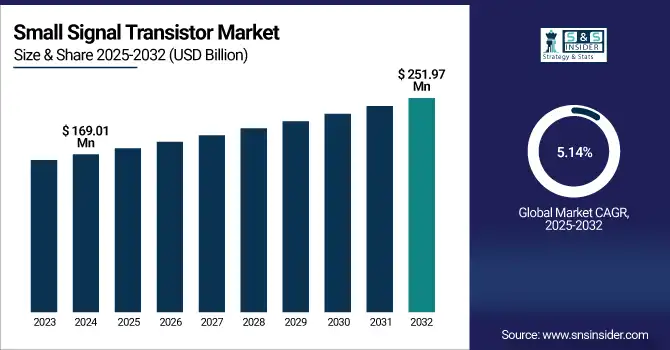

The U.S. Small Signal Transistor market size is estimated to be valued at USD 169.01 million in 2024 and is projected to grow at a CAGR of 5.14%, reaching approximately USD 251.97 million by 2032. Rising demand for Electric Vehicles (EVs) will be one of the major factors driving the U.S. Small Signal Transistor market trends. ASCAP (advanced semiconductor components) for EVs, such as small signal transistors, are needed to manage power, switching speed, and reliability of automotive systems.

Small Signal Transistor Market Dynamics:

Key Drivers:

-

Rising Demand for Miniaturized Power-Efficient Small Signal Transistors Drives Growth in Electronics and Automotive

Factors such as rising demand for miniaturized and power-efficient electronic components in different industries are driving the global Small Signal Transistor market growth. There is a huge demand for small signal transistors for smartphones, wearables, and IoT devices, as well as other consumer electronics that need high-speed switching, operation, and power efficiency, in smaller form factors. Plus, the automotive sector, especially in the field of electric vehicles (EVs), pushes it along as EVs rely heavily on small signal transistors for efficient power conversion and battery management. This generates significant demand for these components due to the requirement to support high-frequency, low-power applications, especially with the energy gained from the proliferation of 5G networks and advancements in telecommunications.

-

In 2024, global electric vehicle sales reached 17.1 million units, a 25% increase compared to 2023. China accounted for 11 million of these sales, marking a 40% year-on-year growth.

-

T-Mobile achieved a record-breaking 5G uplink speed of 550 Mbps using sub-6 GHz spectrum and 5G Advanced technology. This milestone demonstrates the potential of 5G networks to support high-demand applications like real-time gaming and augmented reality.

Restraints:

-

Overcoming Challenges of Semiconductor Complexity to Maintain Performance in Small Signal Transistor Technology

The increasing complexity of semiconductor technology is the major challenge for the global Small Signal Transistor market. With the exponential shrinkage of transistors to cater for the smaller electronic devices, there is a limit to the absolute scaling of the device sizes, with a risk of a performance loss due to thermal effects and crosstalk. So, these challenges demand ongoing evolution in materials science and materials engineering, for such devices to live up to their promise, avoiding increased power dissipation and switching delays by working on the right optoelectronic and biochemical time scales.

Opportunities:

-

Emerging Economies Drive Opportunities in Small Signal Transistor with Industrial Automation and IoT Growth

The small Signal Transistor market has a multitude of opportunities available, especially in emerging economies where both industrial automation and smart manufacturing are rising. The growing demand for infrastructure from and adoption of IoT and 5G create an opportunity for high performance of high invisible high invisible transistors. In addition, more autonomous and electric vehicles will create new opportunities for small signal transistors, which will require innovations in semiconductor technologies throughout this decade.

-

Electric vehicle (EV) sales in India reached a record 1.95 million units in 2024, marking over a 27% growth year-over-year. EVs accounted for 3.6% of overall automobile sales, with monthly sales consistently surpassing the 100,000-unit mark. Uttar Pradesh had the highest number of EVs sold, followed by Maharashtra and Karnataka.

Challenges:

-

Ensuring High-Quality and Reliable Small Signal Transistors for Automotive Telecommunications and Consumer Electronics

The big challenge is to supply high-quality and high-reliability transistors to more industries like automotive, telecommunications, and consumer electronics. Electric vehicles and autonomous driving systems require a large number of small signal transistors, and for them to operate safely, optimally, and accurately, the reliability of the components in harsh environments such as high temperatures, vibrations, and electrical noise is critical.

Small Signal Transistor Market Segmentation Analysis:

By Type

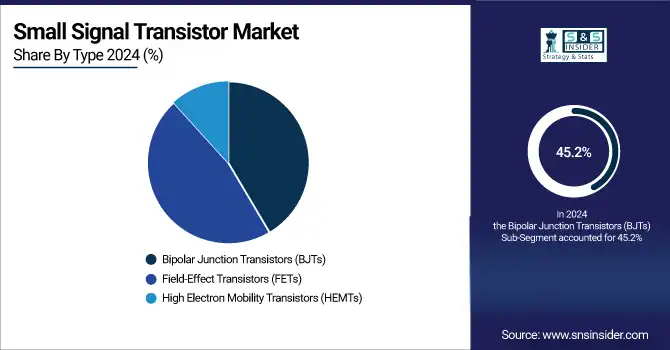

In 2024, Bipolar Junction Transistors (BJTs) accounted for a significant share of 45.2% in the Small Signal Transistor market, and are expected to remain the dominating product type over the forecast period, due to their dominant presence in analog applications, such as signal amplification and switching. OPAMPs are prevalent in audio applications, in RF circuits, and industrial control because they offer high gain and linear operation.

Field-Effect Transistors (FET) have been estimated to grow the highest CAGR opportunity from 2025-2032 due to their high energy efficiency, high input impedance, and potential to be suitable for mild to moderate low power components at high-speed applications. Due to the increasing need for compact and low-power components in Internet of Things (IoT) devices, mobile electronics, and next-gen computing, there is a growing appeal for FETs.

By Industry Vertical

In 2024, the industrial segment held the largest market share in the Small Signal Transistor market, accounting for 35.3%. The rising adoption of industrial automation, robotics, and smart manufacturing systems, which require small signal transistors for efficient switching and signal amplification, is further enabling the small signal transistors segment to dominate the market. Such elements play a vital role in automating industrial machinery and system monitoring, as well as energy management in process automation.

The automotive segment will grow at the fastest CAGR from 2025 to 2032. The rising electric vehicles (EVs), autonomous driving systems, and advanced driver-assistance systems (ADAS) are driving demand for small and robust transistors with high performance. With vehicles increasingly moving towards being electronically based, automotive software-driven products, small signal transistors are essential for battery management, motor control, and in-vehicle infotainment systems.

Small Signal Transistor Market Regional Outlook:

In 2024, Asia Pacific accounted for 41.6% of the total small signal transistor market share and is expected to grow at the fastest CAGR during the forecast period, owing to emerging consumer markets in the region. The strong growth in electronics manufacturing, the broad acceptance of industrial automation, and the rapid development of telecommunications infrastructure are all leading this region to the forefront of the twentieth century. Growing smartphone, consumer electronics, and IoT-enabled device production is driving demand for high-performing and energy-efficient small signal transistors. And, of course, the region is gaining fast in electric vehicle production and smart manufacturing, both powered by small, fast transistors. A strong semiconductor ecosystem and a heavy focus on R&D and innovation help the region maintain its top spot and set up for the future.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia Pacific Small Signal Transistor market has been heavily dominated by China, which benefits from having the largest electronics manufacturing plant, a significant presence of semiconductor companies, aggressive industrial automation, and an ever-growing need for consumer electronics, electric vehicles, and 5G infrastructure developing across many industries.

North America is also one of the prominent regions for the Small Signal Transistor market due to its technically advanced infrastructure and high demand from the telecommunications, automotive, aerospace, and consumer electronics industries. The region is characterized by constant innovation in the design and manufacturing of semiconductor devices, along with large investments in R&D by major players. This growing demand for electric vehicles, 5G networks, and IoT devices drives the need for high-performance and energy-efficient transistors.

In North America, the United States is dominant in the market for Small Signal Transistors due to its leading position in semiconductor technology, high-tech manufacturing, and innovation in automotive construction, telecommunications, and consumer electronics. The hub of big tech firms and R&D projects

The small signal transistor market operation in Europe is seeing a stable growth due to the strong industrial base in the region and increasing demand for energy-efficient electronic components, mainly driven by advancements in automotive, telecommunications, and industrial automation, amongst other industry verticals. This regional demand growth has increased the demand for small signal transistors deployed for power management, control systems, and high-speed communication with the rise of electric vehicles (EVs) and smart manufacturing.

The presence of a dominant automotive sector, a leading position in industrial automation, and advanced high-tech manufacturing skills has made Germany a leader in the European market. Demand for advanced semiconductor components is spurred by the electric vehicle ambition, Industry 4.0, as well as R&D in next-generation technologies.

The Small Signal Transistor market in Latin America and the Middle East & Africa is emerging and steadily growing, and will benefit due to accelerating industrial automation, telecommunications, and increasing adoption of consumer electronics. As the manufacturing sector expands in Latin America, this drives the demand for compact and power-efficient electronic components in the regional market. Infrastructure development across telecommunications and energy sectors is likely to create opportunities for small signal transistors in the Middle East & Africa.

Key Players Listed in the Small Signal Transistor Market are:

Some of the major Small Signal Transistors companies are Infineon, onsemi, STMicroelectronics, Nexperia, Toshiba, Texas Instruments, Vishay, Diodes Inc., Rohm, and Panasonic.

Recent Trends:

-

In February 2025, Infineon launched CoolGaN™ G3 Transistors in silicon-compatible RQFN packages, promoting industry-wide standardization. The new 80V and 100V variants enhance thermal performance and ease GaN adoption in diverse applications.

-

In June 2024, Nexperia announced a USD 200 million investment to expand its Hamburg facility, focusing on producing next-generation wide bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN), as well as increasing capacity for silicon-based diodes and transistors.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 896.75 Million |

| Market Size by 2032 | USD 1386.30 Million |

| CAGR | CAGR of 5.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Bipolar Junction Transistors (BJTs), Field-Effect Transistors (FETs), and High Electron Mobility Transistors (HEMTs)) • By Industry Vertical (Industrial, Automotive, Telecommunication, Consumer electronics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Infineon, onsemi, STMicroelectronics, Nexperia, Toshiba, Texas Instruments, Vishay, Diodes Inc., Rohm, and Panasonic. |