Thermal Imaging Market Size & Trends:

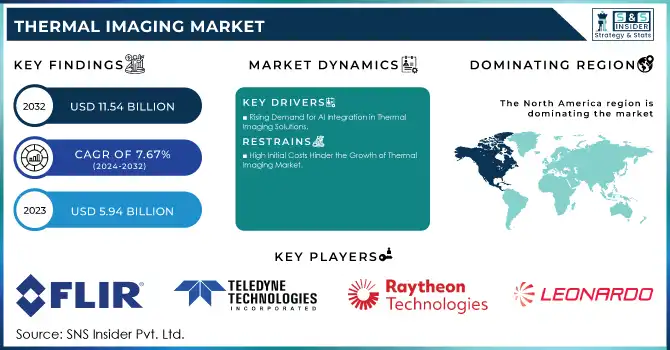

The Thermal Imaging Market Size was valued at USD 5.94 Billion in 2023 and is expected to reach USD 11.54 Billion by 2032 and grow at a CAGR of 7.67% over the forecast period 2024-2032.

The Thermal Imaging Market is showing steady growth due to technological advancement and increasing demand across various industries. In 2023, key countries like Japan, China, USA, Germany, France, and India are driving the market with strategic investments and technological innovation. Government policies like Japan funding advanced surveillance and thermal imaging for security, cutting-edge applications from China for healthcare and manufacturing, and policies in the USA focusing on technological investment in defense, healthcare, and infrastructure monitoring have been greatly contributing to the development of the market.

Get more information on Thermal Imaging Market - Request Sample Report

Some of the recent developments are AI-based thermal imaging systems and portable thermal cameras launched in 2023 and 2024, which help industries analyze things faster and more accurately for manufacturing, security, and healthcare applications. For instance, Hanwha Vision launched its AI-based high-performance radiometric thermal camera series globally recently. These small-sized cameras meet the need of all customers requiring such precision measurement of temperature up to the range of −40°C and 550°C while delivering a security and surveillance package making them suitable for industrial uses such as manufacturing, utilities, energy, airports, shipping industries, and the mining business.

Technological innovations, such as AI integration, IoT, and real-time data analytics, propel the market. These technologies provide predictive maintenance in industries, smart building energy efficiency solutions, and surveillance with real-time threat detection. Opportunities exist in the further development of thermal imaging applications for UAVs, medical diagnostics, and renewable energy. Governments have offered subsidies to stimulate innovation in this market.

Major companies are also focusing on partnership and technological innovation to stay in line with the demands of the industry. These technological innovations promise opportunities for industry players in terms of new revenue streams and strategic collaborations. Recent launches in 2023 and ongoing technological developments are expected to maintain momentum, offering significant potential for market growth in the coming years.

Thermal Imaging Market Dynamics:

KEY DRIVERS:

-

Rising Demand for AI Integration in Thermal Imaging Solutions

AI technologies are driving innovation within various industries. Government and industry reports indicate that artificial intelligence integration in thermal imaging solutions can optimize predictive maintenance, security surveillance, and even medical diagnostics. With more than 45% of all industries using AI-driven technologies by 2023, the usage of AI-enabled thermal cameras grew by leaps and bounds.

It enhances operational capabilities based on real-time data, making it possible for such industries to foresee maintenance failure, monitor energy efficiency and even protect assets through predictable insights.

-

Increased Adoption in Healthcare for Early Disease Detection

Thermal imaging solutions are increasingly being adopted in the healthcare industry for non-invasive early diagnostics. As reported by recent data of the healthcare sector, demand for advanced imaging tools has grown 30% since 2023 due to their application in detecting anomalies like fevers, inflammation, and other early disease indicators.

According to a new research, by 2035, the number of FDA-cleared artificial intelligence tools in imaging is going to see a massive hike and is supposed to exceed venture capital funding at USD 30 billion. In the last seven years, the number of such products has been on the rise in radiological care, and medical imaging has taken 85% of the VC funding for digital health.

RESTRAIN:

-

High Initial Costs Hinder the Growth of Thermal Imaging Market

The high expenses are mainly because of advanced imaging devices, integration software, and training of human resources. As of government studies in 2023, only 45% of the small and medium-sized enterprises respond that there is a restraint to buy thermal imaging solutions because the budget is tight.

While AI-capable thermal imaging systems have state-of-the-art abilities, acquiring them and keeping them serviced cost too much and therefore fail to penetrate these budgeted regions. In addition, developing countries such as India and parts of Asia do not have the financial infrastructure to support the widespread use of these technologies. The economic cost also limits smaller companies' access to these imaging technologies. The initial cost also affects governmental projects, where some nations opt for other technological needs over thermal imaging infrastructure.

Thermal Imaging Market Segmentation Analysis:

BY PRODUCT TYPE

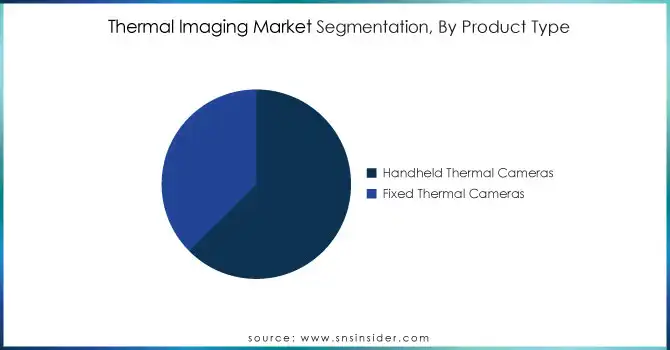

In 2023, the Handheld Thermal Cameras segment dominated in 2023 with 63% of market share, driven by their portability, affordability, and ease of use across industries. Handheld thermal cameras are getting more frequent applications in maintenance operations, police services, as well as building inspections-they facilitate on-site surveillance and response to emergencies as well. Technology advancements such as longer life battery and high-image quality are also driving such increased applications.

The Handheld Thermal Cameras segment is expected to register the fastest CAGR of 7.84% during the forecast period 2024-2032, which reflects increasing demand from different sectors, including healthcare diagnostics, defense, and predictive industrial maintenance. Fixed thermal cameras are used in most stationary monitoring applications, such as border security, factory monitoring, and smart building applications.

BY TYPE

In 2023, Thermal Cameras segment dominated this year with 44% of the market share due to their applications across industries such as defense, security, and healthcare, where they are versatile imaging appliances for real-time temperature scanning, predictive maintenance, or security surveillance. Additionally, the technological advancements in improving their resolution and real-time imaging capabilities have enhanced industrial use cases.

On the other hand, Thermal Scopes segment are projected to grow with the fastest CAGR of 8.26% during the forecast period 2024-2032. Thermal scopes are being adopted for their advanced targeting features in military applications and civilian use cases such as hunting and surveillance. Their rising popularity stems from advanced technological integrations like AI-assisted imaging and improved night-vision capabilities, allowing users to monitor specific targets efficiently. This trend highlights opportunities for companies investing in innovative thermal scope technologies, focusing on superior thermal detection and operational efficiency.

Thermal Imaging Market Regional Outlook:

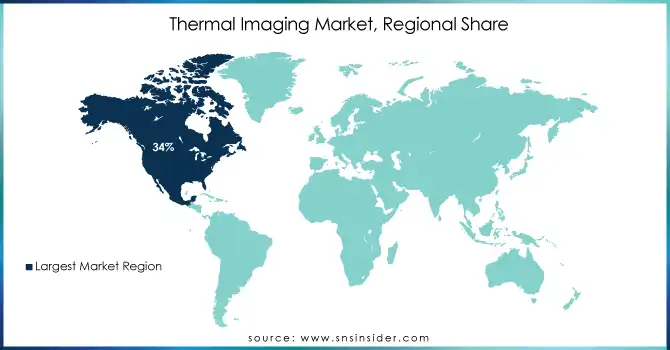

North America region dominated the thermal imaging market in 2023, with a market share of 34%. The leadership in the region is because of technological advancements, strategic government investments, and a strong presence of market leaders focusing on innovation. The USA's focus on defense and infrastructure development has significantly fueled market opportunities, and government spending supports advancements in thermal imaging applications.

Asia Pacific region is expected to grow the fastest with a CAGR of 8.46% during the forecast period of 2024-2032. This is because of the investments in technology by China, Japan, and India, which are expanding their thermal imaging applications in healthcare, defense, and energy sectors. Additionally, government subsidies and technological partnerships are boosting the adoption of advanced imaging technologies across the region, which makes it a hub for market expansion and innovation.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS:

Some of the major players in the Thermal Imaging Market are

-

FLIR Systems (Handheld Thermal Cameras, Fixed Thermal Cameras)

-

Teledyne Technologies (Thermal Cameras, Thermal Modules)

-

Raytheon Technologies (Thermal Scopes, Cooled Thermal Cameras)

-

Leonardo DRS (Thermal Cameras, Military Applications)

-

L3 Technologies (Thermal Scopes, Security Solutions)

-

Seek Thermal (Handheld Thermal Cameras, Thermal Modules)

-

Opgal (Thermal Cameras, Security Surveillance)

-

HIKVISION (Thermal Cameras, Surveillance Tools)

-

Axis Communications (Thermal Cameras, Monitoring Solutions)

-

FLIR OEM Solutions (Thermal Modules, Embedded Imaging)

-

Bosch Security Systems (Surveillance Cameras, Thermal Detection)

-

Northrop Grumman (Military Surveillance, Aerospace Systems)

-

Dahua Technology (Thermal Cameras, Security Solutions)

-

CISCO Systems (Thermal Integration, Security Monitoring)

-

Honeywell (Thermal Scopes, Safety & Security)

-

Thales Group (Defense Solutions, Thermal Cameras)

-

PerkinElmer (Thermal Imaging Applications, Health Diagnostics)

-

Siemens (Thermal Modules, Industrial Monitoring)

-

GE Measurement & Control (Thermal Sensors, Monitoring Solutions)

-

Advances Thermal Imaging Co. (Portable Thermal Imaging, Medical Applications)

MAJOR SUPPLIERS (Components, Technologies)

-

Amphenol Advanced Sensors

-

Honeywell International

-

Vishay Precision Group

-

Raytheon Technologies

-

FLIR Systems’ Component Providers

-

Teledyne's Material Suppliers

-

Bosch Materials Division

-

Opgal Material Suppliers

-

Semiconductor suppliers like Infineon Technologies

-

3M Advanced Materials Division

-

CISCO’s Imaging Component Partners

-

GE Measurement's Sensor Suppliers

-

Thales Group Component Providers

-

Northrop Grumman's Advanced Electronics Suppliers

-

PerkinElmer's Diagnostic Material Suppliers

-

Siemens Industrial Solutions

-

Dahua Component Partners

-

Amphenol Thermal Sensor Providers

-

Honeywell's Manufacturing Supply Chain

-

Vishay Electronics’ Sensor Production Facilities

MAJOR CLIENTS

-

Military & Defense Agencies (e.g., NATO, USA DoD)

-

Aerospace manufacturers (Lockheed Martin, Boeing, Airbus)

-

Energy companies (Shell, BP, Chevron)

-

Industrial companies (General Electric, Siemens)

-

Healthcare providers & government hospitals

-

Automotive companies (Ford, Volkswagen, Toyota)

-

Law enforcement agencies globally (via security solutions)

-

Infrastructure development corporations for monitoring projects

-

Telecommunication & smart infrastructure companies (Cisco, HIKVISION)

-

Firefighting units for emergency deployment

RECENT TRENDS

-

September 2024: Fluke Corporation, the world leader in portable electronic test and measurement tools, announced its new pocket-sized iSee Mobile Thermal Camera-a highly portable thermal camera offering resolution equal to professional cameras and full range of temperature analysis.

-

April 2024: L3Harris Technologies has been awarded a USD 256 M order for the continuation of production for the Enhanced Night Vision Goggle – Binocular, ENVG-B, for the US Army. The order is the first the US Army has placed from the Program of Record full-scale production IDIQ contract.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.94 Billion |

| Market Size by 2032 | USD 11.54 Billion |

| CAGR | CAGR of 7.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Handheld Thermal Cameras, Fixed Thermal Cameras) • By Type (Thermal Modules, Thermal Cameras, Thermal Scopes) • By Technology (Cooled, Uncooled) • By Application (Monitoring & Inspection, Security & Surveillance, Detection & Measurement) • By Industry Vertical (Industrial, Residential, Automotive, Oil & Gas, Commercial, Aerospace & Defense, Healthcare & Life Sciences, Food & Beverages) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FLIR Systems, Teledyne Technologies, Raytheon Technologies, Leonardo DRS, L3 Technologies, Seek Thermal, Opgal, HIKVISION, Axis Communications, FLIR OEM Solutions, Bosch Security Systems, Northrop Grumman, Dahua Technology, CISCO Systems, Honeywell, Thales Group, PerkinElmer, Siemens, GE Measurement & Control, Advances Thermal Imaging Co. |

| Key Drivers | • Rising Demand for AI Integration in Thermal Imaging Solutions. • Increased Adoption in Healthcare for Early Disease Detection. |

| Restraints | • High Initial Costs Hinder the Growth of Thermal Imaging Market. |