Industrial Robotics Market Report Scope & Overview:

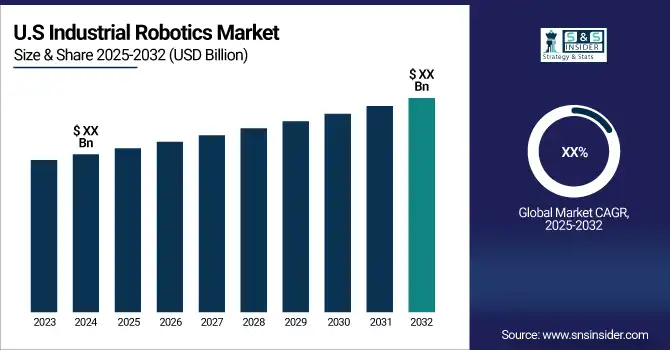

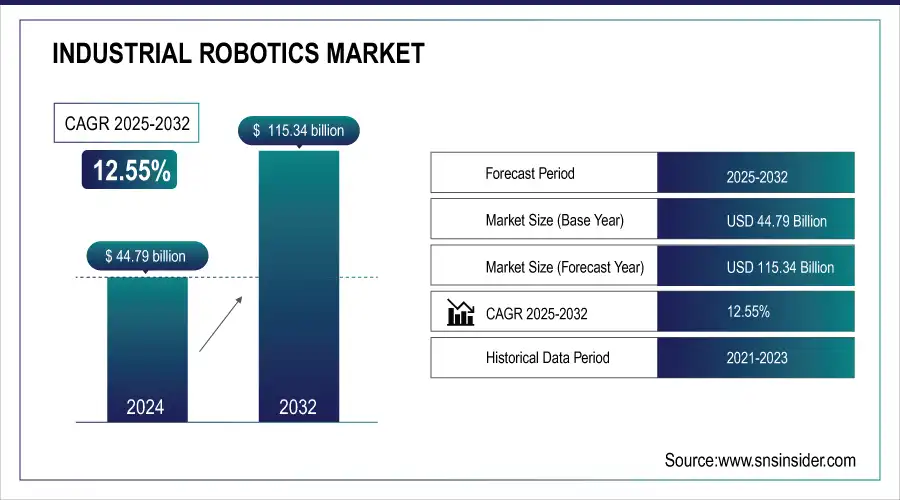

The Industrial Robotics Market size was valued at USD 44.79 billion in 2024 and is projected to reach USD 115.34 billion by 2032, growing at a CAGR of 12.55% during 2025-2032. The industrial robotics sector is currently experiencing significant growth. According to the International Federation of Robotics (IFR), 553,052 units were installed globally in 2022, reflecting a 5% increase from the previous year. While Asia may not lead in overall industrial robotics usage, it is a dominant force in new installations, accounting for 73% of them. China is particularly strong, with 290,258 robots installed, showing a 57% increase from 2021. The industrial robotics industry is expanding dynamically as a result of several industry drivers. The automotive industry is the primary one, and the use of robots for assembly, welding, and painting increases total efficiency and accuracy.

To get more information on Industrial Robotics Market - Request Free Sample Report

Industrial Robotics Market Size and Forecast:

-

Market Size in 2024: USD 44.70 Billion

-

Market Size by 2032: USD 115.34 Billion

-

CAGR: 12.55% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

The electronics and consumer goods sectors are also becoming more reliant on robots to meet high demand with quick and precise manufacturing. According to the VDMA Robotics + AI association, the robotics and automation sector is expected to have sales of 16.2 billion euros in 2023 as a result of increased demand from a number of significant industries. Industrial image processing increased a significant amount of 11% in photo sales for 2022, resulting in a total of 3.4 billion euros. Similarly, the sector of integrated assembly solutions saw a 5% increase, which translates to 7.4 billion euros in sales for 2022 and 17% in 2023. Sales of robotics delivered a small increase of 1% in 2022 and are projected to increase by 12% in 2023, totaling 3.9 billion euros.

Key Industrial Robotics Market Trends

-

Deployment of AI-powered vision analytics in robotic systems to recognize patterns, enable adaptive movement, and optimize precision during manufacturing processes.

-

Surge in demand for energy-efficient servo motors and low-power actuators that reduce operating expenses while maintaining high productivity.

-

Advancements in collaborative automation frameworks allow safe human-robot interaction within shared workspaces across industries such as healthcare, logistics, and automotive.

-

Introduction of modular robotics architectures supporting quick reconfiguration, scalability, and customization for diverse industrial requirements.

-

Expansion of cloud-based orchestration platforms enabling real-time data exchange, remote monitoring, and predictive insights for enhanced system reliability.

Industrial Robotics Market Growth Drivers:

-

Industrial robotics market grows rapidly in certain regions and sectors

The industrial robotics market is growing globally, driven by the rise of automation, increasing labor costs, and strong demand. While Asia, particularly China and South Korea, has been leading in this space for some time, the Americas saw the most significant growth in 2022. The installations grew by 8% and reached 56,053 units, which overcame the previous maximum of 55,212 units of 2018. The leading country in this region, the United States, accounted for 39,576 units, which reached its maximum, just short of 40,373 units of 2018. The automotive sector itself was a leader as well, with a 47% growth and reaching 14,472 units and 37% in the market share. Mexico continued to grow, as its installations grew by 13% and reached 6,000 units. Canada, in turn experienced a 24% fall to 3,223 units stimulated by lesser demand in the automotive sector.

According to the International Organization of Motor Vehicle Manufacturers, whereas in Brazil was produced 2.4 million vehicles, the number of robot installations in the country increased by 4% and reached 1,858 robots. An emerging type of robot, a collaborative one, or a “cobot” for short, is a type of automation that is responsible for the expanding use of robotics in the non-manufacturing sectors. The robots are capable of working in the same environment as human workers flux and are genuinely unfit to harm humans. The growth of the industrial robotics market appears to be sustained despite the anticipated world economic slowdowns. According to the forecast for 2023 by 2024, one should expect that the installations will come close to a 600,000-unit milestone by showing yearly growth. The long-time expansion rate should be explained by continuous advancement and the growing need for automation in the immense industrial branches.

-

AI Integration and its Effect on the Industrial Robotics Market

The incorporation of AI technology in industrial robots is making a difference, equivalent to what Unimate did in 1962. Unlike other sources, newer robots such as cobots and AMRs are equipped with AI technology, enhancing their ability to learn, adjust, and perform tasks in a highly flexible approach. Integration of AI in robotics is vital as it helps overcome constrictions in the traditional sector. Traditional robotics is very reliable but often experiences problems about variable and speedy task handling. AI robots use sophisticated deep learning algorithms that analyze intensive images. As a result, they can easily identify and snatch off faulty components, enhancing the process of quality control and operational efficiency. As such, there are predictions that the industrial robotics industry will achieve 600,000 installations across the globe. This is due to the installation of robots in the Americas that rose by 8% to 56,053 in 2022. These installations surpassed the previous high, thus showing the growth trend.

In addition, the primary force behind these significant demands for automation is the United States. The United States is a leading driver due to its mastering industries such as the automotive sector. The latter witnessed a 47% increase in installations as the US led with 71%. AI’s contribution to robotics is crucial as it aids in enhancing efficiency and eventually results in the development of highly advanced, autonomous systems that can efficiently operate in harsh settings. Notably, as AI continues to integrate into this sector, the conjoined strength of robotics’ reliability and AI’s flexibility will enhance growth and innovation.

Industrial Robotics Market Restraints:

-

Challenges of adopting AI in industrial robotics

While AI undoubtedly made great strides, several challenges are associated with its adoption in industrial robotics. Firstly, conventional robots were created for use in manufacturing environments that are atypical; repetitive and massive. Consequently, it is difficult for AI to acclimate to various manufacturing environments that are changeable and unique. Indeed, AI requires increased programming and adjustment to accept unpredicted changes in products and processes regardless of its proposed flexibility. Secondly, proficient workers are lacking from the manufacturing sector, where skilled staff are accustomed to their fields and technologies. AI robots’ efficiency is stunted by a lack of trained personnel. Third, the most glaring downside of the AI system is its natural opacity. Generative models, which are more prevalent in robotics, can often become opaque systems, giving suggestions without divulging how such suggestions were ascertained. Indeed, placing the processing-generated price of manufacturing workers and manufacturers with regard to heavy consequences associated with AI use in unfamiliar manners is expectable. Indeed, despite the potential of AI in dealing with the manufacturing sector’s problems, manufacturers may be reluctant to employ AI for important decision in industrial robotics while trusting and detecting systems featuring unknown logic. Lacking the ability to comprehend why an AI made a suggestion will increase the unwillingness to trust and foster AI adoption. What is more, more efforts should be put into research and development to eliminate the current AI systems’ drawbacks and ensure their successful integration into manufacturing settings.

Industrial Robotics Market Segment Analysis

By Type

Based On Type, Articulated dominated the industrial robotics market with 28% of share in 2023. Articulated robots dominate the international industrial robotics market due to their precision and versatility, showing the highest growth rate and market share. These robots are particularly good at performing tasks that involve precise, repetitive movements, like handling materials, assembling items, and packaging products. Their extensive use can be seen across different sectors such as food and beverage, pharmaceuticals, and automotive, as their flexibility and precision greatly improve operational efficiency. Recent advances in technology have enhanced the abilities of articulated robots even more. Improved actuators have increased their capacity for handling loads and allowed them to complete more intricate tasks with improved accuracy. KUKA, ABB, and Fanuc are leading the way in developing articulated robots with advanced sensors and improved actuators to meet a variety of growing demands. KUKA's KR QUANTEC and ABB's IRB 6700 are excellent examples of top-of-the-line articulated robots that offer outstanding precision and versatility.

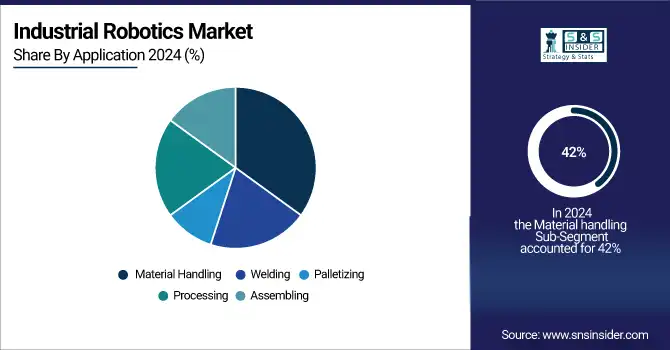

By Application

Based On Application, Material handling is dominate with Industrial Robotics Market with 42% Share in 2023. Material handling is expected to make substantial advancements in the upcoming period, fueled by growing requirements from sectors including food and beverage, pharmaceutical, and electrical and electronics. Material handling robots are essential for improving efficiency and safety in certain industries, especially when dealing with dangerous chemicals and substances. In chemical and pharmaceutical sectors, robots are utilized to reduce accidents and guarantee the safety of employees through automated transportation of hazardous chemicals. An autonomous robot introduced by Amazon.com, Inc. in June 2022, designed for handling and moving packages within its facilities, is a significant innovation in this industry. These robots function autonomously, greatly decreasing mistakes and enhancing operational efficiency overall. In addition, fast-growing sectors such as automotive and electronics are depending more and more on robots for material handling in order to move items safely and efficiently within factory premises, whether they are small parts or heavy objects. FANUC and Yaskawa are at the forefront in creating advanced material handling robots tailored to the exact requirements of industries, guaranteeing precision and dependability.

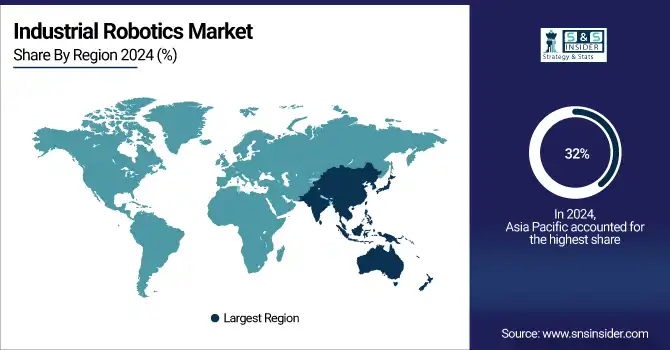

Industrial Robotics Market Regional Outlook

Asia-Pacific Industrial Robotics Market Insights

Asia Pacific Dominate the Industrial Robotics market with 32% of share in 2023. The Asia Pacific region is a dominant force in industrial robotics due to its numerous industries and factories that depend heavily on automation in manufacturing. Nations such as Japan, China, and India are leading the way in this change, placing significant emphasis on implementing automation, artificial intelligence, and other cutting-edge technologies. This trend is driving substantial expansion in the local market. In Japan and China, the growth of automation is propelling industrial expansion, while in India, the rising use of robotics in manufacturing is key to boosting market growth. With the increasing population and disposable incomes in these nations, there is also a growing need for consumer goods and various products, resulting in higher production capacities. This leads to an increase in the need for industrial robots, which are required to uphold precise and fast production capabilities.

Need any customization research on Industrial Robotics Market - Enquiry Now

North America Industrial Robotics Market Insights

North America is the second fastest growing region in Industrial Robots with 29% of share in 2023. The increase in smart factories and Industry 4.0 is a significant driver of growth in North America. The rise in need for personalized and compact robotic systems is driving the industry forward, with companies looking to speed up production and increase capacity to achieve a faster ROI. There is a rise in the use of cutting-edge robotics technologies in industries such as automotive, electronics, and consumer goods in this area, where accuracy and productivity are crucial.

Europe Industrial Robotics Market Insights

At the same time, Europe is set to experience significant expansion as a result of the increasing use of collaborative robots, or cobots, that are specifically made to assist human workers. There is a strong push for enhancing industrial operations throughout Europe, with cobots playing a key role in this evolution. These robots, which have advanced sensors, can identify and engage with humans, which makes them well-suited for handling demanding jobs in sectors like manufacturing, logistics, and aerospace. The increased emphasis on improving industrial automation in Europe is fueling the need for these cutting-edge robotic solutions.

Middle East & Africa Industrial Robotics Market Insights

In the Middle East & Africa as well as Latin America, there is expected to be substantial growth in the industrial robotics market. The use of robots in the automotive sector has spurred interest from other industries such as electronics, food and beverage, and aerospace in these regions. Companies like Philips, Ford, GM, and Nestle have implemented robotic work cells in these areas, emphasizing the increasing significance of automation. In April 2021, Accenture obtained Pollux, a Brazilian company focused on robotics and automation solutions, in order to improve its digital manufacturing, operations, and supply chain capabilities. The rise in robot usage is driving market expansion, especially in Brazil, where the industrial sector is quickly adopting automation to keep up with growing production needs.

Industrial Robotics Companies are:

-

DÜRR

-

FANUC

-

YASKAWA

-

KUKA

-

Denso Corporation

-

Mitsubishi Electric

-

Kawasaki Heavy Industries

-

Universal Robots A/S

-

NACHI-FUJIKOSHI

-

Panasonic Corporation

-

Rockwell Automation, Inc.

-

Bosch GmbH

-

Yaskawa Electric Corporation

-

Seiko Epson

-

Comau

-

Stäubli Robotics

-

Doosan Robotics

-

Hanwha Robotics

Competitive Landscape for Industrial Robotics Market:

Comau S.p.A., an Italian multinational, is a leading provider of advanced industrial automation solutions, specializing in robotics, digital manufacturing, and systems integration. Founded in 1973 and headquartered in Grugliasco, Turin, Italy, Comau operates as a subsidiary of Stellantis. The company offers a broad range of industrial robots, collaborative robots, and automated systems for sectors such as automotive, aerospace, logistics, and general manufacturing. With a strong focus on innovation, Comau integrates artificial intelligence, digital platforms, and Industry 4.0 technologies to optimize productivity and efficiency.

-

July 2022: Compau SpA unveiled a new Racer-5 SE industrial robot. It is utilized in essential sectors like pharmaceuticals, health & beauty, food & beverage, and electronics industries. It enhances production capacity, operational productivity, and quality.

ABB is a global technology leader specializing in electrification, robotics, automation, and motion, driving innovations that enable a more sustainable and efficient future. The company provides advanced solutions for industries such as manufacturing, utilities, transportation, and infrastructure, focusing on digital transformation and energy efficiency. With a strong portfolio in industrial robots, automation systems, and smart technologies, ABB plays a vital role in shaping the future of Industry 4.0. Headquartered in Zürich, Switzerland, ABB was founded in 1988 through the merger of ASEA (Sweden) and BBC Brown, Boveri & Cie (Switzerland), combining over a century of engineering expertise.

-

In July 2022, ABB launched a new Flex Picker IRB 365 delta robot made for packing and picking tasks, able to handle up to 1.5 KG. This kind of robots is employed for packaging light items like peppers, candies, small bottles, and chocolates.

Mitsubishi Electric Corporation is a global leader in electrical and electronic equipment, offering advanced solutions in factory automation, robotics, energy systems, and information technology. Established in 1921 and headquartered in Tokyo, Japan, the company has played a pivotal role in driving industrial innovation and smart manufacturing. Mitsubishi Electric’s robotics and automation technologies are widely used in automotive, electronics, and packaging industries, focusing on precision, efficiency, and sustainability. With a strong commitment to research and development, the company emphasizes eco-friendly technologies and digital transformation, aiming to contribute to a more sustainable society while maintaining its position as a trusted global innovator.

-

In March 2022, Mitsubishi Electric Corporation unveiled AI-powered industrial robots for the food processing and manufacturing industries. It is utilized to enhance the efficiency of manufacturing processes. Moreover, these latest technologies are widely used in the manufacturing industry, resulting in a decrease in the timeline ranging from 5 to 60 hours.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 44.70 Billion |

| Market Size by 2032 | USD 115.34 Billion |

| CAGR | CAGR of 12.55% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Palletizing, Assembling, Welding, Material Handling, Painting) • By Types (6-Axis Robots, SCARA, Cartesian, Articulated, Redundant, Delta, Dual-Arm, and Parallel) • By End-user (Entertainment, Electronics, Automotive, Rubber & Plastic, Food & Beverage, Pharmaceuticals) • By Component (Robotic Arms, End Effectors, Drive Units, Robot Accessories, Controllers, Vision Systems, Sensors) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | ABB, DÜRR, FANUC, YASKAWA, KUKA, Denso Corporation, Mitsubishi Electric, Kawasaki Heavy Industries, Universal Robots A/S, NACHI-FUJIKOSHI, Panasonic Corporation, Rockwell Automation, Inc., Bosch GmbH, Toshiba Corporation, Seiko Epson, Comau, Stäubli Robotics, Doosan Robotics, Hanwha Robotics. |