Autonomous Construction Equipment Market Report Scope & Overview:

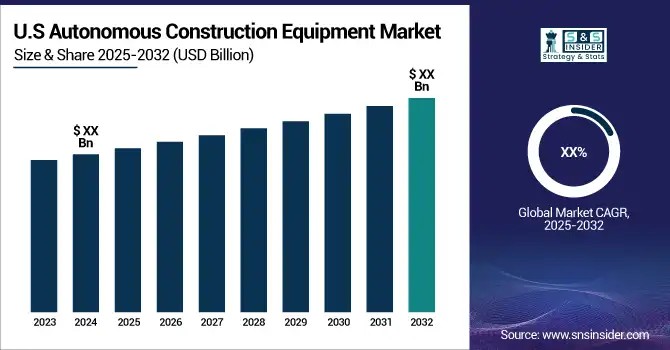

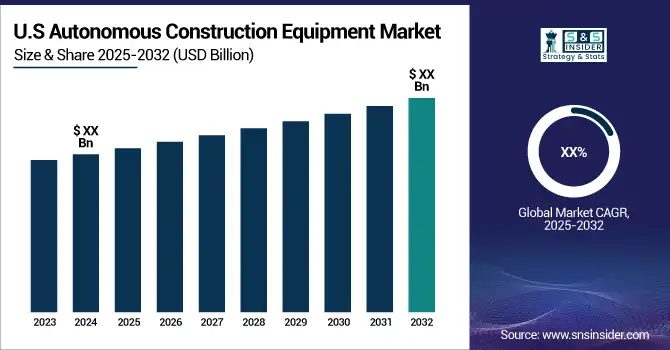

The Autonomous Construction Equipment Market was valued at USD 13.86 billion in 2024 and is expected to reach USD 27.60 billion by 2032, growing at a CAGR of 8.99% from 2025-2032.

The autonomous construction equipment market is experiencing significant growth, driven by technological advancements and the increasing need for efficiency in construction operations. Innovations in artificial intelligence (AI), machine learning, and sensor technologies are enhancing the capabilities of construction machinery, enabling tasks to be performed with greater precision and reduced human intervention. AI integration allows for predictive maintenance, real-time monitoring, and autonomous operations, streamlining construction processes and improving safety standards. A notable trend is the shift towards electric-powered autonomous equipment. Electric excavators and loaders, equipped with autonomous features like automated digging and grade control systems, are gaining popularity due to their environmental benefits and suitability for urban construction sites where noise reduction is crucial. Advancements in battery technology are further propelling this trend, offering longer operational ranges and faster charging times.

Autonomous Construction Equipment Market Size and Forecast

-

Market Size in 2024: USD 13.86 Billion

-

Market Size by 2032: USD 27.60 Billion

-

CAGR: 8.99% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2022–2023

To get more information on Autonomous Construction Equipment Market - Request Free Sample Report

Autonomous Construction Equipment Market Trends

-

Rising demand for automation and efficiency in construction operations is driving autonomous equipment adoption.

-

Integration of AI, GPS, IoT, and telematics is enabling precision, safety, and remote operation.

-

Growing focus on labor cost reduction and productivity improvement is boosting market growth.

-

Adoption of autonomous earthmovers, excavators, and loaders is expanding across infrastructure and mining projects.

-

Increasing use of electric and hybrid construction machinery is shaping sustainable development trends.

-

Collaborations between OEMs, tech providers, and construction firms are accelerating innovation.

-

Government initiatives and smart city projects are fostering deployment of autonomous construction solutions.

The demand for autonomous construction equipment is also influenced by labor shortages in the construction industry. Automated machinery addresses this challenge by performing tasks that would otherwise require a large workforce, thereby maintaining productivity levels. This shift towards automation is particularly evident in regions with significant infrastructure development and mining activities, where the need for efficient and precise construction technologies is paramount.

Autonomous Construction Equipment Market Growth Drivers:

-

The rising demand for efficiency and productivity drives the adoption of autonomous construction equipment, which automates tasks, reduces errors, and optimizes resource use for faster and cost-effective project completion.

The rising demand for increased efficiency and productivity is a key driver in the adoption of autonomous construction equipment. These advanced machines streamline operations by automating repetitive and labor-intensive tasks, reducing the risk of delays caused by human error or fatigue. Autonomous equipment, equipped with technologies like GPS, sensors, and AI, ensures precision and consistency, resulting in faster project completion and optimized resource utilization. By eliminating downtime and improving task accuracy, these machines meet the construction industry's growing need to maximize output while minimizing costs. This is particularly critical in large-scale infrastructure projects where time and resource efficiency are paramount. Moreover, autonomous systems allow for round-the-clock operation, further enhancing productivity compared to traditional methods. As construction companies seek solutions to address tight project timelines and rising labor costs, the adoption of autonomous construction equipment is becoming a strategic imperative for boosting operational efficiency.

Autonomous Construction Equipment Market Restraints:

-

High initial investment and maintenance costs, coupled with the need for skilled management, significantly hinder the adoption of autonomous construction equipment, particularly for small and medium-sized companies.

The adoption of autonomous construction equipment is hindered by its substantial initial investment and high maintenance costs. These advanced machines, equipped with cutting-edge technologies like artificial intelligence, sensors, and automation systems, demand significant capital expenditure. For small and medium-sized construction companies, this financial burden can be prohibitive, limiting their ability to compete with larger players who can more easily absorb such costs. Additionally, ongoing expenses related to software updates, specialized repairs, and technical support further add to the financial strain. While autonomous equipment offers long-term cost-saving potential through enhanced efficiency and reduced labor costs, the immediate financial commitment required often outweighs these benefits for smaller firms. This challenge is compounded by the need for skilled personnel to manage and maintain the systems, adding to operational costs. Consequently, the high initial and maintenance costs remain a significant barrier to widespread adoption in the construction industry.

Autonomous Construction Equipment Market Segment Analysis

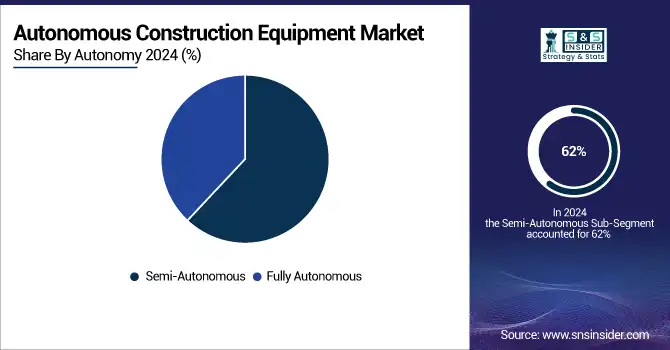

By Autonomy, Semi-autonomous equipment segment dominated in 2024 with over 62% market share.

Semi-autonomous equipment segment dominated with the market share over 62% in 2024 due to its maturity and broader acceptance among construction companies. These machines often feature advanced technologies such as GPS guidance systems, telematics, and remote monitoring capabilities, which enhance efficiency and safety on construction sites. However, they still rely on human operators to oversee and control their operations, particularly in complex or unpredictable environments.

By Application, Road construction segment dominated in 2024 with over 42% market share.

Road construction segment dominated with the market share over 42% in 2024. Machines like autonomous graders, pavers, and material handlers are revolutionizing tasks by performing grading, paving, and transporting materials with high precision and efficiency. These innovations reduce the need for manual labor, minimizing human error and enhancing safety on construction sites. Additionally, the automation of these tasks leads to faster project completion times and lower operational costs, making road development projects more cost-effective and sustainable.

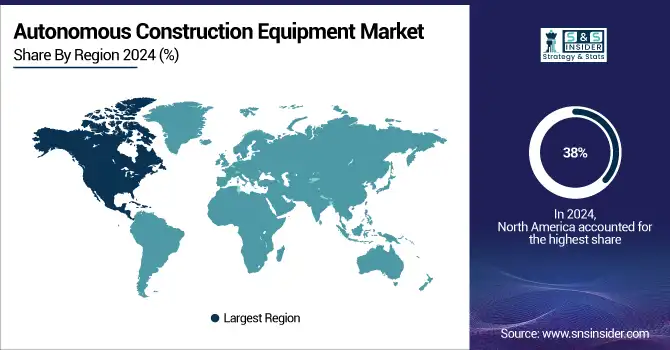

Autonomous Construction Equipment Market Regional Analysis

North America Autonomous Construction Equipment Market Insights

North America region dominated with the market share over 38% in 2024, with the United States at the forefront. The region benefits from its advanced technological infrastructure and substantial investments in construction automation, which have led to the widespread adoption of autonomous machinery across various construction projects. The early adoption of autonomous technologies in the U.S., coupled with the presence of industry giants like Caterpillar and Komatsu, further solidifies its market leadership. These factors, along with a focus on enhancing productivity and reducing labor costs, contribute to North America's continued dominance in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Autonomous Construction Equipment Market Insights

Asia-Pacific is the fastest-growing region in the autonomous construction equipment market, driven by rapid urbanization and the increasing demand for large-scale infrastructure projects. Countries like China, Japan, and South Korea are adopting autonomous technologies to improve efficiency, reduce labor costs, and enhance safety in construction operations. Government initiatives and investments in automation, smart cities, and advanced construction techniques further support market expansion. Additionally, the region's strong focus on technological advancements and innovation in the construction sector creates significant opportunities for growth.

Europe Autonomous Construction Equipment Market Insights

Europe holds a significant share in the autonomous construction equipment market, driven by advanced infrastructure development, increasing adoption of Industry 4.0 technologies, and rising labor costs. Countries across the region are investing in smart construction solutions, including autonomous excavators, loaders, and graders. Strong government initiatives, emphasis on safety, and growing demand for efficient, precise, and sustainable construction operations are further accelerating the adoption of autonomous equipment in Europe.

Middle East & Africa and Latin America Autonomous Construction Equipment Market Insights

The Middle East & Africa and Latin America autonomous construction equipment markets are witnessing gradual growth, fueled by infrastructure development, urbanization, and increasing adoption of smart construction technologies. Rising investments in large-scale construction and mining projects, coupled with the need for enhanced productivity, safety, and operational efficiency, are driving demand. Limited skilled labor and growing awareness of automation benefits further support the expansion of autonomous construction equipment in these regions.

Autonomous Construction Equipment Market Competitive Landscape:

Caterpillar Inc

Caterpillar Inc., founded in 1925, is a global leader in construction and mining equipment, offering autonomous and semi-autonomous solutions such as excavators, loaders, and dozers. Its intelligent machine technologies enhance operational efficiency, safety, and precision, enabling remote operation and data-driven decision-making. Caterpillar’s focus on innovation, durability, and sustainability drives adoption of autonomous construction equipment across global construction and mining projects.

-

2025: Caterpillar added Luminar LiDAR sensors to its Cat Command autonomy platform, enhancing perception in dusty quarry environments and boosting safety and efficiency in heavy-duty construction equipment.

Built Robotics

Built Robotics, founded in 2016, specializes in transforming standard construction equipment into fully autonomous machines using AI and robotics. Its solutions, including autonomous excavators and bulldozers, enhance efficiency, precision, and safety on construction sites while reducing labor requirements. Built Robotics focuses on integrating sensors, machine learning, and automation software to support large-scale infrastructure and industrial projects, driving innovation in the autonomous construction equipment market.

-

2023: Built Robotics introduced the RPD 35 Robotic Pile Driver, an excavator-based autonomous system capable of surveying, driving piles, and generating as-built documentation on utility-scale solar projects.

Deere & Company (John Deere)

Deere & Company (John Deere), founded in 1837, is a global leader in construction and agricultural machinery, offering autonomous and smart equipment such as tractors, graders, and wheel loaders. Its advanced technologies, including machine learning, telematics, and precision control systems, improve operational efficiency, safety, and productivity. John Deere’s focus on automation and intelligent equipment drives adoption in large-scale construction and infrastructure projects worldwide.

-

2024: John Deere launched SmartDetect on select wheel loaders, enhancing operator safety through object detection using radar, cameras, and machine learning.

-

2024: John Deere partnered with Trimble to integrate Trimble Earthworks grade control into Deere’s SmartGrade platform for seamless construction site compatibility.

Autonomous Construction Equipment Companies are:

-

Caterpillar Inc. (Autonomous Excavators, Loaders, Dozers)

-

Bobcat Company (Compact Track Loaders, Skid-Steer Loaders with Autonomous Features)

-

CNH Industrial America LLC (Autonomous Tractors, Excavators)

-

Komatsu Ltd. (Intelligent Machine Control Dozers, Autonomous Haulage Systems)

-

AB Volvo (Autonomous Haulers, Excavators)

-

Hitachi Construction Machinery Co., Ltd. (Excavators, Loaders with Aerial Imaging Technology)

-

Sany Group (Autonomous Cranes, Excavators)

-

Royal Truck & Equipment (Autonomous Truck-Mounted Attenuators)

-

TOPCON CORPORATION (Construction Automation Solutions, GNSS Systems)

-

Built Robotics (Autonomous Excavator Upgrades, Bulldozer Automation Kits)

-

Deere & Company (John Deere) (Autonomous Tractors, Graders)

-

Doosan Infracore (Smart Excavators, Loaders)

-

Trimble Inc. (Automation Control Systems, Software)

-

Leica Geosystems AG (Machine Control Systems, Autonomous Grading)

-

Hyundai Construction Equipment Co., Ltd. (Smart Excavators, Loaders)

-

Komatsu Mining Corp. (Autonomous Mining Trucks, Drills)

-

JCB (Compact Excavators, Loaders with Telematics)

-

Liebherr Group (Autonomous Mining Trucks, Excavators)

-

XCMG Group (Intelligent Excavators, Loaders)

-

Cognex Corporation (Vision Systems, Automation Tools for Construction)

Suppliers for (Advanced GPS and machine-learning technologies for autonomous navigation and operation) on Autonomous Construction Equipment Market

-

John Deere

-

Caterpillar

-

Trimble Autonomy

-

Teleo

-

Wacker Neuson

-

Doosan Infracore

-

Built Robotics

-

Komatsu

-

Volvo Construction Equipment

-

Hitachi Construction Machinery

| Report Attributes | Details |

|---|---|

|

Market Size in 2024 |

USD 13.86 billion |

|

Market Size by 2032 |

USD 27.60 billion |

|

CAGR |

CAGR of 8.99% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Autonomy (Semi-Autonomous, Fully Autonomous) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Caterpillar Inc., Bobcat Company, CNH Industrial America LLC, Komatsu Ltd., AB Volvo, Hitachi Construction Machinery Co., Ltd., Sany Group, Royal Truck & Equipment, TOPCON CORPORATION, Built Robotics, Deere & Company (John Deere), Doosan Infracore, Trimble Inc., Leica Geosystems AG, Hyundai Construction Equipment Co., Ltd., Komatsu Mining Corp., JCB, Liebherr Group, XCMG Group, Cognex Corporation. |