Industrial Thermopile Sensors Market Report & Overview:

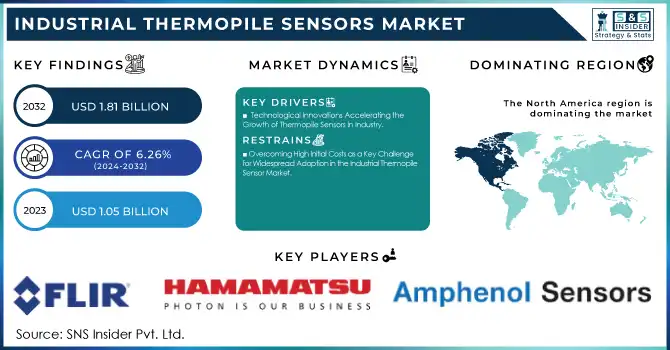

The Industrial Thermopile Sensors Market was valued at USD 1.05 Billion in 2023 and is projected to reach USD 1.81 Billion by 2032, growing at a CAGR of 6.26% during 2024-2032.

Get More Information on Industrial Thermopile Sensors Market - Request Sample Report

The Industrial Thermopile Sensors market is experiencing significant growth due to advancements in sensor technology, which are aligning with the increasing demand for automation, real-time monitoring, and system efficiency across various industries. Thermopile sensors, initially used for basic temperature sensing, are now integral to the smart manufacturing landscape, driven by the Industrial Internet of Things (IIoT) and Artificial Intelligence (AI). As industries continue to adopt automation to optimize operations and reduce energy consumption, the need for high-performance sensors, like thermopile-based systems, becomes more apparent. These sensors, which track critical variables like temperature, pressure, and humidity, help industries ensure that production processes run efficiently and prevent energy waste due to temperature fluctuations. The latest advancements in MEMS thermopile sensors, which use single-crystalline silicon thermocouples, have pushed the performance boundaries by reducing detection limits. Traditional catalytic reaction-based hydrogen (H2) sensors typically detect hydrogen concentrations at a minimum of 0.1%, while MEMS thermopile-based sensors now offer enhanced sensitivity with a detection limit of 10 ppm. The latest generation of these sensors, featuring single-crystalline silicon thermocouples, is capable of detecting hydrogen gas concentrations as low as 1 ppm, which is essential for hydrogen energy applications. The sensors’ ability to detect such low concentrations is a result of the high Seebeck coefficient of single-crystalline silicon, which is several times higher than that of polysilicon, contributing to improved sensitivity. With the increasing adoption of hydrogen as a clean energy source and the growing focus on energy efficiency in industries like manufacturing, oil and gas, and automotive, the demand for precise and reliable thermopile sensors is expected to rise significantly. This market trend is set to continue as industries increasingly rely on automated systems and real-time monitoring solutions for optimal performance.

Market Dynamics

Drivers

-

Technological Innovations Accelerating the Growth of Thermopile Sensors in Industry

These sensors, known for their accuracy in temperature measurements, are increasingly vital in systems requiring reliable data for process control. Improvements in thermopile technology allow for smaller, more compact sensor designs without compromising performance, making them ideal for space-constrained applications. Additionally, the integration of thermopile sensors with advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) enhances their capabilities, enabling real-time monitoring and predictive maintenance in industries like automotive and manufacturing. This evolution has made thermopile sensors more cost-effective; ensuring they are accessible to a broader range of industries that seek high quality, budget-friendly solutions. In sectors requiring precise temperature control, such as gas detection in Malaysia’s industrial landscape, thermopile sensors are increasingly deployed due to their precision and cost efficiency. The growing demand for automation in industries further drives the need for sensors capable of seamlessly integrating with automated systems. As thermopile sensors continue to evolve and become more affordable, they are poised to play a larger role in optimizing industrial processes, enhancing operational efficiency, and supporting the increasing reliance on automation. These technological strides are positioning the thermopile sensor market for sustained growth, driven by the need for enhanced performance and integration with advanced systems.

Restraints

-

Overcoming High Initial Costs as a Key Challenge for Widespread Adoption in the Industrial Thermopile Sensor Market

The industrial thermopile sensor market faces a significant challenge due to the high initial costs associated with advanced thermopile sensors, particularly those utilizing MEMS (Microelectromechanical Systems) technology and single-crystalline silicon. While these sensors offer superior accuracy and sensitivity, their high manufacturing costs can deter adoption, especially among small to medium-sized enterprises (SMEs). The initial investment in these sensors, as well as the costs for calibration, integration, and ongoing maintenance, can strain the budgets of smaller companies. This financial barrier is amplified by the complex nature of MEMS technology and the precision required in manufacturing these sensors. Leading manufacturers, such as TE Sensor Solutions and Micro hybrid, provide advanced sensors with enhanced performance, but these come at a higher price point. As industries push towards greater automation, real-time monitoring, and smart manufacturing, the demand for thermopile sensors is expected to grow. However, the high upfront costs could limit their widespread adoption, particularly in budget-conscious sectors like small-scale manufacturing or emerging markets. Despite the increasing demand for these sensors in applications such as environmental monitoring and energy management, the financial challenges for SMEs remain a key obstacle to broader market penetration. To overcome this restraint, there is a need for cost-reduction strategies in manufacturing or potential support from government incentives and industry players, aimed at helping smaller businesses adopt these critical technologies.

Segment Analysis

By Type

The Thermopile Infrared Sensor segment dominates the Industrial Thermopile Sensors market, accounting for approximately 59% of the market share in 2023. This dominance is attributed to the widespread application of thermopile infrared sensors in various industries such as manufacturing, automotive, and energy. These sensors offer accurate, reliable, and non-contact temperature measurement, making them ideal for real-time monitoring in automated systems and industrial environments. Their ability to detect infrared radiation from objects, coupled with advancements in MEMS (Microelectromechanical Systems) technology, has further enhanced their performance. With increasing adoption of automation, the demand for temperature and environmental monitoring solutions drives the growth of this segment. The rising need for efficient energy management in industries contributes to the significant market share of thermopile infrared sensors.

By Application

The Automobile Industry segment leads the Industrial Thermopile Sensors market, holding approximately 35% of the market share in 2023. This dominance is driven by the growing need for advanced sensor technologies in automotive applications such as engine temperature monitoring, exhaust gas temperature regulation, and safety systems. Thermopile sensors offer non-contact temperature measurement, which is crucial for ensuring optimal performance, energy efficiency, and safety in modern vehicles. With the rise of electric vehicles (EVs) and the increasing adoption of autonomous driving technologies, the demand for precise temperature sensors has surged, particularly for battery management systems and advanced driver-assistance systems (ADAS). The automobile industry's focus on sustainability, energy efficiency, and real-time monitoring further fuels the adoption of thermopile sensors, thereby contributing to the segment's growth in the industrial thermopile sensors market.

Regional Analysis

North America dominates the Industrial Thermopile Sensors market, accounting for approximately 35% of the global share in 2023. The region's leadership is attributed to advancements in industrial automation, the widespread adoption of smart manufacturing practices, and a robust focus on renewable energy solutions. The United States, as the largest contributor, is a hub for technological innovation, with significant investments in industries such as automotive, aerospace, and energy. Government initiatives promoting clean energy and stringent regulatory frameworks for environmental monitoring have further boosted the adoption of thermopile sensors in the region. Additionally, Canada is witnessing growth in the oil and gas sector, where thermopile sensors are increasingly used for temperature monitoring in harsh environments. The region’s mature infrastructure, coupled with strong R&D efforts, ensures North America remains at the forefront of the industrial thermopile sensors market.

The Asia-Pacific region is set to be the fastest-growing market for industrial thermopile sensors from 2024 to 2032, driven by rapid industrialization, technological advancements, and the growing adoption of automation. Key countries like China, Japan, South Korea, and India are leading this growth with significant developments in automotive, electronics, and renewable energy sectors. China, as the world’s largest manufacturing hub, is seeing high demand for thermopile sensors in smart factories and IoT-driven production lines, supported by government investments in hydrogen energy. Japan and South Korea are advancing sensor integration in electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Meanwhile, India’s “Make in India” and Industry 4.0 initiatives are boosting automation and smart manufacturing. Asia-Pacific’s expanding manufacturing base, lower production costs, R&D focus, and increasing infrastructure development fueled by urbanization collectively position the region as a key driver of market growth.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Some of the major key players in Industrial Thermopile Sensors with product:

-

Excelitas Technologies (Thermopile Sensors, Infrared Detectors)

-

Fuji Ceramics Corporation (Thermopile Sensors, Infrared Sensors)

-

Ampheonl Advanced Sensors (Thermopile Sensors, Radiation Detectors)

-

FLIR Systems (Thermal Cameras, Infrared Sensors)

-

Heimann Sensor GmbH (Thermopile Sensors, Infrared Sensors)

-

Nippon Ceramic (Thermopile Sensors, Ceramic Components)

-

Hamamatsu Photonics (Infrared Sensors, Light Sensors)

-

Texas Instruments (Thermopile Sensors, Analog-to-Digital Converters)

-

Panasonic (Infrared Sensors, Thermopile Sensors)

-

GE (Infrared Sensors, Thermal Imaging Products)

-

Zilog (Microcontrollers, Thermal Sensors)

-

InfraTec (Thermopile Sensors, Infrared Thermometers)

-

TE Connectivity (Thermopile Sensors, Temperature Sensors)

-

Murata (Thermopile Sensors, Sensors for Automotive Applications)

-

Winsensor (Thermopile Sensors, Temperature Sensors)

-

Honeywell (Infrared Sensors, Thermopile Sensors, Temperature Sensors)

-

Omron (Thermal Sensors, Infrared Sensors, Temperature Sensors)

-

STMicroelectronics (Thermopile Sensors, MEMS Sensors)

-

Rockwell Automation (Industrial Sensors, Thermopile Sensors)

-

Broadcom (Infrared Sensors, Thermal Sensing Modules)

List of Suppliers that provide Raw material and Component in Industrial Thermopile Sensors market

Ceramic Materials

-

Saint-Gobain (Ceramic Components, Substrates)

-

CoorsTek (Ceramic Substrates, High-performance Ceramics)

-

Murata Manufacturing (Ceramic Materials for Sensors)

Semiconductors & Electronics Components

-

Texas Instruments (Semiconductor Components, Signal Processing Chips)

-

ON Semiconductor (Thermopile Sensor ICs, Power Management ICs)

-

Infineon Technologies (Semiconductors for Sensors)

-

NXP Semiconductors (Semiconductors for Sensor Systems)

Infrared & Thermal Sensing Components

-

Emerson Electric Co. (Infrared Sensors, Thermal Sensors)

-

Hamamatsu Photonics (Infrared Sensors, Photodiodes, Photomultiplier Tubes)

-

FLIR Systems (Thermal Cameras, Infrared Detectors)

Optical Materials

-

Thorlabs (Optical Components, Lenses, Filters)

-

Edmund Optics (Optical Lenses, Windows, Coatings)

-

Asahi Glass (Optical Glass, Lenses)

Packaging Materials

-

Amkor Technology (Packaging Solutions for Sensors)

-

ASE Group (Sensor Packaging, Semiconductor Packaging)

-

JCET Group (Packaging Components)

Raw Materials for Manufacturing Sensors

-

Albemarle Corporation (Materials for Sensor Manufacturing)

-

Honeywell Advanced Materials (Thermal Management Materials)

-

Laird Technologies (Thermal Interface Materials)

Recent Development

-

January 2025, in Pittsburgh, PA, Excelitas Technologies introduced the VTH3020 Large Area Silicon Photodiode, featuring a 10 mm x 10 mm active area and advanced CoB design for precise alpha particle detection applications, including radon gas monitoring.

-

DECEMBER 2024 — Teledyne FLIR OEM, in collaboration with VSI Labs, revealed testing results showcasing how its thermal imaging PAEB system surpassed state-of-the-art AEB systems in meeting FMVSS No. 127 nighttime safety standards, set to take effect by 2029.

-

December 2024 — Honeywell unveiled a new liquid flow sensing platform aimed at enhancing the precision of liquid medication dosing and streamlining patient treatment processes across healthcare applications.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.05 Billion |

| Market Size by 2032 | USD 1.81 Billion |

| CAGR | CAGR of 6.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Thermopile Laser Sensor & Thermopile Infrared Sensor) • By Application (Medical Industry, Automobile Industry, Defence Industry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Excelitas Technologies, Fuji Ceramics Corporation, Ampheonl Advanced Sensors, FLIR Systems, Heimann Sensor GmbH, Nippon Ceramic, Hamamatsu Photonics, Texas Instruments, Panasonic, GE, Zilog, InfraTec, TE Connectivity, Murata, Winsensor, Honeywell, Omron, STMicroelectronics, Rockwell Automation, and Broadcom are key players in the industrial thermopile sensor market. |

| Key Drivers | • Technological Innovations Accelerating the Growth of Thermopile Sensors in Industry |

| Restraints | • Overcoming High Initial Costs as a Key Challenge for Widespread Adoption in the Industrial Thermopile Sensor Market |