Intelligent Power Module Market Report Scope & Overview:

Get More Information on Intelligent Power Module Market - Request Sample Report

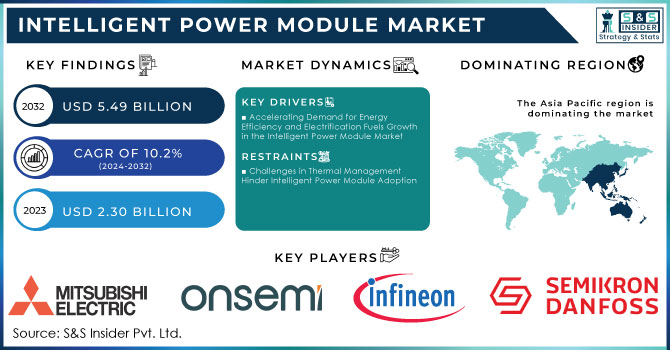

The Intelligent Power Module Market Size was valued at USD 2.30 Billion in 2023 and is expected to reach USD 5.49 Billion by 2032 and grow at a CAGR of 10.2% over the forecast period 2024-2032.

The Intelligent Power Module (IPM) market is experiencing significant growth, Growing demands for energy-efficient electronic systems, new developments in power electronics, and the drive towards renewable energy sources are forcing rapid growth within the IPM marketplace. IPMs are critical elements of power conversion systems since they house the power switching devices along with in-built protection circuits and driving circuitry. The use of an IPM offers a compact and efficient solution for a wide range of applications. They primarily perform tasks related to controlling and managing electrical energy conversion efficiently; hence, they are regarded as one of the most enabling technologies in industries dealing with automotive, industrial automation, consumer electronics, and renewable energy systems.

Government initiatives and regulations are also major factors driving the intelligent power module market. For instance, the European Union in September 2024 came up with new policy updates for its Energy Efficiency Directive that is aimed at helping industrial and commercial systems reduce their energy consumption by 32.5% before the year 2030. The regulation has forced industries to shift their focus toward more energy-efficient technologies, and such technologies include IPMs.

The U.S. Government has also realized this and has undertaken several initiatives to spur the use of efficient power electronics via the EERE office. It has agreed to commit substantial funding to the DoE for research and development of advanced power electronics, meaning SiC and GaN, key components of intelligent power modules. Besides, the proliferation of electric vehicles in the U.S., driven by tax incentives and subsidies under the Inflation Reduction Act of 2022, is likely to accelerate the demand for IPMs in EVs, which have increasing power management needs.

Intelligent Power Module Market Dynamics

Key Drivers:

-

Accelerating Demand for Energy Efficiency and Electrification Fuels Growth in the Intelligent Power Module Market

An increasing number of industries are looking at sustainability with less energy consumption. This has thrown a massive order for intelligent power modules. According to the International Energy Agency (IEA), electricity consumption is going to augment profoundly in 2050, thus creating a strong need for power management solutions with high efficiency. Rapid growth in the transition toward electric vehicles also drives the demand for IPMs, given the very complex power requirements associated with electric vehicles and charging stations. The adoption of Intelligent Power Modules has been accelerating. All these present a significant picture of rapid growth given the complexity and rising efficiency of power solutions in automotive and renewable energy applications. It was reported that the advanced IPMs would improve the system performance by 10-20% through enhanced efficiencies in the conversion of energy. In the meantime, potential enhancement in the performance of Intelligent Power Modules itself would also come with further advancement of thermal management technologies. Through effective thermal management, efficiency, and reliability increase by as much as 30% or more in high-power applications. How much is the importance of thermal management in power electronics, the fact that in several applications, failures due to thermal reasons account for more than 50% of failures of power modules discloses this.

Restrain:

-

Challenges in Thermal Management Hinder Intelligent Power Module Adoption

High-performance applications, such as automotive and renewable energy applications, generate a massive amount of heat that would reduce the reliability and lifespan of the IPM. The most common cause of failure about inefficient thermal management is system failure, hence impairing the efficiency of operations in the modules. A study, in 2024, emphasized thermal management to boost the performance of thermal systems by as much as 15-20%, which allows an improvement of up to 30% of an IPM life span in the automotive and industrial manufacturing industries. More than 50% of the module failures in these industries are related to thermal problems, which would demand better cooling technologies for uninterrupted operation and loss prevention through downtime. The addition of silicon carbide (SiC) technology in IPMs further improves thermal conductivity to enable a more efficient dissipation of 20-30% of heat to traditional silicon modules.

The use of renewable energy-based IPMs had a strong potential for significant growth as more efficient energy conversion was needed in solar and wind power systems. Integration of IPMs in renewable energy infrastructure will be seen to increase by 25-30% over the next five years, and SiC-based IPMs are expected to have up to 50% better efficiency in managing power output variations. By 2030, the sector is anticipated to account for 35% of the total IPM demand, as driven by the industry's push for sustainability and reducing carbon footprints. Overall, they pinpoint the pivotal role that holds thermal management and efficient energy conversion technologies in the IPM market's expansion.

Intelligent Power Module Market Segmentation Overview

By Application Type

In 2023, Automotive was the largest segment registering over 32% of the total market share, and is to be expected to grow at the highest CAGR of 11.6% during the next forecast period. This is due to increasing HEV and EV adoption, which will become wider in future years. The International Energy Agency reported that electric car sales hit nearly 14 million in 2023, 95 percent of which were in China, and Europe, up again. IPMs play an important role within the automotive systems due to the ever-increasing electrification within this industry, being used to control and optimize diverse functions, such as oil pumps, AC compressors, and onboard chargers of electric vehicles. The IEA also predicts that in 2030, electric vehicles could account for up to 30 percent of new car sales worldwide, thereby increasing the demand for intelligent power management systems in this sphere.

The Consumer Electronics Segment is expected to be remarkable in terms of CAGR during the forecast period. Sharp growth in this segment can be envisaged due to the immense demand for smart as well as performance-intensive products. Intelligent power modules are used in all types of household appliances such as air conditioners, Washing Machines, Refrigerators, Fans, Air Purifiers, And Many More Electronic Devices.

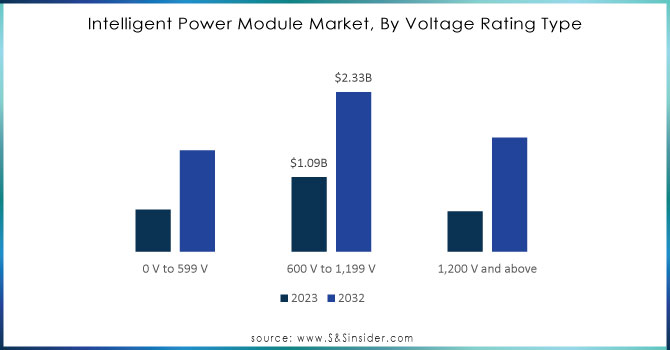

By Voltage Rating Type

In 2023, the 600 V to 1,199 V segment accounted for above 47% of the revenue share from 2023. This segment is mainly driven by its widespread usage in high-end home appliances and industrial drives as it covers a wide range of applications in this voltage category. The segment has gained dominance because the IPM is available within the voltage category. The majority of market players offer IPMs with voltage ratings in this range. As an example, the 650 V TRENCHSTOP IGBT-based IPM IFCM20T65GD is specifically designed by Infineon Technologies AG to be included in industrial drives and appliances that are used within homes. Therefore, as both industry and households change the way they consume energy to more efficient methods, high demand has developed for IPMs whose voltage rating falls in the mid-range.

The 1,200 V and above segment is expected to grow the most rapidly, during the forecast period with a compound annual growth rate of 12.25%. This growth is attributed to the increasing need for high-voltage IPMs in applications such as automotive, industrial automation, and HVAC systems. It also continues to rise due to the global trends toward electric and hybrid vehicles where there is a significant growth in high-voltage IPMs for power management. For instance, onsemi designs the NFVA23512NP2T, an intelligent power module that has a 1,200 V rank and is extensively used in hybrid and electric vehicle applications. In line with increasing demands for energy efficiency, industrial automation is gaining momentum.

Need Any Customization Research On Intelligent Power Module Market - Inquiry Now

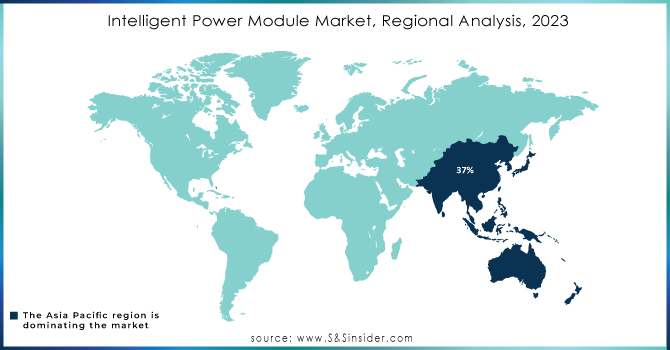

Intelligent Power Module Market Regional Analysis

The Asia Pacific region captured over 37% of the Intelligent Power Module market in 2023 and is forecasted to maintain the highest CAGR at 10.83% during the forecast period. This is mainly due to China being the prime market for automobiles and passenger vehicles. In addition, the region has good renewable capacity too. Increased use cases of Intelligent Power Modules in automobiles and renewable energy call fuel for this growth. Manufacturing engagements within the region are strong. Asia's automobile sales grew by 4.5% year over year to 5,378,704 units in the first half of 2023. Economic recovery improved supply, accounting for the growth. The automobile production for the quarter increased by 13.3% at 7.48 million units on account of robust manufacturing activities in the region. The exports of India went down by 1.3%, while other nations were experiencing double-digit growth in exports. Such a vibrant automotive scene lends scope for the demand for IPMs in electric and hybrid vehicles, growing more and more common in the market.

The growth in the North American region is likely to be significant due to an expected robust increase in the Intelligent Power Module market with a high CAGR during the forecast period. The major proponents for this growth are led by the major players, such as Semiconductor Components Industries, LLC (onsemi) and Alpha and Omega Semiconductor, which set the pace of innovation. The advanced technology setup and relatively high electronics manufacturing activities in the region are enabling growth in this market. In addition, government initiatives undertaken in 2023 to promote the development of semiconductor production will boost market trends, which is one step among other measures taken to further develop the electronics sector.

Key Players in Intelligent Power Module Market

Some of the major players in the Intelligent Power Module Market are:

-

Mitsubishi Electric Corporation (Mitsubishi Electric Power Modules, Mitsubishi Electric IPM Drivers)

-

Semiconductor Components Industries, LLC (onsemi) (onsemi IPM Modules, onsemi IPM Gate Drivers)

-

Infineon Technologies AG (Infineon CoolSiC™ IPMs, Infineon CoolMOS™ IPMs)

-

Fuji Electric Co., Ltd. (Fuji Electric IPM Modules, Fuji Electric IPM Gate Drivers)

-

Semikron Danfoss (Semikron SK600 IPM Modules, Semikron SK300 IPM Modules)

-

ROHM CO., LTD. (ROHM Power Modules, ROHM Gate Drivers)

-

STMicroelectronics (STPower IPM Modules, STMicroelectronics Gate Drivers)

-

Alpha and Omega Semiconductor (Alpha and Omega Power Modules, Alpha and Omega Gate Drivers)

-

Sensitron Semiconductor (Sensitron Power Modules, Sensitron Gate Drivers)

-

Ideal Power, Inc. (Ideal Power Half Bridge Modules, Ideal Power Full Bridge Modules)

-

Cissoid (Cissoid Power Modules, Cissoid Gate Drivers)

-

Texas Instruments (Texas Instruments Power Modules, Texas Instruments Gate Drivers)

-

Vicor Corporation (Vicor Power Modules, Vicor Gate Drivers)

-

Powerex, Inc. (Powerex Power Modules, Powerex Gate Drivers)

-

Littelfuse (Littelfuse Power Modules, Littelfuse Gate Drivers)

-

Diodes Incorporated (Diodes Incorporated Power Modules, Diodes Incorporated Gate Drivers)

-

Vishay Intertechnology (Vishay Power Modules, Vishay Gate Drivers)

-

Fairchild Semiconductor (Fairchild Power Modules, Fairchild Gate Drivers)

-

Microchip Technology (Microchip Power Modules, Microchip Gate Drivers)

-

Renesas Electronics Corporation (Renesas Power Modules, Renesas Gate Drivers)

Recent Trends

-

In February 2024, onsemi debuted its 7th generation IGBT-based Intelligent Power Modules to further unlock performance in applications in the automotive and industrial arenas. The modules deliver enhanced efficiency and thermal performance that are better equipped to meet increasing power management demands in electrification and renewable energy groups.

-

In August 2024, At the company's booth, Infineon showed its new CIPs Maxi Intelligent Power Modules, optimized for high-performance applications. The company expects that the leading-edge technology implemented in its modules will satisfy the requirements for robust power solutions in all areas - especially automotive and industrial automation.

-

In January 2024, Thelec announced, "Thelec reaches landmark in power module technology". According to them, the company is experiencing tremendous progress in the power module segment, still reflecting the main trends in this industry. The report underlined "Efficiency and reliability becoming ever more significant issues in Intelligent Power Modules as industries look towards sustainable energy solutions".

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.30 Billion |

| Market Size by 2032 | US$ 5.49 Billion |

| CAGR | CAGR of 10.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Device Type (IGBT, MOSFET) • By Voltage Rating Type (0 V to 599 V, 600 V to 1,199 V, 1,200 V and above) • By Application Type (Automotive, Industrial, Consumer Electronics, Energy & Utility, IT & Telecommunication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mitsubishi Electric Corporation, Semiconductor Components Industries, LLC (onsemi), Infineon Technologies AG, Fuji Electric Co., Ltd., Semikron Danfoss, ROHM CO., LTD., STMicroelectronics, Alpha and Omega Semiconductor, Sensitron Semiconductor, Ideal Power, Inc., Cissoid, Texas Instruments, Vicor Corporation, Powerex, Inc., Littelfuse, Diodes Incorporated, Vishay Intertechnology, Fairchild Semiconductor, Microchip Technology, Renesas Electronics Corporation |

| Key Drivers | • Accelerating Demand for Energy Efficiency and Electrification Fuels Growth in the Intelligent Power Module Market. |

| Restraints | • Challenges in Thermal Management Hinder Intelligent Power Module Adoption |