Inflation Devices Market Key Insights:

Get More Information on Inflation Devices Market - Request Sample Report

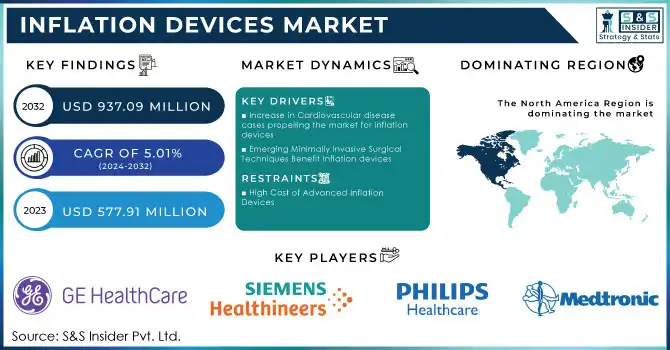

The Inflation Devices Market Size was valued at USD 577.91 million in 2023 & is expected to reach USD 937.09 million by 2032, growing at a CAGR of 5.01% during the forecast period of 2024-2032.

The inflation device market is an important area for healthcare, especially in interventional procedures like angioplasty, balloon catheterization, and other minimally invasive surgeries. These devices are used to inflate and monitor pressure in medical balloons during treatment. Their widespread application in cardiology, gastroenterology, and radiology confirms the importance of inflation devices in modern healthcare.

Advances in technology have propelled the development of more ergonomic and high-pressure-capable devices, leading to improved clinical results. Leaders within this market, including Boston Scientific, Medtronic, and Terumo Corporation, continue to innovate to improve the efficiency and user-friendliness of the products. For example, the new designs are designed to be light and easy to handle, with fewer complexities in the procedure.

Boston Scientific has recently developed high-performance inflation devices with enhanced pressure control, which have been reported to be reliable. Medtronic took eco-friendly and cost-effective devices into focus as they converged the market demand and environment sensitivity.

The market is also seeing increased adoption in emerging economies, which are driven by the expansion of healthcare infrastructure and a growing focus on improving surgical outcomes. Perhaps the most significant development is that regulatory authorities in Asia-Pacific recently approved innovative inflation devices from Terumo Corporation, thereby expanding the market reach even further.

Inflation Devices Market Dynamics

Drivers

-

Increase in Cardiovascular disease cases propelling the market for inflation devices

Cardiovascular diseases (CVDs) are still the leading cause of death in the world, claiming around 18 million lives every year, as reported by the World Health Organization (WHO). The increasing burden of these diseases requires the need for minimally invasive procedures such as balloon angioplasty, where inflation devices are critical for accurate balloon catheter operations. According to various studies, the global prevalence of coronary artery disease has risen by more than 15% in the last decade. This propels the demand for advanced medical devices even more. Indeed, the shift by hospitals and surgical centers towards tools that improve the outcome of CVD treatments is accelerating the adoption of reliable and efficient inflation devices.

-

Emerging Minimally Invasive Surgical Techniques Benefit Inflation devices

The global healthcare industry prefers MIS over other types of surgical procedures due to a faster recovery time, less discomfort for patients, and less likelihood of further complications compared to open surgeries. For instance, annually, more than 400,000 coronary angioplasties are performed in the United States alone, and similar trends are reflected all over the world. Inflation devices are an essential component of MIS procedures, allowing for precision control in pressure-sensitive applications such as balloon dilation and stent placements. The continued development of MIS technologies, allied with the increased availability of skilled professionals, has opened up significant market opportunities for inflation devices, which would be markedly enhanced by cardiology and gastroenterology applications.

Restraint

-

High Cost of Advanced Inflation Devices

The major restraint for the inflation device market is the high price associated with advanced products. Newer inflation devices are feature-rich with technologies such as state-of-the-art pressure measurement, ergonomic design, and electronic display, making them more expensive to manufacture. That could reduce their affordability, especially in developing countries with lower healthcare budgets.

For example, acquisition of these devices in low- and middle-income countries could be difficult for hospitals and surgical centers because they have limited budgets; these facilities could instead opt for cheaper, more affordable options or traditional equipment. Thus, price sensitivity could minimize the adoption of advanced inflation devices in many areas, retarding market growth for the geography.

Key Segmentation Analysis

by Display type

The analog inflation devices segment has dominated the market with a market share of 55%, in 2023. Pressure levels in analog inflation devices are measured and given out on a simple scale. The readings are measured using a needle pointing to the reading on the scale. Each movement by the needle changes the pressure. Unlike the earlier forms of the model, readings on these devices may be recorded, making them easier to use.

Further, analog displays are found in larger buildings that consist of multiple units. The growing number of cardiovascular diseases that need surgery as their cure is the primary reason causing this increase in analog inflation devices. Furthermore, lower price quotes for analog inflation devices raise their demand and, as a result, push this market to grow. The ease of use of these devices, along with no need for power, promotes the expansion of this market.

by application

Interventional cardiology and radiology dominate the way in this market by having a maximum share and it is further expected to grow at a CAGR of 6.80% during the forecast period.

The use of catheters in interventional cardiology aids in treating structural conditions of the heart. For instance, during a procedure such as coronary angioplasty, deflated balloon catheters are placed inside narrowed arteries and then inflated to restore proper blood flow. Devices for inflating these balloons are critical in accurately inflating the balloon. Inversely, interventional radiology involves minimally invasive techniques that often involve the use of balloons and therefore require inflation tools.

The increasing prevalence of cardiovascular diseases is one of the major drivers for inflation devices in their above applications. Increasing demand helps to underpin the fact that inflation devices play an important role in ensuring the success and safety of such procedures.

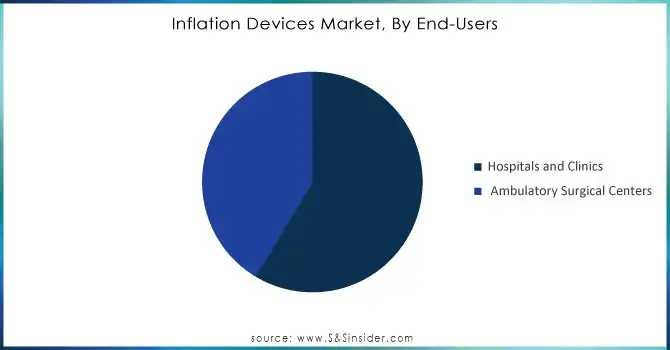

by end-users

The hospitals and clinics segment is the fastest growing in the market and is expected to grow at a CAGR of 3.86% for the forecast period.

Hospitals are healthcare centers that offer diverse medical care services, such as surgery and nursing care, to patients suffering from different afflictions. In a hospital, critical surgeries like cardiac and gastrointestinal surgeries are performed on patients with the help of other special devices and highly trained doctors. Inflation devices play an integral role in these surgeries as well, assisting these surgeries to be completed effectively. The large-scale usage of these inflation devices in hospitals is significantly contributing to the growth of this segment globally.

Need Any Customization Research On Inflation Devices Market - Inquiry Now

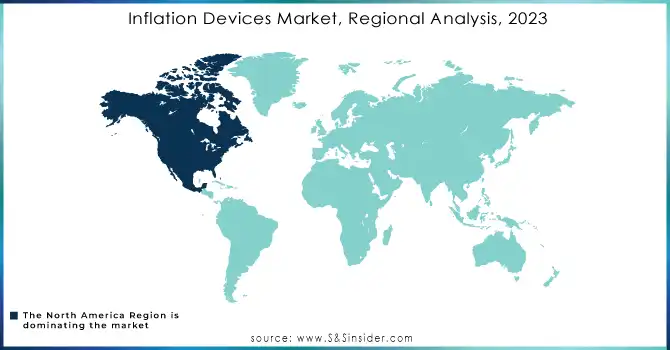

Inflation Devices Market Regional Overview

North America holds the largest share of the inflation devices market and is projected to grow at a CAGR of 3.73% during the forecast period. The region's dominance can be attributed to increased healthcare spending. For instance, the Centers for Medicare & Additionally, North America is home to leading industry players such as Merit Medical Systems, Teleflex Inc., Argon Medical Devices Inc., Medtronic Plc., and Becton Dickinson and Company, further bolstering market growth.

The rise in surgical procedures and the growing elderly population in the region also contribute significantly to market expansion. Older individuals are more prone to conditions like cardiovascular and gastrointestinal diseases, which often require surgical intervention, driving demand for inflation devices.

The Asia-Pacific region is anticipated to experience the fastest growth during the forecast period, driven by increasing consumer spending power. With populous nations like China and India leading the way, the demand for inflation devices is expected to surge. The market growth in this region is further supported by rising healthcare expenditures and advancements in healthcare infrastructure. These developments have led to a rise in surgical procedures, subsequently boosting the demand for inflation devices in the region.

Key Players in Inflation Devices Market

-

GE Healthcare (CardioMed Inflation Device, Voluson E10 Ultrasound Inflation System)

-

Philips Healthcare (XperFlex Inflation Device, Interventional Cardiology Inflation Systems)

-

Siemens Healthineers (Artis Zeego Inflation System, ACUSON SC2000 Ultrasound Inflation System)

-

Medtronic (Invivo Inflation System, SynchroMed II Infusion System)

-

Terumo Corporation (Radifocus Inflation Device, Sterile Infusion Pump)

-

Boston Scientific (RotaWire Inflation Device, QuickCross Inflation System)

-

Abbott Laboratories (INR Inflator, Inflation Device for Coronary Artery Bypass Grafting)

-

Cook Medical (Vertebral Balloon Inflation System, Radiological Inflation Devices)

-

Becton Dickinson (BD) (BD Nexiva Inflator, BD Pyxis Infusion Pump)

-

Cardinal Health (Inflation Control Device for Catheters, Cordis Inflation System)

-

Fujifilm Holdings Corporation (Fujifilm Inflation Valve System, Fujifilm Cardiovascular Inflation Device)

-

Stryker Corporation (Stryker Infusion Pump, Stryker Balloon Inflation Device)

-

Johnson & Johnson (Ethicon) (Ethicon Inflation Device, Endo GIA™ Inflation System)

-

Smith & Nephew (Synovial Joint Inflation Device, Wound Closure Inflation Systems)

-

Covidien (Medtronic) (DuoClamp Inflation Device, MiniStar Inflation Systems)

-

Halyard Health (Sterile Gas Inflation Device, Halyard Balloon Inflator)

-

Angio Dynamics (Inflation Pump for Angioplasty, FlowMaster Inflation Systems)

-

Mindray (AccuFlo Inflation System, Mindray CorFlo Cardiovascular Inflator)

-

Conmed Corporation (Supera Inflator, Conmed VisiClear Inflation System)

-

Merit Medical Systems (Merit Inflation System, Merit Flex Inflation Device)

Key Suppliers

This list provides key suppliers in the market that play significant roles in providing the components and technologies used in inflation devices.

-

GE Healthcare

-

Philips Healthcare

-

Siemens Healthineers

-

Medtronic

-

Terumo Corporation

-

Boston Scientific

-

Abbott Laboratories

-

Cook Medical

-

Becton Dickinson (BD)

-

Cardinal Health

Recent Developments

-

In November 2024, GE Healthcare unveiled its AI Innovation Lab, an important effort aimed at advancing the company's initial AI initiatives. In line with its larger strategy in AI and digital technology, the lab specializes in integrating AI into medical equipment, improving diagnostic processes, and simplifying healthcare operations.

-

In June 2024, Royal Philips, a leading company in health technology, revealed the findings of its Future Health Index 2024 report: Improved healthcare for a larger population. Unveiled during HLTH Europe, the ninth yearly FHI global report reveals that healthcare executives are embracing virtual care and AI-driven advancements to tackle challenges stemming from workforce deficiencies, financial pressures, and increasing need.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 577.91 million |

| Market Size by 2032 | US$ 937.09 million |

| CAGR | CAGR of 5.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Display Type (Analog Inflation Devices, Digital Inflation Devices) • By Applications (Gastroenterological Procedures, Urological Procedures, Interventional Cardiology and Radiology, Peripheral Vascular Procedures) • By End-Users (Hospitals and Clinics, Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Philips Healthcare, Siemens Healthineers, Medtronic, Terumo Corporation, Boston Scientific, Abbott Laboratories, Cook Medical, Becton Dickinson (BD), Cardinal Health, Fujifilm Holdings Corporation, Stryker Corporation, Johnson & Johnson (Ethicon), Smith & Nephew, Covidien (Medtronic), Halyard Health, Angio Dynamics, Mindray, Conmed Corporation, Merit Medical Systems, and other players. |

| Key Drivers | • Increase in Cardiovascular disease cases propelling the market for inflation devices • Emerging Minimally Invasive Surgical Techniques Benefit Inflation devices |

| Restraints | • High Cost of Advanced Inflation Devices |