Angioplasty Balloon Market Report Scope & Overview:

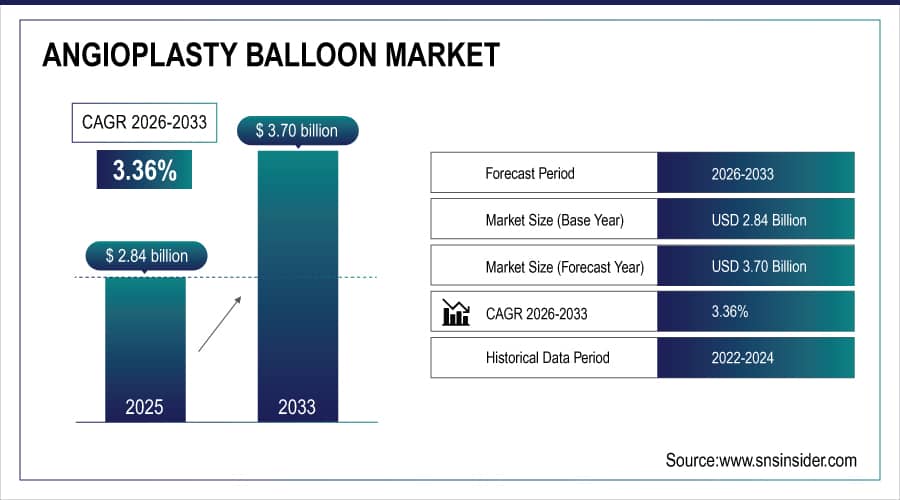

The Angioplasty Balloon Market size is estimated at USD 2.84 Billion in 2025 and is expected to reach USD 3.70 Billion by 2033, growing at a CAGR of 3.36% over the forecast period of 2026-2033.

The global angioplasty balloon market growth is driven by the rising global burden of cardiovascular and peripheral artery diseases, an aging population, and increasing prevalence of risk factors, such as diabetes and obesity. New technologies in balloon design, such as drug-coated, scoring, and customized balloons for complicated lesions, are making procedures more successful and lowering the risk of restenosis. This is helping the industry grow. The increased preference for outpatient settings and good payment regulations for minimally invasive procedures further help the global use of angioplasty balloons.

For instance, in March 2024, a clinical study published in the Journal of the American College of Cardiology reported that drug-eluting balloons demonstrated a 25% lower target lesion revascularization rate compared to conventional balloons in femoropopliteal artery disease, accelerating their adoption in peripheral interventions.

Angioplasty Balloon Market Size and Forecast:

-

Market Size in 2025E: USD 2.84 Billion

-

Market Size by 2033: USD 3.70 Billion

-

CAGR: 3.36% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Angioplasty Balloon Market - Request Free Sample Report

Angioplasty Balloon Market Report Highlights:

-

Increasing incidence of coronary artery disease and peripheral artery disease is driving demand for effective minimally invasive revascularization therapies.

-

Development of patient-specific balloon catheter technologies based on lesion characteristics, vessel anatomy, and restenosis history for improved clinical outcomes.

-

Introduction of drug-eluting balloons, cutting and scoring balloons, and combination therapies to improve vessel patency and reduce repeat revascularization rates.

-

Use of intravascular imaging modalities, AI-driven lesion assessment tools, and real-time monitoring platforms for optimized procedural planning and enhanced patient outcomes.

-

Growth in demand for ambulatory surgical center procedures, outpatient interventions, and same-day discharge protocols for improved patient convenience and reduced hospital stays.

-

Partnerships between medical device manufacturers, healthcare institutions, and research organizations to advance balloon catheter innovation and accelerate regulatory approvals.

-

FDA, EMA, and regional regulatory authorities promoting standardized clinical trial protocols, safety monitoring requirements, and post-market surveillance to ensure device efficacy and patient safety.

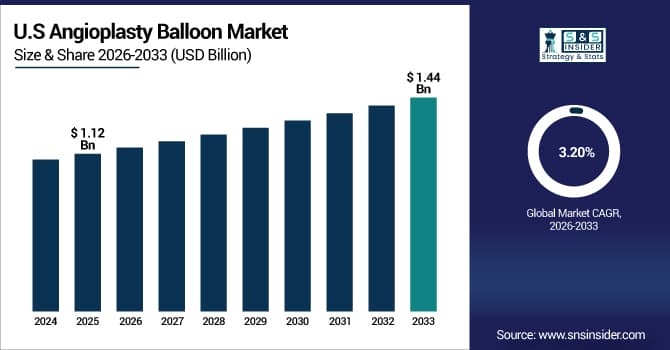

The U.S. Angioplasty Balloon Market is estimated at USD 1.12 Billion in 2025 and is expected to reach USD 1.44 Billion by 2033, growing at a CAGR of 3.20% from 2026-2033.

The U.S. has the most share of the angioplasty balloon market as cardiovascular disorders are so common, interventional cardiology infrastructure is so advanced, and cutting-edge medical technology are so easy to get. Comprehensive insurance coverage, strong reimbursement systems for percutaneous coronary procedures, and high healthcare spending on cardiac care all help the market thrive. The U.S. is also the biggest market in the world because it was one of the first to use drug-eluting balloon technology and is still doing clinical trials for next-generation devices.

Angioplasty Balloon Market Growth Drivers:

-

Drug-Eluting Balloon Technology is Driving the Angioplasty Balloon Market Growth

Drug-eluting balloon technology is a major factor in the growth of the angioplasty balloon market as paclitaxel- and sirolimus-coated balloons deliver antiproliferative drugs directly to vessel walls, which greatly lowers the rates of restenosis and makes permanent metallic implants unnecessary. These new ideas deal with the important problem of in-stent restenosis and give patients with numerous stent layers or those at high risk for thrombotic consequences real therapy alternatives. The FDA's approval of the AGENT Drug-Coated Balloon in March 2024 is an example of the regulatory backing for this technology. It is becoming more popular in both coronary and peripheral applications, which is leading to big gains in its global market share.

For instance, in October 2024, Medtronic secured FDA investigational-device-exemption approval to launch the Prevail DCB pivotal trial, comparing outcomes with Boston Scientific's AGENT platform across 65 global centers, underscoring the competitive innovation landscape and expanding drug-eluting balloon market adoption.

Angioplasty Balloon Market Restraints:

-

High Device Costs and Reimbursement Challenges are Hampering the Angioplasty Balloon Market Growth

High device costs and problems with getting paid back are major obstacles to the growth of the angioplasty balloon market as advanced drug-eluting balloons and specialty devices cost more than regular balloon catheters and drug-eluting stents. This price difference makes it harder for people to accept, especially in markets and healthcare systems where prices are sensitive and funds for interventional cardiology procedures are tight. Also, because of safety warnings related to late mortality two to three years after treatment, regulators are still keeping a close eye on paclitaxel-coated devices. This has made physicians and payers hesitant, which has led to the need for long-term follow-up studies and strict patient selection protocols. These characteristics together make it harder for the industry to grow in areas where reimbursement rules favor cheaper options or where bundled payment structures encourage the use of drug-eluting stents instead of balloon-only methods.

Angioplasty Balloon Market Opportunities:

-

Emerging Applications in Peripheral Artery Disease Drive Future Growth Opportunities for the Angioplasty Balloon Market

The angioplasty balloon industry has a chance to increase because the population is getting older quickly and lifestyle-related vascular disorders are becoming more common in Asia Pacific and Latin America. Drug-coated balloons created specifically for femoropopliteal and below-the-knee procedures are exhibiting better vascular patency rates than traditional angioplasty. Clinical investigations have shown that these benefits endure for at least twelve months. Drug-eluting balloons that treat stenosis in arteriovenous fistulae are used in specialized applications for maintaining dialysis access. This is another area that has seen a lot of growth since the FDA approved them. These new uses, along with better healthcare infrastructure, more skilled interventional cardiologists, and easier access to medical devices in developing markets, create a lot of chances to reach more people, improve patient outcomes, and make a lot of money in new geographic areas and clinical settings.

For instance, in October 2024, the CDC reported that approximately 5% of adults aged 20 and older have coronary artery disease in the U.S., translating to about 1 in 20 individuals, highlighting the substantial patient population requiring interventional treatments and underscoring the significant market opportunity for angioplasty balloon technologies.

Angioplasty Balloon Market Segment Analysis:

-

By Product, the Drug-Eluting Balloons segment held the largest share of around 42.5% in 2025E and is also expected to register the highest growth with a CAGR of 4.1% from 2026-2033.

-

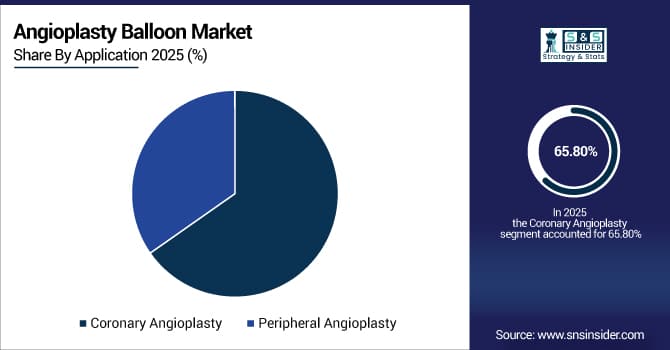

By Application, the Coronary Angioplasty segment dominated the market with approximately 65.8% share in 2025E, while the Peripheral Angioplasty segment is expected to register a higher growth rate with a CAGR of 3.9%.

-

By End-Users, Hospitals accounted for the leading share of nearly 78.2% in 2025E, while the Ambulatory Surgical Centers segment is forecasted to grow the fastest at a CAGR of 5.2%.

By Product, Drug-Eluting Balloons Lead and Show Fastest Growth in the Market

The Drug-Eluting Balloon (DEB) segment commands the largest revenue share, driven by its proven efficacy in reducing restenosis and repeat revascularization in both coronary in-stent restenosis and peripheral artery disease. Its position as the fastest-growing segment is fueled by expanding clinical indications, strong physician preference for improved long-term outcomes, and new product launches. The Cutting/Scoring balloon segment holds a significant niche for preparing calcified lesions, while Normal Balloons remain essential for pre-dilation and basic procedures.

By Application, Coronary Angioplasty Dominates, Peripheral Angioplasty Grows Steadily in the Market

The Coronary Angioplasty segment holds the dominant share due to the high global volume of percutaneous coronary interventions (PCIs) for coronary artery disease. The Peripheral Angioplasty segment is growing at a robust rate, driven by increasing diagnosis and treatment of peripheral artery disease (PAD), especially in the lower extremities, and the growing adoption of minimally invasive, limb-saving techniques. Technological advancements specifically for peripheral vessels are accelerating this growth.

By End-User, Hospitals Lead, Ambulatory Surgical Centers Experience Rapid Growth

Hospitals, specifically those with catheterization labs, are the primary end-users, performing the vast majority of complex and emergency angioplasty procedures. The Ambulatory Surgical Centers segment is projected to grow at the fastest CAGR, supported by the trend of shifting elective percutaneous interventions to outpatient settings for cost efficiency, patient convenience, and efficient bed utilization in hospitals. This shift is particularly notable in regions with favorable ASC reimbursement policies.

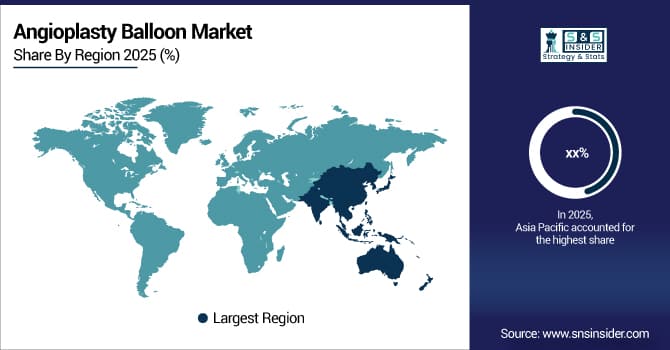

Angioplasty Balloon Market Regional Highlights:

Asia Pacific Angioplasty Balloon Market Insights:

Asia Pacific is expected to be the fastest-growing area in the market, with a CAGR of 4.8% as the population is huge and getting older, rates of cardiovascular disease are rising, healthcare infrastructure is getting better, and healthcare spending is going up. Government efforts to improve heart care and the rise of medical tourism are also helping the industry grow. In this area, local manufacturing and low prices are quite important.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Angioplasty Balloon Market Insights:

In 2025, North America made the most money, at 44.7% of the total. A lot of procedures, a well-developed healthcare system, early adoption of new technologies, good reimbursement systems, and the fact that major global device makers are doing a lot of research and development and clinical trials in the region all contribute to market leadership.

Europe Angioplasty Balloon Market Insights:

Europe is a mature and important market with well-established healthcare systems, a high level of awareness, and strong clinical standards that enable modern angioplasty procedures. Growth is constant, due to an aging population and the widespread use of drug-eluting technologies. The market is also governed by strict yet unambiguous CE marking rules.

Latin America and Middle East & Africa (MEA) Market Insights:

These regions represent emerging growth opportunities. The market is driven by increasing investment in healthcare facilities, a growing burden of vascular diseases, and rising medical awareness. Growth is moderated by economic volatility and budget constraints in some areas, but private sector investment and government health programs are gradually improving access to interventional procedures.

Angioplasty Balloo Market Competitive Landscape:

Boston Scientific Corporation, which was founded in 1979, is a global leader in medical technology that focuses on interventional medical solutions in the disciplines of cardiology, rhythm management, and endoscopy. It uses cutting-edge research and development to make new angioplasty balloon technologies, such as drug-coated balloons that improve clinical outcomes and set new standards for treatment.

-

In March 2024, received FDA approval for the AGENT Drug-Coated Balloon, marking the first coronary drug-eluting balloon approved in the United States for treating in-stent restenosis, demonstrating 41% relative risk reduction in target lesion failure compared to conventional balloon angioplasty.

Medtronic plc, which was founded in 1949, is a global healthcare solutions firm that is leading the way in therapies that help patients across the world feel better, get better, and live longer. Its cardiovascular portfolio includes a wide range of interventional technologies, and it has made large investments in next-generation drug-eluting balloon platforms that are meant to treat complicated coronary and peripheral lesions with better safety profiles.

-

In October 2024, secured FDA investigational-device-exemption approval to launch the Prevail DCB pivotal trial, a head-to-head comparison with Boston Scientific's AGENT platform across 65 global centers, advancing the evidence base for drug-coated balloon efficacy in diverse patient populations.

Abbott Laboratories, which was founded in 1888, is a global healthcare corporation that works in many different areas and uses cutting-edge science to enhance health outcomes. The vascular part of the company works on making new interventional devices, like enhanced angioplasty balloon systems and bio-resorbable technologies that get rid of long-term problems with metal implants while speeding up the repair of blood vessels.

-

In January 2025, announced development initiatives around image-guided angioplasty platforms integrating optical coherence tomography imaging for real-time vessel visualization, enabling precision balloon sizing and optimized procedural outcomes in complex coronary interventions.

Angioplasty Balloon Market Key Players:

-

Boston Scientific Corporation

-

Medtronic plc

-

Abbott Laboratories

-

Becton, Dickinson and Company (BD)

-

Terumo Corporation

-

B. Braun Melsungen AG

-

Cook Medical

-

Cardinal Health (Cordis)

-

BIOTRONIK SE & Co. KG

-

Teleflex Incorporated

-

AngioDynamics

-

Koninklijke Philips N.V.

-

MicroPort Scientific Corporation

-

Nipro Medical Corporation

-

Shockwave Medical Inc.

-

Concept Medical Inc.

-

Spectranetics Corporation

-

Biomerics

-

Hexacath

-

Elixir Medical Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.84 Billion |

| Market Size by 2033 | USD 3.70 Billion |

| CAGR | CAGR of 3.36% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Normal Balloons, Cutting/Scoring, Drug-Eluting) • By Application (Coronary Angioplasty, Peripheral Angioplasty) • By End-Users (Hospitals, Ambulatory Surgical Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Becton, Dickinson and Company (BD), Terumo Corporation, B. Braun Melsungen AG, Cook Medical, Cardinal Health (Cordis), BIOTRONIK SE & Co. KG, Teleflex Incorporated, AngioDynamics, Koninklijke Philips N.V., MicroPort Scientific Corporation, Nipro Medical Corporation, Shockwave Medical Inc., Concept Medical Inc., Spectranetics Corporation, Biomerics, Hexacath, Elixir Medical Corporation |