Integrated Cloud Management Platform Market Analysis & Overview:

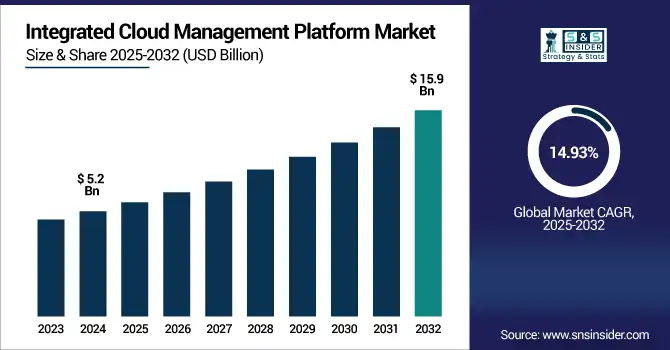

The Integrated Cloud Management Platform Market size was valued at USD 5.2 billion in 2024 and is expected to reach USD 15.9 billion by 2032, growing at a CAGR of 14.93% during 2025-2032.

Integrated cloud management platform market growth is fueled by the increasing complexity of the multi-cloud and hybrid environments throughout enterprises. With companies embarking on their digital scale journey, the need for a single-platform solution that provides end-to-end monitoring, automation, orchestration, and cost optimization is booming. They offer centralized visibility and governance, allowing for better resource efficiency and compliance. Demand is also being driven by the increasing embrace of remote work, DevOps practices, and containerized applications. Moreover, the growing security threat and demand for stable performance in consistent environments are driving companies to integrate solutions. These platforms are further boosted by cloud-native innovations and AI-driven insights. As enterprises increasingly look for agility, scalability, and resilience, the market is expected to continue to grow steadily.

To Get more information on Integrated Cloud Management Platform Market - Request Free Sample Report

The U.S. Integrated Cloud Management Platform Market was valued at USD 1.65 billion in 2024 and is projected to reach USD 4.92 billion by 2032, growing at a CAGR of 14.63%. An uptick in multi-cloud usage and security requirements, and demand for centralized cloud operations, drives growth. The U.S. integrated cloud management platform market trends pertain to AI-driven automation and hybrid cloud optimization.

Integrated Cloud Management Platform Market Dynamics

Drivers:

-

Multi-Cloud Adoption Drives Demand for Unified Cloud Management Solutions

Multiplying cloud and hybrid cloud solutions are now embraced by enterprises to achieve better flexibility, lower vendor lock, and better workload placement. Cloud management platforms need to evolve to provide single-pane-of-glass visibility in disparate environments, along with orchestration and governance in support of this shift. By being integrated, these solutions also help the IT team improve its cost management, enhance compliance, and offer consistent performance. With a greater focus on digital innovation and scalability for businesses in the current global scenario, centralized control over the cloud will soon become a necessity. Expanding remote work and massive data-heavy application trends have only increased demand for strong cloud underpinning. And this is a major factor for growth, especially amongst large enterprises that are managing complex cloud ecosystems globally and verticals.

According to Flexera’s 2024 State of the Cloud Report, 89% of organizations employ multi-cloud strategies, up from 87% in 2023, and 73% use hybrid cloud environments

Restraints:

-

High Implementation Complexity Limits Adoption Among Smaller Enterprises

While demand for AI is surging, the high upfront costs of implementation and integration complexity create high barriers to enterprise AI adoption. Adopting many cloud management platforms will entail a migration of the existing IT infrastructure, retraining of workers, and migrating mission-critical workloads, which means huge costs and downtime risk. Moreover, for SMEs with a limited IT staff, it can be challenging to technically integrate several third-party tools, APIs, and legacy systems into one platform. This adds a financial and technical burden that slows adoption for smaller organizations and budget-constrained sectors. To combat this restraint, vendors are required to make deployment easier and provide scalable pricing models to enhance the market’s scope.

According to Reports, 70% of organizations reported encountering unexpected costs during cloud migration in 2023, stemming from data migration, staff training, and integration of third-party tools, which significantly hinders smaller enterprises from adopting integrated cloud management platforms.

Opportunities:

-

AI Integration Enables Smarter, Automated Cloud Operations

Technological advancements in AI and automation technologies are poised to be a major opportunity for growth for the integrated cloud management platform market. This intelligent automation boosts provisioning, monitoring, and incident response, thereby reducing the level of human effort and human errors involved. Cloud usage optimization is based on AI-driven insights, performance bottleneck predictions, and security posture. With the ongoing evolution of enterprises toward operational efficiency and agility, the demand for platforms with embedded intelligence is skyrocketing. This growing opportunity will be best seized by vendors who embed machine learning models, predictive analytics, and self-healing capabilities into their products. Innovation and market growth will still be fueled by the emphasis on cost governance, security automation & performance analytics.

According to a 2025 industry report, AI automates up to 70% of routine cloud management tasks and reduces manual effort by 45%, enabling teams to save an average of 30 hours per week.

Challenges:

-

Centralized Cloud Control Increases Security and Compliance Risks

From an end-user perspective, one of the primary obstacles to continuing success in the Integrated Cloud Management Platform Market is the overhead to provide data security and compliance across a single scope of control spanning diverse distributed environments. Piling on control over multiple cloud providers gives you a bigger attack surface and a much more complicated regulatory landscape to satisfy. Security risks, such as data breaches and compliance violations due to misconfigurations, insecure APIs, and a lack of real-time visibility. Companies that deal with sensitive data, healthcare, finance, and government are at even greater risk and are under even greater scrutiny. This is easier said than done, as it requires strong access control, encryption, and auditability without sacrificing integration. To some extent, this will require continual disruption of the cloud security frameworks, compliance toolsets, and threat intelligence integration.

Integrated Cloud Management Platform Market Segmentation Analysis:

By Component:

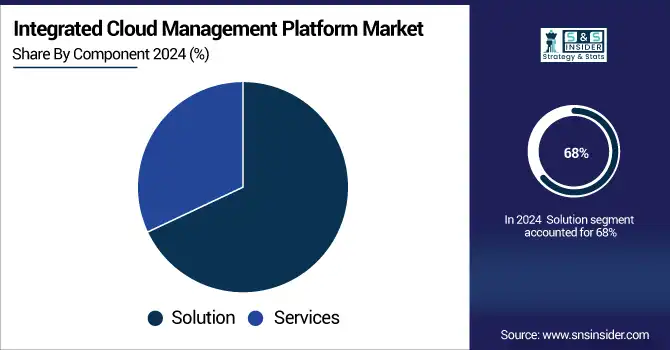

The Solutions segment dominated the market in 2024 and accounted for 68% of the integrated cloud management platform market share, driven by a rising need for centralized cloud control, orchestration, and automation tools across multi-cloud environments. Most Enterprises look for Integrated Platforms that are better in Performance, Security, and Cost. The hybrid and multi-cloud adoption will lead to a constant evolution of the solution offerings with AI, self-service, and policy-based automation capabilities, and continue to remain a preferred choice for enterprises as we further deeper in 2032.

As revealed in a June 2025 internal memo, Microsoft is overhauling its sales organization, merging six solution areas into three key units, including "Cloud & AI Platforms", to sharpen its go-to-market strategy

The Services segment is expected to register the fastest CAGR, as the fact that organizations are leveraging consulting, implementation, and managed services to support their cloud transformation. As platforms become increasingly complex, the need for professional integration, customization, and training rises. The cloud-native adoption by these SMEs is fueling the growth in the services space as they play an important role in accelerating the deployment and ROI.

By Deployment:

Hybrid Cloud dominated the cloud management platform market in 2024 and accounted for a significant revenue share, with enterprises switching to flexible environments that offer the benefits of both public and private clouds. It allows for distributing workloads more efficiently, lower costs, and this also increases security. With the acceleration of digital transformation, the demand for integrated tools to handle hybrid infrastructure is increasing, a trend expected to drive this segment well through 2032, particularly in large-scale organizations with high data sensitivity.

The Private Cloud segment is expected to register the fastest CAGR. Due to its ability to deploy and increasing concerns over data sovereignty, regulatory compliance, and internal control, the Private Cloud segment is expected to gain maximum growth. Private cloud can be of special interest in verticals, such as banking, healthcare, or government, where mission-critical operations are often carried out. As these enhancements to AI-enabled automation and scalable architecture improve, greater adoption of private cloud platforms by organizations seeking custom, secure cloud experiences will take hold.

By Enterprise Size:

Large Enterprises dominated the cloud management platform market in 2024 and accounted for 71% of revenue share, as they typically deploy multi-cloud environments at the largest scale, invest in advanced IT infrastructure, and have a strong focus on security and compliance. These organizations work with integrated platforms as the first step to centralize governance, monitor performance, and control costs. The integrated cloud management will remain a solution-led approach and will be adopted by large enterprises who will be investing more in AI and hybrid strategies.

The SMEs segment is expected to register the fastest CAGR during the forecast period, due to the high adoption of low-cost SaaS-based cloud management tools. With SMEs exploring digital transformation, the need for SMEs to manage different cloud environments calls for simplified, scalable platforms. Through 2032, these trends will accelerate adoption among SMEs, particularly in emerging markets, as vendors hone in on user-friendly interfaces, flexible pricing, and low-code automation.

By End-Use:

The BFSI segment dominated the market in 2024 and accounted for a significant revenue share. Enterprise cloud management platforms emerge at large financial institutions for more integrated operations across business lines, advanced analytics, and enhanced fraud detection. With imposed regulatory pressures and higher trade volumes, this sector will remain invested in risk management and scalability-focused cloud solutions that are not only robust but also AI-enabled.

The Retail & Consumer Goods segment is expected to register the fastest CAGR due to the fast transition to e-commerce, omnichannel fulfillment, and demand forecasting. The recent cloud management for retail use cases shows retailers are using it for inventory visibility, supply chain automation, and personalized customer experience solutions. LED by agility and focused on customer data integration, this segment will see the cloud innovation and adoption accelerate through 2032.

Integrated Cloud Management Platform Market Regional Outlook:

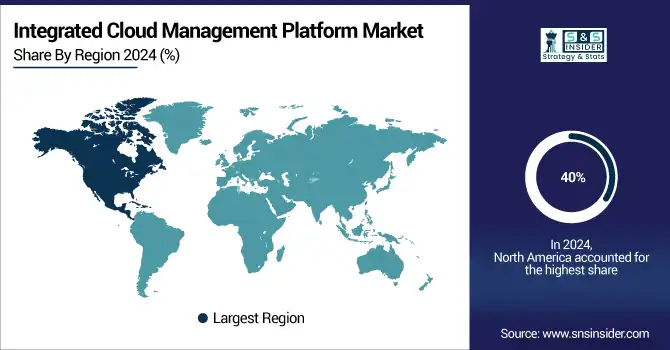

North America dominated the cloud management platform market in 2024 and accounted for 40% of revenue share, due to the well-established cloud ecosystem, have adopted AI-powered solutions, and the presence of major tech giants including Microsoft, IBM, and Oracle. Enterprises in this region are focusing on hybrid cloud management, cybersecurity, and regulatory compliance. As per the integrated cloud management platform market analysis through 2032, the North American region will continue to dominate in the cloud orchestration automation tools market.

In 2024, 82% of enterprise workloads were running in hybrid cloud environments, and 78% of organizations reported using AI/ML within these systems, highlighting a significant shift toward intelligent, managed hybrid architectures.

Asia Pacific is projected to register the fastest CAGR during the forecast period, driven by the fastest digital transformation, vast IT infrastructure, and high cloud adoption in India, China, and Southeast Asia. Integrated platforms for multi-cloud environments are being adopted by SMEs and large enterprises alike. The report also states that growth across the region over the next decade will be accelerated by government initiatives and an increasing investment in technology.

Europe's growth is driven by Rising cloud regulation compliance (GDPR), demand for secure hybrid infrastructures, and enterprise digitization across sectors. AI-driven cloud operations are being adopted across the region. Europe is forecasted to experience steady growth through 2032, especially in financial services, manufacturing, and government.

Germany dominated the cloud management platform market due to a strong industrial base, along with the movement of German industry toward Industry 4.0, and the development of national demand for secure and centralized cloud solutions were major factors for the penetration of the cloud management platform market in Germany. Hybrid automation for enterprises to drive efficiency. In 2032, the cloud-native adoption in manufacturing, logistics, and finance industries will witness an increased lead from Germany.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major cloud management platform market companies are IBM Corporation, Cisco Systems Inc., Microsoft Corporation, VMware Inc., BMC Software Inc., Hewlett-Packard Enterprise, ServiceNow Inc., Oracle Corporation, Nutanix Inc., Citrix Systems Inc., and others.

Recent Developments:

In July 2025, IBM launched its z17 mainframe, embedded with AI coprocessors, engineered for hybrid cloud workloads and automated cloud operations.

In July 2025, Microsoft reorganized its cloud business, merging key product areas (Azure, Fabric, AI Foundry) into a new Cloud & AI Platforms unit to streamline cloud solution delivery and enhance integrated management capabilities.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2024 |

USD 5.2 Billion |

|

Market Size by 2032 |

USD 15.9 Billion |

|

CAGR |

CAGR of 14.93% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solutions, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

|

Company Profiles |

IBM Corporation, Cisco Systems Inc., Microsoft Corporation, VMware Inc., BMC Software Inc., Hewlett Packard Enterprise, ServiceNow Inc., Oracle Corporation, Nutanix Inc., Citrix Systems Inc. and others in the report |