Failure Analysis Market Report Scope & Overview:

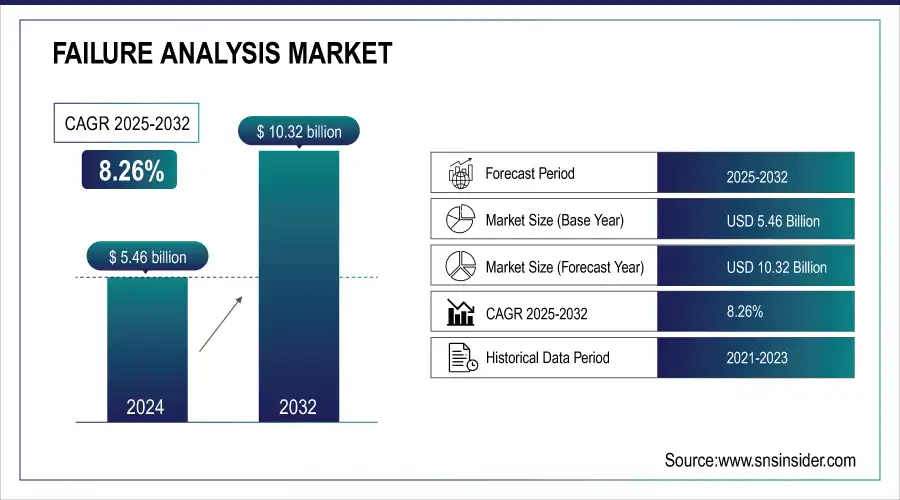

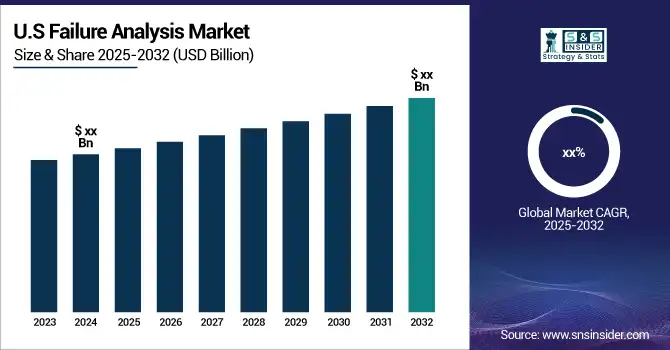

The Failure Analysis Market was valued at USD 5.46 billion in 2024 and is expected to reach USD 10.32 billion by 2032, growing at a CAGR of 8.26% from 2025-2032. This report includes a comprehensive analysis of various factors influencing the market, including Investments & Funding, where increased capital flow is driving advancements in failure detection techniques. Regulatory Impact highlights the role of compliance in shaping market trends. Cost Analysis examines the financial implications of failure analysis tools and services.

To Get more information on Failure Analysis Market - Request Free Sample Report

Adoption Rate discusses the growing demand across industries. Finally, Technologies and Innovations showcases the latest breakthroughs improving efficiency and accuracy in failure detection, thus fueling market growth.

Market Size and Forecast:

-

Market Size in 2024: USD 5.46 Billion

-

Market Size by 2032: USD 10.32 Billion

-

CAGR: 8.26% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Failure Analysis Market Trends

-

Increasing reliance on outsourced failure analysis services

-

Growing demand from additive manufacturing and medical devices

-

Rapid market expansion in APAC (China, India, Taiwan, South Korea)

-

Heightened regulatory and quality compliance requirements

-

Integration of multi-step correlative workflows and turnkey solutions

-

Market sensitivity to capital investment cycles in semiconductor/electronics sectors

Failure Analysis Market Growth Drivers

-

Increasing Complexity of Semiconductor Devices Fueling Advanced Failure Analysis Adoption

The semiconductor business is experiencing phenomenal growth, with devices becoming ever more complex and smaller. While companies continue to push the frontiers of performance and efficiency, detecting and rectifying defects at microscopic scales has become imperative. The increasing requirement for high-precision failure analysis in integrated circuits, microchips, and nanotechnology-driven devices is speeding up the demand for sophisticated methods. Technologies like scanning electron microscopy (SEM) and transmission electron microscopy (TEM) are also playing a crucial role in maintaining product reliability and quality. As demand for consumer electronics, automotive chips, and IoT devices is increasing, businesses are spending a lot on failure analysis solutions to improve manufacturing yields and reduce downtime, while complying with rigorous industry standards.

Failure Analysis Market Restraints

-

High Cost of Advanced Failure Analysis Equipment Restricting Adoption Among Small and Mid-Sized Enterprises, Limiting Market Expansion and Accessibility.

Advanced failure analysis technology, e.g., scanning electron microscopy (SEM), transmission electron microscopy (TEM), and focused ion beam (FIB) systems, commands a very significant investment in financial resources. Due to high acquisition, setup, and upkeep expenses, advanced technology is beyond reach for small and mid-sized firms, which prevents widespread implementation. Furthermore, operational costs, such as training qualified staff and sustaining advanced laboratory facilities, also contribute to the cost. This cost factor compels businesses to use outsourced analysis services or conventional testing, which can be less precise. With industries calling for quicker and more precise defect detection, the affordability challenge remains a key barrier, restraining the growth potential of failure analysis solutions.

Failure Analysis Market Opportunities

-

AI and Machine Learning Revolutionizing Failure Analysis by Enhancing Defect Detection Accuracy, Reducing Analysis Time, and Improving Manufacturing Efficiency.

The integration of artificial intelligence (AI) and machine learning (ML) is transforming failure analysis by enhancing defect detection accuracy and shortening analysis time. AI-based algorithms are capable of rapidly recognizing patterns in large datasets, which allows for rapid root cause analysis and reduces human error. Computer vision-enabled defect classification and predictive analysis are simplifying complicated processes, enabling failure analysis to be cost- and time-effective. Semiconductor, automotive, and aerospace industries are using AI to improve quality monitoring and optimize yields. As AI-based automation further matures, failure analysis becomes easier and scalable, allowing companies to anticipate faults ahead of time, minimize downtime, and increase product reliability in an increasingly technified world.

Failure Analysis Market Challenges

-

Lengthy Failure Analysis Processes Slowing Product Development and Increasing Operational Costs

A detailed failure analysis entails huge time and financial investments, since investigations involve intricate methodologies, precision equipment, and experienced specialists. Sophisticated methods like scanning electron microscopy (SEM) and transmission electron microscopy (TEM) necessitate thorough sample preparation, data interpretation, and iterative testing to accurately detect defects. These extended processes can slow down product development life cycles, affecting time-to-market and escalating operational costs. Moreover, high-volume industries like semiconductor manufacturing and automotive production struggle to find a balance between efficiency and the necessity of in-depth analysis. While companies aim to maximize quality assurance with minimal loss of production velocity, it is a major challenge to discover how to speed up failure analysis without undermining accuracy.

Failure Analysis Market Segment Analysis

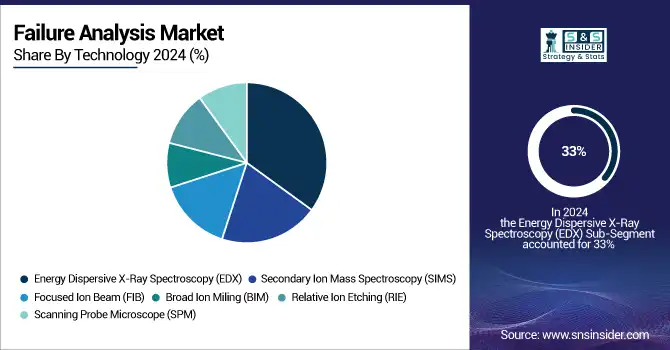

By Technology

The Energy Dispersive X-Ray Spectroscopy (EDX) component dominated the Failure Analysis Market with the largest share in revenue at around 33% in the year 2023. EDX is being applied extensively to characterize materials, thanks to the detection of the elemental composition being high in its precision. Complemented by being part of a Scanning Electron Microscope (SEM), its precision in carrying out chemical analysis of defects also enhances failure analysis. Increased use in semiconductor processing, aerospace, and metallurgy for elemental analysis with high speed and without damaging the material has contributed extensively to its leadership position in the market.

The Scanning Probe Microscope (SPM) category will witness growth at the fastest CAGR of around 10.50% during 2024-2032 due to expanding application of nanoscale failure analysis in the fields of electronics, biotechnology, and materials science. SPM provides ultra-high-resolution imaging and the capability for atomic-level surface property analysis, making it pivotal in next-generation semiconductor fabrication. With industries tending toward miniaturization and advanced materials, the demand for accurate, non-destructive surface analysis is fueling the move toward SPM technology.

By Equipment

The Scanning Electron Microscope (SEM) category led the Failure Analysis Market with the largest revenue share of about 28% in 2023. SEM's extensive usage is due to its superior imaging, high resolution, and precise analysis of material composition. SEM is extensively used in semiconductors, automotive, and aerospace industries for defect analysis and quality inspection. Its relative affordability compared to more sophisticated systems, as well as ongoing technological advances, has further entrenched its pre-eminence in failure analysis applications.

The Dual-Beam System (FIB-SEM) segment is expected grow at the fastest CAGR of approximately 11.90% over 2024-2032. This is driven by growing demand for high-precision failure analysis, especially in the nanotechnology and semiconductor industries. FIB-SEM allows for real-time imaging and accurate material modification, rendering it priceless for sophisticated circuit analysis and 3D reconstruction. With industries advancing toward miniaturization and performance materials, demand for FIB-SEM's flexibility and high resolution keeps increasing, fueling its fast-paced market growth.

By Vertical

The Electronics & Semiconductor segment led the Failure Analysis Market with the largest revenue share of around 36% in 2023. The rising sophistication of semiconductor devices, decreasing size of components, and growing need for high-performance electronics have driven the demand for sophisticated failure analysis. Manufacturers use methods such as SEM, TEM, and EDX to ensure product reliability, enhance yields, and identify defects at the nanoscale. The explosive growth in consumer electronics, IoT devices, and AI processor chips has again added to the dominance of this segment.

The Manufacturing segment is expected to grow at fastest CAGR of around 10.48% between 2024 and 2032. Increasing use of automation, precision engineering, and high-end materials is fueling demand for failure analysis in production at the industrial level. Manufacturers are increasingly putting money into quality control and predictive maintenance to reduce downtime and improve operational efficiency. Strict regulatory requirements in industries like automotive, aerospace, and medical devices further spur the need for sophisticated failure analysis solutions, propelling this segment's high growth rate.

Failure Analysis Market Regional Analysis

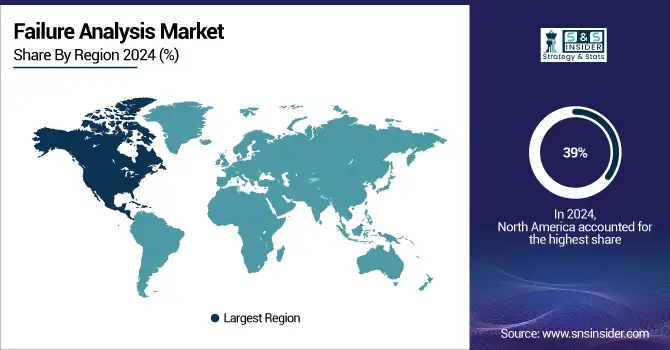

North America Failure Analysis Market Insights

North America dominated the Failure Analysis Market with the highest revenue share of approximately 39% in 2023. The region's leadership is driven by a strong presence of semiconductor manufacturers, advanced research facilities, and high investments in failure analysis technologies. The demand for high-precision analytical tools in industries like aerospace, automotive, and electronics further supports market dominance. Additionally, stringent regulatory standards and the increasing adoption of AI-powered failure analysis solutions contribute to the widespread implementation of advanced diagnostic techniques across various sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Failure Analysis Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 10.50% from 2024 to 2032. The rapid expansion of the semiconductor and electronics industries, especially in China, Japan, South Korea, and Taiwan, is fueling demand for failure analysis solutions. Increasing manufacturing activities, rising government investments in R&D, and the presence of leading technology companies contribute to market growth. The region's focus on miniaturization, automation, and quality control in industries like automotive and telecommunications further accelerates the adoption of failure analysis technologies.

Europe Failure Analysis Market Insights

The Europe Failure Analysis Market is witnessing steady growth in 2024, driven by the region’s strong presence in the semiconductor, electronics, automotive, and aerospace industries. Countries such as Germany, France, and the U.K. are leading adopters of advanced failure analysis solutions to ensure high quality, reliability, and compliance with stringent regulatory standards. The increasing demand for miniaturized electronic components, coupled with the rapid expansion of electric vehicle production and renewable energy infrastructure, is boosting investments in state-of-the-art analytical equipment and services. Furthermore, growing collaborations between research institutions and industry players are fostering innovation and accelerating the adoption of AI-enabled and automated failure analysis technologies across the region.

Latin America (LATAM) Failure Analysis Market Insights

The LATAM Failure Analysis Market is gradually expanding in 2024, supported by the region’s emerging electronics manufacturing sector and increasing investments in industrial quality control. Countries like Brazil and Mexico are witnessing rising adoption of failure analysis techniques in automotive, aerospace, and energy industries to improve product reliability and reduce operational risks. Local service providers are forming partnerships with global technology companies to access advanced analytical tools such as SEM, TEM, and X-ray CT. In addition, supportive government initiatives aimed at enhancing industrial productivity and export competitiveness are contributing to market growth across the region.

Middle East & Africa (MEA) Failure Analysis Market Insights

The MEA Failure Analysis Market is gaining traction in 2024, fueled by rapid industrial diversification and rising demand for high-quality manufacturing processes. Countries including the UAE, Saudi Arabia, and South Africa are increasingly deploying failure analysis technologies to support critical sectors like aerospace, oil & gas, energy, and medical devices. The expansion of advanced manufacturing hubs, coupled with the push to localize production and adhere to global quality standards, is driving investments in cutting-edge analytical infrastructure. Additionally, the growing presence of international TIC (testing, inspection, and certification) companies is improving regional access to specialized failure analysis services, further propelling market growth.

Failure Analysis Market Competitive Landscape

TUV SUD

TUV SUD is a globally recognized provider of testing, inspection, and certification (TIC) services, offering safety, reliability, and quality solutions to industries including automotive, energy, manufacturing, and consumer products. The company supports compliance with international standards and fosters innovation through advanced testing methodologies·

-

In October 2024, TÜV SÜD introduced advanced test beds and methodologies to enhance high-voltage (HV) component testing for electric vehicles, aiming to improve safety and reliability under extreme operating conditions.

Hitachi High-Tech

Hitachi High-Tech Corporation is a leading global provider of analytical instruments, medical systems, and advanced technologies for the life sciences, semiconductor, and industrial fields. The company focuses on delivering cutting-edge analysis, automation, and metrology solutions to drive innovation and productivity.

-

In February 2024, Hitachi High-Tech announced a collaboration with Sysmex Corporation to develop new in-vitro diagnostic equipment, integrating advanced analysis and automation technologies to enhance medical testing efficiency and quality.

Key Players

-

Rood Microtec GmbH (Failure Analysis Services, Test and Measurement Equipment)

-

Eurofins EAG Laboratories (Materials Testing, Failure Analysis Solutions)

-

Presto Engineering Inc. (Engineering Services, Failure Analysis Solutions)

-

TUV SUD (Failure Analysis Consulting, Materials Testing)

-

Eurofins Maser BV (Failure Analysis Testing, Electrical Testing)

-

NanoScope Services Ltd (Nano-materials Characterization, Failure Analysis Services)

-

Crane Engineering (Equipment Diagnostics, Failure Analysis Services)

-

Materials Testing (Mechanical Testing, Failure Analysis Services)

-

McDowell Owens Engineering Inc. (Consulting, Failure Analysis Services)

-

CoreTest Technologies (Physical Testing, Failure Analysis Services)

-

Leonard C Quick & Associates Inc. (Metallurgical Testing, Failure Analysis Consulting)

-

Exponent Inc. (Forensic Engineering, Failure Analysis Services)

-

Thermo Fisher Scientific, Inc. (Scanning Electron Microscope, X-ray Fluorescence Spectrometer)

-

Hitachi High-Technologies Corporation (Scanning Electron Microscope, X-ray Microanalysis Systems)

-

Carl Zeiss (Electron Microscopes, Optical Microscopes)

-

JOEL, Ltd. (Scanning Electron Microscopes, Transmission Electron Microscopes)

-

TESCAN OSRAY HOLDING (Electron Microscopes, Ion Microscopes)

-

Bruker (Atomic Force Microscopes, X-ray Diffraction Systems)

-

Intertek Group Plc (Metallurgical Testing, Failure Analysis Services)

-

Nikon Metrology (3D Metrology, Optical Profiling)

-

Semilab (Semiconductor Testing, Metrology Solutions)

-

A&D Company, Ltd. (Weighing Scales, Analytical Balances)

-

Nanosurf AG (Atomic Force Microscopes, Scanning Tunneling Microscopes)

-

HORIBA, Ltd. (Spectrometers, Particle Size Analyzers)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.46 Billion |

| Market Size by 2032 | USD 10.32 Billion |

| CAGR | CAGR of 8.26% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (Optical Microscope, Scanning Electron Microscope (SEM), Transmission Electron Microscope (TEM), Scanning Probe Microscope, Focused Ion Beam System (FIB), Dual-Beam System (FIB-SEM), Others) • By Technology (Energy Dispersive X-Ray Spectroscopy (EDX), Secondary Ion Mass Spectroscopy (SIMS), Focused Ion Beam (FIB), Broad Ion Milling (BIM), Reactive Ion Etching (RIE), Scanning Probe Microscope (SPM)) • By Vertical (Electronics & Semiconductor, Oil & Gas, Defense, Manufacturing, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Rood Microtec GmbH, Eurofins EAG Laboratories, Presto Engineering Inc., TUV SUD, Eurofins Maser BV, NanoScope Services Ltd, Crane Engineering, Materials Testing, McDowell Owens Engineering Inc., CoreTest Technologies, Leonard C Quick & Associates Inc., Exponent Inc., Thermo Fisher Scientific, Inc., Hitachi High-Technologies Corporation, Carl Zeiss, JOEL, Ltd., TESCAN OSRAY HOLDING, Bruker, Intertek Group Plc, Nikon Metrology, Semilab, A&D Company, Ltd., Nanosurf AG, HORIBA, Ltd. |