Integrated Passive Devices Market Size Analysis:

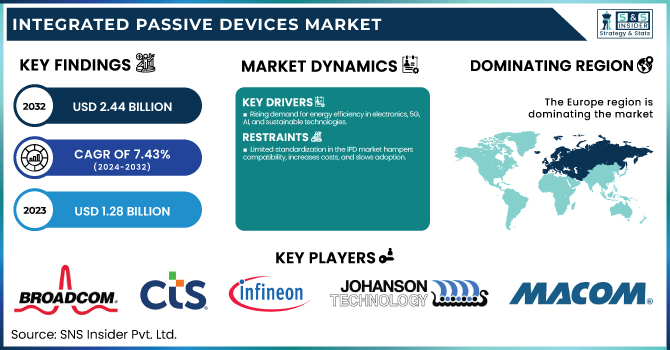

The Integrated Passive Devices Market was valued at USD 1.28 billion in 2023 and is projected to reach USD 2.44 billion by 2032, growing at a CAGR of 7.43% from 2024 to 2032. Miniaturization of electronic devices in various applications such as consumer electronics, automotive, telecommunications, and healthcare is boosting the growth of this market. The proliferation of 5G technology in daily life has enhanced requirements for small form factor, high-performance RF modules, driving the integration of IPDs.

To Get more information on Integrated Passive Devices Market - Request Free Sample Report

Likewise, semiconductor manufacturing advancements—AI-assisted design automation, enhanced fabrication techniques—are making devices more efficient and lowering production cost. With increasing energy-aware electronics, usage of IPDs is also increasing during circuit design due to their low power, high-performance nature which is one of the factors that drive the market growth. The U.S. market, valued at USD 0.22 billion in 2023, is expected to reach USD 0.40 billion by 2032, growing at a CAGR of 6.76%. In automotive applications, the movement towards electric and autonomous vehicles has increased the need for IPDs in advanced driver-assistance systems (ADAS) and power management solutions. In fact, the healthcare industry is flourishing with advancements in wearable and implantable medical devices, which has resulted in an escalation of IPD adoption. However, ongoing research in novel materials and packaging solutions continues to promote market expansion despite supply chain risks and raw material limitations.

Integrated Passive Devices Market Dynamics:

Drivers:

-

Rising demand for energy efficiency in electronics, 5G, AI, and sustainable technologies.

The increasing demand for energy-efficient solutions across smart devices, automotive electronics, and telecommunications is a key driver of the Integrated Passive Devices (IPD) market. In electronic systems, we can already see examples of how this trend is shaping the sector: passive house designs reduce energy consumption by up to 90%, with annual costs dropping from €2,000 to only €150-300. In a similar vein, improvements in HVACR technology are a signal of increasing demand for low-power solutions across fields. In telecommunications, as mobile data traffic is anticipated to triple by 2030, service providers are pushed to improve network efficiency while reducing energy use. The advent of passive antennas for the on-ground page has been an important development in this transition, yielding 11% better-beam efficiency, 18% higher downlink throughput, and 21% uplink throughput, while improving energy efficiency by 7.5% and reducing radio energy consumption by 29%. Moreover the energy efficient applications of artificial intelligence needs low-power circuit designs, which is further propelling the adoption of integrated passive device (IPD) in next generation electronics resulting energy efficiency as one of the market driver.

Restraints:

-

Limited standardization in the IPD market hampers compatibility, increases costs, and slows adoption.

The lack of uniform design standards across industries is a significant restraint in the Integrated Passive Devices (IPD) market, creating compatibility and interoperability issues. Different sectors, including consumer electronics, automotive, and telecommunications, have varying requirements for size, performance, and materials, making it difficult to establish a universal design framework. This inconsistency slows down large-scale adoption as manufacturers must develop customized solutions for each application, increasing development time and costs. Additionally, the absence of standardized testing and certification processes complicates regulatory approvals, further delaying product commercialization. The challenge is amplified by the rapid advancement of semiconductor technologies, requiring constant updates to design specifications, which limits long-term stability. Companies also face difficulties in integrating IPDs into existing electronic systems due to varying industry-specific protocols. Addressing these standardization issues through industry-wide collaboration and regulatory frameworks is essential to enhance compatibility, reduce costs, and accelerate market expansion for IPDs in diverse applications.

Opportunities:

-

IPDs are essential for enhancing energy efficiency in EVs and optimizing performance in advanced ADAS systems.

The rapid electrification of the automotive industry is driving significant demand for Integrated Passive Devices (IPDs), particularly in electric vehicles (EVs) and advanced driver-assistance systems (ADAS). With the growing demand for EVs, car companies want small, efficient structures to improve the performance of the battery, manage electric power, and ensure signal integrity. IPDs are essential for optimizing power conversion while minimizing electromagnetic interference, enhancing the efficiency of the vehicle as a whole. As far as ADAS applications are concerned, the demand for accurate signal processing and low-latency communications has improved the performance of radar, LiDAR and sensor technologies through IPDs. IPD integration is also driven by the need for lightweight, high-performance electronics in modern Vehicles and by the fact that they provide reliability and durability in harsh automotive environments. As EV sales are predicted to reach over 40 million units per year worldwide by 2030, and ADAS continues to be integrated as a standard feature of vehicles, the requirement for an IPD will soon need to ramp dramatically, enabling next-generation automotive aspects.

Challenges:

-

Stringent regulations and certification requirements hinder the growth of the Integrated Passive Devices market.

Stringent industry regulations and complex certification requirements pose a significant challenge to the growth of the Integrated Passive Devices (IPD) market. Compliance with safety, electromagnetic compatibility (EMC), and environmental standards varies across regions, creating hurdles for manufacturers aiming for global expansion. Regulatory frameworks like RoHS and REACH in Europe, along with stringent FCC and FDA approvals in the U.S., require extensive testing and documentation, increasing time-to-market and operational costs. Additionally, evolving standards in automotive, aerospace, and medical electronics demand continuous adaptation, further complicating product development. Companies must invest heavily in compliance strategies, impacting profitability and limiting the participation of smaller players. The ongoing shift toward stricter environmental policies, including the push for lead-free and halogen-free components, adds another layer of complexity. Overcoming these regulatory challenges is crucial for IPD manufacturers to achieve seamless market penetration and sustained growth in an increasingly regulated industry.

Integrated Passive Devices Market Segmentation Overview:

By Application

The EMS and EMI Protection segment accounted for around 40% of the market revenue in 2023, driven by the increasing demand for electromagnetic shielding in consumer electronics, automotive, and telecommunications. As devices become more compact and powerful, the risk of electromagnetic interference (EMI) grows, necessitating efficient integrated passive devices (IPDs). The expansion of 5G networks and rising adoption of electric vehicles (EVs) further accelerate demand for EMI protection, ensuring signal integrity and compliance with stringent industry regulations. Additionally, industries such as aerospace and healthcare rely on EMI shielding to prevent disruptions in critical applications. With advancements in high-frequency electronics and miniaturized circuit designs, the EMS and EMI Protection segment continues to be a dominant force in the IPD market.

The LED Lighting segment is the fastest-growing in the Integrated Passive Devices (IPD) market from 2024 to 2032, driven by the increasing global shift toward energy-efficient and sustainable lighting solutions. The rapid adoption of LED technology in residential, commercial, and industrial applications is fueling demand for IPDs that enhance performance, reduce power consumption, and improve thermal management. Governments worldwide are implementing stringent energy regulations, further accelerating LED adoption. Additionally, advancements in smart lighting and IoT-enabled LED systems are boosting the need for compact, high-performance passive components. With continuous innovation in miniaturized and cost-effective lighting solutions, the LED Lighting segment is set to experience significant expansion, making it a key driver of growth in the IPD market.

By End Use

The automotive segment dominated the Integrated Passive Devices (IPD) market with the largest revenue share of approximately 45% in 2023, due to high adoption of various systems such as advanced driver-assistance systems (ADAS), infotainment, and electrification technologies. With the rise of electric vehicles (EVs) and hybrid vehicles, there is more demand for compact, energy-efficient, and high-performance electronic components. Following the trend of the automotive industry, Integrated Power Devices (IPDs) are becoming increasingly important in improving signal integrity, reducing electromagnetic interference (EMI), and optimizing power efficiency. Sensors, communication modules, and power management systems also necessitate integrated passive solutions due to the transition to autonomous driving and connected cars. This has led to rising trends in European legislation on safety and efficiency and hence increasing the adoption of IPDs by automotive manufacturers to enhance vehicle performance, reliability, and energy management, making automotive the leading business vertical for market growth.

The consumer electronics segment is the fastest-growing in the Integrated Passive Devices (IPD) market over the forecast period 2024-2032, owing to a growing demand for small-sized electronic devices that offer high performance such as smartphones, wearables, tablets, and smart home goods. IPDs facilitate efficient power management, noise reduction, and improved signal integrity in advanced electronic systems, as manufacturers strive for miniaturization and improved functionality. Meanwhile, mobile communication gradually evolves from 2G, 3G, and 4G into 5G, and even into the era of 5G applications, along with the popularity of AI applications and IoT applications, promoting the rapid development of high-frequency devices with low power consumption under the trend of high-speed, high-performance, low power consumption, and high integration, thus promoting the rapid development of IPD. The increasing proliferation of augmented reality (AR), virtual reality (VR) devices and the rising adoption of wireless charging solutions are also increasing the demand for integrated passive solutions. The demand for IPDs in the consumer electronics segment is expected to grow steadily over the forecast period, as consumer preferences align more with energy-efficient and feature-rich gadgets.

Integrated Passive Devices Market Regional Analysis:

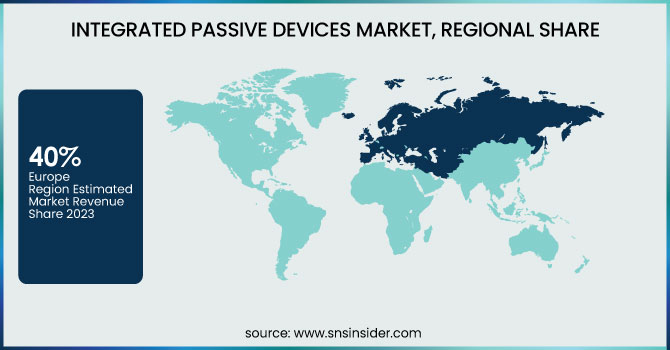

The Europe segment dominated the Integrated Passive Devices (IPD) market with the largest revenue share of around 40% in 2023, driven by the region's strong semiconductor industry, growing demand for automotive electronics, and increasing adoption of 5G technology. European countries, particularly Germany, France, and the UK, are at the forefront of automotive innovation, with a significant push toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS), both of which rely heavily on IPDs for efficient power management and signal integrity. Additionally, the rapid expansion of smart factories and industrial automation in Europe has accelerated the need for high-performance, miniaturized components. The region’s stringent energy efficiency regulations have also contributed to the adoption of IPDs in consumer electronics and telecommunication networks. With strong investments in research and development (R&D) and a focus on technological advancements, Europe is expected to maintain its leadership position in the IPD market throughout the forecast period.

The Asia Pacific segment is the fastest-growing region in the Integrated Passive Devices (IPD) market over the forecast period 2024-2032, attributed to the rapid industrialization, growing production of consumer electronics, and upsurging adoption of technologies like 5G and IoT in the region. Regions such as China, Japan, South Korea, and Taiwan are leading centers for the semiconductor manufacturing market, driving the need for high-performance miniaturized components. The IPD adoption in the region is further boosted by the competitive automotive industry, especially electric vehicles (EV) and advanced driver-assistance systems (ADAS), requiring efficient power management and signal processing capabilities. Besides, the increasing infiltration of smart devices and wearables, along with government funding for advanced manufacturing, is propelling the growth of the market. Asia Pacific is anticipated to witness sustained growth because of increasing investments in research and development (R&D) and presence of regional and global electronics manufacturers, choosing them as a primary market for IPD innovations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Integrated Passive Devices Market are:

-

Broadcom (USA) – Specializes in RF filters, baluns, couplers, and power management solutions.

-

CTS Corporation (USA) – Provides EMI filters, capacitors, and frequency control products.

-

Global Communication Semiconductors, LLC. (USA) – Manufactures RF and microwave semiconductor components.

-

Infineon Technologies AG (Germany) – Offers IPDs for power management, RF, and automotive applications.

-

Johanson Technology, Inc. (USA) – Develops high-frequency ceramic chip antennas, filters, and capacitors.

-

MACOM (USA) – Produces RF components, baluns, couplers, and power amplifiers.

-

Murata Manufacturing Co., Ltd. (Japan) – Specializes in multilayer ceramic capacitors, RF modules, and EMI suppression filters.

-

NXP Semiconductors (Netherlands) – Supplies RF filters, baluns, and semiconductor-based passive components.

-

ON Semiconductor (USA) – Provides power management ICs, RF front-end modules, and EMI filters.

-

Qorvo, Inc. (USA) – Manufactures RF filters, duplexers, and power amplifiers.

-

STMicroelectronics (Switzerland) – Produces integrated passive devices for RF, MEMS, and automotive electronics.

-

Texas Instruments Incorporated (USA) – Develops analog and power management solutions, EMI filters, and integrated circuits.

List of Suppliers who provide raw material and component for Integrated Passive Devices Market:

-

KEMET Corporation

-

Yageo Corporation

-

AVX Corporation

-

Vishay Intertechnology

-

TDK Corporation

Recent Development:

-

August 29, 2024: Broadcom Advances Optical Connectivity for GPUs, Broadcom is integrating co-packaged optics (CPO) into GPUs, achieving 1.6 TB/sec bandwidth to enhance AI accelerator performance while reducing power consumption. The company showcased its latest optical engine at Hot Chips, demonstrating error-free data transfer with a test chip.

-

July 29, 2024: Johanson Technology Unveils 900MHz Mini-Coupler Johanson Technology introduces the 0898CP14C0035001T RF SMD coupler, designed for ISM, IoT, cellular, and LoRa® applications, featuring a compact EIA 0603 design with a 0.35 dB max insertion loss.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 1.28 Billion |

|

Market Size by 2032 |

USD 2.44 Billion |

|

CAGR |

CAGR of 7.43% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Application (EMS and EMI Protection, Radio Frequency Protection, LED Lighting, Digital and Mixed Signal) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Broadcom (USA), CTS Corporation (USA), Global Communication Semiconductors, LLC. (USA), Infineon Technologies AG (Germany), Johanson Technology, Inc. (USA), MACOM (USA), Murata Manufacturing Co., Ltd. (Japan), NXP Semiconductors (Netherlands), ON Semiconductor (USA), Qorvo, Inc. (USA), STMicroelectronics (Switzerland), Texas Instruments Incorporated (USA). |