POWER MANAGEMENT SYSTEM MARKET KEY INSIGHTS:

To Get More Information on Power Management System Market - Request Sample Report

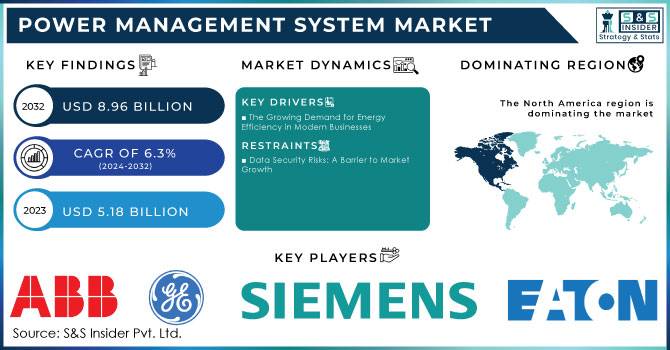

The Power Management System Market Size was valued at USD 5.18 Billion in 2023 and is expected to reach USD 8.96 Billion by 2032 and grow at a CAGR of 6.3% over the forecast period 2024-2032.

Power Management System (PMS) Market has witnessed tremendous growth in the previous years due to an increase in energy management needs, increased usage of renewable energy, and new technological implementations regarding smart grids. The PMS technologies, which form an integral part of the achievement of operational efficiency for industries and consumers. According to the U.S. Energy Information Administration (EIA), the facility accounts for 90% of the load on the state power grid controlled by the Electric Reliability Council of Texas, ERCOT. The key contributors to the growing demand for electricity are huge computing facilities data centres and cryptocurrency mining operations, but whose future demand cannot be predicted. In most recent Short-Term Energy Outlook (STEO), electricity use from customers identified by ERCOT as large flexible load (LFL) will reach 54 billion kilowatt-hours (kWh) in 2025-an increase of almost 60% compared with forecast demand in 2024. LFL demand would account for about 10% of total forecast electricity use on the ERCOT grid next year.

MARKET DYNAMICS

KEY DRIVERS:

-

The Growing Demand for Energy Efficiency in Modern Businesses

Increasing pressure for the creation of more energy-efficient modern business operations is redesigning the entire landscape of business operations, with leading players focusing on the cost of energy and environmental sustainability as the prime aspect of operational strategy. Management systems have been an efficient tool in this change through the oversight of power generation and control of its delivery to ensure efficient operation in a power network. These systems optimize power generation, importation, and distribution to ensure that generators, reactors, transformers, and tie-lines remain within defined limits. It impacts the bottom line, as companies can reduce their operating costs by 10% to 25%. Government initiatives also go a long way in fostering the trend. For instance, the Inflation Reduction Act has fueled a clean energy boom, adding to a private sector clean energy announcement worth more than USD 360 billion. Deployment of clean energy from both the Inflation Reduction Act and the Bipartisan Infrastructure Law is expected to decrease electricity prices by as much as 9% by 2030. The Inflation Reduction Act will also launch several consumer-facing programs using tax credits and rebates that will assist families in bringing home energy bills down even lower., which focuses on advancing energy-saving technologies and practices across all sectors. Furthermore, the U.S. The Department of Energy has such aggressive energy efficiency goals that many industries are adopting innovations not only for better operational performance but also to support sustainability efforts. With the industry ushering in a new consumption pattern, the PMS market is expected to march in step with businesses keen on achieving energy efficiency and complying with regulations. These commitments can take shape with the approach put in place, post the global commitment to cutting carbon emissions and fueling a greener future underlining the imperative role that power management systems play in modern energy policies.

RESTRAIN:

-

Data Security Risks: A Barrier to Market Growth

The increasing threat to data security has developed into a massive challenge for the development of the market of Power Management Systems (PMS). Increasing cyber-attacks as well as virus incidents have caused the industry to face stronger security threats that can lead to extremely damaging effects like stealing sensitive information and disruption of operation. Critical infrastructure, as reported by the Cybersecurity and Infrastructure Security Agency (CISA), has been attacked more frequently in the past years.

KEY SEGMENTATION ANALYSIS

BY APPLICATION TYPE

Load-shedding and management dominated the power management systems market in 2023 with a share of 24% in revenue, pointing toward its critical role in ensuring stability within the grid. Technologies in this area are very important, especially concerning balancing supply and demand, since it is at these peak hours that the former is surpassed by demand or grid stability. Advanced solutions have been unveiled by companies like ABB and General Electric. ABB's Relion 670/650 series allows real-time monitoring and automated load-shedding responses, whereas GE's Advanced Distribution Management System (ADMS) integrates IoT sensors and smart meters in the optimization of load distribution and enhancement of grid reliability. Besides preventing total blackouts by cutting off the most non-critical loads, these systems improve operational efficiency through the promoting use of automation. Schneider Electric's EcoStruxure Power is another such PMS solution through which the load-shedding capabilities are further expanded by incorporating energy storage systems to supply backup power during outages.

The Power Control & Monitoring segment is expected to exhibit the fastest CAGR of 9.20% in the forecasted period 2024-2032. Power control and monitoring is the network of meters connected to the internet, which gives real-time data about the power system in a facility. It uses online software that can identify potential problems in the electrical system. As concerns over power utilization and industrialization continue to grow, along with maximizing the reliability aspect of electricity infrastructure, power monitoring is on the increase.

BY END-USE TYPE

The oil & gas segment held the largest revenue share in 2023 and is expected to grow significantly during the forecast period. The exploration and production of oil in difficult locations due to enhanced global demand for energy are now becoming increasingly common. Power cuts in these streams may face great losses financially, and so power management solutions are shifting towards high-class management systems. The sophisticated systems provide no power cut failure and include Emergency Shutdown systems for extra safety features. They also will comply with regulatory standards and minimize the carbon footprint of the industry through the usage of renewable sources of energy. Strong monitoring and analytics with wise optimization in energy usage are pushing the growth of the market further in this industry.

The fastest growth is expected to be with IT & data centres, at a 9.51% CAGR. The demand for digital services, cloud computing, and data storage, in general, supports the demand for digital services, cloud computing, and data storage; therefore, this enhances growth in IT & data centres. Data centres are among the biggest energy consumers; hence, efficient PMS ensures reliable power supply in optimizing energy usage along with lowering operational costs. More recently, companies like Schneider Electric and Vertiv have built upon their solutions to create even more evolved solutions. Schneider's EcoStruxure Data Centre combines real-time energy monitoring with the integration of load-shedding capabilities to optimize energy efficiency and minimize outages during downtime. Similarly, Vertiv's Liebert EXM2 UPS system delivers continuous power protection for critical data centre operations, protecting them from outages.

REGIONAL ANALYSIS

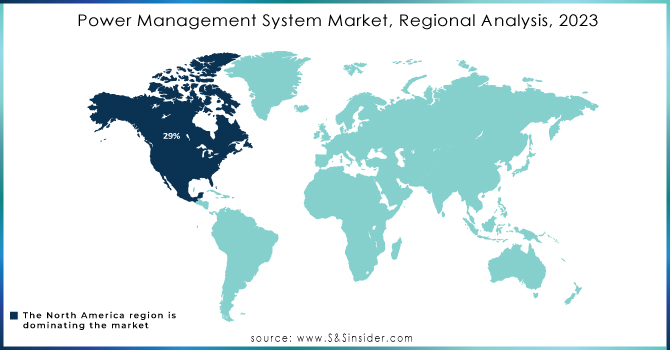

In 2023, North America dominated the Power Management Systems (PMS) market with a revenue share of 29%, driven by the increasing adoption of smart grids and IoT technologies. These innovations enable more efficient energy consumption monitoring and control, crucial in managing rising energy demands. The demand for IoT-enabled technologies is pushing significant investments by key players in the region. For example, Eaton announced over USD 500 million in investments to expand its manufacturing and operational facilities across North America. This expansion aims to meet the growing need for advanced electrical solutions, particularly in the context of smart grid integration and enhanced power management capabilities. The region invests heavily in infrastructure to support IoT and smart grid advancements. Countries like the U.S. and Canada are focusing on sustainable energy management, with government initiatives encouraging smart grid projects and increased energy efficiency. These factors highlight North America’s continued dominance in the PMS market, driven by innovation, investment, and strong regional demand for smarter energy solutions.

The Asia-Pacific region is projected to achieve the highest compound annual growth rate (CAGR) in the market for power management systems (PMS) during the forecast period. Growth is primarily being spurred by a surging adoption of advanced power management systems to deal with the variability and irregularity of renewable energy sources like solar and wind. Countries in this region have invested heavily in renewable energy infrastructure as they strive to reduce fossil fuel use progressively. The International Energy Agency pointed out that global annual renewable capacity additions nearly grew by 50% to almost 510 gigawatts in 2023, the fastest growth rate in the past two decades. This is the 22nd consecutive year in which renewable capacity additions reached a record high level, this time driven by China, India, and Japan. China alone declared that it will have over 1,200 GW of solar and wind capacity by 2030 to meet its carbon-neutrality objectives. Governments across the region continue to put policies in place and initiatives to help the transition.

Do You Need any Customization Research on Power Management System Market - Inquire Now

Key Players

Some of the major players in the Power Management System Market are:

-

ABB (ABB Ability™ Power Grid Control System, ABB Microgrid Solutions)

-

General Electric (GE Digital PowerHouse, GE Power Grid Solutions)

-

Siemens (Siemens Spectrum Power Management System, Siemens Smart Grid Solutions)

-

Schneider Electric (EcoStruxure™ Power Management System, EcoStruxure™ Microgrid Solutions)

-

Emerson Electric (Plantweb™ Optics Power Management Solutions, Emerson Ovation™ Distributed Control System)

-

Eaton (Eaton PowerXL Power Management System, Eaton Uninterruptible Power Supply (UPS) Systems)

-

ETAP (ETAP Power System Analysis Software, ETAP Microgrid Simulation Software)

-

Mitsubishi Electric (MELSEC iQ-F Series PLC, Mitsubishi Electric Power Conditioning Systems)

-

Rockwell Automation (Rockwell Automation PlantPAx Distributed Control System, Rockwell Automation Power Monitoring Software)

-

Honeywell (Honeywell Experion™ PKS Process Knowledge System, Honeywell Home Energy Management System)

-

Fuji Electric (Fuji Electric Power Management System, Fuji Electric Uninterruptible Power Supply (UPS) Systems)

-

Larsen & Tourbo (L&T Power Management Solutions, L&T Smart Grid Solutions)

-

Yokogawa (Yokogawa CENTUM VP DCS, Yokogawa Power Management Software)

-

Wartsila (Wärtsilä Power Management Systems, Wärtsilä Microgrid Solutions)

-

Cpower, Brush (Cpower Demand Response Solutions, Brush Generator Control Systems)

-

Albireo Energy (Albireo Microgrid Solutions, Albireo Energy Storage Systems)

-

Greystone Energy Systems Inc. (Greystone Power Management Software, Greystone Microgrid Solutions)

-

Omron (Omron Sysmac Automation Platform, Omron Energy Management Solutions)

-

Lineage Power (Lineage Power Management Systems, Lineage Power Quality Solutions)

-

Delta Electronics (Delta Power Management Solutions, Delta Uninterruptible Power Supply (UPS) Systems)

RECENT TRENDS

-

In June 2023, ABB closed its acquisition of Eve Systems GmbH of Munich, Germany this company has gained strong recognition in Europe and the United States for its smart home products. The acquisition makes ABB the head of the smart home market. The sector with a particular focus on the products using Matter interoperability standard and wireless connectivity technology known as Thread.

-

In October 2023, Eaton launched the U.S.-based intelligent power management company, Gigabit Network Card, Network-M3. The new solution brings together the strengths of cyberthreat-resistant and connected backup power in a single product line. Channeled through Eaton's technology, which is based on Gigabit Network Card capabilities but that extends to meeting further cybersecurity requirements, web-based monitoring, and advanced security features, it is expected to deliver comprehensive real-time visibility and control over power usage as security demands continue to be shaped.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.18 Billion |

| Market Size by 2032 | US$ 8.96 Billion |

| CAGR | CAGR of 6.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-use Type (Oil & Gas, Marine, Metal & Mining, Chemical & Petrochemical, IT & Data Centres, Utilities, Paper & Pulp, Others) • By Application Type (Load Shedding & Management, Power Control & Monitoring, Generator Control, Switching and Safety Management, Power Simulator, Energy Cost Accounting, Data Historian, Others) • By Component Type (Hardware, Software, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, General Electric, Siemens, Schneider Electric, Emerson Electric, Eaton, Etap, Mitsubishi Electric, Rockwell Automation, Honeywell, Fuji Electric, Larsen & Tourbo, Yokogawa, Wartsila, Cpower, Brush, Albireo Energy, Greystone Energy Systems Inc., Omron, Lineage Power, Delta Electronics |

| Key Drivers | • The Growing Demand for Energy Efficiency in Modern Businesses |

| Restraints | • Data Security Risks: A Barrier to Market Growth |