LiDAR Market Size:

Get more information on LiDAR Market - Request Sample Report

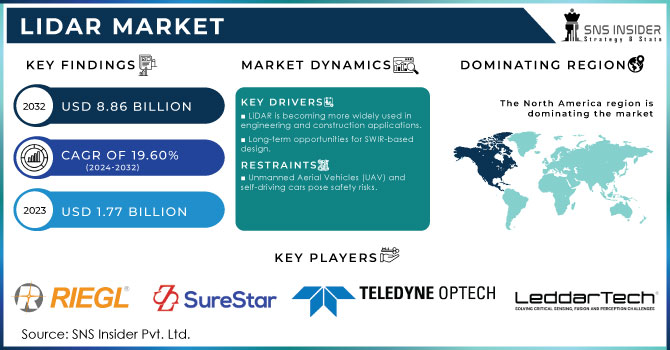

The LiDAR Market Size is valued at USD 1.77 Billion in 2023. It is estimated to reach USD 8.86 Billion by 2032, growing at a CAGR of 19.60% during 2024-2032.

The Light Detection and Ranging (LiDAR) market, has experienced significant growth in recent years, driven by advancements in technology and increasing applications across various industries ranging from automotive to environmental monitoring. As the automotive industry moves towards greater automation, LiDAR systems are essential for providing high-resolution, real-time data that allows vehicles to navigate safely and efficiently. The growing adoption of autonomous vehicles and advanced driver-assistance systems (ADAS) has significantly bolstered the demand for LiDAR technology. In 2023, over 2.5 million autonomous vehicles were sold globally in 2023, and this number is projected to rise to approximately 3.5 million units in 2024. The geographic distribution of autonomous vehicle adoption shows that the United States remains the largest market, accounting for nearly 50% of global sales in 2023, with high adoption rates particularly in states such as California and Arizona. Investment in autonomous vehicle technology and infrastructure has surged to over USD 12 billion annually in 2023, with continued growth anticipated.

LiDAR is increasingly used in environmental monitoring and management. The technology is instrumental in mapping and analysing natural landscapes, such as forests, rivers, and coastal areas. By providing precise elevation data and detailed vegetation information, LiDAR helps in assessing forest health, monitoring soil erosion, and managing water resources. This application is particularly valuable for environmental agencies and organizations involved in conservation and land management.

LiDAR Market Dynamics:

Drivers

-

LiDAR is becoming more widely used in engineering and construction applications

The rising applications of LiDAR in engineering and construction for better mapping and planning are bolstering growth across the market. LiDAR is a technology that uses laser pulses for measuring distances to create three-dimensional representation of the earth surface. The precision of the data allowed with high-quality data produced enable better planning, management, tracking in project development. LiDAR is used in engineering to conduct a range of very accurate topographic surveys providing the engineers with raw ++ data, which allows them to make reliable assessments and plans for their sites. The ability to produce digital elevation models (DEMs), essential in landform analyses and hazard predictions, is also granted by the technology. LiDAR can offer engineers a more detailed understanding of the design and development details in infrastructure projects, reducing chances for error ensuring effective allocation of resources.

In construction, LiDAR plays a huge role in keeping track of progress and making certain projects meet design specs. The uses for this are site mapping, volume calculations and structural inspections. Construction professionals can rapidly capture and analyze considerable quantities of information, allowing them to detect any problems early on in the project cycle while reducing risks associated with rework during construction. What this efficiency does is to speed up project timelines as well managing costs better, which in turn lead to a more safety.

-

Long-term opportunities for SWIR-based design

The SWIR (short-wave infrared) wavelengths vary typically from 1.0 to 2.5 micrometres, which makes it an excellent range for imaging applications in different conditions including poor lighting and bad weather situations such as dust or fog. This means increased penetration through atmospheric particles like fog, rain and dust—all of which often obscure other wavelengths. This way, LiDAR systems with SWIR can retain their high performance and accuracy in extreme weather conditions which is critical for utilizing those technologies in autonomous vehicles, robotics or environmental monitoring.

In addition to this, SWIR technology is capable of detecting fine details about objects and surfaces that are essentially invisible in visual or near-infrared wavelengths. This feature is especially beneficial for industries that depend on accurate material analysis and very high-resolution topographical mapping. The increasing focus on autonomous navigation systems and smart infrastructure is further expected to drive demand for state-of-the-art LiDAR systems using SWIR-based technology.

Restraints

-

Unmanned Aerial Vehicles (UAV) and self-driving cars pose safety risks

LiDAR technology is used to modulate and digitize the wavelength of a laser beam for it produce an accurate 3D map image where UAS (Unmanned Aerial Vehicles) such as unmanned airships, drones and self-driving cars use this tech achieving very challenging navigation goals. Both UAVs and autonomous vehicles depend on LiDAR (Light Detection and Ranging), which helps the devices understand distance measurements in 3-dimensional space necessary for navigation, as well as mapping its environment to detect obstacles.

The biggest security issue is that LiDAR systems can be failed or faulty, and therefore lead to false environmental data. For drones, this may lead the vehicle to collide with objects or other aircraft, risking both itself and people safety in case of being on-grounded. A faulty LiDAR in autonomous vehicles could give incorrect analyses of road status, traffic lights or pedestrian presence sending the wrong signals and therefore causing accidents. Moreover, the implementation of LiDAR systems into UAVs and self-driving cars needs elaborate hardware as well software part which can further rise this product to cybersecurity risks. If hack new access was gained, the LiDAR system is a safety feature of this autonomous vehicle that requires correct working in order to drive correctly and safely.

LiDAR Market Segment Overview:

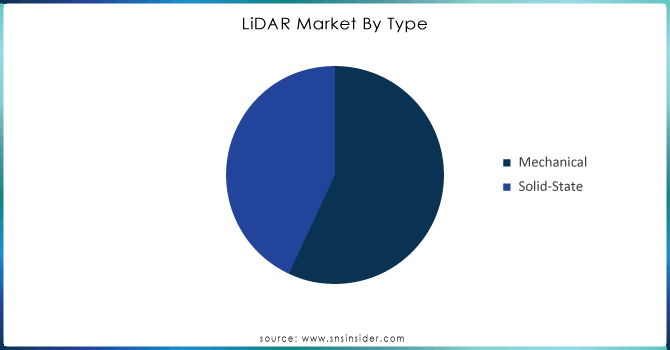

By Type

The mechanical segment held the largest share in 2023, accounting for more than 55% of the market. This LiDAR system that have to move around your environment in order for it do a full scan through scanning. Such systems often use mirrors or prisms that rotate or oscillate to steer the firing of laser pulses across a wide field, obtaining data from different angles. A typical mechanical LiDAR consists of a laser source that emits pulses, scanning mechanism with rotating or oscillating mirrors to direct the light, detectors capturing reflected pulses and control unit which handles both; scan process and data acquisition.

The solid-state segment is projected to become the fastest-growing segment during forecast period. This solid-state ranging system can be built on a silicon chip and does not require moving components. These include microelectromechanical systems (MEMS), electromagnetic light phase array ORPOPA and flash devices. The four systems are in the advanced end of development and architecture, a category predominantly favoured by various industry and defence sectors.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Service

The aerial surveying services dominated in 2023 with market share of over 35%. Aerial surveying services are commonly used to observe incidents in locations like roads, railways, highways, and bridges. Government agencies typically provide these services. Aerial LiDAR is essential for overseeing natural resources, such as forestry and agriculture. This system helps evaluate the health of plants, determine biomass, and track changes in land use. Aerial LiDAR surveys offer precise and accurate 3D mapping of land and scenery. The technology is capable of obtaining precise elevation information and producing precise topographic maps.

The Geographic Information Systems (GIS) is accounted to have a faster growth rate during the forecast period. GIS is commonly seen as the most rapidly expanding category within the range of services provided. This is a result of the growing need for precise geospatial information in different sectors like urban planning, agriculture, forestry, and infrastructure development. The combination of LiDAR and GIS allows for accurate mapping and analysis, which is essential for decision-making in these industries.

By Component

Laser scanner segment held a market share of over 43% in 2023 and dominated the market. Laser scanning is also used to measure intensity values of the return signal strength that can be utilised within classification algorithms, able to differentiate between objects with a metallic and other reflectivity characteristic from the surrounding background for physiological or hazard purposes. Laser scanners in LiDAR systems emit laser pulses toward a target and then measures the time it takes for those reflected pulse to return back to scanner. The distance between the scanner and target is used to create exact 3D models of what we see in our environment, by utilizing this time delay.

The navigation and positioning systems is to witness a significant growth rate during the forecast period 2024-2032, due to the rising demand for advanced driver assistance systems (ADAS), autonomous vehicles, drone technology etc. These systems have contributed to the accuracy and precision of LiDAR solutions leading it across multi-industry. The navigation works in conjunction with the positioning, lock it to a very precise geographical coordinate where that LiDAR scanner is operating. It is important in order to correctly model the spatial context, as LiDAR data does not come georeferenced unless you have a very high accuracy for your positioning.

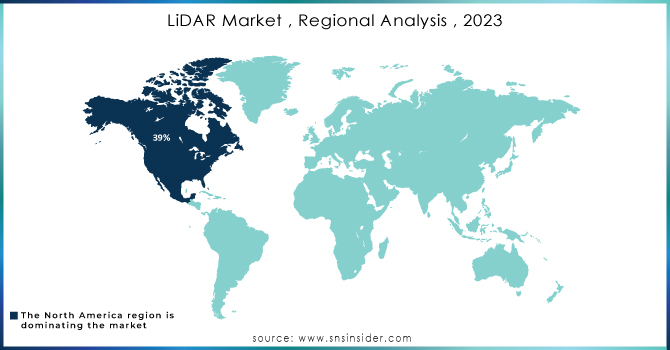

LiDAR Market Regional Overview:

In 2023, North America led the market with a market share of 39% due to the growing adoption of regulations requiring the implementation of particular automotive safety technologies in both light and heavy vehicles in the region. The region, being the technological pioneer generates substantial investments towards LiDAR research and development thereby boosting innovation. Moreover, uptake in the surveying & mapping sector for applications across industries such as agriculture and robotics is estimated to support commercial LiDAR market evolution. The automotive sector in North America experienced growth opportunities due to the rising use of technologies like ADAS and AEB.

Asia Pacific is expected to grow at a fastest CAGR during 2024-2032. The region's significant and well-established developing markets like China and India are key contributors to the increased demand for LiDAR in these countries. The applicability of this technology ranges from surveying and mapping to use in Returnable Aerial Vehicle (RAV), the growth prospects for such applications can be considered as a major driver. This AI and ML automation of the LiDAR deployment can make it a smarter, faster technology.

KEY PLAYERS:

The key players in the LiDAR industry are Teledyne Optech, Leica Geosystems, RIEGL Laser Measurement, Beijing SureStar Technology, Geokno, Leddartech Inc, Trimble, FARO Technologies, Quantum Spatial, Velodyne Lidar, Phoenix LiDAR Systems, Quanergy Systems & Other Players.

Recent Development

-

In April 2024, Hesai introduced the ATX LiDAR, which offers an ultra-wide field of view (FOV) and long-range detection capabilities. It is optimized for autonomous driving and advanced driver assistance systems (ADAS) with a focus on providing precise detection in various environmental conditions.

-

In March 2024, JOUAV launched this airborne LiDAR sensor designed for drone applications. It boasts a 1000-meter detection range with high-precision measurements, making it ideal for terrain mapping, power line inspections, and coastline measurement. It integrates advanced GNSS and inertial navigation systems.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.77 billion |

| Market Size by 2032 | USD 8.86 billion |

| CAGR | CAGR of 19.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Mechanical, Solid-State) • By Technology (2D, 3D, 4D) • By Service (Aerial Surveying, Asset Management, GIS Services, Ground-Based Surveying, Other) • By Component (Laser Scanner, Navigation And Positioning Systems, Others) • By Application (Corridor Mapping, Engineering, Environment, ADAS And Driverless Cars, Exploration, Urban Planning, Cartography, Meteorology, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Teledyne Optech, Leica Geosystems, RIEGL Laser Measurement, Beijing SureStar Technology, Geokno, Leddartech Inc, Trimble, FARO Technologies, Quantum Spatial, Velodyne Lidar, Phoenix LiDAR Systems, Quanergy Systems |

| Key Drivers | • LiDAR is becoming more widely used in engineering and construction applications. • Long-term opportunities for SWIR-based design. |

| RESTRAINTS | • Unmanned Aerial Vehicles (UAV) and self-driving cars pose safety risks. |