EMI Shielding Market Report Scope and Overview:

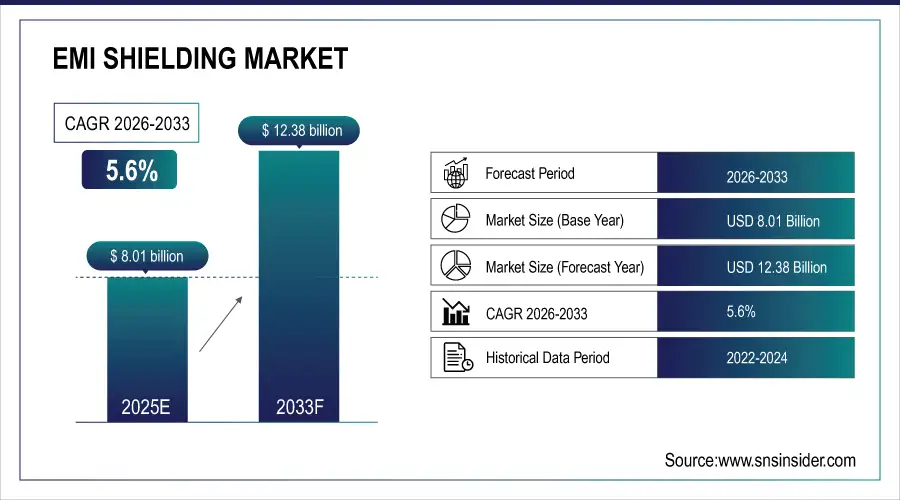

The EMI shielding Market Size was valued at USD 8.01 billion in 2025E and is expected to reach USD 12.38 billion by 2033 and grow at a CAGR of 5.6% over the forecast period 2026-2033.

The EMI shielding market is majorly driven by the increase in the production of various consumer electronics like smartphones, laptops, tablets, etc. The computer segment sales have risen by 34% and TV sets by 12% in 2022 from 2019. Different components required for the production of these electronic items require different frequencies to work properly. Therefore, EMI shielding is very important to keep all the components intact while eliminating electromagnetic interference. Leading electronic companies like Apple, Samsung, and Huawei are investing heavily in advanced EMI shielding solutions to enhance product reliability. Moreover, the growing trend of miniaturization in electronic devices is also driving the demand for advanced EMI shielding solutions. Smaller devices require more efficient and compact shielding materials to prevent interference without compromising performance.

In the automotive industry safeguarding all system-critical components such as ADAS, ECUs or ABS heavily depends on robust EMI shielding concerning safety and performance. Automotive manufacturers are showing a keen interest in using EMI shielded technology to secure their automobile's electronics systems from interference. The expansion of electric vehicles (EVs) also contributes to the increasing necessity for this shielding in automotive applications. The case study by Parker Chromerics, a major manufacturer states that almost every electronic device in the vehicle needs to function effectively and dependably from all onboard signals. However, due to the system complexity, and emission of electromagnetic interference (EMI) is a major worry for clients. Special attention was even paid to EMI shielding over the many optical periscope cameras and sensors on the vehicle. All inlets and outlets on air intake or exhaust ducts needed EMI shielding ventilation panels to provide passage for through-flowing gas particles while blocking radiation that permeated the enclosed environment.

Telecommunications networks, including 4G and 5G, rely on consistent and speedy wireless signal transmission. 5G technology operates at higher frequencies, making electronic devices more susceptible to EMI. The deployment of 5G infrastructure necessitates the use of advanced EMI shielding solutions to ensure reliable communication. EMI shielding is crucial to prevent external interferences and ensure high-quality communication. The expansion of 5G networks is expected to drive the demand for EMI shielding solutions in the telecommunications sector. North America is the leading region in the telecommunications market with more than 250 million mobile users. According to the Federal Communications Commission (FCC), Comcast is the largest internet access provider in the U.S., reported over 27 million residential broadband subscribers in 2020, while AT&T claimed more than 15 million and Charter Communications reported an approx. of 25 million residential subscribers. With the growing need for the Internet of Things (IoT), the need for advanced EMI shielding also increases.

EMI Shielding Market Size and Forecast:

-

Market Size (2025E): USD 8.01 Billion

-

Market Size (2033): USD 12.36 Billion

-

CAGR (2026–2033): 5.6%

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on EMI Shielding Market - Request Sample Report

EMI Shielding Market Highlights:

-

Governments worldwide are enforcing stricter regulations on electromagnetic emissions to protect public health and critical infrastructure

-

EMI shielding materials help manufacturers comply with emission limits and ensure uninterrupted operation of hospitals, air traffic control, and other vital systems

-

High-performance EMI shielding materials and their integration can increase production costs and design complexity for electronic devices

-

Rapid adoption of 5G/6G, electric vehicles, IoT devices, and wearables is driving demand for lightweight, flexible, and high-performance EMI shielding solutions

-

Aerospace, defense, and industrial automation sectors require robust EMI protection to maintain device reliability

-

Shift toward sustainable, polymer-based, and composite shielding materials is creating opportunities for innovative product development and advanced coatings

EMI Shielding Market Drivers:

-

Stringent Government Regulations on Electromagnetic Emissions

Governments worldwide are implementing stricter regulations to control electromagnetic emissions from electronic devices. These regulations aim to protect public health, ensure the proper functioning of critical infrastructure, and prevent interference with radio communication systems. To comply with these regulations, manufacturers need to incorporate EMI shielding solutions into their products. Concerns regarding the potential health risks of prolonged exposure to electromagnetic radiation are prompting regulatory bodies to set stricter emission limits. EMI shielding materials help manufacturers meet these standards by minimizing the radiation emitted by electronic devices. Hospitals, air traffic control systems, and other critical infrastructure rely on uninterrupted communication. EMI from electronic devices can disrupt these systems, potentially leading to catastrophic consequences. EMI shielding safeguards these vital systems by mitigating electromagnetic interference. The radio spectrum is a finite resource used for various communication purposes. Excessive EMI from electronic devices can disrupt radio signals used by emergency services, aviation, and other critical applications. EMI shielding helps maintain a clean radio frequency environment and ensures seamless communication.

EMI Shielding Market Restraints:

- Cost of EMI Shielding Materials and Implementation

The cost of EMI shielding materials and their integration into electronic devices can be a significant restraint for the market. Certain high-performance EMI shielding materials can be expensive, particularly those used in specialized applications. Additionally, the process of incorporating EMI shielding into product design and manufacturing can add complexity and cost. Advanced EMI shielding materials like conductive fabrics and composites can be significantly more expensive than traditional materials. This cost factor can be a hurdle for manufacturers, especially for budget-conscious consumer electronics. Integrating EMI shielding into electronic devices requires careful design considerations and may necessitate additional manufacturing processes. These complexities can translate to higher production costs for manufacturers. There is often a trade-off between the cost and effectiveness of EMI shielding solutions. Manufacturers need to strike a balance between achieving adequate EMI protection and maintaining cost competitiveness.

EMI Shielding Market Opportunities:

-

Rising Demand for Advanced Electronics Protection

The EMI shielding market presents significant growth opportunities driven by rapid adoption of 5G/6G technologies, electric vehicles (EVs), and miniaturized consumer electronics. Increasing reliance on IoT devices and wearable electronics fuels demand for lightweight, flexible, and high-performance shielding materials. Growing aerospace, defense, and industrial automation sectors require robust EMI protection to ensure device reliability. Additionally, the shift toward sustainable, polymer-based, and composite materials creates avenues for innovative product development. Companies focusing on R&D, advanced coatings, conductive films, and integrated thermal‑EMI solutions are well-positioned to capitalize on expanding applications and global electronics growth.

EMI Shielding Market Segment Analysis:

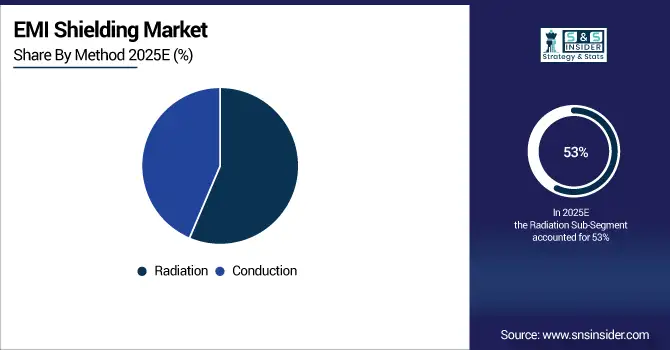

By Method

Radiation shielding methods have acquired the leading position in the EMI shielding market by a market of more than 53% in 2025, as they are easily available and cost-efficient. This method can be adapted to a multitude of materials and surfaces, enabling it as an excellent solution for many applications. They have great shielding properties for protecting sensitive electronic components from EMI and are relatively inexpensive compared to other means of shielding especially in high-volume applications. Moreover, radiation-based shielding techniques are quite easy to install and maintain with the additional speed which increases their adoption rate.

By Industry

The consumer electronics sector such as smartphones, wearables, and tablets is the dominating segment during the forecast period, with a market share of more than 47.56% in 2025. The components used for making the particular electronic item have different frequencies and need proper EMI shielding. If these components are given improper EMI shielding, they could interfere with one another which results in signal degradation, call dropping, and reduced data transfers.

The telecommunications sector is the fastest-growing segment by industry for the EMI shielding market. From 4G to 5G, all wireless technologies function in a set spectrum of frequencies. EMI shielding plays a key role in ensuring seamless wireless signal transmission and preventing damages from external interference. Several system-critical components in the automotive sector, such as anti-lock braking systems (ABS), advanced driver-assistance systems (ADAS), or Engine control units (ECUs) contain electronic assemblies, raising the demand for advanced EMI shielding. Therefore, the automotive is also growing fast.

EMI Shielding Market Regional Analysis:

North America EMI Shielding Market Trends:

North America is the most technologically advanced region in the world, accounting for a market share of 30.89% in 2025. The U.S. is the major contributor to the market share in the region. The disposable income, growing population, and various research and development activities in the healthcare, defense, space, and aerospace industries are some of the main reasons for the region’s overall growth in the EMI shielding market.

Need any customization research on EMI Shielding Market - Enquiry Now

Asia-Pacific EMI Shielding Market Trends:

Asia Pacific is the fastest-growing market over the forecast period due to the presence of a large number of electronics manufacturers. Countries like China and India are mainly contributing to the region’s growth in the EMI shielding market. Rapid industrialization and infrastructure development are expected to drive the market in China. Not only consumer electronics but also the telecommunication sector and the automotive industry are higher in the Asia Pacific region, increasing the demand for advanced EMI shielding. The increase in the manufacturing of electric vehicles is also a key driver for the market.

Europe EMI Shielding Market Trends:

Europe remains a key market for EMI shielding, driven by strong demand from the automotive, industrial automation, aerospace, and renewable energy sectors. Strict electromagnetic compatibility (EMC) regulations across the EU encourage adoption of advanced shielding materials such as coatings, conductive polymers, and shielded enclosures. Growth in electric vehicles, smart grids, and industrial electronics, particularly in Germany, France, and the UK, further supports market expansion.

Latin America EMI Shielding Market Trends:

Latin America is emerging as a growing market due to increasing automotive production, including electric vehicles, and expansion of telecommunications infrastructure. Countries like Brazil and Mexico are seeing higher consumption of EMI shielding materials in electronics manufacturing and export-oriented assembly plants. Although adoption is slower than in developed regions, investments in digital infrastructure and industrialization present long-term growth potential.

Middle East & Africa EMI Shielding Market Trends:

The Middle East is experiencing rising demand for EMI shielding, fueled by 5G network rollout, smart-city projects, and IoT deployments. Industrial sectors such as oil & gas, energy, and automation require EMI-protected control and monitoring systems. In Africa, growth is gradual but supported by increasing mobile penetration, infrastructure upgrades, and urbanization, offering expanding opportunities for shielding materials.

EMI Shielding Market Competitive Landscape:

Henkel AG & Co. Established in 1876, is a global leader in adhesives, sealants, and specialty electronic materials. The company delivers advanced EMI shielding, thermal management, and PCB protection solutions for automotive, telecom, aerospace, and industrial electronics. With strong R&D and digital engineering expertise, Henkel focuses on sustainability, reliability, and high-performance innovation.

-

In October 2025, Henkel unveiled a new cost-efficient EMI shielding film and advanced thermal solutions for automotive and electronic applications at Productronica 2025 in Germany. The company also highlighted digital EMI testing and engineering capabilities to accelerate product validation and development.

Parker Hannifin Corporation Founded in 1917, is a global leader in motion and control technologies, specializing in engineered materials, fluid management, and industrial systems. The company offers advanced EMI shielding gaskets, conductive elastomers, and sealing solutions for aerospace, automotive, defense, telecommunications, and electronics industries, supporting high-reliability and performance-critical applications worldwide.

-

In May 2024, Parker Hannifin launched new EMI Shielding Gaskets known as Anixter A-shield+, which is made by combining both silicone and nickel-plated copper. These shields provide effective and consistent flame retardant that meets the industry standards.

EMI Shielding Market Key Players:

-

3M Company

-

Henkel AG & Co. (Henkel)

-

Kitagawa Industries

-

Leader Tech, Inc.

-

PPG Industries

-

SCHAFFNER HOLDING AG

-

ETS-Lindgren

-

KGS

-

Laird PLC

-

Parker Hannifin Corporation

-

RTP Company

-

MG Chemicals

-

Nolato AB

-

Tech Etch, Inc.

-

Huntsman International LLC

-

Omega Shielding Products

-

HEICO Corporation

-

TE Connectivity

-

Amphenol Corporation

-

Carlisle Companies Incorporated

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 8.01 Billion |

| Market Size by 2033 | USD 12.36 Billion |

| CAGR | CAGR of 5.6% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (EMI Shielding Tapes & Laminates, Conductive Coatings & Paints, Conductive Polymers, Metal Shielding, EMI/EMC Filters) • By Method (Conduction, Radiation) • By Industry (Consumer Electronics, Automotive, Aerospace, Telecommunication, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | 3M Company, Henkel Corporation, Kitagawa Industries, Leader Tech, PPG Industries, SCHAFFNER HOLDING, ETS-Lindgren, KGS, Laird PLC, PARKER HANNIFIN and RTP Company, MG Chemicals, Nolato AB, tech Etch Inc., Huntsman International LLC, ETS-Lindgren, Omega Shielding Products, HEICO Corporation. |