Intracranial Aneurysm Market Report Scope & Overview:

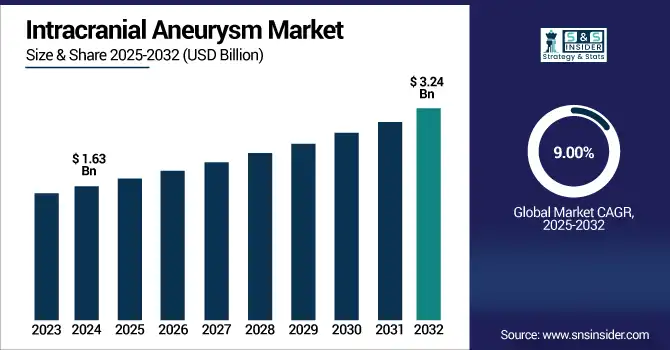

The intracranial aneurysm market size was valued at USD 1.63 billion in 2024 and is expected to reach USD 3.24 billion by 2032, growing at a CAGR of 9.00% over 2025-2032.

To Get more information on Intracranial Aneurysm Market - Request Free Sample Report

The intracranial aneurysm market is further expected to grow due to the rising detection rate of unruptured aneurysms, rising preference for minimally invasive procedures, and technological advancements taking place in the market. Studies show that up to 3–5% of the global population have unruptured intracranial aneurysms, with prevalence increasing in women and the elderly. Endovascular coiling is now responsible for more than 60–65% of treatments globally, and its use is increasing in Asia-Pacific and Latin America, where there is greater access to hospitals and education for specialist training. The use of flow diverters is growing at a rate of more than 12% annually due to their efficacy in the treatment of wide-neck, large aneurysms not conducive to coil indwelling.

Investment in the development of R&D is increasing for major payers, at between 10–12% of annual revenue, and is now being directed into innovation in microcatheters, intrasaccular implants, and embolization systems. Over 30 neurovascular devices have gained regulatory approval (FDA, CE Mark) as of 2022, suggesting a robust innovation pipeline. The artificial intelligence (AI) driven aneurysm detection software and robot-assisted navigation system have been deployed in neurosurgical institutions, which are expected to improve the accuracy of diagnosis and procedure accuracy for additional treatment. In addition, the growing availability of DSA and 3D rotational angiography at regional and national centers is enhancing case recognition and preoperative assessment.

Policy-wise, the U.S., Germany, and Japan reimbursement models are growing more friendly to newer technologies such as flow diverters, driving clinical adoption. At the same time, the adoption of UHC models by a number of emerging economies is contributing to narrowing the gap in treatment access. Combined, these trends posit ongoing intracranial aneurysm market growth due to increasing demand, increasing supply chain, evolving clinical practice angle, and constant signal innovations.

Table: Clinical Pipeline Snapshot – Late-Stage Devices (as of 2025)

|

Sponsor |

Device/Approach |

Trial Phase |

Target Indication |

Expected Launch |

|

Cerus Endovascular |

Contour 2nd Gen |

Phase III |

Wide-neck Aneurysms |

Q4 2025 |

|

Rapid Medical |

TIGERtriever Flow |

Phase II/III |

Ruptured Aneurysms |

2026 |

|

Sequent Medical |

MicroCoil (Bioactive) |

Phase III |

Distal Aneurysms |

2025 |

|

InNeuroCo |

NeuroGuard System |

Phase II |

Aneurysm + Clot Protection |

2026 |

Market Dynamics:

Drivers:

-

Rising Disease Burden, Technological Advancement, and Favorable Regulatory and Investment Dynamics Fuel Market Growth

The intracranial aneurysm market growth is driven by the rising incidence of neurovascular diseases and the rising popularity of minimally invasive methods. About 30,000 people have aneurysm rupture every year in the U.S., making the need for advancements in early diagnosis and treatment essential. Advanced imaging capabilities like 4D CTA and MRI angiogram are facilitating early detection, while next-generation flow diverters and embolic coils are increasing the options for the treatment of earlier deemed inoperable aneurysms. Rising R&D activity is also stoking market growth, with Balt, Sequent Medical, and NeuroVasc, for instance, investing heavily in pipeline innovation, with R&D spend growing at around 10–15% per year in leading players.

Regulatory agency assessments are being prioritized to streamline access, including the FDA’s Breakthrough Device Designation for the eCLIPs Bifurcation Flow Diverter, granted in 2023, to expedite entry to market. The proliferation of both public-private partnerships and neurovascular-focused investment, more than USD 250 million over the past 24 months globally, is also driving device availability and innovation. Moreover, rising physician enlightenment and the development of neurovascular training programs around the world mean that there's more availability of treatments over the long run. Taken together, these parts point to the continued intracranial aneurysm market expansion and are the result of innovation, clinical need, and regulatory aid.

Restraints:

-

The Major Limitations in Market Expansion, Such as Procedural Risk, Access Gaps, Cost Burdens, and Lack of Skilled Specialists in Emerging Economies

Multiple barriers to the market may limit its adoption and access, even with strong innovation. One set of barriers centers around procedural cost and device price, and there are no unreasonable concerns about that with devices like flow diverters, which come to USD 15,000–25,000 dollars a device, and so those are completely unaffordable to most people in low- and middle-income countries. In addition, the technical expertise is in high demand, and there is a lack of neuro-interventionalists working globally, especially in non-metropolitan regions. In rural and underdeveloped areas, basic neuroimaging such as CTA and DSA is scarce, which leads to a late diagnosis, resulting in limited ineligible for advanced intervention. Moreover, safety issues regarding long-term follow-up (e.g., in-stent thrombosis, delayed rupture after the deployment) would explain the conservative clinical uptake in some areas.

Reimbursement issues continue as well; most national health systems are unwilling to pay for these newer, high-cost devices in the absence of robust cost-effectiveness data, impeding product acceptance. Moreover, in some markets, the level of regulation in place also contributes to time-to-market issues. These limitations shed light on the broader policy pathway, economic accessibility, and workforce development to achieve fair growth and reach the global intracranial aneurysm market trends.

Segmentation Analysis:

By Product Type

By 2024, aneurysm therapeutic devices held a major share of the intracranial aneurysm market, with an overall market value of 64%. This superiority is due to the wide use of therapeutic equipment, such as detachable coils, embolization materials, flow diverters, and occlusion catheters, necessary for surgical and endovascular treatments. Given their safety, efficacy, and clinical adaptability, such devices are currently used in hospitals and specialty settings.

Among this category, flow diverters are growing the most rapidly and are expected to gain further ground given the success of treating the wide-neck and large Aneurysms with fewer procedural complications and lower retreatment rates. Material advancements, visibility, and accommodating complex anatomy have also started to speed up acceptance by neurointerventionalists. Even if the segment of population represented by patients who are ineligible for standard coiling is slowly emerging, due to increasing regulatory approvals and good long-term occlusion rates.

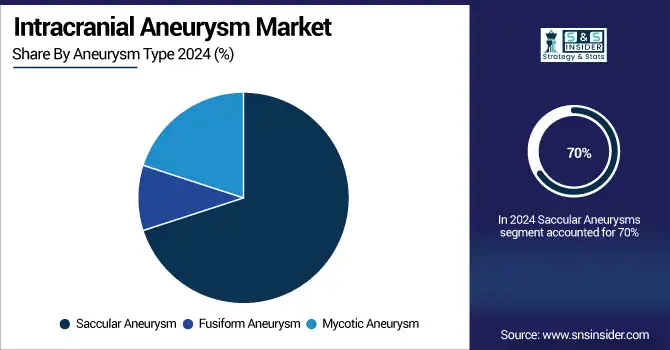

By Aneurysm Type

Saccular aneurysms dominated the product landscape in 2024, with more than 70% of the overall cases treated owing to high prevalence and established treatment guidelines. These aneurysms, which often form at bifurcations of cerebral arteries, can be more readily imaged and respond to traditional endovascular treatments, such as coiling and flow diversion, the report added. The rising trend of screening tests, including CT angiography and MR angiography, has contributed to the advancement in early diagnosis, thereby making it the largest segment.

Conversely, mycotic aneurysms are the segment experiencing the highest growth rate due to increasing complications of infection, particularly in immunocompromised and elderly patients. The second type of aneurysms is less common and represent an emergency clinical situation that demands aggressive treatment, with a high risk of aneurysm rupture. Awareness, microbiological diagnostics, and therapeutic strategies need to be enhanced including individualized (targeted) antibiotic strategies as more and more patients are treated (surgically/ endovascularly) for their management.

By Treatment Type

In 2024, endovascular coiling was the most common treatment, with endovascular coiling representing 61% of all treatments globally. It is popular because of less-invasiveness, shorter hospitalization, and high safety. It continued to be the standard of care for small to medium aneurysms, especially in poor open surgical candidate patients. The development of improved devices with bioactive and detachable coils has led to better clinical outcomes and low recurrence rates.

The most rapidly growing treatment category is flow diverters, which are more commonly used for the treatment of large, wide-necked aneurysms that are not suitable for coiling or clipping. They can change blood flow and occlude the aneurysms in long-term follow-up without entering to aneurysm sac, and that is why they are chosen for use. Late clinical experience and gaining registration of newer-generation devices foster physician confidence in and procedural preference for EVT, particularly in tertiary care and neuro-specialty centers.

By End-User

Hospitals accounted for the largest share of the intracranial aneurysm market trends in 2024 and are expected to account for 68% of all procedures performed. They have become the standard owing to modern neuroimaging equipment, hybrid operating rooms, trained neurointerventionists, and postoperative care support. Hospitals are also the place of the most high-risk and emergency cases of aneurysm, especially ruptures, which demand immediate help. The centralized availability of multidisciplinary assessment teams and emergency intervention services also enhances the role of the teams in aneurysm care.

Specialty clinics, on the other hand, recorded the highest CAGR, as the trend towards outpatient care and dedicated neurosurgery centers reinforced their demand. The surge in CPT chimeric days is driven by progress in compact imaging systems, manageable day-care surgery, and increasing insurance coverage of outpatient neurointerventional procedures. These clinics have reduced turnaround time, lower procedural costs, and personalized patient care, and they are desirable for elective, unruptured aneurysm patients in urban settings.

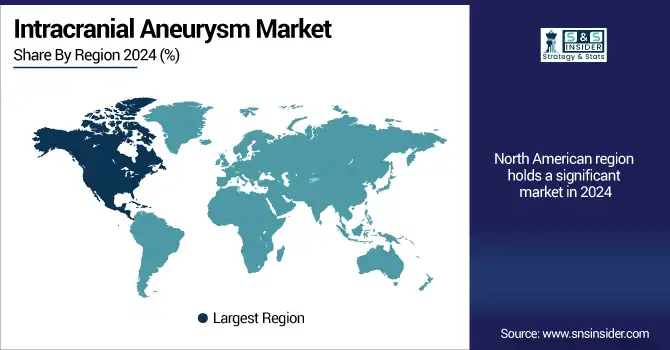

Regional Analysis:

In 2024, North America held a major position in the intracranial aneurysm market share, primarily owing to its well-established healthcare infrastructure, high adoption of minimally invasive neurosurgical procedures, and favorable reimbursement policies.

The U.S. intracranial aneurysm market size was valued at USD 0.61 billion in 2024 and is expected to reach USD 1.18 billion by 2032, growing at a CAGR of 8.68% over 2025-2032. The leading position of the U.S. can be attributed to the high number of intracranial procedures, the existence of major neurovascular devices manufacturers, and large hospital networks. Endovascular coiling was the dominant treatment in U.S. aneurysm procedures in 2024, consisting of more than four-fifths of all cases. Canada was also seeing an upward trend, mainly due to enhanced access to neuroimaging and increases in government-sponsored aneurysm screening. The U.S. is the leading market contributor, with a large intracranial aneurysm market share accounting for the initial adoption of advanced technology, FDA-approved technology, and also aging population with the elevated occurrence of aneurysms. The increasing prevalence of lifestyle-related risk factors like high blood pressure and smoking can only stoke the market in this region.

Table: Regulatory Approvals of Key Intracranial Aneurysm Devices (2022–2025)

|

Company |

Device Name |

Regulatory Body |

Approval Type |

Date |

|

MicroVention |

WEB 17 System |

FDA |

PMA |

June 2024 |

|

Stryker |

Contour Neurovascular |

CE Mark |

Commercial Use |

May 2025 |

|

Balt |

Silk Vista Baby |

FDA |

510(k) |

Feb 2025 |

|

Phenox GmbH |

pEGASUS Stent |

CE Mark |

New Device |

Mar 2025 |

|

Terumo |

SOFIA Catheter (update) |

PMDA (Japan) |

Expansion |

Oct 2024 |

Europe is the second-largest growing region due to rising technological improvements, favorable reimbursement policies, and strong R&D investment in neurovascular treatment. Germany is a frontrunner in the intracranial aneurysm market owing to high procedural volume, government-initiated health insurance, and the presence of leading medical device companies. There is also a substantial contribution from France and the UK, where demand can now be attributed to an increase in elective endovascular procedures and exposure to neurointervention trainees. Germany is a significant player in the European market with highly developed neurovascular centers and access to DSA and hybrid ORs. There were more than 40,000 intracranial aneurysm procedures in Germany in 2024, and demand is high for flow diverters and embolization devices. Furthermore, the growing uptake of robotic-assisted devices and EU CE-mark clearances is driving market penetration in Western and Eastern Europe.

The Asia Pacific is the fastest-growing region of the intracranial aneurysm market analysis due to the increasing healthcare investments, growing medical infrastructure, and awareness regarding neurological disorders.

High procedural volume in Japan is attributed to a high prevalence of intracranial aneurysms and early adoption of advanced neurovascular devices. In 2024, more than 50,000 intracranial interventions are performed in Japan, with a preference for flow diverters and microcatheter-based coiling. China is in a period of rapid development, receiving large investments from the government and private sectors for neurosurgery centers and possessing a vast patient population. The market is being expanded by the Chinese government’s drive for the provision of universal access to healthcare and domestic manufacture of embolic devices. India is also developing as a hotspot for growth, thanks to improved availability of neuro-specialty hospitals and growing patient knowledge. The regulatory infrastructure in the region has been improving, and CRO firms and companies like MicroPort and Terumo have been conducting clinical trials, which is also encouraging this growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading intracranial aneurysm treatment companies in the market include Medtronic, Stryker, MicroPort Scientific Corporation, Johnson & Johnson Services, Inc., MicroVention Inc., B. Braun SE, Integra LifeSciences, RAUMEDIC AG, Terumo Corporation, Delta Surgical, Penumbra, Inc., Balt, Wallaby Medical, Shape Memory Medical Inc., Zylox-Tonbridge Medical Technology Co., Ltd., Spartan Micro, Inc., Mizuho Medical Co., Ltd., Lepu Medical Technology Co., Ltd., Phenox GmbH, and Peter LAZIC GmbH.

Recent Developments:

-

In May 2025, Stryker Corporation published a meta-analysis of nearly 500 patients showing high safety and efficacy of the Contour Neurovascular System, strengthening its clinical validation for wide-neck bifurcation aneurysms.

-

In February 2025, Balt USA received FDA 510(k) clearance for its Silk Vista Baby flow diverter, designed for small distal vessels, expanding treatment options for previously hard-to-reach aneurysms.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.63 billion |

| Market Size by 2032 | USD 3.24 billion |

| CAGR | CAGR of 9.00% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Aneurysm Therapeutic Devices [Clips, Coils, Intravascular Devices, Flow Diverters, Embolization Devices, Occlusion Catheters, Embolic Agents], Aspiration Devices [Aspiration Catheters, Clot Retrieval Devices], Access Devices [Micro Catheters, Guidewires]) • By Aneurysm Type (Saccular Aneurysm, Fusiform Aneurysm, Mycotic Aneurysm) • By Treatment Type (Surgical Clipping, Endovascular Coiling, Flow Diverters, Others [Bypass surgery, Stent-assisted coiling]) • By End-User (Hospitals, Specialty Clinics, Others [Ambulatory Surgical Centers, Academic Institutes]) |

| Regional Analysis/Coverage | North America (U.S., Canada), Europe (Germany, France, UK, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Stryker, MicroPort Scientific Corporation, Johnson & Johnson Services, Inc., MicroVention Inc., B. Braun SE, Integra LifeSciences, RAUMEDIC AG, Terumo Corporation, Delta Surgical, Penumbra, Inc., Balt, Wallaby Medical, Shape Memory Medical Inc., Zylox-Tonbridge Medical Technology Co., Ltd., Spartan Micro, Inc., Mizuho Medical Co., Ltd., Lepu Medical Technology Co., Ltd., Phenox GmbH, and Peter LAZIC GmbH. |