Soft Tissue Allograft Market Key Insights:

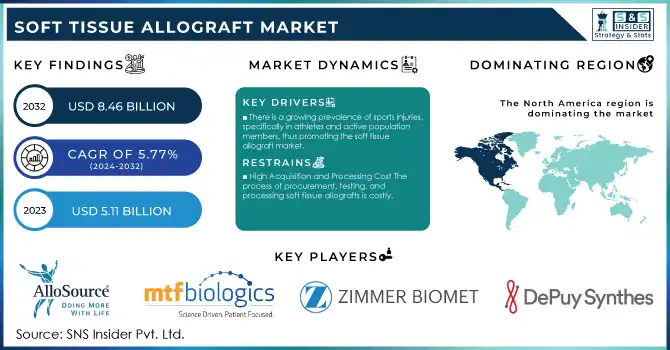

The Soft Tissue Allograft Market size was valued at USD 5.11 billion in 2023 and is expected to reach USD 8.46 billion by 2032, with a growing at CAGR of 5.77% over the forecast period of 2024-2032.

To get more information on Aviation Crew Management Systems Market - Request Free Sample Report

The soft tissue allograft market is growing significantly due to the advancement in regenerative medicine and increased demand in sports medicine and orthopedic surgeries. These allografts, derived from human tissue, are essential for repairing damaged ligaments, tendons, and cartilage in various surgical applications, offering advantages over synthetic alternatives. Key players, like MTF Biologics and AlloSource, are working towards better tissue processing techniques, enhancing graft preservation, and ensuring better outcomes for patients. Innovations such as the tendon allografts for sports injuries developed by Zimmer Biomet will illustrate the ever-increasing need for biologic solutions in sports medicine. Additionally, Smith and Nephew introduced the REGENETEN Bioinductive Implant for tendon repair as part of the company's evolution in shifting towards biologically-based healing solutions with increasing preference for natural tissue instead of synthetic materials.

In addition, the market is expanding across global regions, especially in North America, Europe, and Asia Pacific. Soft tissue allografts have become integral in providing durable and effective solutions with the rise in sports injuries and orthopedic conditions. Companies like Stryker and Medtronic are broadening their product offerings to include biologic implants aimed at improving surgical recovery. In addition, the increased regulatory standards from agencies such as the FDA and the American Association of Tissue Banks (AATB) ensure the safety and efficacy of these products, which increases market confidence. Asia Pacific, especially China and Japan, is growing rapidly in terms of market, driven by increasing investments in healthcare and advances in regenerative medicine, which positions the region as a significant player in the soft tissue allograft sector.

Drivers

-

There is a growing prevalence of sports injuries, specifically in athletes and active population members, thus promoting the soft tissue allograft market.

In 2023, there were over 30 million participants in organized sports in the United States alone, with increasing incidences of tendon, ligament, and cartilage injuries that require surgery. Soft tissue allografts are thus an effective means of rehabilitation especially in ligament reconstruction and cartilage repair, among many other applications in sports medicine.

The increasing sports injuries, especially among athletes and the active population, is highly driving the soft tissue allograft market. Sports participation is increasing globally, and hence the incidence of injuries to soft tissues like ligaments, tendons, and cartilage. Most of these injuries result from physical exertion, intense training, or high-impact activities, so they need proper treatment solutions to regain mobility and functionality.

Soft tissue allografts are increasingly being recognized as a valuable option in the repair and reconstruction of damaged tissues. These allografts, donated from healthy individuals and processed for medical use, provide a biologically compatible solution that promotes faster healing and minimizes the risk of rejection compared to synthetic alternatives. In recent years, the need for appropriate treatments for sports injuries has seen many athletes and other physically active people seek soft tissue allografts to address damage caused to the joints and tendons as a result of conditions like tears, sprains, and fractures.

-

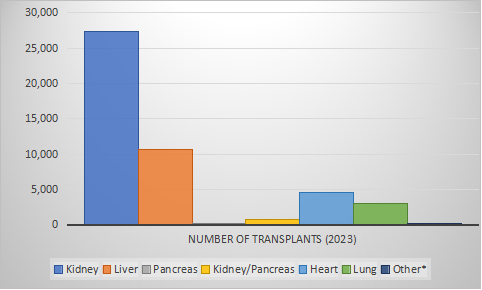

A considerable driving factor for the soft tissue allograft market is the growth in organ transplants.

An increasing rate of organ transplants, demand for high-quality biological materials is rising for the facilitation of surgical procedures and effective healing along with improved patient results. Soft tissue allografts are derived from human cadaveric tissue and utilized for a wide range of medical applications, such as reconstruction procedures involving ligament and tendon repair, which many patients suffer from after transplant procedures. Therefore, the demand for these grafts is being driven up due to the increased need for tissue reconstruction among organ transplant patients experiencing injury to the joint, muscles, or ligaments that are a result of surgery.

As organ transplants become more widespread and are made more accessible by increasing medical technology and organ donations, healthcare systems are looking forward to improving patient recovery outcomes. Soft tissue allografts provide a key solution by promoting tissue regeneration, reducing the risk of infection, and aiding in faster rehabilitation, mainly in post-transplant surgeries. This increasing integration of soft tissue allografts into transplant-related procedures is going to boost the market growth in the coming years.

The chart "Transplants Performed by Organ" illustrates the total number of transplants conducted over the span of an entire year (specifically 2023), rather than representing the data for a single day.

Others include allograft transplants like the face, hands, and abdominal wall.

Restraint

-

High Acquisition and Processing Cost The process of procurement, testing, and processing soft tissue allografts is costly.

Organ and tissue donation, processing, preservation, and regulatory compliance raise the cost of the allografts. That will limit their access as this can be a matter of challenge to low resource settings and other regions with less advanced health systems that could thus restrict the growth of the market.

Key Segmentation Analysis

By Allograft Type

The musculoskeletal allografts segment dominated the soft tissue allograft market with a 56% market share due to their extensive applications in orthopedic and sports medicine procedures. These grafts, which are derived from bone and soft tissues, play a crucial role in repairing and reconstructing ligaments, tendons, cartilage, and other musculoskeletal structures. The growing prevalence of sports injuries, osteoarthritis, and trauma cases has driven demand. For instance, AlloSource and Zimmer Biomet have revolutionized innovations such as tendon and ligament grafts, which have improved surgical outcomes. Another improvement in graft preparation processes like sterilization and testing of biomechanical integrity have improved the reliability of musculoskeletal allografts and firmly established them.

Vascular allografts are projected to exhibit the fastest growth as a result of increased prevalence rates of vascular diseases such as aneurysms, peripheral artery disease, and arterial occlusions. Unlike synthetic grafts, vascular allografts provide better biocompatibility, lowering the risk of infection and immune rejection. The aging population and the increasing global burden of diabetes and cardiovascular conditions amplify this segment's growth. Advances in tissue engineering and novel preservation techniques by companies such as CryoLife are further accelerating growth. Vascular allografts are increasingly favored in bypass surgeries and vascular reconstructions, especially in complex cases requiring high durability and minimal long-term complications.

By Application

Musculoskeletal repair and reconstruction dominated the market, with 53% of the market share in 2023 due to wide application for treating sports injuries, fractures, and degenerative joint diseases. An increasing aged population and sports and physical activity participation have enhanced the scope of orthopedic procedures. Technological progress in the areas of minimally invasive surgery and biologics will boost the recovery rate. Companies like Arthrex and Smith & Nephew are at the forefront of innovative graft solutions designed for musculoskeletal repair, which will ensure robust growth in this segment.

Vascular surgery is one of the most rapidly growing areas due to an increased need for effective solutions to complex vascular conditions. The rise in cardiovascular diseases, which are the leading cause of death worldwide, highlights the need for biological grafts that have better outcomes compared to synthetic options. Vascular allografts are of extreme value in the procedures for limb salvage as well as bypass surgeries. There is also better compatibility with less complication in comparison. It is further assisted by continuous R&D work and collaborative efforts such as CryoLife and LifeNet Health, which work towards improving vascular repair techniques.

By Donor Type

The deceased donor's segment dominated the soft tissue allograft market in 2023, due to their ability to provide many types of tissues, like musculoskeletal, cardiovascular, and integumentary allografts, which are essential for almost all surgical applications, from orthopedics to reconstructive procedures. In 2023, more than 16,000 deceased donors contributed to saving lives through organ donation. Despite the continued rise in deceased donations, the demand for organ donors remains exceptionally high. Deceased donor allografts can be processed and sterilized to high levels of safety, ensuring efficacy and reliability. Their availability and scalability make them a cornerstone of the soft tissue allograft market.

By Sterilization Method

The Gamma irradiation segment dominated the soft tissue allograft market with a 40% market share in 2023. Gamma irradiation is still the most popular method used for sterilization and occupies the largest share in this segment. This method can be used in the removal of pathogens, yet it will not destroy the structure of the tissue. Due to its reliability in producing reliable sterilization results in several types of tissues, this process is preferred. Companies such as Medtronic and MTF Biologics consider gamma irradiation to ensure graft safety and longevity, solidifying its leadership.

Electron beam irradiation is gaining momentum as the fastest-growing sterilization technique due to its efficiency in sterilizing tissues with minimal structural and biological degradation. The technique provides accurate sterilization at lower doses, which is appropriate for preserving the functional properties of sensitive grafts. Due to increased demand for high-quality, minimally altered allografts, companies are investing in this advanced sterilization technology to meet market needs, thus driving its rapid adoption.

Regional Analysis

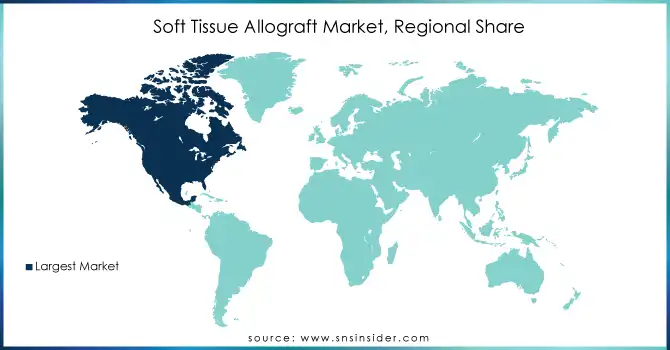

North America continues to dominate in soft tissue allograft market and also accounted for the maximum market share in 2023, primarily due to its highly advanced healthcare infrastructure, increased incidences of sports injuries, and orthopedic-related conditions, and allograft solutions are gradually accepted in surgeries. Apart from this, the region experiences generous investments in biotechnology and tissue banking as well as a favorable reimbursement policy that favors allograft-based procedures. As per recent industry reports, North America held around 42% of the market share in 2023. Among them, the United States was considered to be the largest contributor. The presence of leading market players such as MTF Biologics, AlloSource, and Zimmer Biomet further supports the market in this region. Growth in musculoskeletal procedures along with new product launches such as Smith & Nephew's REGENETEN Bioinductive Implant are enhancing the market growth trajectory in the region.

Asia Pacific is expected to be the fastest-growing region in the soft tissue allograft market, with a projected compound annual growth rate (CAGR) of more than 10% from 2024 to 2032. The growth is mainly due to increasing healthcare expenditure, awareness about advanced surgical solutions, and the prevalence of chronic conditions such as osteoarthritis and cardiovascular diseases. The major driving forces behind this expansion are countries like China and India, which have a vast patient population, advancements in medical technology, and government initiatives for healthcare infrastructure development. For example, the launch of the Precision Medicine Industrial Base project by China in 2023 signifies the region's advancement in regenerative medicine. The strategic collaborations of Japan in tissue engineering and innovations in cartilage and vascular grafting contribute to market growth. The trend is supported by a growing interest in minimally invasive surgeries and the enlarging biopharmaceutical industry in the Asia Pacific region.

Key Players

• AlloSource (AlloMatrix, FiberCel)

• MTF Biologics (MFT Tendon Allograft, ProClean)

• Zimmer Biomet (Tissue Graft, AlloMatrix)

• DePuy Synthes (Johnson & Johnson) (GRAFTJACKET Regenerative Tissue Matrix, Orthovita)

• Stryker (Allograft Bone, Malleolar Bone Graft)

• Medtronic (Infuse Bone Graft, Autograft and Allograft Solutions)

• Smith & Nephew (GraftJacket, Peri-Strips)

• Arthrex (ArthroFLEX, ALL-SPORT Graft)

• CryoLife (Synergraft, CryoValve)

• Biologix (BioBind, BioPatch)

• Orthofix (Cortical Allograft, RegenaCyl)

• Integra LifeSciences (Integra Dermal Regeneration Template, DuraGen Plus)

• Tissue Regenix (dCELL Tendon, dCELL Cartilage)

• LifeNet Health (OsteoBiologix, Lifecell)

• Bioventus (GEL-SYN, EXOGEN)

• Xtant Medical (Xpress, ProMatrix)

• Transplant Solutions (AlloTendon, AlloSkin)

• Medline Industries (Allograft Soft Tissue, Cytograft)

• Vasken (Vascular Allografts, Vascu-Graft)

• KCI Medical (VAC Therapy, TheraBond)

Key Suppliers

Key suppliers for soft tissue allograft products, based on companies that provide essential components or services related to these products.

-

AlloSource Suppliers

-

MTF Biologics Suppliers

-

Zimmer Biomet Suppliers

-

DePuy Synthes (Johnson & Johnson) Suppliers

-

Stryker Suppliers

-

Medtronic Suppliers

-

Smith & Nephew Suppliers

-

Arthrex Suppliers

-

CryoLife Suppliers

-

LifeNet Health Suppliers

Recent Developments

-

Smith+Nephew: In February 2024, Smith+Nephew, a leading global medical technology company, showcased its newly acquired CARTIHEAL AGILI-C Cartilage Repair Implant and REGENETEN Bioinductive Implant at the AAOS Annual Meeting. These products are designed to support biological healing in sports medicine, further establishing Smith+Nephew's leadership in the field

-

AlloSource: In June 2023, AlloSource enhanced its production and packaging capabilities at its Centennial, Colorado facility to meet the increasing demand for high-quality musculoskeletal allografts

-

Zimmer Biomet: In April 2023, Zimmer Biomet expanded its portfolio of allografts, introducing new tendon and ligament solutions aimed at improving surgical outcomes in various musculoskeletal applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.11 Billion |

| Market Size by 2032 | US$ 8.46 Billion |

| CAGR | CAGR of 5.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Allograft Type (Musculoskeletal Allografts, Vascular Allografts, Cardiovascular Allografts, Integumentary Allografts, Others) •By Application (Musculoskeletal Repair and Reconstruction, Vascular Surgery, Cardiothoracic Surgery, Plastic and Reconstructive Surgery, Dental Surgery, Other Medical Applications) •By Donor Type (Living Donor, Deceased Donor) • By Sterilization Method (Gamma Irradiation, Electron Beam Irradiation, Ethylene Oxide Sterilization, Steam Sterilization, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AlloSource, MTF Biologics, Zimmer Biomet, DePuy Synthes (Johnson & Johnson), Stryker, Medtronic, Smith & Nephew, Arthrex, CryoLife, Biologix, Orthofix, Integra LifeSciences, Tissue Regenix, LifeNet Health, Bioventus, Xtant Medical, Transplant Solutions, Medline Industries, Vasken, KCI Medical, and other players. |

| Key Drivers | •There is a growing prevalence of sports injuries, specifically in athletes and active population members, thus promoting the soft tissue allograft market. •An increasing shift towards biologic-based solutions in orthopedic and reconstructive surgeries propels the Soft Tissue Allograft market |

| Restraints | •The soft tissue allograft market is the stringent regulatory and ethical requirements associated with donor tissue procurement and processing. |