Transfer Membrane Market Report Scope & Overview:

To Get More Information on Transfer Membrane Market - Request Sample Report

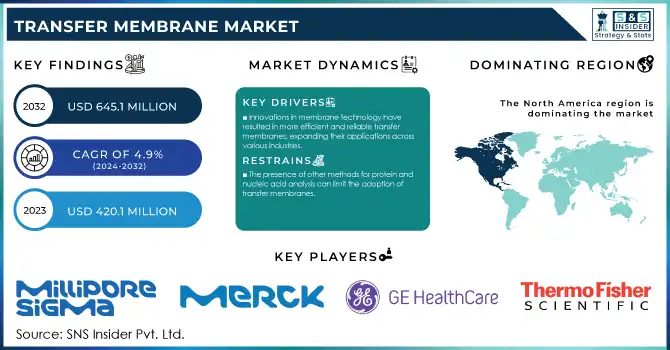

The Transfer Membrane Market size was estimated at USD 402.91 million in 2023 and is expected to reach USD 645.1 million by 2032 with a growing CAGR of 4.9% over the forecast period 2024-2032.

The transfer membrane market is mainly driven by advancements in biotechnological research and growing government support for healthcare infrastructure development. Federal support for biomedical research grew by 5.3% from 2022 levels to $47.5 billion, the latest figures from the U.S. National Institutes of Health (NIH) research. Funding has strengthened research projects that already depend on transfer membrane technologies for the analysis of proteins and nucleic acids. The same can be said about the European Union which funded €5B in life sciences research under the Horizon Europe program for 2023 with a focus on molecular diagnostics and drug discovery. Rising demand for transfer membranes in biotechnology applications, along with growing investments in life sciences research in developed and emerging economies, is driving the market growth. This expansion has been made possible by government funding. The European Union Horizon Europe program has also spent major funds on health R&D, encouraging innovation across the region.

Transfer membranes are the key tools in the field of molecular biology, playing a crucial role in the detection and analysis of proteins and nucleic acids. Usage of these tools includes Western blotting, Southern blotting, and Northern blotting, essential for disease diagnosis and genetic testing. The demand for these tools has increased due to the high prevalence of chronic and infectious diseases, which in turn is expected to drive the growth of this market. While pre-existing government funding has been supplemented by a somewhat booming private-sector investment landscape. R&D investment is being undertaken by pharmaceutical and biotechnology companies to identify new therapies and diagnostics. This trend is evident globally, with significant financial support for life science research in various nations.

Market Dynamics

Drivers

-

Pharmaceutical and biotechnology companies are boosting R&D spending, leading to higher demand for transfer membranes in protein and nucleic acid analysis.

-

The widespread occurrence of diseases such as cancer and infectious ailments necessitates advanced diagnostic and research tools, propelling the use of transfer membranes.

-

Innovations in membrane technology have resulted in more efficient and reliable transfer membranes, expanding their applications across various industries.

The rising number of chronic illnesses is one of the key factors driving transfer membrane market demand, as it is leading to the need for better diagnostic and research tools for treatment. The number of people across the globe living with chronic diseases like cancer, diabetes, and cardiovascular disorders is rapidly increasing. Cancer is one of the most common causes of death in the world with nearly 10 million people dying from cancer in 2020 in just alone, as reported by the World Health Organization (WHO). Similarly, the International Diabetes Federation found that there were an estimated 537 million adults worldwide living with diabetes in 2021, and a projected rise to 643 million by 2030.

The increase in these disorders has escalated the market demand for accurate diagnostic techniques and bolstered research for effective treatments of various diseases. Transfer Membranes are used in molecular biological techniques like Western blot for the detection of specific proteins known to be associated with several diseases. This method, for instance, is widely applied in cancer research to examine tumor markers which help in the early diagnosis of cancer as well as in evaluating the effectiveness of the treatment Western blotting is an important technique that is applied in cancer research to study tumor markers that help in the early detection of cancer and also in the assessment of the effectiveness of the treatment. Additionally, transfer membranes are widely used in diabetes research to study insulin signaling pathways by transferring proteins related to glucose metabolism for analysis. It helps researchers to understand how the mechanisms work on a molecular level, which may facilitate the discovery of new therapeutic strategies for diabetes.

Restraints

-

The presence of other methods for protein and nucleic acid analysis can limit the adoption of transfer membranes.

-

Proper utilization of transfer membranes requires specialized knowledge, and a shortage of trained personnel can hinder market growth.

-

Transfer membranes are typically made of synthetic materials that may not be biodegradable, leading to environmental concerns if not disposed properly.

Transfer membranes contribute to environmental pollution in both manufacture and disposal. These membranes are frequently made up of synthetic materials like nitrocellulose or polyvinylidene fluoride (PVDF) which are non-biodegradable. If not disposed correctly, disposed masks can stock up in landfills for years polluting the environment. Moreover, their production uses chemicals and requires energy-intensive production processes leading to high carbon cost. With stricter rules about the environment around the world, pressure is on companies to embrace sustainability. But making that switch to cleaner substitutes can hit the pocket and draw on technology too, which may hit some smaller producers hard. In addition, the requirement for a trade-off between performance and sustainability in membrane design is delaying the transition to greener alternatives. All of these factors contribute to environmental concerns, which are regarded as major constraining factors for transfer membranes series growth and adoption by various industries.

Transfer Membrane Market Segmentation Analysis

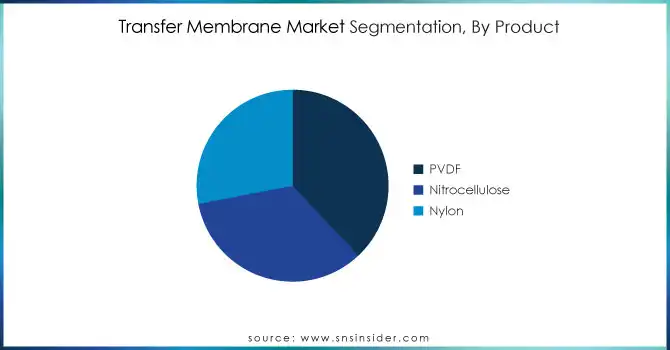

By Product

In 2023, the largest market share 38% was attributed to PVDF membranes, which reflects the increasing popularity of PVDF membranes for life sciences research and diagnostics. PVDF is preferred over nitrocellulose membranes and other alternatives due to its excellent durability, high protein retention efficacy, and resistance to harsh solvents. The National Cancer Institute (NCI) reported that the U.S. funding number of projects was up +7% higher in 2023. As a result, this surge is raising the use of utilized PVDF membranes within cancer research including for protein analysis and biomarker discovery. Moreover, China’s Ministry of Science and Technology reported a 10% increase in funding for biotechnology projects under its National Key R&D Program, further fuelling the adoption of PVDF membranes in the Asia-Pacific region. Moreover, the increased adoption of proteomics along with precision medicine in areas of molecular diagnostics is also expected to contribute to the growth of the segment as PVDF membranes are used in high-resolution applications of protein transfer.

By Application

The Western blotting application segment led the market with a 54% share of the total revenue in 2023. Western blotting is the most important analytical tool for the identification and quantification of proteins, especially in academic and clinical research. The implementation of various government initiatives like India’s Department of Biotechnology (DBT) programs which allocated $500 million under a 2023 call for protein analysis research have driven Western blotting use. Likewise, the National Research Council (NRC) of Canada also saw a 6% rise in proteomics and genomics grants in 2023 which has subsequently spurred demand for Western blot transfer membranes. The technique’s precision, reliability, and applicability in diverse fields from immunology to molecular biology underscore its market dominance.

By Transfer Method

In 2023, Dry Electro Blotting (Dry Transfer) segment dominated the market and held the highest market share of 36% because of its advantages, such as its user-friendly and convenient method of operation and fast transfer speed. Furthermore, the approach eliminates the requirement to equilibrate gels in buffer, lowering the time required to complete the transfer. Moreover, no transfer buffer preparation or pre-soaking of filter paper in deionized water is necessary. These advantages are fueling the growth of this segment.

By End Use

The biopharmaceutical and pharmaceutical companies are the largest segment of the end-user market in 2023, accounting for 61% of the total market share. The growth of this sector can be attributed to the rising need for drug development and quality control procedures in which transfer membranes play an important role. Government spending on pharmaceutical R&D has been gradually increasing over the years, as shown by the 8% increase in the biopharmaceutical R&D budget by Japan's Ministry of Health, Labour and Welfare in 2023. Concurrently, the U.K. Biobank reported an uptick in pharmaceutical collaborations, with over 15 new drug discovery projects initiated in 2023 alone. These developments highlight the critical role of transfer membranes in advancing drug pipelines and ensuring product efficacy and safety.

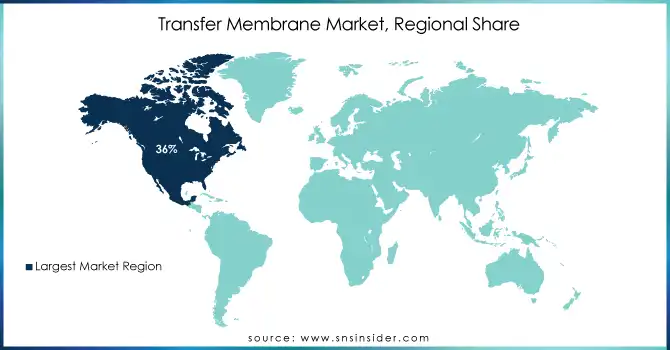

Regional Analysis

North America dominated the global transfer membrane market and accounted for 36% of revenue share in 2023. The region owes its leading position to strong healthcare infrastructure, high R&D investments, and supportive government policy. The U.S. National Institutes of Health NIH is a major player in this landscape, financing considerable portions of basic biomedical research. Furthermore, the boost in life sciences research grants offered by the Canadian government strengthens the region's focus on the development of the biotechnology and pharmaceutical industry.

The transfer membrane market is growing fastest in the Asia-Pacific region, with a significant CAGR from 2024 to 2032. This rapid growth is mainly due to China, India, and other countries devoting significant resources to pharmaceutical and biotechnology growth. Some examples include India's National Biotechnology Development Strategy which envisions India as a global hub in biotechnology and plans to invest heavily in high-end technology. In parallel, China has poured money into molecular biology study and the adoption of transfer membranes is going to be widely used in basic and industrial studies too. These regional dynamics highlight the global shift towards enhancing research capabilities and healthcare infrastructure, with North America maintaining a leading position due to its established systems and Asia-Pacific emerging as a significant player through rapid development and investment in the life sciences sector.

Do You Need any Customization Research on Transfer Membrane Market - Enquire Now

Recent Developments

-

Thermo Fisher Scientific announced the Gibco™ CTS™ OpTmizer™ One Serum-Free Medium (CTS OpTmizer One SFM) in April 2024 with an animal-origin-free formula for improved T-cell expansion for clinical and commercial cell therapies. It is a medium that enhances scalability and efficiency to support the rapid delivery of T-cell therapies.

-

In March 2023, The U.S. Food and Drug Administration (FDA) introduced a new program to prepare standard protein analysis techniques, which indirectly increases the requirement for high-quality transfer membranes.

Key Players

Key Service Providers/Manufacturers

-

GE Healthcare (Hybond™ ECL, Hybond™ N+)

-

Thermo Fisher Scientific (Pierce™ Nitrocellulose Membranes, Hybond™ PVDF Membranes)

-

MilliporeSigma (Immobilon™-P, Immobilon™-FL)

-

Bio-Rad Laboratories (Trans-Blot® Turbo, Trans-Blot® SD)

-

VWR International (Whatman™ Nitrocellulose, Whatman™ PVDF Membranes)

-

Merck KGaA (Protran™ Nitrocellulose Membranes, PVDF Membranes)

-

Cytiva (Amersham™ Hybond™ C Extra, Amersham™ Hybond™ P)

-

F. Hoffmann-La Roche (Roche Membrane Systems, Roche Diagnostics)

-

Shanghai Genechem Co. Ltd. (Genechem PVDF, Genechem Nitrocellulose)

-

Eppendorf (PerfectBlue™ PVDF, PerfectBlue™ Nitrocellulose)

Key Users:

-

Pfizer Inc.

-

Johnson & Johnson

-

Novartis International AG

-

AbbVie

-

Roche Diagnostics

-

Merck & Co., Inc.

-

GSK (GlaxoSmithKline)

-

Bayer AG

-

Amgen Inc.

-

Sanofi

| Report Attributes | Details |

| Market Size in 2023 | USD 420.1 Million |

| Market Size by 2032 | USD 645.1 Million |

| CAGR | CAGR of 4.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (PVDF, Nitrocellulose, Nylon) • By Transfer (Wet or Tank Transfer, Semi-dry Electro Blotting, Dry Electro Blotting, Others) • By Application (Western Blotting, Southern Blotting, Northern Blotting, Others) • By End User (Biopharmaceutical & Pharmaceutical Companies, Academic & Research Institutes, Diagnostic Labs |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | GE Healthcare, Thermo Fisher Scientific, MilliporeSigma, Bio-Rad Laboratories, VWR International, Merck KGaA, Cytiva, F. Hoffmann-La Roche, Shanghai Genechem Co. Ltd., Eppendorf |

| Key Drivers | • Pharmaceutical and biotechnology companies are boosting R&D spending, leading to higher demand for transfer membranes in protein and nucleic acid analysis. • The widespread occurrence of diseases such as cancer and infectious ailments necessitates advanced diagnostic and research tools, propelling the use of transfer membranes. |

| Market Challenges | • The presence of other methods for protein and nucleic acid analysis can limit the adoption of transfer membranes. • Proper utilization of transfer membranes requires specialized knowledge, and a shortage of trained personnel can hinder market growth. |