IoT in Warehouse Management Market Size & Overview:

To Get More Information on IoT in Warehouse Management Market - Request Sample Report

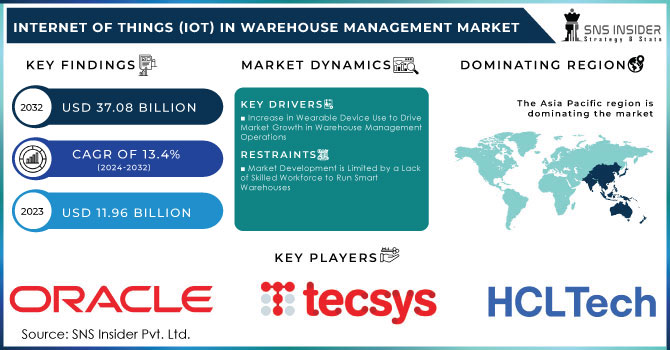

Internet of Things (IoT) in warehouse management Market size was valued at USD 11.96 Billion in 2023 and is expected to grow to USD 37.08 Billion by 2032 and grow at a CAGR of 13.4 % over the forecast period of 2024-2032.

The expansion of the Internet of Things in warehouse management is increasing due to the demand for operational efficiency and inventory accuracy. As reported by the U.S. Department of Commerce, companies utilizing IoT devices have reported a productivity gain of 30%. Additionally, as of 2023, 70% of warehouses so far had adopted IoT devices or the internet of things is relatively high, indicating a significant transition towards digital technology. Based on the report by the government, IoT devices yield a reduction in inventory errors of 50%, which means a significant cost reduction in manually managing items. The present and future booming of e-commerce, in which the National Retail Federation estimates US$1 trillion worth of cargo through sale by 2024, has called for efficient warehouse management systems. In addition, warehouses have great compliance with the environmental and safety requirements from the government. There is an investment in infrastructure by governments around the world in an expansion of internet things. IoT is facilitating logistics and supply-related tasks in assisting warehouses, thus allowing companies to adopt them.

IoT uses IoT sensors for tracking motions and temperature, RFID tags that float on traceable items, automated vehicles for lifting, and pallets to streamline work in the warehouse. The government is forecasting an Internet of Things in warehouse management of US$21 billion worth of agencies spent between 2020 and 2028. Furthermore, the IoT in warehouses is being promoted by initiatives such as the U.S. government’s “Smart Manufacturing” whose aim is to expand modern manufacturing methods. The government offers vast infrastructure and industry stats support, thus creating a greater presence in the IoT in warehouse management industry. It exchanges data in real-time to track, monitor, and maintain a variety of warehouse management operations, greatly enhancing the effectiveness of the warehouse. It has been noted in recent years that IoT has significantly helped the manufacturing sector in comparison to other industry verticals to automate sizable warehouse operations. In order to enhance warehouse management procedures, it has significantly increased IoT investment in the industrial sector. The accuracy of warehouse management activities may be substantially enhanced by IoT penetration, which can also help with space optimization and improved product distribution.

IoT in warehouse management Market Dynamics

Drivers

-

Increase in Wearable Device Use to Drive Market Growth in Warehouse Management Operations

-

The growing number of machine-to-machine applications utilized across various industries, including video surveillance, transportation, smart meters, asset tracking, and health monitoring, is a significant factor projected to drive market expansion.

Wearable technology provides accurate real-time information on a variety of assets as well as prompt notifications to increase process efficiency and get rid of non-compliance. IoT integration in warehouses can also increase the efficiency of human operators and increase the accuracy of inventory tracking. The increasing productivity of warehouses caused by wearable technology greatly improves process transparency.

Numerous wearable gadgets, such as voice control headsets, smart safety helmets, smart safety glasses, smart gloves, and smart glasses, make it easier for operators to communicate with tech support and automate the packing and scanning processes by ensuring worker safety. Every component of the supply chain network has been impacted by Industry 4.0's penetration of digital technology, which has greatly increased the value of the company. These elements will support the expansion of the IoT in the warehouse management market.

Restrains

-

Market Development is Limited by a Lack of Skilled Workforce to Run Smart Warehouses

Warehouse operators can communicate across the network thanks to the deployment of IoT-connected hardware and software. However, among warehouse managers, these cutting-edge technologies have also sparked worries about cybersecurity and privacy. Additionally, a lack of experienced workers can significantly slow down logistical operations, which in turn has a detrimental effect on an organization's profit margins.

The efficiency of warehouses across many industries can be hampered by a lack of internal capabilities, which can impede the digital transformation of conventional warehouses, according to an Inmarsat Study. A lack of data science and connection expertise might limit an organization's ability to expand when developing, deploying, and managing IoT initiatives in the manufacturing and logistics sectors. These elements might have a negative effect on market growth.

Opportunities

-

Consistently increasing automation in industries that create opportunities in the future.

-

Convert the traditional warehouse into a smart warehouse by adopting IoT in warehouse management.

Challenges

-

Initial investment is high for the installation of IoT in warehouse management.

Internet of Things in warehouse management Market Segment analysis

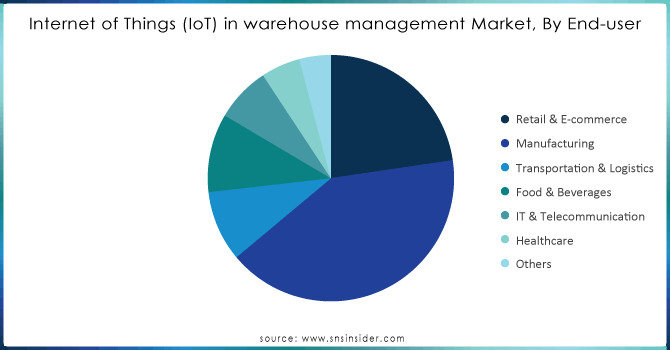

By End-user

In the IoT in warehouse management market, the manufacturing segment held the largest market share, owing to its significant dependency on efficient inventory management systems. Manufacturing accounted for almost 25% of the total market share by 2023, and it is considered the most influential segment for the adoption of IoT technologies. The growth of this sector is related to the expanding use of automation and data analytics solutions by manufacturers to optimize their supply chain operations. Based on government data, the incorporation of IoT technologies by manufacturers has led to a 25% increase in operational efficiency as affected best manufacturers reduce their inventory holding costs by around 20%. In addition, with the rapid development of Industry 4.0, the employment of IoT solutions has become a trend so that manufacturers have realized their numerous advantages in promoting production organization, inventory accuracy, and supply chain visibility. Furthermore, the use of IoT devices allows manufacturers to monitor their equipment’s performance in real-time and predict failures in time to prevent downtime. As companies continue to reflect on cost-saving measures and ensure operational efficiency, the market leadership of the manufacturing segment regarding the inclusion of IoT in warehouse management systems may be expected to advance further in the coming years.

Do You Need any Customization Research on IoT in Warehouse Management Market - Enquire Now

By Application

In 2023, the inventory optimization segment held the highest market share of the market. This dominance is driven by the increasing need for businesses to maintain optimal stock levels and reduce excess inventory, ultimately leading to enhanced cash flow and profitability. According to government statistics, firms that have implemented an IoT-based inventory optimization strategy have seen their carrying costs reduced by an average of 15% to 20% per year. Furthermore, as people get used to having instant access to goods ordered on e-commerce websites, they are not likely to patiently wait for their items to arrive, which means that companies have to focus on their inventory management more. IoT can help them achieve a real-time inventory status, so they know at any point what products are moving or not moving and can adjust their offer accordingly to avoid neither stock nor stock outs. As an increasing number of companies realize the benefits that IoT can bring to a warehouse, especially to accuracy and efficiency of delivery, the inventory optimization segment is expected to continue to hold the maximum market share.

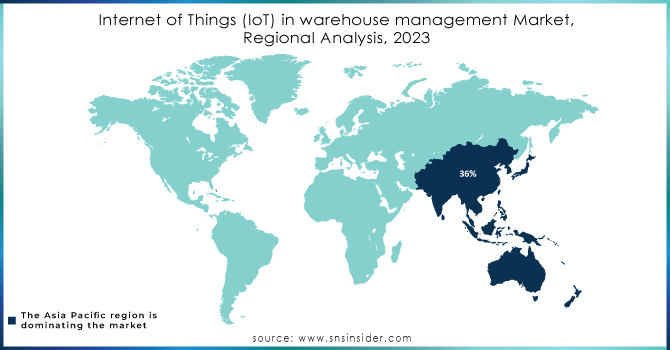

Regional Insights

In 2023, the Asia Pacific held the highest market share of about 36% in the Internet of Things in warehouse management market. This was attributed to several factors, including rapid industrialization and the surge in e-commerce activities in some of the major economies, such as China, India, and Japan. The Ministry of Industry and Information Technology of China reported that the uptake of IoT technologies for logistics and warehousing had rapidly expanded, with more than 65% of warehouses in major cities integrating IoT solutions. China’s “Made in China 2025” plan reinforced the implementation of cutting-edge technologies, including IoT, in the manufacturing and logistics sectors. Similarly, with the Digital India campaign encouraging IoT adoption in the logistics sector, the Ministry of Electronics and Information Technology predicted a 20% CAGR growth in the integration of IoT by 2025. Aside from the supportive government policies, Asia Pacific retained the leading position in the market due to the cost variations and the rising demand for efficient supply chain systems.

North America region held a significant share of the market the region managed to retain the second position in the international market share. The surge in demand was characterized by the well-developed technological infrastructure, higher internet access rates, and the significant investment in the IoT solution by major players. With the U.S. government focusing on fostering IoT technology deployment through the “IoT Initiative,” cutting across various disciplines, increased savings are expected. According to the U.S. Department of Transportation, such deployment would save the economy $600 billion every year. In addition, while North American investment in IoT technology in logistics and warehousing continues to rise, the growth in digital transactions.

Key Players

-

Amazon Web Services (AWS) (AWS IoT Core, AWS IoT Greengrass)

-

Microsoft Corporation (Azure IoT Hub, Azure Digital Twins)

-

IBM Corporation (IBM Maximo, IBM Watson IoT Platform)

-

Siemens AG (Siemens MindSphere, SIMATIC RTLS)

-

Cisco Systems, Inc. (Cisco Kinetic, Cisco Industrial IoT)

-

Honeywell International Inc. (Honeywell Movilizer, Honeywell Vocollect Voice)

-

Zebra Technologies (Zebra MotionWorks, Zebra SmartLens)

-

Oracle Corporation (Oracle IoT Cloud, Oracle Warehouse Management Cloud)

-

PTC Inc. (ThingWorx, Vuforia)

-

SAP SE (SAP IoT, SAP Extended Warehouse Management)

-

Intel Corporation (Intel Connected Logistics, Intel IoT Platform)

-

Rockwell Automation, Inc. (FactoryTalk InnovationSuite, IoT Gateway)

-

Bosch Rexroth AG (Bosch IoT Suite, Nexeed)

-

Schneider Electric SE (EcoStruxure IoT, WMS Edge Control)

-

Logility, Inc. (Voyager Inventory Optimization, Logility Digital Supply Chain)

-

Oracle Netsuite (NetSuite Warehouse Management, NetSuite IoT for Inventory)

-

SAP SE (SAP IoT Services, SAP Warehouse Insights)

-

GE Digital (Predix IoT, Asset Performance Management)

-

JDA Software Group, Inc. (JDA Warehouse Management, JDA IoT)

-

TECSYS Inc. (TECSYS WMS, TECSYS Elite) and others.

Latest News and Developments

-

In September 2024, Amazon declared a $1-billion investment in IoT-related warehouse facilities with a focus on advanced robotics and automation used in transportation and inventory location. This initiative will be directed at the optimization of order processing time and overall reduction of costs related to warehouse and inventory management along the supply chain.

-

In August 2024, Walmart introduced an IoT initiative related to the optimization of inventory management. IoT sensors will be integrated to optimize the stock level and avoid limited supply chains in warehouses, which complements the current demands of the government and administration to modernize all retail chains.

-

In July 2024, the U.S. government provided $0.5 billion of grants to supply smart warehousing for the business industry along various supply chains. Such grants drive IoT implementation through the warehousing sector reduce costs and enhance efficiency for businesses in different sectors across the nation.

-

August 2022: Sensolus has formed a strategic partnership with Deutsche Telekom AG to introduce an innovative asset-tracking solution for the management of non-powered assets. This collaboration has the potential to significantly enhance Sensolus' IoT-based solution portfolio, enabling it to offer cutting-edge services to organizations throughout Germany.

| Report Attributes | Details |

| Market Size in 2023 | US$ 11.96 Billion |

| Market Size by 2032 | US$ 37.08 Billion |

| CAGR | CAGR of 13.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application(Asset Tracking, Inventory Optimization, Warehouse Automation, Workforce Management, Predictive Maintenance, Others) • By Device(Sensing devices, Gateways) • By Enterprise Type(Small & Medium Enterprises, Large Enterprises) • By End-user(Retail & E-commerce, Manufacturing, Transportation & Logistics, Food & Beverages, IT & Telecommunication, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Amazon Web Services (AWS), Microsoft Corporation, IBM Corporation, Siemens AG, Cisco Systems, Inc., Honeywell International Inc., Zebra Technologies, Oracle Corporation, PTC Inc., SAP SE, Intel Corporation, Rockwell Automation, Inc., Schneider Electric SE |

| Key Drivers | • Increase in Wearable Device Use to Drive Market Growth in Warehouse Management Operations • The growing number of machine-to-machine applications utilized across various industries, including video surveillance, transportation, smart meters, asset tracking, and health monitoring, is a significant factor projected to drive market expansion. |

| Market Restraints | • Market Development is Limited by a Lack of Skilled Workforce to Run Smart Warehouses |