Enterprise Data Management Market Report Scope & Overview:

Get more information on Enterprise Data Management Market - Request Sample Report

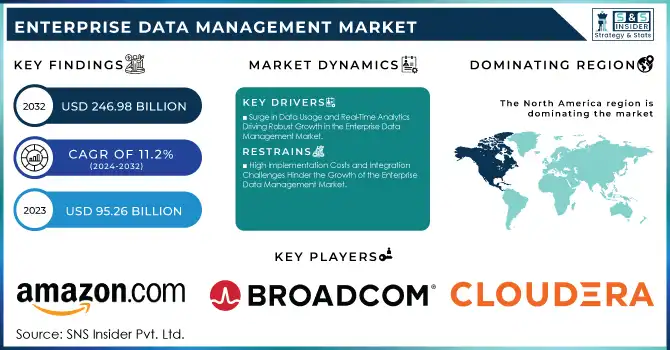

The Enterprise Data Management Market Size was valued at USD 95.26 Billion in 2023 and is expected to reach USD 246.98 Billion by 2032 and grow at a CAGR of 11.2% over the forecast period 2024-2032.

The Enterprise Data Management (EDM) market is growing rapidly due to the rising significance of data as an integral strategic asset for organizations across industries. EDM is the set of practices, technologies, and tools that allow organizations to effectively manage, govern, and utilize their data assets. The market is characterized by a surge in demand for comprehensive solutions that ensure data quality, compliance, and accessibility, while at the same time supporting advanced analytics and decision processes.

The adoption of cloud data platforms has increased dramatically. In 2023, 80% of enterprises rely on cloud-based systems to manage scalability and efficiency, and this is becoming momentum since organizations strive to realize seamless access to data and advanced insights. It also facilitates the implementation of data-driven strategies through which companies optimize their operations and minimize associated costs. There are promising potential gains for reducing operational costs by up to 30%, as experienced by enterprises using automation of data quality and governance processes. Another development is self-service analytics, with 60% of enterprises granting broader access to analytics tools for employees, thus improving decision-making efficiency across departments. These developments underscore the critical role EDM plays in enabling organizations to remain competitive and compliant within a data-driven economy.

Enterprise Data Management Market Dynamics

KEY DRIVERS:

-

Surge in Data Usage and Real-Time Analytics Driving Robust Growth in the Enterprise Data Management Market

The explosion of data spread across industries via digital transformation and the proliferation of IoT is a significant growth driver for the EDM market. Structured and unstructured data generation and collection are carried out by organizations in huge volumes every day. Thus, organizations need robust tools to store, manage, and analyze this information effectively. Also, real-time analytics. According to recent reports, 80% of companies that implemented real-time data analytics have seen increased revenue. Secondly, the speed at which real-time analytics is evolving is becoming critical for several industries such as financial services, healthcare, and retail, where relevant timely decision-making impacts their operations and profitability.

Moreover, the data for innovation relies on its increasing use-in fact, it is shown that 98% of business leaders are monetizing data, pointing out how important data management is toward business success. Data-driven leaders stated that their data monetization strategy has an annual growth rate of 40.5% while beginners have a growth of 20%. As this takes place, firms are focusing on developing data innovation for competitiveness, and within their technology budgets, 53% more is being allocated to data-intensive tools such as AI/ML and cloud analytics. This will create an upward swell for the EDM market, as businesses embrace the enormous opportunity afforded by real-time data analysis.

-

Rising Data Privacy Regulations and Cybersecurity Threats Drive the Adoption of Enterprise Data Management Solutions

Data privacy regulations like GDPR, CCPA, and HIPAA have increased the need for robust data governance and management systems as organizations face hefty fines and reputational damage for non-compliance. With the rise in cyberattacks and data breaches, companies are prioritizing data security more than ever before. EDM platforms help organizations maintain data integrity, implement access controls, and monitor usage patterns to prevent breaches and comply with regulatory requirements. These systems not only help enterprises meet legal obligations but also build trust with customers and stakeholders by demonstrating a commitment to data protection.

The financial impact of non-compliance is a key driver for the adoption of EDM solutions. For example, under GDPR, companies may face fines of up to USD 21.09 million or 4% of their global annual turnover for breaches of compliance. Similarly, the Gramm-Leach-Bliley Act (GLBA) mandates stringent data protection measures for financial institutions, with breaches resulting in average costs of USD 4.35 million globally. This has motivated companies to invest in EDM technologies that enhance security measures and ensure adherence to regulations, driving market growth. As data privacy and security continue to be major concerns for organizations across industries, the demand for EDM solutions in sectors such as finance, healthcare, and retail is set to expand further.

RESTRAIN:

-

High Implementation Costs and Integration Challenges Hinder the Growth of the Enterprise Data Management Market

High costs and complexity associated with EDM implementations continue to be a significant restraint to the growth of the market. Setting up an EDM system involves high investments in software, hardware, and skilled personnel, thus rendering the whole process impossible for SMEs. Challenges also include integration problems arising from the connection of EDM solutions with legacy systems or other disparate data sources within organizations. These challenges not only postpone implementation but also lead to uneven data management practices if not handled effectively. Business operations have to resort largely to outside consultants and experts in technical matters, with all the consequent added expense.

One of the key inhibitors to market growth is the high implementation and integration costs related to Enterprise Data Management solutions. According to research insights, most organizations often high infrastructure costs in trying to deploy new data solutions, especially where introducing new technologies requires integration with already existing systems. A research study pointed out that the deployment of next-generation IT infrastructure would allow companies to save up to 30% in data spending and speed up the time-to-market for their data products by 40%, but many companies are still not willing to commit large sums at the start and bear high implementation costs. Moreover, most organizations face a significant issue of integrating EDM solutions with existing legacy systems or disparate data sources. Most firms feel "locked into" a relationship with existing, expensive vendors due to the inability to justify switching to newer, more efficient tools when the maintenance of their current systems would be so expensive. These integration hurdles and the cost of maintaining legacy systems are cited to be among the biggest barriers to the effective implementation of EDM, in the first place, for smaller enterprises with limited budgets.

Enterprise Data Management Market Segment Analysis

BY DEPLOYMENT TYPE

In 2023, The Cloud-Based segment of the Enterprise Data Management market accounted for the largest share of 51%, This would be on the grounds of customers seeking cloud alternatives because of their scalability, cost, and accessibility. Companies are now adopting cloud platforms instead of on-premises systems due to large volumes of data to operate on with real-time analytics. Companies such as Microsoft, Amazon Web Services, AWS, and Google Cloud have taken the lead in innovation development in this field. For instance, in 2023, AWS released an upgraded feature of Data Exchange, advancing the movement of shared information across organizations.

The On-Premises segment of the EDM market is the fastest-growing one in the forecast period with an 11.8% CAGR. The reason is most banks, healthcare organizations, and government organizations aggressively implemented EDM solutions that can be designed as highly secure, customized, and controlled data sources to satisfy stringent privacy and compliance regulations. On-premises also helps in reducing latency, giving better control over sensitive information, and providing integration with legacy systems. The major players in this market are IBM, Oracle, and SAP, which shape the business's advancement. Data management globally stood at USD 73.1 billion in 2021 and is expected to touch USD 150.6 billion by 2027, with on-premises solutions playing an important role in meeting regulatory and performance demands through robust and tailored infrastructures.

BY ENTERPRISE SIZE

The Large Enterprises segment dominated the Enterprise Data Management (EDM) market in 2023, capturing 55% of the total revenue share. This dominance underlines the great investments large organizations make in data management to ensure operational efficiency, data security, and real-time decision-making. Organizations of above 500 employees have been the top users of advanced data solutions as they handle large-scale operations, complex data ecosystems, and a host of departmental integrations. The need for integrated products such as those provided by Oracle, SAP, and Microsoft is driven mainly by the push for automation, AI capabilities, and real-time analytics.

The Small & Medium Enterprises (SMEs) segment in the Enterprise Data Management (EDM) market is growing rapidly, projected to expand CAGR during the forecast period. The reason for this rapid growth is the implementation of cloud-based data management solutions in emerging economies, such as China and India. Here, SMEs are digitizing at a very fast pace to streamline and reduce their operating costs through a more effective decision-making capability. SMEs are also favoring cloud technology with its capability to scale, save costs, and flexibility. These solutions will optimize SME data management without excessive investment in traditional on-premises systems.

Enterprise Data Management Market Regional Overview

In 2023, North America led the Enterprise Data Management (EDM) market, capturing over 33% of the global market share. This dominance is fueled by extensive adoption of technologies such as cloud computing, AI, and big data analytics, particularly in the U.S. and Canada. Enterprises in the U.S. typically spend an average of USD 1.3 billion annually on data management, reflecting a focus on analytics-driven competitive advantages. The main sectors are finance, which has installed EDMs in 60% of the institutions due to compliance requirements, and healthcare, where nearly 45% reported annual growth in data management investment as mandated by HIPAA requirements and for real-time patient data. Oracle, IBM, and AWS are among those that lead innovation and scalability in the region.

The Asia Pacific region emerged as the fastest-growing in the Enterprise Data Management (EDM) market in 2023, driven by the surge in digital transformation and data-driven strategies across industries. The region is projected to achieve a CAGR of 12.81% from 2024 to 2032. The main reasons for this growth comprise the rapid adoption of cloud computing, big data analytics, and enterprise resource planning solutions in countries like China, India, and South Korea. For example, the Asia Pacific enterprise software market that supports EDM solutions generated a revenue of approximately USD 51.84 billion in 2023 with enormous contributions from ERP and CRM software.

Need any ucstomization research/data on Enterprise Data Management Market - Enquiry Now

Key Players in Enterprise Data Management Market

Some of the major players in the Enterprise Data Management Market are:

-

Amazon.com, Inc. (Amazon Redshift, Amazon S3)

-

Broadcom (CA Database Management Solutions for DB2, DX AIOps)

-

Cloudera, Inc. (Cloudera Data Platform, Cloudera Data Engineering)

-

Informatica Inc. (Informatica PowerCenter, Informatica Intelligent Data Management Cloud)

-

International Business Machines Corporation (IBM) (IBM InfoSphere Information Server, IBM Cloud Pak for Data)

-

LTIMindtree Limited (LTIMindtree Mosaic Data Platform, LTIMindtree Data Analytics Solutions)

-

Open Text (OpenText Magellan, OpenText Analytics Suite)

-

Oracle Corporation (Oracle Autonomous Database, Oracle Data Integration Platform)

-

SAP SE (SAP HANA, SAP Data Intelligence)

-

Teradata Corporation (Teradata Vantage, Teradata IntelliCloud)

-

Commvault (Commvault Complete Data Protection, Commvault Data Governance)

-

Talend (Talend Data Fabric, Talend Data Integration)

-

Microsoft Corporation (Azure Synapse Analytics, Azure Data Factory)

-

Google LLC (Google BigQuery, Google Cloud Dataflow)

-

Snowflake Inc. (Snowflake Data Cloud, Snowflake Data Marketplace)

-

Alteryx, Inc. (Alteryx Designer, Alteryx Intelligence Suite)

-

Qlik Technologies Inc. (Qlik Sense, Qlik Data Integration)

-

Domo, Inc. (Domo BI Platform, Domo Appstore)

-

Tableau Software (a Salesforce company) (Tableau Desktop, Tableau Prep Builder)

-

SAS Institute Inc. (SAS Data Management, SAS Viya)

RECENT TRENDS

-

In May 2024, SAP and AWS announced an expansion of their alliance to embed generative AI into SAP's enterprise solutions. This includes integrating the AI models from Amazon Bedrock in SAP AI Core, thus enabling enterprises to modernize processes with secure and efficient AI applications. SAP further enhanced performance and energy efficiency by adopting AWS Graviton chips.

-

In November 2024, at VMware Explore 2024, Broadcom discussed the innovations made in VMware solutions focused on enabling seamless multi-cloud operations. These developments will further enhance the enterprise's ability to manage data by offering more flexibility and more scalability in the cloud.

-

In September 2024, Cloudera launched a new suite of Accelerated Machine Learning Projects (AMPs), offering enterprises ready-to-use machine learning tools for data management and analytics. This initiative aims to simplify the deployment of advanced data solutions, addressing scalability and efficiency needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 95.26 Billion |

| Market Size by 2032 | US$ 246.28 Billion |

| CAGR | CAGR of 11.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Type (Cloud, On-premise) • By Component Type (Software, Service) • By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises) • By Function Type (Data Warehouse, Data Governance, Data Integration, Data Security, Master Data Management, Others) • By Industry Type (BFSI, Retail, Healthcare, IT & Telecom, Manufacturing, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon.com, Inc. (Amazon Web Services, Inc.), Broadcom, Cloudera, Inc., Informatica Inc., International Business Machines Corporation, LTIMindtree Limited, Open Text, Oracle, SAP SE, Teradata, Commvault, Talend, Microsoft Corporation (Azure Data Services), Google LLC (Google Cloud Platform), Snowflake Inc., Alteryx, Inc., Qlik Technologies Inc., Domo, Inc., Tableau Software (a Salesforce company), SAS Institute Inc. |

| Key Drivers | • Surge in Data Usage and Real-Time Analytics Driving Robust Growth in the Enterprise Data Management Market • Rising Data Privacy Regulations and Cybersecurity Threats Drive the Adoption of Enterprise Data Management Solutions |

| Restraints | • High Implementation Costs and Integration Challenges Hinder the Growth of the Enterprise Data Management Market |