IoT Medical Devices Market Report Scope & Overview:

Get more information on IoT Medical Devices Market - Request Sample Report

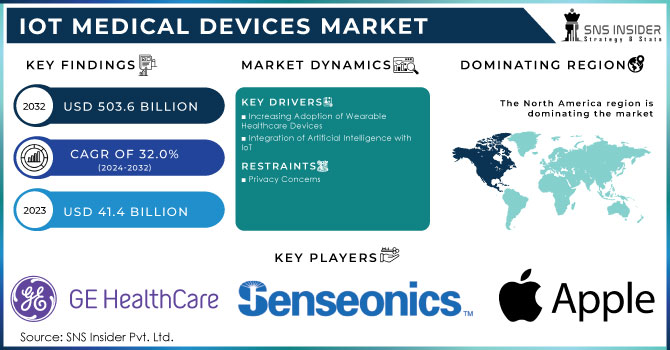

The IoT Medical Devices Market Size was valued at USD 41.4 billion in 2023 and is expected to reach USD 503.6 billion by 2032 and grow at a CAGR of 32.0% over the forecast period 2024-2032.

Global IoT in Healthcare Market: Accelerated Growth with Advancements in Remote Patient Monitoring

Rising Adoption of Smartphones, Smart Devices, and Wearables Boosting Market Demand

The global IoT in the healthcare market is witnessing substantial growth, fueled by the increasing adoption of smartphones, smart devices, and wearables for enhanced patient monitoring. The surge in demand for remote patient care, accelerated by the COVID-19 pandemic, has significantly boosted the need for IoT-enabled solutions. Wearable sensors, connected medical devices such as smart inhalers and blood pressure monitors, and other remote monitoring technologies have empowered healthcare providers to track patients’ health data in real time. These technological advancements have facilitated early detection of health issues, improved disease management, and contributed to reduced hospital readmissions.

The COVID-19 pandemic has further catalyzed the adoption of IoT technologies, with governments implementing digital health initiatives. For instance, in February 2022, the Government of India launched projects aimed at improving digital healthcare services, including telemedicine, digital health registries, and healthcare identities. Additionally, rising investments in digital technologies and the emergence of connected care models are driving market growth. The increased prevalence of chronic conditions, an aging population, and technological advancements are also contributing to market expansion. The affordability and rising adoption of smartphones play a crucial role in fueling the demand for IoT in healthcare. According to The Mobile Economy 2022, smartphone penetration reached 67% of the global population in 2021 and is projected to increase to 70% by 2025. Emerging economies like India, China, and parts of Africa and Latin America are contributing significantly to this growth due to rising mobile subscriptions. Moreover, advancements in network infrastructure and expanding coverage are creating new opportunities for IoT applications in healthcare. Favorable government regulations are also supporting market growth. For example, in the U.S., the FDA’s Digital Health Innovation Action Plan is driving the implementation of IoT technologies while addressing governance issues. The introduction of solutions like Palo Alto Networks’ Zero Trust Security for medical IoT in 2022 highlights the importance of data security as connected devices become integral to healthcare systems.

Market Dynamics

Drivers

-

Increasing Adoption of Wearable Healthcare Devices

Advancements in AI and sensor technology are enabling individuals to monitor and manage chronic health conditions using compact wearable devices. In 2022, global shipments of wearable devices reached an estimated USD 190.4 million. Over USD 250 million units of smartwatches and fitness trackers were shipped globally in 2023, alongside wearable medical sensors and devices accounting for USD 130 million. The portability and compactness of these devices have driven widespread adoption, allowing users to track vital signs such as heart rate, physical activity, and sleep patterns, promoting healthier lifestyles. However, barriers such as occasional inaccuracies, slow adoption of new technologies, a shortage of skilled professionals, and inconsistent user engagement remain. Addressing these challenges is expected to further drive wearable healthcare device adoption in the coming years.

-

Integration of Artificial Intelligence with IoT

The integration of artificial intelligence (AI) with IoT technology is transforming healthcare by enhancing operational efficiency, diagnostics, and automation. AI is used to develop patient-centric IoT devices capable of real-time diagnosis and predictive capabilities. For example, AI can enhance scan quality, aiding healthcare professionals in diagnosing complex conditions such as cancer. AI technologies, including deep learning, natural language processing, and machine learning, analyze patient data to improve detection, treatment, and patient experience. During the 2020 lockdown, many hospitals integrated AI with IoT in telemedicine applications, including telediagnosis, healthcare IT, and patient monitoring, significantly improving tracking and treatment. This integration is expected to drive continued growth in the IoT healthcare market.

Restraints

-

Privacy Concerns

The IoT healthcare market faces challenges related to data privacy, security, and algorithmic complexity. The healthcare sector is vulnerable to data breaches due to the vast amount of personal and medical information it stores. IoT in healthcare relies on machine learning, deep learning tools, and connected devices to optimize insights from this data. These tools handle sensitive information such as patient medical histories, diagnosis details, insurance data, and payment transactions. Security risks associated with IoT in healthcare have led to data breaches impacting millions of U.S. patients. As cyberattacks targeting healthcare data continue to rise, these concerns are expected to limit the demand for IoT technologies in the sector.

Key Segmentation

By Component

In 2023, the medical devices segment held the largest share at 37.5%, due to the widespread adoption of these devices as efficient and cost-effective solutions in healthcare services. Medical devices equipped with IoT sensors provide continuous, real-time health data, including glucose levels, heart rate, and blood pressure monitoring. The increasing demand for self-monitoring devices, such as wearables, is expected to further drive the demand for connected medical devices. For example, in January 2022, Abbott launched biowearables designed to monitor critical nutritional health indicators. The systems and software segment is projected to experience the fastest CAGR, driven by technological advancements and increased investments from industry players developing new connected solutions for the life sciences industry. In September 2021, McKesson launched a rapid return solution for health systems, helping hospitals maximize credits for returned pharmaceuticals and streamline return processes.

By Technology

In 2023, the cellular segment held the largest share 34% in the connectivity technology market. Cellular technology facilitates the transmission of large amounts of data over long distances and is widely used for remote patient monitoring. This makes it a fast, secure, and efficient solution for remote monitoring. The LPWANs (Low Power Wide Area Networks) segment is expected to grow rapidly due to its low power consumption and long-range communication capabilities, making it ideal for wireless monitoring and emerging healthcare applications.

By Application

In 2023, telemedicine dominated the market with a 54.3% share, driven by the rising prevalence of chronic diseases and the growing demand for patient monitoring. Advancements in telemedicine technology and new service launches are accelerating the adoption of IoT solutions in healthcare. For instance, in May 2021, Lytus Technologies introduced its telemedicine services in India in collaboration with local health centers. Key players in the healthcare IoT space are also focusing on developing innovative telemedicine solutions. Walmart Inc., for example, acquired MeMD in May 2021 to offer virtual access to urgent, behavioral, and primary care services across the U.S. The telemedicine segment is expected to witness the fastest growth due to rising consumer demand, patient acceptance, and improved care quality.

By End-use

In 2023, hospitals and clinics accounted for the largest revenue share 43.2%, driven by the enhanced operational efficiency IoT provides. IoT solutions assist in managing real-time communication, medical records, billing, and hospital workflows, leading to improved treatment outcomes and patient experiences. The Clinical Research Organizations (CROs) segment is expected to grow at the fastest CAGR due to the increasing use of IoT solutions to enhance clinical research accuracy. CROs have implemented IoT technologies to address patient recruitment and retention challenges, contributing to the segment's growth.

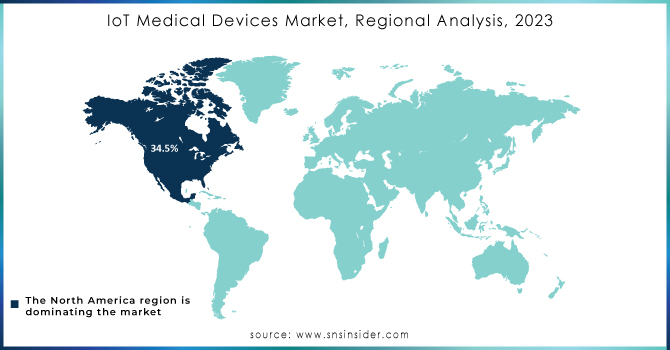

Regional Analysis

In 2023, North America held the largest market share at 34.5%, driven by the increased use of telehealth, e-prescribing, and mHealth technologies in response to COVID-19. Government mandates supporting IoT solutions and the rise in hospitals and medical device manufacturers further boosted the market growth. In the U.S., nearly 90% of physicians used electronic health records (EHR) by 2021. The Asia Pacific region is expected to experience the fastest growth due to advancements in healthcare infrastructure and rising healthcare expenditures in developing countries. Governments in the region, especially in Australia, are supporting IoT integration through initiatives like HealthSmart and HealthConnect. Key digital health startups in Japan are also contributing to market expansion.

Need any customization research on IoT Medical Devices Market - Enquiry Now

Key Players

-

Apple Inc. (HealthKit)

-

Intel Corporation (Intel Health Application Platform (HAP), Intel Edison)

-

Senseonics (Eversense CGM)

-

QUALCOMM Incorporated (2net Platform, Snapdragon Wear)

-

GE Healthcare (Carestation Insights, Mural Virtual Care Solution)

-

Medtronic (Guardian Connect System, MiniMed Insulin Pump)

-

IBM Corporation (IBM Watson Health, IBM Remote Patient Monitoring)

-

Wipro Ltd (Wipro Assure Health, Connected Devices in Healthcare)

-

Infosys Limited (Infosys Health Insights Platform)

-

Microsoft Corporation (Microsoft Azure IoT for Healthcare, Microsoft HealthVault)

-

Cerner Corporation (HealtheIntent, Cerner CareAware)

-

SAP SE (SAP Connected Health Platform, SAP Leonardo for Healthcare)

-

Amazon (AWS IoT for Healthcare, Amazon Halo)

-

Cisco Systems, Inc. (Cisco Healthcare Network, Cisco Connected Health)

-

Koninklijke Philips N.V. (Philips HealthSuite, Philips IntelliVue)

-

Abbott Laboratories (FreeStyle Libre, Confirm Rx)

-

Proteus Digital Health Inc. (Proteus Discover), and others.

Recent Developments

-

March 2023: Philips launched a new remote patient monitoring platform designed to enhance chronic disease management and patient engagement, integrating various IoT devices for real-time health data and actionable insights.

-

June 2024: Johnson & Johnson expanded its digital surgery platform with advanced IoT-connected surgical tools, offering enhanced real-time data integration and analytics for complex surgical procedures.

-

July 2024: Abbott introduced a next-generation wearable health monitor leveraging IoT technology for continuous glucose monitoring and other vital health metrics, integrating seamlessly with digital health platforms.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 41.4 Billion |

| Market Size by 2032 | US$ 503.6 Billion |

| CAGR | CAGR of 32.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Medical Devices, System and Software, Services)

• By Technology (Cellular, Wi-Fi, Bluetooth, LPWANs, Zigbee, RFID) • By Application (Telemedicine, Patient Monitoring, Connected Imaging, Clinical Operations, Medical Management, Others) • By End-use (Hospitals and Clinics, Clinical Research Organizations, Research and Diagnostic Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc. (HealthKit), Intel Corporation (Intel Health Application Platform (HAP), Intel Edison), Senseonics (Eversense CGM), QUALCOMM Incorporated (2net Platform, Snapdragon Wear), GE Healthcare (Carestation Insights, Mural Virtual Care Solution), Medtronic (Guardian Connect System, MiniMed Insulin Pump), IBM Corporation (IBM Watson Health, IBM Remote Patient Monitoring), Wipro Ltd (Wipro Assure Health, Connected Devices in Healthcare), Infosys Limited (Infosys Health Insights Platform), Microsoft Corporation (Microsoft Azure IoT for Healthcare, Microsoft HealthVault), Cerner Corporation (HealtheIntent, Cerner CareAware), SAP SE (SAP Connected Health Platform, SAP Leonardo for Healthcare), Amazon (AWS IoT for Healthcare, Amazon Halo), Cisco Systems, Inc. (Cisco Healthcare Network, Cisco Connected Health), Koninklijke Philips N.V. (Philips HealthSuite, Philips IntelliVue), Abbott Laboratories (FreeStyle Libre, Confirm Rx), Proteus Digital Health Inc. (Proteus Discover), and others. |

| DRIVERS | • Increasing Adoption of Wearable Healthcare Devices • Integration of Artificial Intelligence with IoT |

| RESTRAINTS | • Privacy Concerns |