Downstream Processing Market Size & Overview:

Get more information on Downstream Processing Market - Request Sample Report

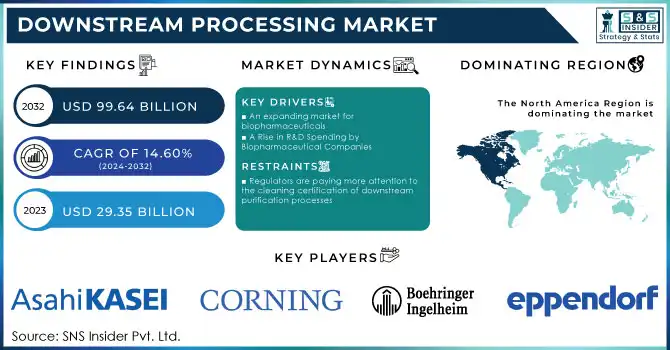

Downstream Processing Market was valued at USD 29.35 billion in 2023 and is expected to reach USD 99.64 billion by 2032, growing at a CAGR of 14.60% from 2024-2032.

The downstream processing market is witnessing remarkable growth, due to the increasing demand for biopharmaceuticals such as vaccines, monoclonal antibodies, and enzymes. This surge in demand is closely tied to the growing prevalence of chronic diseases and advancements in biotechnology, which have accelerated the development of biologics. With the global pharmaceutical industry generating revenues of approximately 1.6 trillion U.S. dollars in 2023, biopharmaceuticals represent a significant and rapidly expanding segment of this market. As the industry continues to grow, downstream processing has become a critical component to ensure the efficient purification and recovery of these complex products, fostering further innovation in the field.

This innovation is evident in the adoption of advanced technologies such as single-use systems, membrane chromatography, and continuous processing, transforming downstream processing. These technologies address key challenges in the industry, such as scalability, contamination risks, and regulatory compliance, making them indispensable for biomanufacturers. By improving operational efficiency and reducing production costs, they are enabling companies to meet the rising global demand for biologics, creating a virtuous cycle of growth and technological advancement.

This innovation is evident in the adoption of advanced technologies such as single-use systems, membrane chromatography, and continuous processing, transforming downstream processing. These technologies address key challenges in the industry, such as scalability, contamination risks, and regulatory compliance, making them indispensable for biomanufacturers. By Q1 2023, there were over 100 approved gene, cell, and RNA therapies globally, with more than 3,700 therapies in clinical and preclinical development stages, further driving the demand for efficient and scalable downstream processing solutions. By improving operational efficiency and reducing production costs, these technologies are enabling companies to meet the rising global demand for biologics, creating a virtuous cycle of growth and technological advancement.

Downstream Processing Market Dynamics

DRIVERS

-

Surging Demand for Biopharmaceuticals Drives Growth in Downstream Processing Market

The escalating prevalence of chronic and life-threatening diseases such as cancer, diabetes, autoimmune disorders, and rare genetic conditions has significantly increased the global demand for biopharmaceuticals. According to the U.S. Department of Health and Human Services, 129 million Americans—nearly 40% of the population—are living with at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension. These conditions have driven the need for innovative therapies, with biologics, monoclonal antibodies, and biosimilars playing a central role due to their high specificity and efficacy. However, these complex biomolecules require advanced downstream processing technologies to ensure their purity, safety, and efficacy before they can reach patients. The rising prevalence of chronic diseases thus directly propels the demand for efficient and scalable downstream processing solutions.

-

Advancements in RNA Drugs, Gene Editing, and Cell Therapies Expand Downstream Processing Market

The rapid emergence of cutting-edge therapeutics, including RNA-based drugs, gene-editing technologies like CRISPR, and advanced cell and gene therapies, is revolutionizing the biopharmaceutical industry. These therapies hold immense potential for treating previously incurable diseases, such as rare genetic disorders and certain cancers. However, their complexity and sensitivity present unique challenges in downstream processing. For instance, RNA-based drugs and gene-edited products demand precise purification techniques to maintain molecular integrity and functionality. Similarly, cell therapies require tailored downstream processes to ensure cell viability and consistency across batches. The increasing adoption of these transformative therapies is driving a surge in demand for innovative downstream processing technologies, including specialized filtration, chromatography, and formulation solutions, positioning this segment as a cornerstone in next-generation therapeutic production.

RESTRAINTS

-

High Costs of Technologies and Consumables Create Barriers in Downstream Processing Market

Advanced equipment, such as chromatography systems, filtration units, and centrifuges, often require substantial capital investment, making them financially burdensome for small and mid-sized biotech companies. Additionally, consumables like chromatography resins, filters, and single-use components further escalate operational expenses, particularly for high-volume production or complex biologics. These costs not only strain the budgets of smaller players but can also limit the adoption of cutting-edge downstream processing technologies. As a result, companies may struggle to scale their operations or meet the growing demand for biopharmaceuticals efficiently. The high expense of downstream processing remains a critical restraint, necessitating the development of cost-effective solutions to support market growth.

-

Stringent Regulatory Requirements Pose Challenges to Downstream Processing Market Growth

The downstream processing market faces significant hurdles due to the stringent regulatory requirements imposed on biopharmaceutical production. Regulatory bodies like the FDA and EMA mandate rigorous validation, compliance testing, and detailed documentation to ensure the safety, efficacy, and quality of biologics. These regulations, while critical for patient safety, can create bottlenecks in production timelines, delaying product approvals and market entry. The process of meeting these requirements often demands additional resources, including skilled personnel, advanced technologies, and time-intensive audits, which can increase operational costs. Furthermore, frequent updates to regulatory standards necessitate continuous adaptation, further complicating downstream processing workflows. For smaller biotech companies with limited resources, navigating these challenges can be particularly burdensome, making regulatory compliance a significant restraint on market expansion.

Downstream Processing Market Segment Analysis

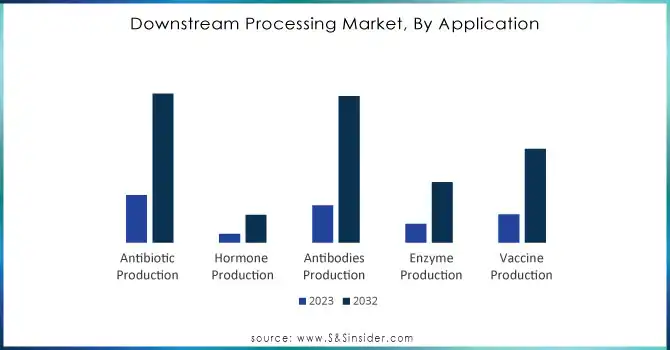

BY APPLICATION

In 2023, the Antibiotic Production segment led the downstream processing market with a 34% revenue share, driven by the sustained global demand for antibiotics to combat bacterial infections. Their widespread use in healthcare and agriculture, coupled with well-established manufacturing processes, ensures large-scale production and consistent revenue. Antibiotics' critical role in public health and cost-effective purification methods further cemented their dominance in the market.

The Antibodies Production segment is expected to grow at the fastest CAGR of 16.51% from 2024 to 2032, fueled by the rising adoption of monoclonal antibodies and biosimilars for treating cancer, autoimmune disorders, and infectious diseases. A robust pipeline of antibody-based therapies, along with advancements in scalable downstream technologies like chromatography and single-use systems, is accelerating this growth. This trend highlights antibodies' increasing prominence in biopharmaceutical innovation.

Need any customization research on Downstream Processing Market - Enquiry Now

BY TECHNIQUE

In 2023, the Purification by Chromatography segment captured the largest revenue share of 42% in the downstream processing market due to its superior ability to deliver high-purity biomolecules. Its versatility in handling diverse biopharmaceutical products, such as monoclonal antibodies and vaccines, has made it a cornerstone of the industry. Continuous technological advancements further cemented its dominance as the most reliable and efficient purification method.

The Solid-liquid Separation segment is expected to grow at the fastest CAGR of 16.99% from 2024 to 2032, driven by increasing demand for scalable and efficient filtration and centrifugation solutions. Its role in supporting biologics and cell therapy production, alongside a growing emphasis on cost-effective and sustainable manufacturing, has spurred significant innovation. These advancements make it essential for addressing the evolving needs of the biopharma sector.

BY PRODUCT

In 2023, the Chromatography Systems segment dominated the downstream processing market with a revenue share of approximately 43%, owing to its critical role in achieving high-purity separation of biomolecules. Widely used in the production of biopharmaceuticals such as monoclonal antibodies and recombinant proteins, chromatography systems offer unmatched precision and scalability. Their continuous innovation and adaptability to diverse product requirements have solidified their status as an industry cornerstone.

The Filters segment is expected to grow at the fastest CAGR of 16.67% from 2024 to 2032, driven by rising demand for efficient and cost-effective solutions in bioprocessing. Filters are essential for ensuring sterility and removing impurities in the production of biologics, a field witnessing significant growth. Increasing investments in single-use technologies and advancements in filtration materials are further fueling the segment’s rapid expansion.

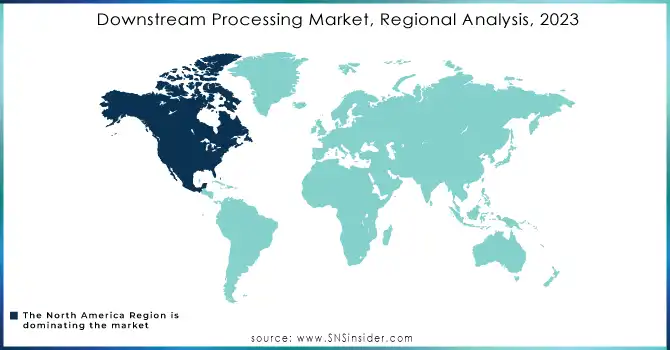

Downstream Processing Market Regional Outlook

In 2023, North America led the downstream processing market with the highest revenue share of approximately 36%, driven by its well-established biopharmaceutical industry and robust R&D infrastructure. The region's dominance is further supported by significant investments in advanced manufacturing technologies and a strong presence of key market players. Additionally, favorable regulatory frameworks and high demand for biologics and vaccines have solidified its leading position.

The Asia Pacific region is expected to grow at the fastest CAGR of 16.68% from 2024 to 2032, fueled by increasing biopharma investments and expanding healthcare infrastructure. Rapid industrialization, coupled with government initiatives to boost local biomanufacturing, has created a favorable growth environment. The rising demand for biologics and biosimilars, along with cost-efficient production capabilities, positions Asia Pacific as a critical driver of market expansion.

LATEST NEWS -

-

On November 21, 2024, Sartorius Stedim Biotech opened its Center for Bioprocess Innovation in Marlborough, USA. The facility focuses on advancing cell and gene therapy manufacturing, offering services like process optimization, proof-of-concept runs, and customer training, with GMP suites set to open in 2025.

-

On November 7, 2024, Thermo Fisher Scientific announced the construction of a 10,000-square-foot Bioprocess Design Center in Hyderabad, India, set to open in early 2025.

KEY PLAYERS

-

Merck KGaA (MilliporeSigma) (Viresolve Barrier Filters, ProSep Ultra Plus Protein A Resin)

-

Sartorius Stedim Biotech S.A (Sartobind Membrane Adsorbers, Sartoflow Advanced Systems)

-

Thermo Fisher Scientific Inc. (POROS Chromatography Resins, CaptureSelect Affinity Ligands)

-

Danaher Corporation (Pall Allegro MVP Single-Use System, Cytiva ReadyToProcess Columns)

-

Repligen (OPUS Pre-packed Columns, XCell ATF Systems)

-

3M Company (Zeta Plus Depth Filters, Emphaze AEX Hybrid Purifiers)

-

Boehringer Ingelheim International GmbH (BIHEX Process Solutions, Biopharmaceutical Contract Services)

-

Corning Corporation (Corning CellCube Systems, X-Series Hollow Fiber Filters)

-

Lonza Group Ltd (Centrifuge Systems, Viral Clearance Services)

-

Dover Corporation (Quattroflow Diaphragm Pumps, Maag Industrial Filtration Solutions)

-

Asahi Kasei (Planova Virus Filters, Microza UF Membranes)

-

Eppendorf AG (Centrifuge 5910 R, BioFlo Bioprocess Controllers)

-

Finesse Solutions Inc. (Thermo Fisher Subsidiary) (SmartVessel Bioreactor, G3Lab Universal Controllers)

-

Purolite Life Sciences (Praesto Protein A Resins, Chromalite Ion Exchange Resins)

-

Tosoh Bioscience (TOYOPEARL Protein A Resins, TSKgel Chromatography Columns)

-

Novasep (BioSC Chromatography Systems, Prochrom Bio Columns)

-

MilliporeSigma (a subsidiary of Merck KGaA) (Durapore Filters, Chromabolt Pre-packed Columns)

-

Waters Corporation (PATROL UPLC Process Analyzer, AutoPurification Systems)

-

PerkinElmer Inc. (LabChip GXII Microfluidics System, QSight 420 Mass Spectrometer)

-

Bio-Rad Laboratories, Inc. (UNOsphere Chromatography Resins, NGC Chromatography Systems)

-

Avantor (VWR) (J.T.Baker High Purity Solvents, Arium Sterile Filtration Units)

-

Spectrum Labs (Repligen subsidiary) (KrosFlo TFF Systems, Hollow Fiber TFF Modules)

-

Meissner Filtration Products (UltraCap Depth Filters, FlexGro Single-Use Assemblies)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 29.35 Billion |

| Market Size by 2032 | USD 99.64 Billion |

| CAGR | CAGR of 14.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Chromatography Systems, Filters, Evaporators, Centrifuges, Dryers, Others) • By Technique (Cell Disruption, Solid-liquid Separation, Concentration, Purification by Chromatography, Formulation) • By Application (Antibiotic Production, Hormone Production, Antibodies Production, Enzyme Production, Vaccine Production) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Merck KGaA (MilliporeSigma), Sartorius Stedim Biotech S.A, Thermo Fisher Scientific Inc., Danaher Corporation, Repligen, 3M Company, Boehringer Ingelheim International GmbH, Corning Corporation, Lonza Group Ltd, Dover Corporation, Asahi Kasei, Eppendorf AG, Finesse Solutions Inc. (Thermo Fisher Subsidiary), Purolite Life Sciences, Tosoh Bioscience, Novasep, MilliporeSigma (a subsidiary of Merck KGaA), Waters Corporation, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Avantor (VWR), Spectrum Labs (Repligen subsidiary), Meissner Filtration Products. |

| Key Drivers | • Surging Demand for Biopharmaceuticals Drives Growth in Downstream Processing Market • Advancements in RNA Drugs, Gene Editing, and Cell Therapies Expand Downstream Processing Market |

| Restraints | • High Costs of Technologies and Consumables Create Barriers in Downstream Processing Market • Stringent Regulatory Requirements Pose Challenges to Downstream Processing Market Growth |