IoT Middleware Market Report Scope & Overview:

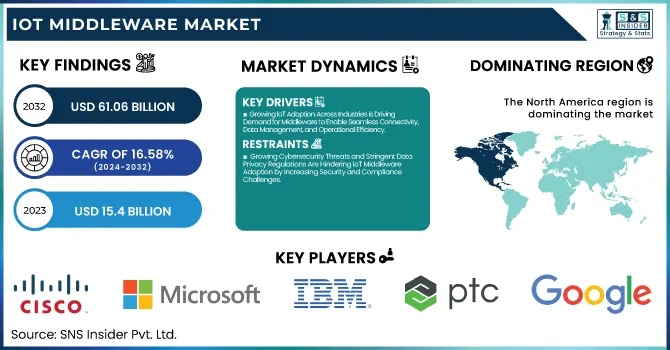

The IoT Middleware Market was valued at USD 15.4 billion in 2023 and is expected to reach USD 61.06 billion by 2032, growing at a CAGR of 16.58% from 2024-2032.

To Get more information on IoT Middleware Market - Request Free Sample Report

This report includes an analysis of customer satisfaction & retention rates, investment patterns, cost structure, number of connected devices, and security breaches. The market is witnessing strong growth owing to growing IoT adoption across various sectors, which results in more connected devices. Companies are concentrating on cost-effective solutions while having solid security infrastructures to protect against cyber threats. Investment in next-generation middleware technology is increasing due to the necessity of smooth device integration and enhanced data management. Customer satisfaction and retention at high levels are dictating competitive plans, leading to greater long-term market stability.

IoT Middleware Market Dynamics

Drivers

-

Growing IoT Adoption Across Industries is Driving Demand for Middleware to Enable Seamless Connectivity, Data Management, and Operational Efficiency.

Manufacturing, healthcare, and smart cities are among the industries that are embracing IoT solutions to improve efficiency, automation, and data-driven decision-making. With more devices connected, organizations need middleware solutions to ensure seamless device interoperability, data management, and security. Middleware is the backbone that allows real-time communication between IoT ecosystems while ensuring scalability and integration with cloud and edge computing platforms. Also, increasing demand for predictive maintenance, remote monitoring, and automation also boosts middleware adoption. As IoT growth fuels networks of sensors and intelligent devices, middleware solutions become vital in managing connectivity, data flow, and improving operational efficiency across various industry verticals.

Restraints

-

Growing Cybersecurity Threats and Stringent Data Privacy Regulations Are Hindering IoT Middleware Adoption by Increasing Security and Compliance Challenges.

With more devices connected, cybersecurity threats and data breaches pose significant challenges for companies deploying IoT solutions. IoT middleware is vital in controlling device-to-device communication, but weak points in security protocols can make sensitive data vulnerable to cyberattacks. Moreover, strict data privacy laws necessitate organizations to install strong security features, raising compliance complexities. The necessity for end-to-end encryption, authentication, and access control features contributes to implementation difficulties. While hackers target IoT networks, organizations have to spend a lot on security frameworks and threat detection solutions, increasing the difficulty of adoption. Security concerns need to be addressed to create trust and enable safe and efficient IoT ecosystem functioning.

Opportunities

-

Rising Smart City Investments Are Boosting Demand for IoT Middleware to Enable Seamless Integration of Connected Infrastructure and Real-Time Data Management.

Governments and city planners are investing significantly in smart city programs to improve public services, traffic management, energy efficiency, and security. These initiatives are based on IoT-connected infrastructure, such as smart grids, smart transportation systems, and networked surveillance, placing a high need for middleware solutions to orchestrate data exchanges and device communication. Middleware facilitates real-time exchange of messages between sensors, cloud platforms, and city-level networks, facilitating effective automation and decision-making. With cities embracing 5G, edge computing, and AI-powered analytics, IoT middleware is the key to scalability and unification of sophisticated systems. The relentless drive toward sustainable and technologically advanced urban growth further fast-tracks the demand for middleware, making it a central piece of future-proof smart cities.

Challenges

-

Increasing IoT Device Volumes Are Creating Scalability Challenges, Driving the Need for Advanced Middleware to Ensure Efficiency and Low Latency.

As the number of IoT devices connecting to the web is growing constantly, efficient flow of data, low latency, and smooth management of devices pose an ever-greater challenge. Legacy middleware products tend to scale poorly, resulting in performance bottlenecks at scale. Sectors deploying massive IoT networks, including smart cities, manufacturing, and healthcare, need middleware that supports high volumes of data, real-time processing, and device interoperability without sacrificing speed or security. Moreover, the convergence of cloud, edge computing, and AI-based analytics necessitates middleware with sophisticated scalability features. Without strong solutions, companies can expect network congestion, latency, and inefficiency in operations, which creates the need to build next-generation middleware capable of backing the escalating IoT environment.

IoT Middleware Market Segment Analysis

By Enterprise Size

Large enterprises led the IoT Middleware Market with the largest revenue share of around 63% in 2023 because of their large-scale IoT deployments, high IT expenditure, and superior infrastructure capabilities. Such companies need powerful middleware solutions to support extensive IoT ecosystems spread across different locations, providing uninterrupted connectivity, real-time data processing, and security compliance. Besides, big companies are early adopters of cutting-edge technologies such as AI, edge computing, and cloud-based IoT platforms, thereby fueling middleware demand. Their capacity to invest in tailored solutions and high-end security frameworks confirms their market dominance.

Small and Medium Enterprises (SMEs) will expand at the fastest CAGR of approximately 17.97% during 2024-2032 owing to their growing adoption of IoT for automation, efficiency, and cost reduction. Increased use of low-cost and cloud-based middleware offerings allows SMEs to implement IoT with minimal investments in infrastructure. Furthermore, government programs and digitalization of industries stimulate SMEs to adopt IoT for smart manufacturing, logistics, and remote monitoring. With increased competition, SMEs are integrating scalable IoT offerings, edge computing, and AI-powered analytics at an increasing rate, leading to strong growth in the middleware market.

By Vertical

The manufacturing industry led the IoT Middleware Market with the largest revenue share of around 31% in 2023 as a result of the extensive use of Industrial IoT (IIoT) for automation, predictive maintenance, and real-time monitoring. Manufacturers depend on middleware solutions to combine smart sensors, robotics, and AI-based analytics to achieve better operational efficiency and cost reduction. Moreover, middleware allows for easy communication between machines, cloud environments, and enterprise systems, ensuring maximum production efficiency. The increasing requirement for smart factories and Industry 4.0 technologies further amplifies its hegemony.

The healthcare sector will expand at the fastest CAGR of approximately 19.84% during the period from 2024 to 2032 owing to increasing IoT adoption in remote patient monitoring, telemedicine, and intelligent medical devices. Middleware solutions are essential for secure data transfer, interoperability, and real-time health analytics to ensure effective patient care. Growing interest in AI-based diagnostics, wearable health monitoring, and hospital automation fuels IoT middleware demand. Stringent data security laws and the requirement for transparent healthcare system integration also spur market growth in this segment.

By Platform

The device management segment led the IoT Middleware Market with the largest revenue share of around 38% in 2023 because of the increasing requirement for hassle-free provisioning, monitoring, and maintenance of connected devices. With increasing IoT adoption across sectors, organizations need middleware to provide device security, firmware updates, and performance optimization. Device management solutions assist companies in minimizing downtime, improving operational efficiency, and enhancing scalability in large-scale IoT networks. The increasing complexity of multi-device environments and remote monitoring solutions further fortifies its market leadership.

The connectivity management segment is expected to grow at the fastest CAGR of approximately 18.90% during the forecast period 2024-2032 with rising demand for optimized network orchestration, low-latency communications, and transparent IoT connectivity. As 5G, LPWAN, and edge computing grow at a fast pace, organizations require middleware solutions to handle network traffic, optimize bandwidth consumption, and provide secure data transmission. Smart cities, industrial automation, and remote IoT applications increase the growth of connectivity management platforms, accelerating the adoption at a fast rate.

Regional Analysis

North America dominated the IoT Middleware Market with the highest revenue share of about 36% in 2023 due to its advanced technology infrastructure, high IoT adoption across industries, and strong presence of key market players. The region benefits from widespread deployment of smart manufacturing, healthcare IoT, and industrial automation solutions, driving middleware demand. Additionally, early adoption of 5G, AI-driven analytics, and cloud computing enhances IoT ecosystem efficiency. Stringent cybersecurity regulations and enterprise investments in IoT security further contribute to the region’s market leadership.

Asia Pacific is expected to grow at the fastest CAGR of about 18.95% from 2024 to 2032 due to rapid industrialization, increasing smart city initiatives, and expanding IoT deployments across manufacturing and healthcare. Government support for digital transformation, growing 5G networks, and rising adoption of cloud-based IoT solutions drive regional growth. Additionally, the expansion of automotive IoT, consumer electronics, and smart infrastructure projects accelerates demand for middleware solutions. The region’s large-scale investments in automation and connectivity advancements further fuel its rapid market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Microsoft (Azure IoT Hub, Azure Digital Twins)

-

IBM (IBM Watson IoT, IBM Maximo)

-

PTC (ThingWorx, Vuforia)

-

Cisco (IoT Control Center, Cisco Kinetic)

-

AWS (AWS IoT Core, AWS IoT Greengrass)

-

SAP (SAP Leonardo IoT, SAP Cloud Platform IoT)

-

Google (Google Cloud IoT, Google Cloud IoT Core)

-

Hitachi (Lumada, Hitachi Vantara)

-

Oracle (Oracle IoT Cloud, Oracle Integration Cloud)

-

HPE (HPE Edgeline, HPE GreenLake)

-

Bosch (Bosch IoT Suite, Bosch IoT Cloud)

-

Siemens (MindSphere, Siemens Industrial IoT)

-

GE (Predix, GE Digital)

-

Schneider Electric (EcoStruxure, Schneider Electric IoT)

-

Software AG (Cumulocity IoT, webMethods)

-

Aeris Communication (Aeris IoT Platform, Aeris Mobility Suite)

-

Salesforce (Salesforce IoT Cloud, Salesforce Einstein)

-

Atos (Atos Codex IoT, Atos Digital Transformation)

-

ClearBlade (ClearBlade IoT Platform, ClearBlade Edge)

-

Davra Networks (Davra IoT Platform, Davra Edge)

-

Axiros (Axiros AXCESS, Axiros AXPERIENCE)

-

Eurotech (Eurotech Everyware IoT, Eurotech IoT Edge)

-

Litmus Automation (Litmus Edge, Litmus Edge Connect)

-

Ayla Networks (Ayla IoT Platform, Ayla IoT Cloud)

-

SumatoSoft (SumatoSoft IoT Solutions, SumatoSoft Cloud Integration)

-

QiO Technologies (QiO IoT, QiO AI for Industry)

-

Particle Industries (Particle IoT Platform, Particle Device Cloud)

-

Exosite (Exosite IoT Platform, Exosite Device Management)

Recent Developments:

-

2024 Microsoft announced the general availability of Windows Server IoT 2025 with enhanced security, hybrid cloud capabilities, and AI-driven performance improvements. Key features include strengthened Active Directory security, SMB over QUIC for secure file sharing, and GPU partitioning support for AI workloads.

-

2025 Qualcomm and IBM expanded their collaboration to enhance enterprise-grade generative AI across edge and cloud devices. IBM’s watsonx.governance and Granite models will integrate with Qualcomm’s AI Inference Suite, enabling AI solutions with improved reliability, privacy, and energy efficiency. Qualcomm's AI accelerators also received Red Hat OpenShift certification for hybrid cloud deployments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.4 Billion |

| Market Size by 2032 | USD 61.06 Billion |

| CAGR | CAGR of 16.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Device Management, Application Management, Connectivity Management, Security Management, Data Management) • By Enterprise Size (Large Enterprises, Small And Medium Enterprises) • By Vertical (Government & Defense, Manufacturing, BFSI, Transportation & Logistics, Energy & Utilities, Healthcare, Retail, Other Vertical) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, IBM, PTC, Cisco, AWS, SAP, Google, Hitachi, Oracle, HPE, Bosch, Siemens, GE, Schneider Electric, Software AG, Aeris Communication, Salesforce, Atos, ClearBlade, Davra Networks, Axiros, Eurotech, Litmus Automation, Ayla Networks, SumatoSoft, QiO Technologies, Particle Industries, Exosite |