ATM Market Report Scope & Overview:

Get more information on ATM Market - Request Sample Report

The ATM Market was valued at USD 23.86 Billion in 2023 and is expected to reach USD 34.23 Billion by 2032, growing at a CAGR of 4.11% over the forecast period 2024-2032.

A big driver of growth is the growing worldwide demand for cash access and self-service banking solutions, especially in underbanked areas. The growing idea of financial inclusion assumes ATMs as a critical part of this provision of accessibility to banking services in a cheap and fast manner. AMR Group stated that rising demand for higher technology features, such as biometric authentication, currency recycling, and availability of multi-functional services have driven the adoption of the smart ATM. This innovation strengthens security, saves money on operational expenses for banks, and expands the range of services, making ATMs more appealing to financial institutions and users alike. More than 10,000 ATMs around the world now include biometric functionality as of 2023, including 2,000 ATMs in India to boost financial inclusion. By 2022, the global installed base for cash recycling ATMs had risen to 1.4 million, up from 1 million in 2021, with 25% of U.S. ATMs now outfitted with this capability. More than 50,000 ATMs now provide multi-functional services including bill payments, mobile top-ups, and check deposits instead of a simple cash withdrawal.

The increasing automation of the banking sector is another reason. ATMs provide a great way to handle at least routine transactions with little human intervention, which is a big cost saver for banks, which are under constant pressure to increase the operational efficiency of their branches. This increase further augments the viability of ATMs that can open and allow people to take out digital currencies and digital accounts with increased digital banking and e-wallet usage. Furthermore, there is a rapid growth of the ATM networks in emerging markets, in particular, Asia-Pacific and Africa the banking penetration is rising along with a growing middle-class population. All of the aforementioned factors augur well for the growth of the ATM market in the coming years.

It is estimated that more than 3 million ATMs will be rolled out globally, having undergone considerable automation to minimize human involvement and operational costs by 2024. For instance, more than 80% of ATMs in the U.S. sort cash in addition to recycling and facilitating digital transactions. Africa's ATM network is expanding by 10% each year as institutions work to enhance financial accessibility in unbanked areas. Aside from this, there are 40,000 cryptocurrency ATMs in the world, 35,000 of which are in the U.S., indicating a growing demand for cash out in the form of digital currencies.

MARKET DYNAMICS

KEY DRIVERS:

- Surge in Contactless ATM Adoption and Mobile Integration Revolutionizing the Future of Banking Services

The expanding need for contactless and secure payment options is a major factor contributing to growth in the ATM market. With the growing apprehensions surrounding the reliability and security of financial transactions both on consumer and enterprise segments alike ATMs are increasingly being upgraded with contactless payment functionalities. This includes access to cash withdrawals via mobile or tap-and-go card functionality. COVID-19 created serious worries around close interactions, requiring urgent demand for touch-free solutions. As a result, ATM manufacturers and banks are responding by upgrading old machines for contactless enablement which allows a much smoother and safer way to withdraw money. The rise of features in ATMs like Near Field Communication (NFC) or QR code readers is expected to rise, it will provide an easy, faster, and safer way for users to get their cash without inserting any physical card into the ATM. Globally, 50% of ATMs will be ready for contactless by 2024 with 40,000 ATMs in the U.S. being upgraded for tap-and-go card functionality. In 2024 alone, expect 35% more ATMs to integrate QR code transactions. On top of that, 200,000 cardless ATMs are expected to be in use throughout the globe by using a mobile app or other device to access cash machines without needing to use a physical card.

- Digital Banking Revolution Drives Growth in Smart ATMs and Enhances Customer Experience Globally

The growth in demand for integrated digital banking solutions is the other key driver. As digital banking has proliferated, banks are increasingly recasting the ATM as a form of omnichannel banking strategy. Smart ATMs aim to continue addressing the space between physical banking and digital banking; enabling customers to make types of transactions like transfers between banks, pay bills, and make checks. These machines are evolving into an extension of digital platforms, providing new digital services with advanced features, thus improving customer experience. This has led the banks to deploy these advanced ATMs as a part of their digital transformation strategies where they meet the customers online and offline. Such a trend is spurring investments and innovations in the ATM market paving the way for its omnipresence in the banking infrastructure. More than 300,000 smart ATMs worldwide are projected to be available by 2024, providing bill payment and transfer services. 55% of banking customers in U.S. prefer mobile apps to manage their accounts and billions of people around the globe, 2 billion to be precise uses mobile banking. On top of that, 40% of ATMs are linked with mobile apps, features such as cardless ATM withdrawals, and mobile check deposits.

RESTRAIN:

- Rising Cybersecurity Threats and Regulatory Challenges Hampering Growth of the ATM Market Globally

Growing threats regarding fraud and security are one of the major challenges faced in the ATM market. With the increased integration of ATMs into digital banking and new technology, they are also increasingly exposed to cyberattacks and deception. Criminals employ methods such as skimming, card trapping, and malware to obtain customer data and money. This threat can only supplement the need for ATM financial institutions; regular upgrades and the practice of consumers watching ensuring ATM security itself. Another difficulty comes from the regional safety regulation that differs from one country to another. Given that financial institutions have to deal with an ever-evolving regulatory landscape, spanning AML laws and data privacy rules, they have to do a delicate balancing act to stay in compliance with the letter of the law while providing customers and regulators with seamless access to financial services. The mix of country and domain ATM requirements can create challenges for ATM rollout and machine management. Such differences in legal systems can also delay the advancement of good markets and lead to the need to have extra resources to battle for compliance management something that is seen predominantly in developing markets.

KEY MARKET SEGMENTS

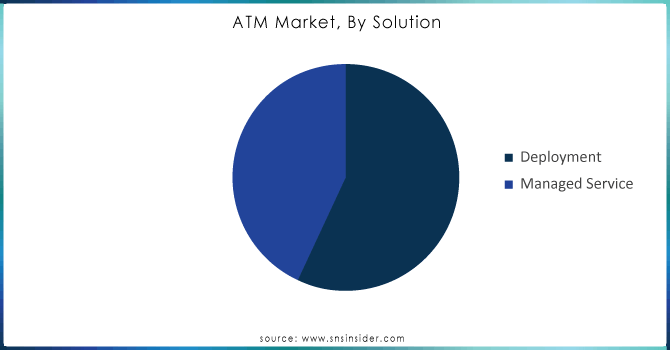

BY SOLUTION

The deployment segment held the largest ATM market with a share of 52.7% in 2023, and it is evaluated to grow at the highest CAGR from 2024 to 2032 owing to, one is the growing ATM networks in emerging markets. Geographically, demand for more ATMs to reach un-banked populations scales as financial inclusion initiatives grow across Asia-Pacific, Latin America, and Africa. Investment from banks and financial institutions is expanding access to convenient and accessible banking services through them, in turn, fueling demand for the new ATM deployments. In addition, the latest digital transformation in the banking sector is instigating demand for smart ATMs which offer ease over simple cash withdrawal functionalities. Smart ATMs support multi-function services (cash recycling, bill, and coin deposit, bill payments, cash deposits, and withdrawal, passbook printing) and various biometric authentication, which increase the number of times advanced machines are deployed for the day. Due to the role these innovative ATMs play in forming some of the core aspects for all financial institutions that are especially crucial in a competitive environment such as increasing customer experience and minimizing operational costs. Therefore, the segment of deployment will sustain its steady growth and will increase at a significant pace in the upcoming years.

BY TYPE

The Conventional/Bank ATM segment captured a market share of 54.7% in 2023 and this can be attributed to the widespread presence that these ATMs have along with their importance in traditional banking services. Such ATMs have been historically known as a trusted means for carrying credit/debit-related operations that solely include cash withdrawals, balance checks, fund transfers, etc. Their persona and omnipresence in urban and rural regions combined with the familiarity and reliability of paper as a medium explains why paper is still widely used by most users, especially in countries where digital banking is yet to mature. These ATMs are still kept alive by financial institutions, often serving a significant customer base, particularly older demographics and those with a lower tendency to embrace digital banking solutions.

Smart ATMs are expected to record the highest CAGR between 2024 and 2032, due to the growing technical demand for advanced features and multi-functional capabilities. They include smarter services such as cash recycling, biometric authentication, integration with mobile and online banking platforms, etc. They serve growing trends and tech-savvy consumers, while also aligning with banks' digital transformation strategies, a seamless merge of the physical and digital bank. Global demand for Smart ATMs is anticipated to increase due to their growing usage and the need among financial institutions to diminish branch operations and offer better experiences to customers, particularly in developed economies and cities worldwide.

Do you need any custom research/data on ATM Market - Enquiry Now

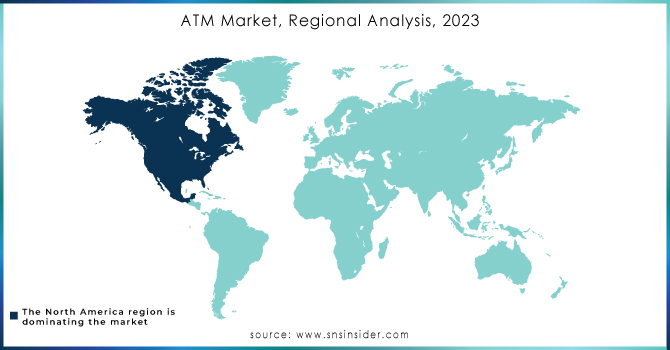

REGIONAL ANALYSIS

North America holds the largest ATM market share of 30.7% in 2023, which is due to its highly developed financial ecosystem combined with developed countries, and high adoption of advanced banking technologies. The area is home to one of the highest per capita ATM densities in the world in part enabled by a stable regulatory climate and strong consumer banking behavior. Banks across the US and Canada (Bank of America, RBC (Royal Bank of Canada)) have been focused on increasing customer convenience with value added features in ATMs. Cardless ATM withdrawal methods through a phone app or NFC technology, are already a reality, providing the user with an extra layer of security and access. North America, the developed nations will inspire more development in the vertical since it is the repository of research and development on financial technologies and would witness the introduction of features such as real time account updates and sophisticated measures to prevent fraudulent access in the ATM column. Such trends only solidify the region's position as the global leader in ATM.

Asia-Pacific is anticipated to register the highest CAGR during the forecast period, owing to rapid economic growth, urbanization, and the growing initiatives for financial inclusion. Countries like India, China, and Indonesia are heavily investing in increasing ATM coverage, thanks to well-structured government backing and financial institutions. For example, India has encouraged ATM installations in rural areas through the PMJDY program, thus bringing financial services to millions of unbanked people. China has already seen the likes of regular and enhanced Smart ATMs from banks such as ICBC and China Construction Bank, focusing on multifunctional capabilities like cash recycling; opening accounts, and biometric-enabled capabilities. Additionally, trends such as the region's increasing adoption of mobile payments and QR code-based cash withdrawals are changing the way consumers use ATMs, well in line with Asia-Pacific's drive towards a cash-lite digital economy. Combined, these factors make this region an important source of innovation and growth for the ATM market.

Key players

Some of the major players in the ATM Market are:

-

Diebold Nixdorf (Opteva Series, ActivEdge Card Reader)

-

NCR Corporation (SelfServ ATMs, Interactive Teller Machines)

-

Triton Systems of Delaware LLC (RL2000, FT5000)

-

Hitachi Channel Solutions Corp (Cash Recycling ATMs, Card Readers)

-

Hyosung TNS Inc. (Halo II, 2700 CE)

-

GRG Banking Equipment Co. Ltd. (H68N Series, P2800L)

-

Fujitsu Frontech Ltd. (Series 8000 ATMs, PalmSecure Vein Authentication)

-

Euronet Worldwide Inc. (REN Self-Service ATM, iCash ATMs)

-

OKI Electric Industry Co. Ltd. (ATM-Recycler G7, ATM-Recycler G8)

-

Glory Ltd. (RG Series ATMs, TellerInfinity)

-

Hantle USA (1700W, T4000)

-

Genmega Inc. (G2500, GT3000)

-

Nautilus Hyosung America Inc. (MX8800, MX5600)

-

Wincor Nixdorf AG (ProCash Series, Cineo Series)

-

Sigma ATM (Monimax 5000CE, Monimax 5100T)

-

Shenzhen Zhongji Technology Co. Ltd. (ZJ6000, ZJ8000)

-

KingTeller Technology Co. Ltd. (KT ATM-7000, KT ATM-8000)

-

Hitachi-Omron Terminal Solutions Corp. (HT-2845-V, HT-2845-S)

-

Keba AG (KePlus D10, KePlus D6)

-

Euronet India (Euronet ATMs, REN ATMs)

Some of the Raw Material Suppliers for ATM companies:

-

ATM Polymers

-

Shenzhen Mufeng Paper Limited

-

ATM Trafilerie

-

KUNSHANG INTERNATIONAL CO., LTD.

-

Hebei Luobin Trading Co., Ltd.

-

Advance Traffic Markings

-

Sailing Paper

-

Asia Manufacturer

-

ATM Recyclingsystems

-

Global Sources

RECENT TRENDS

-

In December 2024, Diebold Nixdorf becomes the first to deploy Microsoft® Windows 11® on live ATMs, enhancing security and user experience in banking technology.

-

In October 2024, NCR Corporation introduced advanced ATMs equipped with facial recognition technology and self-service capabilities, enhancing security and streamlining user transactions.

-

In September, Hitachi introduces India's first Android-powered ATM, enabling seamless UPI-based withdrawals and deposits, revolutionizing digital banking services.

| Report Attributes | Details |

| Market Size in 2023 | USD 23.86 Billion |

| Market Size by 2032 | USD 34.23 Billion |

| CAGR | CAGR of 4.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2022-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Deployment, Managed Service) • By Type (Conventional/Bank ATMs, Brown ATMs, White ATMs, Cash Dispenser ATM, Smart ATMs) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Diebold Nixdorf, NCR Corporation, Triton Systems of Delaware LLC, Hitachi Channel Solutions Corp, Hyosung TNS Inc., GRG Banking Equipment Co. Ltd., Fujitsu Frontech Ltd., Euronet Worldwide Inc., OKI Electric Industry Co. Ltd., Glory Ltd., Hantle USA, Genmega Inc., Nautilus Hyosung America Inc., Wincor Nixdorf AG, Sigma ATM, Shenzhen Zhongji Technology Co. Ltd., KingTeller Technology Co. Ltd., Hitachi-Omron Terminal Solutions Corp. |

| Key Drivers | • Surge in Contactless ATM Adoption and Mobile Integration Revolutionizing the Future of Banking Services • Digital Banking Revolution Drives Growth in Smart ATMs and Enhances Customer Experience Globally |

| Market Challenges | • Rising Cybersecurity Threats and Regulatory Challenges Hampering Growth of the ATM Market Globally |