Kaolin Market Report Scope & Overview:

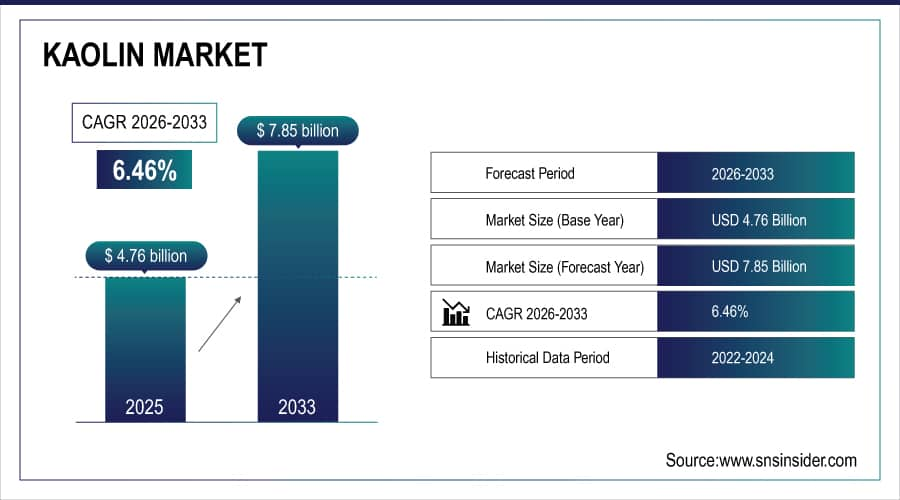

The Kaolin Market size is valued at USD 4.76 Billion in 2025E and is expected to reach USD 7.85 Billion by 2033 and grow at a CAGR of 6.46% over the forecast period 2026-2033.

The kaolin market analysis, driven by wide range of industrial applications, especially in paper, ceramics, paints & coatings, rubber, and plastics. In the paper industry, which has historically been the largest consumer of kaolin, the mineral improves brightness, smoothness, and printability enhancing overall paper quality. Growing demand for high‑grade coated papers in packaging, printing, and publishing continues to support kaolin consumption.

According to study, construction and building applications account for 15–20% of kaolin consumption, including tiles, bricks, and cement blends.

To Get More Information On Kaolin Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 4.76 Billion

-

Market Size by 2033: USD 7.85 Billion

-

CAGR: 6.46% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Kaolin Market Trends:

-

Paper industry remains largest consumer of kaolin for brightness and smoothness.

-

Specialty kaolin demand rising in paints, plastics, coatings, and adhesives.

-

Calcined and delaminated kaolin products gaining popularity for high-performance applications.

-

Emerging regions in Asia-Pacific and Latin America driving market expansion.

-

Environmental regulations encourage sustainable mining practices and responsible kaolin sourcing.

-

High-brightness and surface-modified kaolin enabling premium products in pharmaceuticals and cosmetics.

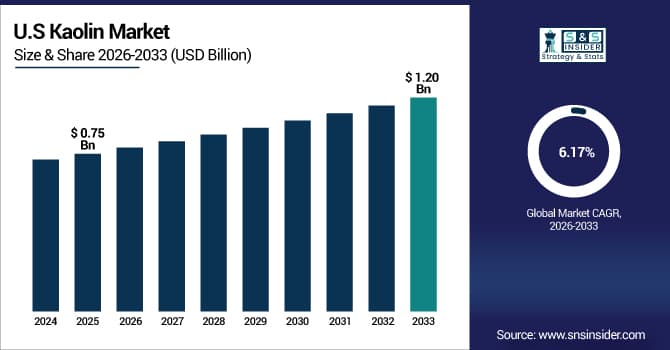

The U.S. Kaolin Market size is USD 0.75 Billion in 2025E and is expected to reach USD 1.20 Billion by 2033, growing at a CAGR of 6.17% over the forecast period of 2026-2033,

The U.S. kaolin market is growing steadily, driven by demand from paper, ceramics, paints, coatings, and rubber industries. Specialty and processed kaolin are increasingly adopted for high-performance applications. Industrial modernization, technological advancements in surface-modified and delaminated kaolin, and regulatory compliance further support market expansion across the country.

Kaolin Market Growth Drivers:

-

Growing demand from paper, ceramics, coatings, and rubber drives kaolin consumption.

A major driver for the kaolin market growth is the expanding demand from industries such as paper, ceramics, paints & coatings, rubber, and plastics. In the paper industry, kaolin improves brightness, smoothness, and printability, enhancing overall paper quality. Its application in ceramics, paints, and coatings provides superior opacity, texture, and durability, boosting product performance. The continuous growth in packaging, printing, publishing, and construction sectors drives the demand for kaolin as a functional filler and coating material. Rising industrialization, urbanization, and end-user consumption are fueling market expansion.

Ceramics, paints, and coatings sectors collectively represent over 30% of kaolin demand.

Kaolin Market Restraints:

-

Raw material price volatility and environmental concerns limit kaolin market growth.

A major restraint for the kaolin market is the fluctuating cost of raw kaolin and environmental concerns related to mining operations. Mining activities can lead to land degradation, dust emissions, and water pollution, which trigger stringent environmental regulations and increase operational costs for producers. Additionally, price volatility in raw kaolin due to supply-demand imbalances affects profit margins and may limit investments in new mining projects. These challenges can slow down the growth of the kaolin market, particularly in regions with strict mining and environmental policies.

Kaolin Market Opportunities:

-

Emerging markets and specialty kaolin applications create significant growth opportunities.

A major opportunity lies in the rising adoption of specialty kaolin and the expansion of end-use markets in emerging economies. Specialty kaolin products, including calcined, delaminated, surface-modified, and high-brightness grades, are increasingly used in paints, plastics, coatings, adhesives, and pharmaceuticals due to their improved performance characteristics. Emerging regions in Asia-Pacific, Latin America, and the Middle East are witnessing rapid industrialization, growing construction activities, and rising demand for quality consumer goods. This trend creates significant growth potential for kaolin manufacturers to diversify product offerings and expand into high-value applications.

Specialty kaolin adoption in paints, plastics, coatings, and adhesives could drive 35–40% of market revenue.

Kaolin Market Segmentation Analysis:

-

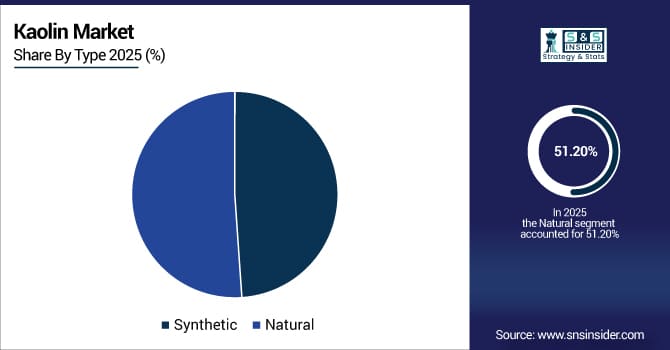

By Type: Natural dominated the market with a share value 51.20%, while Synthetic is the fastest-growing with 6.80% CAGR.

-

By Process: Air float dominated the market with a share value with 34.50%, while Water-Ished is the fastest-growing with 7.90% CAGR.

-

By Application: Powder dominated the market with a share value with 42.70%, while Slurry is the fastest-growing with 7.20% CAGR.

-

By End-Use: Paper dominated the market with a share value with 46.80%, while Ceramic & Sanitaryware is the fastest-growing with 8.10% CAGR.

By Type, Natural Lead Market and Synthetic Fastest Growth

In 2025, Natural kaolin dominates the market, accounting for the majority of consumption. Its widespread availability, lower production cost, and consistent quality make it the preferred choice for bulk industrial applications. Natural kaolin is extensively used in paper, ceramics, paints, and coatings due to its high brightness, smooth texture, and chemical stability. The mature supply chain, ease of mining, and extensive historical usage reinforce its dominance across traditional end-use industries.

Synthetic kaolin is the fastest-growing segment, as industries increasingly require high-purity, performance-enhanced kaolin for specialty applications. Synthetic kaolin offers controlled particle size, surface treatment options, and higher chemical purity. It is highly sought after in advanced coatings, plastics, and pharmaceutical applications where consistent quality and tailored properties are critical. Rising industrial automation and quality standards in developed and emerging markets are accelerating its adoption.

By Process, Airfloat Lead Market and Water-Ished Fastest Growth

In 2025, Airfloat kaolin dominates, especially in high-end applications like coated paper and premium ceramics. The airfloat process produces fine, uniformly sized particles with excellent brightness and low contamination, making it ideal for industries requiring high surface finish and premium quality. Its reliability, mature production technology, and broad applicability in paper, ceramics, and coatings contribute to its dominant market position.

Water-washed kaolin is the fastest-growing process segment, primarily driven by its cost-efficiency and eco-friendly production. Water-washed kaolin removes impurities and improves particle consistency, making it suitable for specialty coatings, plastics, and industrial fillers. Growing environmental regulations and rising demand for high-performance yet cost-effective kaolin in emerging markets is fueling adoption of water-washed kaolin.

By Application, Powder Lead Market and Slurry Fastest Growth

In 2025, Powder kaolin dominates the market, as it is highly versatile and widely used in paper, ceramics, paints, rubber, and plastics. Powdered kaolin offers ease of handling, uniform mixing, and process flexibility, making it suitable for large-scale industrial production. Its dominance is reinforced by consistent demand from traditional industries like paper coating and ceramics manufacturing, where bulk kaolin supply is critical.

Slurry kaolin is the fastest-growing segment, particularly in ceramics, specialty coatings, and plastic applications. Slurry form reduces processing steps, improves dispersion, and enhances application efficiency, especially in coating and molding processes. The shift toward large-scale industrial processes and the need for time-efficient, ready-to-use kaolin solutions are driving rapid adoption .

By End-Use, Paper Leads Market and Ceramic & Sanitaryware Fastest Growth

Paper dominates the kaolin market, as it remains the largest consumer of kaolin Kaolin improves paper brightness, smoothness, and printability, making it essential for coated and uncoated paper. The sustained demand for high-quality printing and packaging papers, especially in emerging economies, ensures natural kaolin retains a dominant share.

Ceramics & sanitaryware are the fastest-growing segment, driven by rising urbanization, residential construction, and infrastructure development. Specialty kaolin enhances whiteness, strength, thermal stability, and durability of ceramic products, making it indispensable in sanitaryware, tiles, and advanced ceramic applications. The growth of the construction and luxury housing sectors is fueling demand for high-quality ceramic kaolin, accelerating this segment’s market expansion.

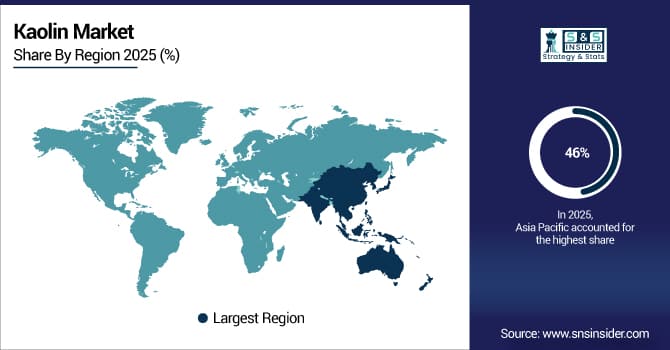

Kaolin Market Regional Analysis:

Asia Pacific Kaolin Market Insights:

The Asia Pacific dominated the Kaolin Market in 2025E, with over 46% revenue share, due to high demand from paper, ceramics, paints, coatings, and rubber industries. Rapid industrialization, urbanization, and expansion of manufacturing sectors drive consumption. Availability of high-quality natural kaolin, coupled with growing specialty kaolin adoption in paints, plastics, and pharmaceuticals, strengthens regional dominance. Infrastructure development, increasing packaging and printing demand, and investments in end-use industries further fuel market growth. Asia Pacific’s position as the largest consumer and producer ensures sustained leadership in the kaolin market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China and India Kaolin Market Insights

China and India dominate kaolin consumption due to rapid industrialization, growth in paper, ceramics, paints, and packaging industries, and increasing adoption of specialty and processed kaolin to meet quality, performance, and regulatory standards.

Europe Kaolin Market Insights:

The Europe region is expected to have the fastest-growing CAGR 7.63%, driven by increasing demand for specialty kaolin in paints, coatings, plastics, adhesives, and pharmaceuticals. Rapid industrial modernization, adoption of high-quality coated papers, and growth in construction and ceramic applications boost consumption. Technological advancements in processing and surface-modified kaolin, along with strong focus on sustainability and environmental compliance, accelerate market growth. Rising investments in end-use sectors, coupled with increasing use in lightweight and high-performance materials, make Europe the fastest-growing region in the kaolin market.

Germany and U.K Kaolin Market Insights

Germany and the U.K. maintain strong kaolin market growth through specialty and processed kaolin use in construction, ceramics, paints, and packaging. Focus on high-performance materials, regulatory compliance, and industrial adoption supports market expansion in both countries.

North America Kaolin Market Insights

North America shows steady growth in the kaolin market due to demand from paper, ceramics, paints, coatings, and rubber industries. Adoption of specialty kaolin for high-performance applications, combined with industrial expansion and technological advancements, supports market growth. Focus on sustainability, quality improvement, and regulatory compliance enhances kaolin consumption. The region benefits from established supply chains, efficient logistics, and ongoing investment in manufacturing and end-use industries. Growing demand for coated papers, specialty ceramics, and industrial fillers ensures consistent market expansion across North America.

U.S and Canada Kaolin Market Insights

The U.S. and Canada show steady kaolin market growth, driven by demand from paper, ceramics, paints, and coatings industries, along with specialty kaolin adoption, industrial modernization, and technological advancements in processing and surface-modified grades.

Latin America (LATAM) and Middle East & Africa (MEA) Kaolin Market Insights

Latin America and the Middle East show steady growth in the kaolin market, driven by rising demand from construction, ceramics, paper, paints, and industrial applications. In Latin America, industrialization, urbanization, and infrastructure expansion support adoption, while investments in specialty kaolin and manufacturing enhance market potential. In the Middle East, growing urban development, industrial projects, and adoption of processed and specialty kaolin boost demand. Technological advancements in surface modification and product quality, along with government initiatives promoting industrial growth, further accelerate market expansion, positioning both regions as steadily growing contributors to the kaolin market.

Kaolin Market Competitive Landscape:

Imerys is a leader in mineral-based solutions, including kaolin, serving paper, ceramics, paints, rubber, and plastics industries. Its kaolin products enhance brightness, opacity, and durability in coatings and papers while supporting industrial applications. Imerys focuses on high-performance, specialty kaolins, sustainable mining practices, and R&D-driven innovation, enabling consistent quality and supply. Its diversified portfolio positions it as a major influencer in the kaolin market.

-

In August 2025, Imerys launched a new line of eco‑friendly kaolin products for sustainable packaging and paper coatings, strengthening its position in high‑growth, environmentally conscious industrial segments.

Thiele Kaolin Company specializes in high-quality kaolin clay production for paper, ceramics, paints, rubber, and adhesive applications. Its products improve brightness, smoothness, and functional performance across end-use industries. Thiele emphasizes sustainable mining practices, consistent product quality, and technical support to customers. With a strong U.S.-based manufacturing and distribution network, the company plays a key role in supplying specialty kaolin and expanding its presence in industrial markets.

-

In July 2025, Thiele Kaolin Company entered a strategic partnership with a technology firm to implement AI‑driven analytics into its kaolin supply chain, boosting operational efficiency and customer responsiveness.

SCR-Sibelco is a major kaolin producer, offering high-purity and specialty clays for paper, ceramics, coatings, and construction applications. Its kaolin products enhance performance, appearance, and durability in diverse industrial uses. The company focuses on sustainable extraction, technical innovation, and tailored solutions for customer-specific needs. With international operations, robust supply chains, and expertise in mineral processing, SCR-Sibelco is a significant player driving growth and innovation in the kaolin market.

-

In March 2025, Sibelco announced a strategic partnership with BASF to co‑develop and commercialize high‑white kaolin grades for specialty coatings and paper applications, expanding both companies’ market reach and product capabilities.

Kaolin Market Key Players:

-

Thiele Kaolin Company

-

KaMin LLC

-

SCR-Sibelco

-

BASF SE

-

Active Minerals Company

-

English Indian Clays Ltd. (EICL)

-

Quarzwerke Group

-

I-Minerals Inc.

-

Kaolin AD

-

Sedlecký Kaolin a.s.

-

LB Minerals

-

Golcha Group

-

J.M. Huber Corporation

-

Covia Holdings Corporation

-

GMCI (Georgia Mining Corporation International)

-

Sibelco Asia

-

Poraver GmbH

-

KaMin Brazil

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.76 Billion |

| Market Size by 2033 | USD 7.85 Billion |

| CAGR | CAGR of 6.46% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Synthetic, Natural) •By Process (Water-Washed, Airfloat, Calcined, Delaminated, Surface-Modified & Unprocessed) •By Application (Powder, Granules, Slurry) •By End-Use (Paper, Ceramic & Sanitarywares, Fiberglass, Paints & Coatings, Rubber & Plastics) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Imerys, Thiele Kaolin Company, KaMin LLC, SCR-Sibelco, BASF SE, Active Minerals Company, Ashapura Group, English Indian Clays Ltd. (EICL), Quarzwerke Group, I-Minerals Inc., Kaolin AD, Sedlecký Kaolin a.s., LB Minerals, Golcha Group, J.M. Huber Corporation, Covia Holdings Corporation, GMCI (Georgia Mining Corporation International), Sibelco Asia, Poraver GmbH, and KaMin Brazil |