Kombucha Market Report Scope & Overview:

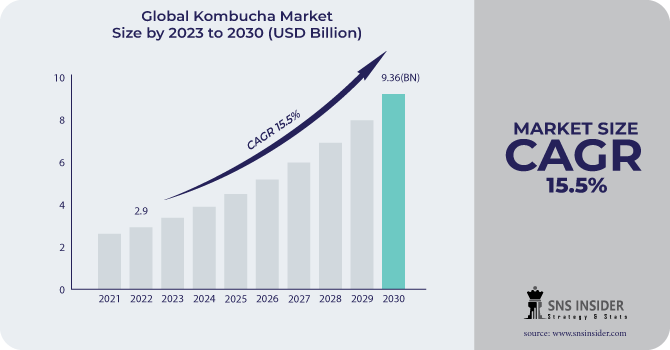

The Kombucha Market size was USD 2.9 billion in 2022 and is expected to Reach USD 9.36 billion by 2030 and grow at a CAGR of 15.5 % over the forecast period of 2023-2030.

Kombucha is a fermented tea beverage created from tea, sugar, and a SCOBY (symbiotic culture of bacteria and yeast). The tea and sugar are fermented by the SCOBY, resulting in a bubbly, mildly sweet, and sour beverage.

Fermented beverages have been shown to aid in the treatment of diabetes, arthritis, cancer, and other degenerative disorders. One such item is kombucha. It strengthens the body's defense and immunological system, detoxifies and cleanses the body, regenerates connective tissues, lessens headaches, and aids in weight maintenance. As a result, kombucha consumption is on the rise everywhere, which can be attributed to customers' desire for healthy alternatives. Since many customers are still uninformed of the health advantages of kombucha, the market offers wonderful opportunities for companies to raise consumer awareness and increase sales of their goods.

Consumers are increasingly changing their lifestyles as a result of growing health consciousness and the necessity to choose functional foods and beverages. As they maintain potential health benefits, people are choosing kombucha drinks.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing demand for natural and healthy beverages

-

The rising popularity of functional beverages

Kombucha is a functional beverage prepared from fermented tea that is thought to provide a variety of health advantages such as enhancing gastrointestinal health, stimulating the immune system, and lowering inflammation. Consumers are becoming more health conscious, and they seek beverages that they believe will improve their overall health and well-being. Kombucha contains probiotics, which are healthy bacteria that can enhance intestinal health. It is also caffeine-free and includes antioxidants, which can help protect the body from free radical damage.

RESTRAIN

-

Lack of awareness about kombucha drink

-

Stringent regulation on alcohol & sugar content

Kombucha is a fermented beverage that contains trace levels of alcohol, often ranging from 0.5% to 2% ABV. However, several nations have laws limiting the quantity of alcohol that can be found in kombucha. In the United States, for example, kombucha cannot have more than 0.5% ABV if it is labeled as a non-alcoholic beverage. As a result, it may restrict the availability of kombucha in certain markets.

OPPORTUNITY

-

Availability of a variety of flavor options in kombucha

Nowadays, consumers enjoy a wider range of fruit flavors drinks that provide them with increased nutritional value. Innovation in kombucha flavors is what is driving the kombucha market. There are currently numerous flavors of kombucha, including fruity, herbal, and spicy. Customers who are looking for a tasty, refreshing beverage will find this assortment of flavors intriguing. Guava, blueberry, lavender, hibiscus lime, and many other appealing flavors are just a few.

CHALLENGES

-

High cost of kombucha drinks

Kombucha production is a labor-intensive procedure, which can raise the cost of production. The fact that kombucha is sometimes marketed in little bottles might also raise the price. Producers are forced to take measures to lower the alcohol content of kombucha, such as switching up the brewing process or adding water, due to strict regulations like those requiring less alcohol. As a result, production expenses can go up and kombucha might become less competitive.

IMPACT OF RUSSIAN UKRAINE WAR

In Russia, kombucha sales have decreased since the conflict began. Fruits used in kombucha, both fresh and processed, are heavily imported into Russia. Fruit is sold in a significantly smaller market in Ukraine. Exports of fresh produce to other nations are now at risk due to the conflict in Ukraine. The demand for goods like fresh tomatoes, guava, blueberries, and processed fruits and vegetables can increase at the same time. The importation of components and the sale of goods have become more challenging for enterprises as a result of the economic sanctions placed on Russia.

IMPACT OF ONGOING RECESSION

In a recession, kombucha sales may drop by 5% to 10% globally. This is due to the likelihood that customers will reduce discretionary expenditure in hard times. Since kombucha is regarded as a more expensive beverage than other drinks, it is more likely to be impacted by a recession. There may be a shift in the market for kombucha toward less expensive varieties. Larger kombucha producers are better equipped to withstand downturns in the economy. The imports and exports of fruits are disrupted due to war leading to an increase in prices of fruits and tea. Hence, this price rise indirectly effects led to inflation in the kombucha market.

MARKET SEGMENTATION

By Type

-

Natural

-

Flavoured

By Product

-

Conventional

-

Hard

-

Other

By Distribution Channel

-

Convenience/Grocery Stores

-

Specialty Retail Stores

-

Supermarkets/Hypermarkets

-

Online Stores

-

Other

.png)

REGIONAL ANALYSIS

North America made the largest contribution to the market and is anticipated to retain its position in the future. Customers who are looking for a high-quality, healthier soft drink alternative are bringing more people to the market with this beverage. Demand for products has increased as a result of consumers' desire for an ethical, environmentally friendly, and low-sugar lifestyle in the US and Canada. Additionally, the product has grown in popularity as a specialty beverage that contains probiotics and fermented foods, which may have health benefits. Demand has also increased as a result of the product's availability as a health product in more shops. The demand for kombucha among American consumers is also being driven by the use of organic kombuchas.

Asia Pacific regional market for kombucha is predicted to growth during the projection period. Due to its increased exposure and awareness in nations like China, Japan, Australia, Malaysia, and Vietnam. Kombucha is primarily a native Japanese beverage. Customers in Japan want it fermented with kelp-based tea and mildly brown in color. In other nations, kombucha is a fermented tea that is softly carbonated and delicious. Due to significant product innovation and growing brand penetration, the Japanese kombucha market began to gain traction with consumers.

Europe is expected to have the largest market, followed by North America. The need in the area has been fueled by the trend of consuming probiotic beverages and functional beverages. As the beverages become more well-known among customers as adult soft drinks, nations like Russia and the U.K. are among the top consumers of them.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Health-Ade LLC, MOMO KOMBUCHA, GT’s Living Food, Remedy Drinks, Læsk, Humm Kombucha LLC, BB Kombucha, Real Kombucha, VIGO KOMBUCHA, Equinox Kombucha, København Kombucha, GO Kombucha, and other key players are mentioned in the final report.

Remedy Drinks-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023 Health-Ade company partnered with media personality, Ryan Seacrest to share the benefits of Kombucha with the American people and Advance Their Joint Mission to Make Gut Health More Accessible.

In 2023 Caravan Coffee Roasters collaborated with Momo Kombucha, an authorised organic kombucha brewer, to develop the Gesha Coffee Kombucha.

In 2022 Just Peachy is Brew Dr. Kombucha launched the first-ever kombucha with peach flavor and nutrition. It's created with high-quality green tea and five different kinds of organic peaches.

In 2022 Remedy Drinks expanded its product portfolio in the United Kingdom by introducing the product in wild berry taste. The 'Remedy Kombucha Wild Berry' beverage will initially be available only at Tesco stores. To increase its sales of healthy products, the retail giant aims to launch 'Remedy Kombucha Mango Passion' as well as double the distribution of its existing varieties (Ginger lemon and raspberry lemonade).

| Report Attributes | Details |

| Market Size in 2022 | US$ 2.9 Billion |

| Market Size by 2030 | US$ 9.36 Billion |

| CAGR | CAGR of 15.5% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Natural, Flavoured) • By Product (Conventional, Hard, Other) • By Distribution Channel (supermarkets/hypermarkets, convenience stores, specialist stores, online retailers, and other distribution channels) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Health-Ade LLC, MOMO KOMBUCHA, GT’s Living Food, Remedy Drinks, Læsk, Humm Kombucha LLC, BB Kombucha, Real Kombucha, VIGO KOMBUCHA, Equinox Kombucha, København Kombucha, GO Kombucha |

| Key Drivers | • Increasing demand for natural and healthy beverages • The rising popularity of functional beverages |

| Market Opportunity | • Availability of a variety of flavor options in kombucha |