Biscuits Market Report Scope & Overview:

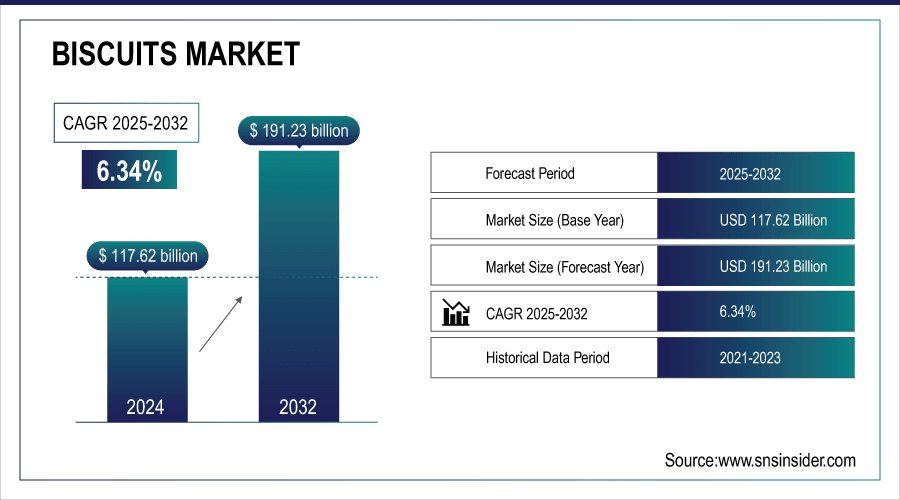

The Biscuits Market size was valued at USD 117.62 Billion in 2024 and is projected to reach USD 191.23 Billion by 2032, growing at a CAGR of 6.34% during 2025-2032.

The global market is experiencing healthy growth owing to increasing demand for convenient snacking options and premiumization through innovative flavors. This is the reason butters, low-sugar brief whole-fiber, and gluten-free biscuits are gaining share of the overall biscuit market consumer preference. This demand is being propelled by factors such as increasing retail penetration and expanding e-commerce platforms, along with the changing snacking culture of millennials and Gen Z. Therefore, countries from both sections such as developed as well as developing are majorly contributing giving the biscuits business a positive outlook around the globe.

Around 68% of global consumers report they actively look for healthier snack alternatives (low sugar, high fiber, or protein-rich).

Exotic and indulgent flavors (chocolate-coated, fruit & nut, spiced variants) now account for over 25% of new product launches annually.

To Get More Information On Biscuits Market - Request Free Sample Report

Key Biscuits Market Trends:

-

hanging consumer expectations in taste, ingredients, and packaging significantly influence biscuit market growth and long-term sustainability.

-

Manufacturers are introducing whole grain, low-sugar, gluten-free, and fortified biscuits to attract health-conscious consumers.

-

Portion-controlled packs and eco-friendly packaging provide added convenience while supporting sustainability goals.

-

Indulgent chocolate, fruit, and savory flavors are being developed to broaden product appeal and enhance brand loyalty.

-

Expansion of e-commerce and subscription-based platforms allows wider consumer reach and easier access to niche markets.

-

Digital channels provide valuable consumer insights, enabling personalized marketing campaigns and customized product offerings.

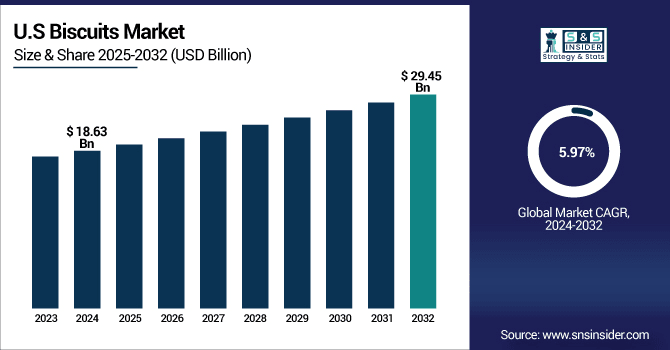

The U.S. Biscuits Market size was valued at USD 18.63 Billion in 2024 and is projected to reach USD 29.45 Billion by 2032, growing at a CAGR of 5.97% during 2025-2032. The U.S. market is growing steadily as increasing consumer demand for richer but healthy snack options such as organic, fiber-rich and low-calorie biscuits. Rising demand is bolstered by the growth of hypermarkets and online retail channels, coupled with continuous product innovations from prominent players. Furthermore, factors supporting the continued strength of the country in the North American biscuits market include trends towards premiumization and increased consumption of convenient, on-the-go snacks.

Biscuits Market Growth Drivers:

-

Product Innovation in Flavors, Ingredients, and Packaging Enhances Consumer Appeal and Drives Sustainable Growth in the Biscuits Market

Biscuits are a fast moving consumer goods (FMCG) product category wherein changing consumer expectations lead to discouragement in the growth of the market and hence any change in taste, ingredients or packaging which would result in the enhancement of consumer appeal will most likely help the biscuits market with sustainable growth in the future. To better appeal with the health conscious, manufacturers are introducing whole grain, low-sugar, gluten-free, and fortified biscuits. Innovations in packaging that feature portion-controlled packs and eco-friendly alternatives provide convenience and help achieve sustainability objectives. In addition, the development of other varieties such as indulgent chocolate, fruit and savory flavors to widen market ownership. Not only do these innovations help in establishing better differentiation of the brands, but also aids in stimulating repeat purchases, and thus solidifying consumer loyalty to the brand and promote larger market growth globally in the long run.

More than 50% of shoppers now actively seek low-sugar or fortified snack options in FMCG categories.

Over 72% of consumers prefer brands offering recyclable or biodegradable packaging, aligning with sustainability goals.

Biscuits Market Restraints:

-

Rising Health Concerns Over High Sugar, Fat, and Additive Content Pose Challenges for the Biscuits Market’s Long-Term Expansion

Although the biscuits market is booming in response to changing lifestyles, increasing awareness of dietary risks is compromising its sustainability through rising health concerns on high sugar, fat, and additive content. The growing popularity for consumption of healthy snacks over processed foods due to governments and health organizations advocating for reduced consumption of processed foods, consumers are adjusting their behavior by shifting their demand towards healthy snacks from other snacks. High prevalence of obesity, diabetes and cardiovascular diseases are attracting strict concern for nutritional labeling and regulatory oversight. Such conditions are a recipe for challenges to traditional biscuit makers, needing to reformulate biscuits or spend on healthier substitutes, to grow and retain consumer’s trust.

Biscuits Market Opportunities:

-

Rapid Expansion of E-Commerce and Online Retail Channels Drives Future Growth Opportunities for Biscuit Sales Worldwide

Future growth opportunities for biscuit sales globally are provided by the rapid expansion of the e-commerce and online retail channels, allowing for convenient direct consumer access. Manufacturers are also exploring subscription-based platforms where the service-delivery process can be completed on a base system or component part in an online-centricity trend, enabling them to reach a wider audience and offering new opportunities to target the niche markets. Premium, artisanal, and health biscuit brands enjoy better visibility on e-commerce platforms, particularly in regions with limited access to physical retail channels. Another advantage of digital is access to deep data on what consumers like, opening the door for targeted marketing campaigns and customized products. The online shift plays a major role in driving revenue and building of scalable business models for biscuit manufacturers globally.

Retail analytics show over 70% of consumers are more likely to buy when offered personalized recommendations online.

Surveys reveal that 64% of Gen Z and millennials prefer buying snacks online for home delivery convenience.

Key Biscuits Market Segment Analysis:

-

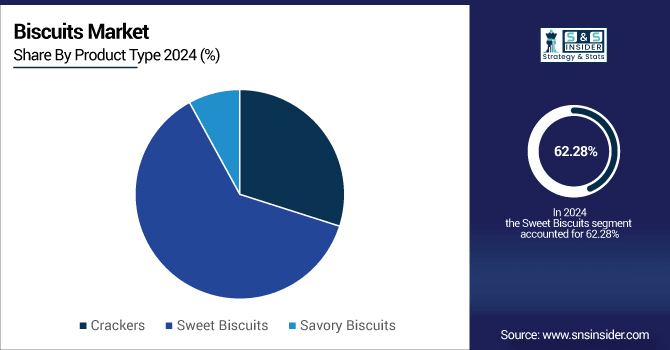

By Product Type, Sweet Biscuits held the largest share of around 62.28% in 2024, whereas Savory Biscuits is projected to be the fastest-growing segment with a CAGR of 7.40%.

-

By Flavor, Plain segment dominated the market with approximately 38.56% share in 2024, while Fruit & Nut segment is expected to register the highest growth with a CAGR of 7.30%.

-

By Distribution Channel, Hypermarkets/Supermarkets accounted for the leading share of nearly 45.20% in 2024, whereas Online segment is anticipated to be the fastest-growing segment with a CAGR of 8.40%.

-

By Packaging Type, Plastic Packets segment led the market with about 58.40% share in 2024, while Others segment is forecasted to grow the fastest at a CAGR of 7.20%.

By Product Type, Sweet Biscuits Leads Market While Savory Biscuits Registers Fastest Growth

Sweet Biscuits segment accounted for the highest revenue share of approximately 62.28% in 2024, due to the continued strong consumer demand for indulgent and versatile snacks. Mondelez International has launched brands such as Oreo and Chips Ahoy! brand, have been able to firmly hold onto this space with consistent product developments. In comparison, the Savory Biscuits segment is anticipated to achieve the highest CAGR of nearly 7.40% during the 2024–2032 period, due to the increasing preference of consumers for savory snacking options that are healthy, and high in protein.

By Flavor, Plain Segment Dominate While Fruit & Nut Segment Shows Rapid Growth

Plain segment held the largest revenue share of approximately 38.56% in 2024, as consumers are still inclined towards simple, traditional flavors providing affordability and familiarity in biscuits. And Britannia Industries has a long-established product portfolio in this space, which has created a strong consumer franchise. On the other hand, Fruit & Nut segment driven is predicted to grow at the strongest CAGR of approximately 7.30% during 2024–2032 as consumers have eye for nutrient-loaded choices combining pleasure and health.

By Distribution Channel, Hypermarkets/Supermarkets Segment Lead While Online Segment Registers Fastest Growth

The hypermarkets/supermarkets segment accounted for the largest share of biscuits market with about 45.20%, driven by product pelting, discounted bulk purchases and visibility on store shelf in 2024. With its variety of biscuit offerings, Nestlé is well supported by channel leading retailers in the segment. In addition, the Online segment is slated to grow at a fastest rate with CAGR of around 8.40% throughout the forecast period of 2024–2032 on account of growing e-commerce adoption, comfort of doorstep supply, and D2C brand name methods.

By Packaging Type, Plastic Packets Segment Lead While Others Segment Grows the Fastest

Plastic Packets segment held the largest revenue share of around 58.40% in biscuits market in 2024, as they are cost-effective and lightweight to handle and having a long shelf life to the large scale distribution, mass market segments. This trend has been leveraged by Parle Products with their low-priced biscuits in container such as affordable plastic cover shapes. On the flip side, the Others segment, however, is projected to register the highest CAGR of around 7.30% during the forecast period of 2024 - 2032 due to rise of biodegradable and premium packaging alternatives from eco-friendly and health-focused consumers.

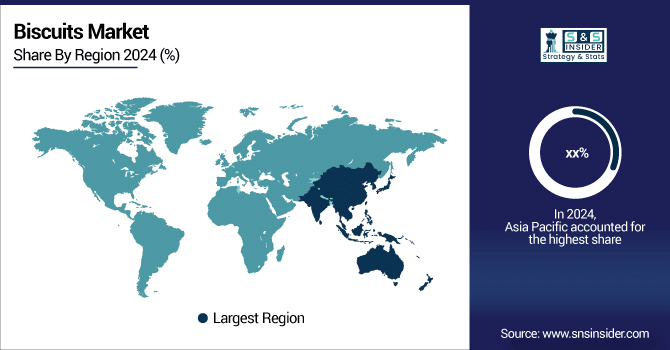

Asia Pacific Biscuits Market Insights:

The Asia Pacific region is anticipated to grow at the fastest CAGR of 7.90% during the forecast period, owing to a large population, rapid urbanization, increasing disposable incomes, and changing dietary habits. With growing demand for innovation-led flavors, health-focused options, and variety in product formats, countries including India and China are leading the way and driving enhanced market growth throughout the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Biscuits Market Insights:

The North America biscuits market is projected to grow at a stable pace as the consumers of North America are inclined towards ready-to-eat and on-the-go snacks as well as premium indulgent products. Continual product innovations along with increasing retail channels have continued to drive the U.S. as the top contributor. The long-term market growth of the region is driven by increasing preference for healthier options including low-sugar and gluten-free biscuits and increasing contribution of online retail.

Europe Biscuits Market Insights:

the Europe dominated the biscuits market with 32.50% of market revenue share in 2024, due to its well-established snacking culture, presence of global manufacturers and ability of consumers to spend on premium & traditional biscuits. With an innovative product mix, high penetration in retail complemented with artisanal offerings, the region is poised to maintain its leadership position in the global biscuits industry.

Latin America (LATAM) and Middle East & Africa (MEA) Biscuits Market Insights:

Middle East & Africa and Latin America biscuits market is growing consistently, driven by urbanization, improving disposable income and changing habits for snacking. Regional demand is bolstered by increase in the number of retail channels that offer accessible products, alongside rising consumer inclination towards premium, health-conscious and novel biscuit offerings in the UAE, Saudi Arabia, Brazil and Argentina.

Competitive Landscape for Biscuits Market:

Mondelez International is one of the global snacking giant players contributing with a robust presence in biscuits. Its iconic brands: Oreo and Chips Ahoy!, known for their decadent flavors and creative formats, from traditional cookies to thins and filled formats, around the world. Prioritizing healthier formulations, sustainable sourcing, and premiumization strategies to better align with evolving consumer preferences. Mondelez also has a strong global distribution network that allows it to maintain dominance across the developed and emerging markets, while continually building consumer loyalty through brand innovation.

-

In December 2024, Mondelez introduced six new Oreo products for 2025, including “Oreo Game Day,” “Oreo Loaded,” “Golden Oreo Cakesters,” “Irish Creme Thins,” “Mini Peanut Butter Oreos,” and Oreo Frozen Treats.

Britannia Industries is one of the largest food companies in India and a global market leader in biscuits. Good Day and Bourbon, its widely consumed flagship products, are famous for their taste and value for money. Britannia continues to breed innovation, introducing healthier alternatives to cater demand for mutant products like whole wheat and sugar-free biscuits. The company has strong brand equity with a wide reach covering almost entire India and is also expanding globally. The product diversity enables the company to target mass as well as premium consumer segments around the globe.

-

In August 2025, Britannia announced reformulating its biscuits by increasing whole-grain content and reducing sugar and sodium, as part of its health-driven efforts.

Parle Products are amongst the top biscuit manufacturers in the world, best known for the iconic Parle-G, the best-selling biscuit in the world and Hide & Seek, a leading chocolate chip biscuit. Focusing on affordability, mass-market appeal, and consistent quality create deep consumer loyalty for the company. Parle is moving into premium categories but still has a large firm grip in value-based segments. With its extensive distribution network spanning from town to countryside, it's found its way into the homes of its consumers. Parle retains its undisputed position as the most consumed biscuit brand globally, with constant innovations and adoptions in its repertoire.

-

In January 2024, Parle launched its #SeekTheHiddenPrizes Valentine’s Day campaign for Hide & Seek, featuring treasure-hunt-themed TV ads where consumers could scan packs to win exciting prizes like Samsung Galaxy smartphones.

Biscuits Market Key Players:

Some of the Biscuits Market Companies are:

-

Mondelez International

-

Nestlé S.A.

-

Britannia Industries Limited

-

Parle Products Pvt. Ltd.

-

Lotus Bakeries

-

Campbell Soup Company

-

Kellogg Company

-

ITC Limited

-

United Biscuits

-

Grupo Bimbo

-

PepsiCo, Inc.

-

Hain Celestial Group

-

Walkers Shortbread Ltd.

-

Burton’s Biscuit Company

-

Yildiz Holding

-

Arnott’s Biscuits Limited

-

Bahlsen GmbH & Co. KG

-

Danone S.A.

-

Ralcorp Holdings

-

Annas Pepparkakor AB

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 117.62 Billion |

| Market Size by 2032 | USD 191.23 Billion |

| CAGR | CAGR of 6.34% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Crackers, Sweet Biscuits and Savory Biscuits) • By Flavor (Plain, Chocolate, Cheese, Fruit & Nut and Others) • By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Independent Bakeries and Online) • By Packaging Type (Boxes, Plastic Packets and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Mondelez International, Nestlé S.A., Britannia Industries Limited, Parle Products Pvt. Ltd., Lotus Bakeries, Campbell Soup Company, Kellogg Company, ITC Limited, United Biscuits, Grupo Bimbo, PepsiCo, Inc., Hain Celestial Group, Walkers Shortbread Ltd., Burton’s Biscuit Company, Yildiz Holding, Arnott’s Biscuits Limited, Bahlsen GmbH & Co. KG, Danone S.A., Ralcorp Holdings and Annas Pepparkakor AB. |