Krypton Market Report Scope & Overview:

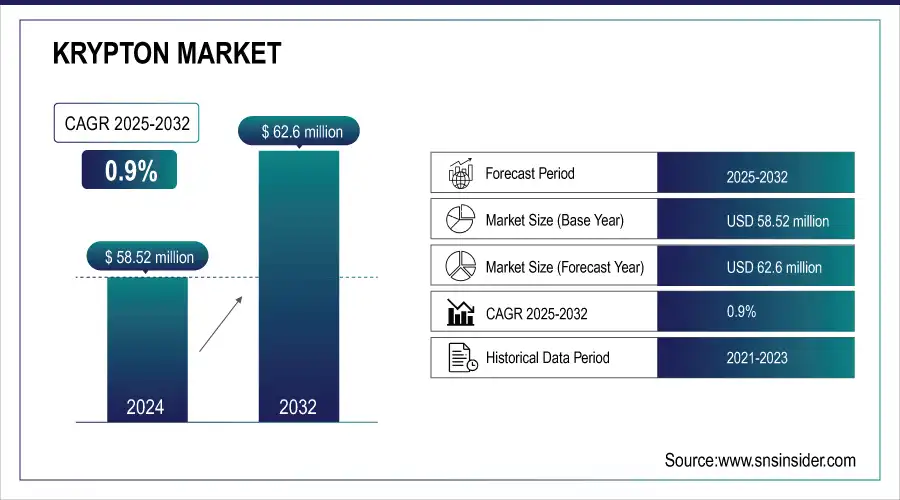

The Krypton Market Size was valued at USD 58.52 million in 2024, and is expected to reach USD 62.6 million by 2032, and grow at a CAGR of 0.9% over the forecast period 2025-2032.

The Krypton market is driven by its essential role in high-tech applications across lighting, insulation, and electronics. Krypton, a noble gas extracted from the atmosphere, is used in energy-efficient lighting solutions, such as fluorescent and incandescent lamps, and high-performance insulation windows. Its unique properties make it valuable for enhancing energy efficiency and thermal insulation, aligning with global sustainability goals. For example, Saint-Gobain's launch of krypton-filled double-glazed windows in March 2024 reflects the increased demand for energy-efficient building materials.

Get E-PDF Sample Report on Krypton Market - Request Sample Report

In the lighting industry, krypton is integral to producing energy-efficient bulbs. The shift towards more sustainable lighting solutions has bolstered krypton demand. Osram, a leading lighting manufacturer, introduced krypton-based energy-efficient bulbs in June 2023, highlighting the industry's response to stringent energy regulations and environmental concerns. These innovations in lighting demonstrate krypton’s continuing importance despite advancements in alternative technologies.

The electronics sector also relies on krypton, especially in producing plasma display panels (PDPs) and semiconductor manufacturing. Krypton is used in excimer lasers for precise semiconductor fabrication. Samsung Electronics’ krypton-based excimer laser production expansion in January 2024 illustrates the gas's crucial role in meeting the growing demand for high-performance electronic components and advanced display technologies.

Market Size and Forecast:

-

Market Size in 2024 USD 58.52 Million

-

Market Size by 2032 USD 62.6 Million

-

CAGR of 0.9% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Krypton Market Trends:

-

Strong demand for krypton gas in commercial and decorative lighting due to high luminous efficacy and energy efficiency.

-

Adoption of krypton-based lamps by premium brands like Philips Lighting and GE for enhanced brightness and longer lifespan.

-

Rising use of krypton in chip production, driving demand in the electronics sector.

-

Increasing application of N4.5 and N5 krypton types in glass panel insulation for energy-efficient buildings.

-

Continued innovation in krypton-based technologies supporting sustainable, high-performance, and aesthetically appealing solutions across industries.

Krypton Market Growth Drivers:

-

Demand for krypton gas in commercial and decorative lighting remains high

The demand for krypton gas in commercial and decorative lighting remains robust due to its unique properties that enhance lighting efficiency and aesthetics. Krypton, with its high luminous efficacy and low energy consumption, is particularly valued in the production of specialty lighting solutions that are crucial for both functional and aesthetic purposes in commercial spaces. For instance, in February 2024, Philips Lighting launched a new line of krypton-based high-performance decorative lamps designed specifically for upscale retail environments and luxury hotels. These lamps not only offer superior brightness but also a longer lifespan compared to traditional incandescent bulbs, making them a preferred choice for high-end applications where both energy efficiency and ambiance are essential. Additionally, in October 2023, General Electric (GE) introduced a series of krypton-filled bulbs for commercial use, aimed at providing brighter and more energy-efficient lighting for office buildings and public spaces. These bulbs are particularly valued for their ability to produce clear, high-quality light while reducing energy consumption and maintenance costs.

Krypton Market Restraints:

-

The upfront expense of advanced filtration systems may deter some consumers, impacting market adoption.

Disruption in the supply chain of krypton gas acts as a significant constraint in the market due to its complex extraction and processing requirements, which lead to supply volatility and price instability. Krypton is a rare gas, and its production involves intricate separation processes from atmospheric air, making it vulnerable to disruptions in the supply chain. For instance, in November 2023, Air Liquide, a major industrial gas supplier, reported a temporary halt in its krypton production facilities in Eastern Europe due to geopolitical tensions and supply chain issues in the region. This disruption caused a ripple effect across industries relying on krypton, leading to shortages and increased prices. Additionally, in February 2024, Praxair, another leading industrial gas company, experienced delays in its krypton deliveries due to a major equipment malfunction at one of its extraction plants in North America. These issues not only affected the timely supply of krypton but also contributed to rising costs for downstream industries such as lighting and glazing window manufacturers.

Krypton Market Opportunities:

The Krypton gas market is witnessing growing demand across multiple sectors, driven by its use in commercial and decorative lighting, electronics, and energy-efficient building applications. In the electronics sector, krypton is increasingly utilized in chip production, supporting semiconductor manufacturing. Simultaneously, the adoption of high-purity N4.5 and N5 krypton in glass panel insulation is rising, enabling superior thermal performance and energy efficiency. Overall, innovation and expanding applications in lighting, electronics, and construction are key factors fueling market growth.

Krypton Market Segment Analysis:

By Type

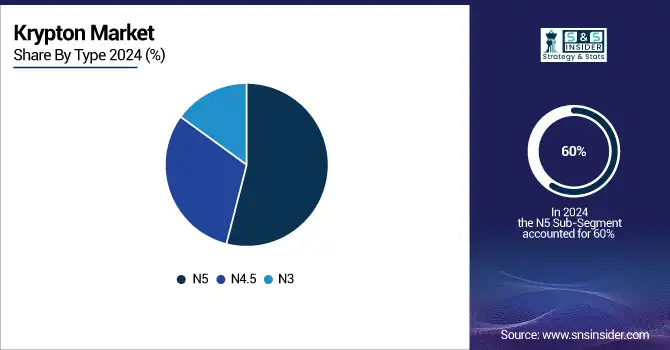

In 2024, the N5 segment emerged as the dominant segment in the krypton market due to its superior purity levels and performance in high-precision applications. N5 krypton, with its higher purity compared to N3 and N4.5 grades, is extensively used in demanding industries such as high-performance lighting and advanced glazing technologies, where even slight impurities can affect product efficiency and quality. For example, in July 2023, leading lighting company Cree Inc. adopted N5 krypton for its latest range of high-efficiency bulbs to enhance brightness and energy performance. Similarly, in October 2023, Saint-Gobain utilized N5 krypton in its advanced insulating glass units to achieve superior thermal insulation properties. As a result of these applications, the N5 segment captured approximately 60% of the krypton market share in 2023, reflecting its crucial role in high-end technological solutions and the growing preference for high-purity krypton in specialized applications.

By Supply Mode

In 2024, the Bulk & Micro Bulk segment dominated the krypton market, capturing approximately 50% of the market share. This dominance is attributed to the segment's suitability for large-scale and continuous applications that require a steady and reliable supply of krypton. For instance, in May 2023, Linde PLC expanded its bulk krypton supply capabilities to cater to the growing demands of semiconductor manufacturers, who require large quantities of krypton for production processes. Similarly, in September 2023, Air Products and Chemicals Inc. introduced new micro bulk delivery systems for krypton to support the needs of energy-efficient glazing manufacturers. The Bulk & Micro Bulk segment's ability to provide consistent and scalable supply solutions makes it the preferred choice for industries with substantial and ongoing krypton requirements, contributing to its leading position in the market.

By Application

In 2024, the Window Insulation segment emerged as the dominant application in the krypton market, holding an estimated market share of around 45%. This prominence is due to the increasing demand for energy-efficient building solutions, where krypton’s excellent insulating properties are leveraged to enhance thermal performance in glazing applications. For example, in June 2023, Guardian Glass launched a new range of krypton-filled insulating glass units designed to meet rising energy efficiency standards in both residential and commercial buildings. Similarly, in August 2023, Saint-Gobain introduced advanced window insulation solutions featuring krypton to improve energy conservation in modern architecture. The growing emphasis on reducing energy consumption and improving building sustainability has driven significant demand for krypton in window insulation, making it the leading application segment in the market.

By End-Use Industry

In 2024, the Electronics & Semiconductor segment dominated the krypton market, commanding an estimated market share of approximately 55%. This dominance is driven by the critical role krypton plays in high-precision applications such as semiconductor manufacturing and plasma display panels. For instance, in January 2023, Samsung Electronics expanded its use of krypton for excimer lasers essential in semiconductor production, reflecting the industry's need for high-purity gases to ensure the performance and reliability of advanced electronic components. Additionally, in March 2023, Intel Corporation reported increased krypton usage in the production of its latest microchips, highlighting the segment's reliance on krypton for high-tech manufacturing processes. The electronics and semiconductor industry's substantial demand for krypton underscores its leading position in the market.

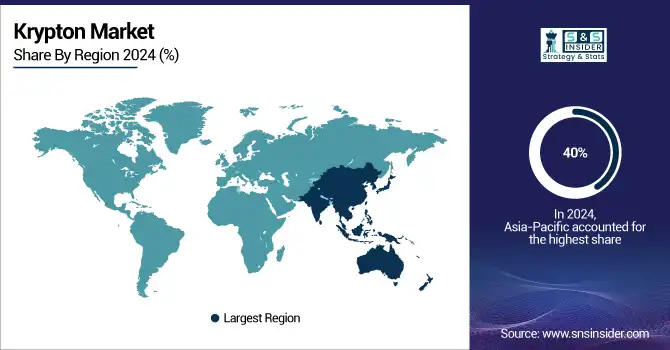

Krypton Market Regional Analysis:

Asia Pacific Krypton Market Insights

In 2024, the Asia-Pacific region dominated the krypton market, capturing approximately 40% of the global market share. This dominance is largely due to the region's robust electronics and semiconductor manufacturing sectors, which are major consumers of krypton. For instance, in March 2023, TSMC (Taiwan Semiconductor Manufacturing Company) significantly increased its krypton procurement to support its advanced semiconductor production lines in Taiwan. Similarly, in July 2023, LG Display ramped up its krypton usage for its OLED panel production in South Korea, driven by rising demand for high-performance display technologies. The Asia-Pacific region’s strong industrial base and technological advancements in electronics and semiconductor industries contribute to its leading position in the krypton market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

North America Krypton Market Insights

In 2024, the North American region emerged as the fastest-growing region in the krypton market, with an estimated market share growth of approximately 30% compared to the previous year. This rapid growth is driven by the expansion of high-tech industries, particularly in electronics and semiconductor manufacturing, which are major consumers of krypton. For example, in April 2023, Intel announced a major investment in its semiconductor fabrication facilities in the United States, increasing its krypton consumption for advanced chip production. Additionally, in August 2023, Tesla expanded its use of krypton for high-performance lighting in its electric vehicles, further boosting demand in the region. North America's growth is also supported by increased investments in energy-efficient building solutions, such as krypton-filled insulating glass, reflecting a broader trend toward sustainable technologies. This combination of factors has positioned North America as the fastest-growing region in the krypton market.

Europe Krypton Market Insights

Europe’s krypton market is driven by strong demand in commercial and decorative lighting, semiconductor manufacturing, and energy-efficient glass insulation. Stringent energy-efficiency regulations and growing adoption of sustainable lighting solutions support market growth, while technological advancements in high-purity krypton applications further enhance its use across industrial and commercial sectors.

Latin America (LATAM) and Middle East & Africa (MEA) Krypton Market Insights

The LATAM and MEA krypton markets are gradually expanding, fueled by rising electronics manufacturing, construction of energy-efficient buildings, and growing commercial lighting demand. Limited local production encourages imports and partnerships, while government initiatives promoting sustainable technologies and infrastructure development present long-term opportunities for krypton adoption across multiple applications.

Krypton Market Key Players:

- Messer Group GmbH

- Air Liquide

- Air Products & Chemicals Inc

- Linde PLC

- Air Water Inc

- Praxair Inc

- Proton Gases Pvt. Ltd

- Coregas Pty Ltd

- Iceblivk Ltd

- Electronic Fluorocarbons

Competitive Landscape for Krypton Market:

Linde PLC is a global leader in industrial gases, including krypton, supplying high-purity gases for applications in lighting, electronics, and glass insulation. The company supports semiconductor manufacturing, energy-efficient lighting, and advanced industrial processes. Linde’s extensive production, distribution network, and innovation in specialty gases position it as a key player in the krypton market.

-

June 2023: Linde PLC announced the opening of one of the world’s largest plants for the production and filling of krypton and xenon at Leuna, Germany. The move is anticipated to enable the company to consolidate its European noble gas production at the Leuna site in Germany.

| Report Attributes | Details |

| Market Size in 2024 | USD 58.52 Million |

| Market Size by 2032 | USD 62.6 Million |

| CAGR | CAGR of 0.9% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (N3, N4.5, N5) •By Supply Mode (Cylinders, Bulk & Micro bulk, Drum tanks, Others) •By Application (Laser, Window Insulation, Lightning, Others) •By End-Use Industry (Construction, Automotive, Healthcare, Electronics & Semiconductor, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Messer Group GmbH, Air Liquide, Air Products & Chemicals Inc, Linde PLC, Air Water Inc, Praxair Inc, Proton Gases Pvt. Ltd, Coregas Pty Ltd, Iceblivk Ltd, Electronic Fluorocarbons, LLC and other players |