Labor Management System Market Report Scope & Overview:

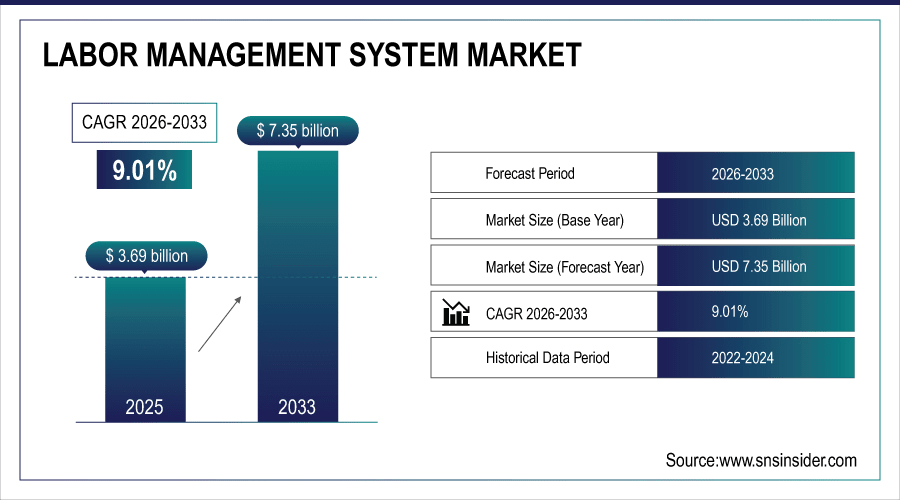

The Labor Management System Market Size was valued at USD 3.69 Billion in 2025E and is expected to reach USD 7.35 Billion by 2033 and grow at a CAGR of 9.01% over the forecast period 2026-2033.

The Labor Management System Market growth is primarily driven by the combination of high demand amongst organizations for workforce efficiency and corresponding reduction of labor costs. From industry to industry, businesses are being more burdened by increasing labor costs, complex scheduling needs, and the increasing effort to ensure labor laws compliance. By offering real-time employee attendance tracking, productivity monitoring, automated scheduling, and labor analytics, LMS solutions allow businesses to enhance use of the workforce and reduce operational cost. Furthermore, the growing trend of digital transformation and cloud-based solutions has sped up learning management system deployment, enabling organizations of every size to easily implement scalable and cost-effective workforce management solutions. According to study, Organizations adopting LMS report up to 20–25% improvement in workforce efficiency due to optimized scheduling and productivity monitoring.

To Get More Information On Labor Management System Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 3.69 Billion

-

Market Size by 2033: USD 7.35 Billion

-

CAGR: 9.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Labor Management System Market Trends

-

Real-time workforce monitoring increasingly adopted to enhance productivity and efficiency.

-

Automated scheduling solutions reduce labor costs and prevent overstaffing issues globally.

-

Cloud-based LMS platforms gaining popularity due to scalability and lower infrastructure investment.

-

AI-driven predictive analytics improving labor demand forecasting and workforce planning accuracy.

-

Integration of LMS with HR and payroll systems streamlines operations significantly.

-

SMEs increasingly adopting cloud LMS solutions to optimize workforce remotely and efficiently.

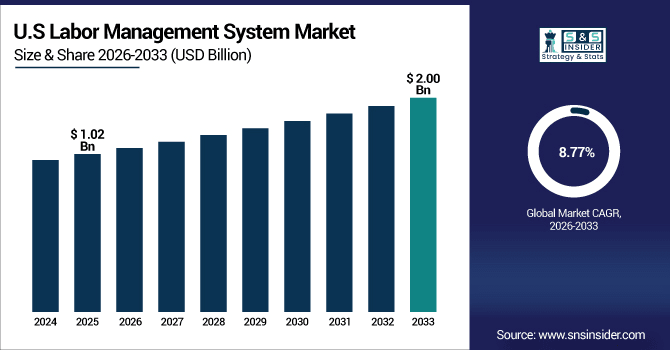

The U.S. Labor Management System Market size was USD 1.02 Billion in 2025E and is expected to reach USD 2.00 Billion by 2033, growing at a CAGR of 8.77% over the forecast period of 2026-2033, driven by advanced adoption of AI and cloud-based solutions, enabling real-time workforce tracking, automated scheduling, labor analytics, and compliance management, enhancing productivity, reducing labor costs, and optimizing operational efficiency across industries.

Labor Management System Market Growth Drivers:

-

Rising Demand for Workforce Optimization Boosts LMS Market Growth Globally

Organizations across industries are under constant pressure to improve workforce efficiency while controlling labor costs. The increasing cost of labor coupled with complicated scheduling demands has made it inefficient and error prone to manage a large, dispersed workforce manually. An LMS solution offers real-time tracking of employee attendance, productivity tracking, automatic scheduling, and labor analytics. With the help of these tools, businesses can control overtime, avoid understaffing or overstaffing, and use human resources in an optimal manner. The need for operational efficiency and cost effectiveness is fuelling the global adoption of LMS, especially among large enterprises and high-growth small to medium-enterprises (SMEs).

Automated scheduling and labor analytics can reduce manual errors by approximately 30%.

Labor Management System Market Restraints:

-

High Implementation Costs Challenge LMS Adoption Among Small Enterprises

The Implementing of Labor Management System Market solutions can prove very costly which can be a huge hindrance even when advantages are many especially for SMEs who generally need to operate in budgets. Expenses are related to software licensing, hardware infrastructure (for on-premises solutions), training, and continual maintenance or subscription fees for cloud-based platforms. Moreover, connecting LMS with already existing ERP, HR or payroll systems may demand technical expertise also and will also include further investment. Such factors can delay adoption, especially in the most cost-sensitive regions or sectors where labour management is a straightforward task.

Labor Management System Market Opportunities:

-

Cloud-Based AI Solutions Unlock Significant Growth Potential in LMS

The rapid adoption of cloud computing and AI technologies presents a significant growth opportunity for the Labor Management System market. Cloud LMS solutions offer low up-front infrastructure cost, easily scalable delivery and remote access that are appealing to both SMEs and multi-national enterprises. In addition, labor demand forecasting, smart scheduling, and performance monitoring powered with AI and predictive analytics improve organizations capacity to optimize workforce planning on the flight. Novel AI-Driven Labor Management System solutions are going to be the hotbed of investment and there are many candidates to garner interest and start a bidding war for these Labor Management System development companies.

Intelligent scheduling features enabled by AI can reduce under- or overstaffing by 20–25%.

Labor Management System Market Segmentation Analysis:

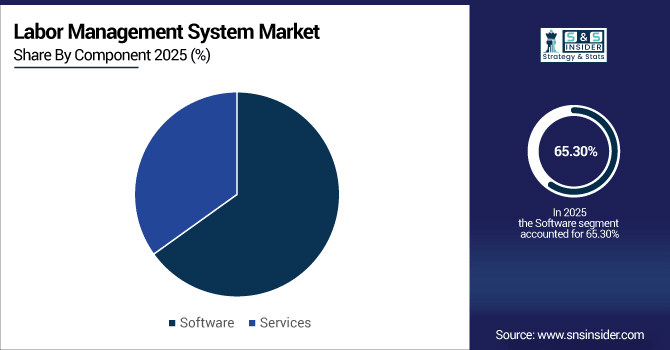

• By Component: In 2025, Software led the market with a share of 65.30%, while Services is the fastest-growing segment with a CAGR of 10.40%.

• By Deployment Mode: In 2025, Cloud led the market with a share of 55.60%, while On-Premises is the fastest-growing segment with a CAGR of 9.50%.

• By Organization Size: In 2025, Large Enterprises led the market with a share of 60.20%, while Small and Medium Enterprises (SMEs) is the fastest-growing segment with a CAGR of 10.80%.

• By Industry Vertical: In 2025, Retail led the market with a share of 30.14%, while Healthcare is the fastest-growing segment with a CAGR of 10.60%.

By Component, Software Leads Market and Services Fastest Growth

In the Labor Management System market, The software segment had the largest market share due to the software's ability to seamlessly record workforce location, monitor productivity, and optimize scheduling automatically and effectively. It is the scalable nature of LMS software, their integration with HR and payroll systems, and the ability to deliver real-time insights that enhances operational efficiency and reduces the cost of labour in enterprises. On the other hand, services are the fastest-growing segment, fueled by an increasing demand for support in cloud deployment, implementation, consulting, and training. The growing need for smooth LMS adoption and enhanced workforce performance across organizations, especially SMEs, along with compliance, is motivating organizations to maximize the benefits of LMS services, and thus, services are identified as one of the high growth opportunity areas in the burgeoning LMS market.

By Deployment Mode, Cloud Leads Market and On-Premises Fastest Growth

The cloud deployment segment accounted for the largest share of the Labor Management System Market, owing to its scalability, remote access, relatively lower upfront costs and ease of integration with enterprises' existing systems. Cloud-based LMS platforms help organizations streamline the management of their workforce scheduling, attendance tracking and labor analytics in real-time, which in turn leads to enhancement in productivity and operational efficiency. On-premises deployment, however, is the fastest-growing segment, with a handful of enterprises that want more control over their data security, customization, and regulations. On-premises solution for organizations, which provides customized configurations that will benefit the organization and also directly managing the system.

By Organization Size, Large Enterprises Lead Market and Small and Medium Enterprises (SMEs) Fastest Growth

In the Labor Management System market, large enterprises lead the market, leveraging LMS solutions to manage complex workforce, optimize labor costs, and increase productivity across different departments and locations using LMS solutions. Robust capabilities like automated scheduling, real-time attendance tracking, labor analytics, and compliance management serve large organizations looking for scalable workforce planning tools. On the other hand, SMEs are the most rapidly expanding vertical segment due to the launching of relatively economical, cloud-based LMS solutions available in the market. LMS platforms are gaining momentum amongst SMEs with a need to streamline operations, minimize manual labor errors and enter a new phase of employee engagement. Overall LMS market growth worldwide is being driven by growth from large enterprises and SMEs.

By Industry Vertical, Retail Leads Market and Healthcare Fastest Growth

The Retail industry holds the largest share in Labor Management System (LMS) market, as intricacies of workforce, seasonal need for labor, are on the rise, which needs usual systematic requirement of attendance and productivity monitoring. LMS solutions enable retail companies to improve workforce management, leading to effective optimization of labor costs, enhanced operations, and better customer service. At the same time, the healthcare industry is the fastest-growing ingredient as the need for hospitals and clinics to manage shifts, compliance with labor regulations, and employee performance is increasing. Cloud-based and AI-enabled LMS platforms are being rapidly adopted to optimize workforce planning, minimize the administrative load and perfect patient care, fueling the market growth.

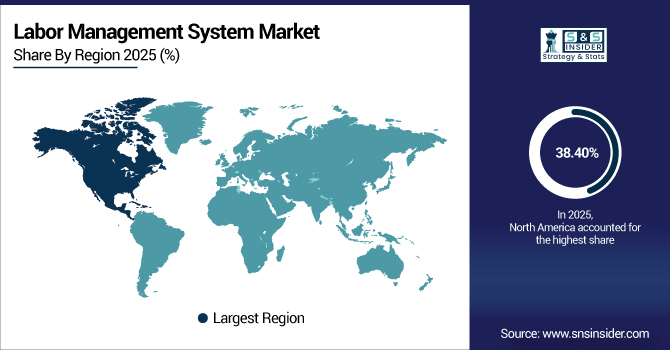

Labor Management System Market Regional Analysis:

North America Labor Management System Market Insights:

The Labor Management System Market in North America held the largest share 38.40% in 2025, Owing to increasing labor optimization and operational efficiency. The significant adoption of cloud-based and AI-powered LMS solutions facilitates attendance tracking in real time, automated scheduling, and predictive labor analytics. Reduced labor costs, better management of resources, and productivity make it beneficial for organizations. The growing emphasis on employee engagement and monitoring compliance also accelerates adoption of LMS solutions. Strong tech infrastructure and innovations in the workforce management solutions ensure the growth of the market over time.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Labor Management System Market with Advanced Technological Adoption

U.S. dominates the Labor Management System market, driven by advanced technological adoption, including AI, cloud-based solutions, real-time workforce tracking, automated scheduling, predictive analytics, and enhanced operational efficiency.

Asia-Pacific Labor Management System Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Labor Management System Market, projected to expand at a CAGR of 9.88%, due to rapid industrialization, growth of SMEs, and the growing complexity of organizations and workforce. Some organizations are choosing cloud-based and AI-enabled LMS solutions to balance scheduling, provide productivity tracking, and help improve labor cost efficiency. As digital transformation initiatives pick up pace, and the realization of the efficacy of workforce optimization starts to permeate across every industry, LMS deployment is on the rise. Cloud platforms are flexible and scalable, making them ideal for businesses that are sensitive to costs, while performing predictive analytics helps improve labor forecasting and resource planning.

China and India Propel Rapid Growth in Labor Management System Market

China and India drive rapid Labor Management System market growth, fueled by industrial expansion, SME adoption, workforce digitization, cloud-based LMS solutions, AI integration, and increasing demand for efficient labor management processes.

Europe Labor Management System Market Insights

The Labor Management System Market in Europe is significant due to backed-up by investments in digital workforce management and automation technologies. Labor Management System solutions can make the complex of employee scheduling, productivity, and labor compliance relatively more effortless and universal experience across sectors. Cloud-based platforms for AI-driven analytics will make predictive labour forecasting and improved resource utilisation more feasible. The rising emphasis on operational efficiency, employee engagement & cost reduction drives the medium & large enterprises to embrace it. The other factor which forces LMS to deploy is the fast pace technological advancements along with the easily available IT infrastructure.

Germany and U.K. Lead Labor Management System Market Expansion Across Europe

Germany and the U.K. lead Europe’s Labor Management System market expansion, driven by advanced workforce automation, cloud-based LMS adoption, AI integration, operational efficiency improvements, and growing demand for labor optimization solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Labor Management System Market Insights

The Latin America and Middle East & Africa regions are emerging markets for the Labor Management System Market, showing steady growth driven are experiencing moderate growth with rising adoption of LMS, their limited functionalities are a matter of concern. Organizations based in these regions are progressively adopting cloud-based and AI-enabled LMS solutions to facilitate scheduling, measure productivity, and minimize labor costs. The increasing need for operational efficiency, compliance requirements, and workforce analytics is promoting both SMEs and large enterprises to deploy their Learning Management Systems. Although adoption is lagging as compared to North America and Europe, the evolving IT infrastructure, various government initiatives and growing investments in digital workforce solutions are facilitating a steady market growth.

Labor Management System Market Competitive Landscape

Oracle’s LMS solutions integrate real-time workforce tracking, automated scheduling, and labor analytics within its Fusion Cloud HCM platform. Advanced AI features optimize staffing, reduce overtime, and improve resource utilization. Oracle focuses on scalability and cloud-based accessibility, empowering enterprises of all sizes to enhance productivity and achieve operational efficiency.

-

In May 2024, Oracle introduced self-scheduling alert notifications in Fusion Cloud Workforce Scheduling 24B, enhancing communication between workers and schedule managers.

Workday leverages AI-driven LMS solutions, offering automated scheduling, predictive labor analytics, and real-time workforce insights. Its Workday Assistant and AI agents streamline HR and finance tasks while enhancing employee productivity. Continuous innovations and global cloud-based deployment enable Workday to serve diverse industries, driving efficient labor management and operational excellence.

-

In September 2024, Workday unveiled the new Workday Assistant, an AI-powered companion designed to help employees’ complete HR and finance tasks more efficiently.

ADP provides comprehensive workforce management solutions, including time and attendance, scheduling, payroll, and compliance management. Its LMS offerings help organizations optimize labor costs, improve operational efficiency, and enhance employee engagement. ADP’s acquisition of WorkForce Software further strengthens its global LMS presence, catering to both large enterprises and growing SMEs.

-

In October 2024, ADP announced the acquisition of WorkForce Software, expanding its global offering and driving workforce management innovation to meet future business needs

Labor Management System Market Key Players:

Some of the Labor Management System Market Companies are:

-

Oracle

-

Workday

-

Dayforce

-

Infor

-

ADP

-

UKG

-

Kronos

-

SAP SuccessFactors

-

Reflexis Systems

-

Kronos Workforce Ready

-

Epicor

-

Ascentis

-

Kronos Dimensions

-

Kronos Workforce Central

-

BambooHR

-

Paycor

-

Paychex

-

Quinyx

-

TimeClock Plus

-

Deputy.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.69 Billion |

| Market Size by 2033 | USD 7.35 Billion |

| CAGR | CAGR of 9.01 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Software, Services) •By Deployment Mode (On-Premises, Cloud) •By Organization Size (Small and Medium Enterprises, Large Enterprises) •By Industry Vertical (Retail, Manufacturing, Healthcare, Transportation and Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Oracle, Workday, Dayforce (Ceridian), Infor, ADP (including WorkForce Software), UKG (Ultimate Kronos Group), Kronos, SAP SuccessFactors, Reflexis Systems (Zebra Technologies), Kronos Workforce Ready, Epicor, Ascentis, Kronos Dimensions, Kronos Workforce Central, BambooHR, Paycor, Paychex, Quinyx, TimeClock Plus, Deputy, and Others. |