Wealth Management Software Market Size Analysis:

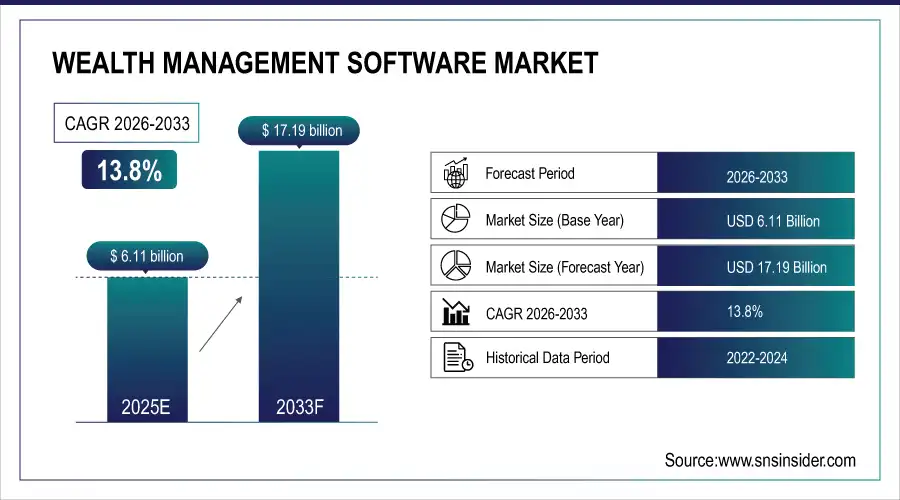

The Wealth Management Software Market was valued at USD 6.11 billion in 2025E and is expected to reach USD 17.19 billion by 2033, growing at a CAGR of 13.8% from 2026-2033.

The Wealth Management Software Market is growing due to rising demand for digital transformation in financial services, increasing adoption of AI and cloud-based platforms, and the need for personalized investment and advisory solutions. Expanding wealth management services, regulatory compliance requirements, and the shift towards automated portfolio management further drive growth. Additionally, growing client expectations for real-time insights and enhanced customer experiences are boosting software adoption across banks, financial institutions, and advisory firms.

Wealth Management Software Market Size and Forecast

-

Market Size in 2025E: USD 6.11 Billion

-

Market Size by 2033: USD 17.19 Billion

-

CAGR: 13.8% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Wealth Management Software Market Market - Request Free Sample Report

Wealth Management Software Market Trends

-

Rising demand for digital wealth management solutions is driving the wealth management software market.

-

Growing adoption of AI, analytics, and robo-advisory tools is enhancing portfolio management and client insights.

-

Expansion across banks, brokerage firms, and financial advisory services is boosting market growth.

-

Increasing focus on personalized investment strategies, risk assessment, and compliance is shaping adoption trends.

-

Integration with CRM, ERP, and mobile platforms is improving efficiency and customer experience.

-

Advancements in cloud-based deployment, cybersecurity, and data analytics are supporting scalability and reliability.

-

Collaborations between software providers, financial institutions, and fintech startups are accelerating innovation and global adoption.

Wealth Management Software Market Growth Drivers:

-

The adoption of advanced financial technology is enhancing efficiency and service quality in wealth management, driving market growth.

The increase in the adoption of financial technology (fintech) is playing a major role for the growth of wealth management software market. Tech solutions in the financial services industry are being adopted more widespread to improve internal operations and provide a better service all-around for clients. A report by Deloitte states that 80% of wealth management firms are putting resources in technology to remain competitive and deliver services according to their clients' changing circumstances. That is what the growing focus on digital tools that automate low-interest but complex processes and decisions suggests. For instance, the growth of robo-advisors employing algorithms that offer financial advice with minimal human intervention is one.

By early 2024, the total global assets under robo-advisory groing with significant growth rate exemplifying their growing significance in wealth management. They create the cost-effective and enabled broad client base for driving fintech adoption in this sector.

Wealth Management Software Market Restraints:

-

Substantial initial and maintenance costs can deter smaller firms from adopting advanced wealth management software.

The data security and privacy concerns are one of a major factor that are restraining the global Wealth Management Software market. As the amounts of financial data handled by these systems has increased, it is critical to provide strong security controls. This underscores the significant monetary impacts of security breaches. stringent data protection regulations in several countries, like the General Data Protection Regulation (GDPR) for European nations and the California Consumer Privacy Act (CCPA) within the US are also increasing pressure on wealth management firms to enhance their data security. These regulations impose strict requirements on how personal data must be handled, leading to increased costs for compliance and risk management. Applying these standards to wealth management software often entails complexity and a significant financial investment.

Wealth Management Software Market Segment Analysis

By Application, Portfolio, Accounting, and Trading Management dominated the Market, while Financial Advice & Management is expected to grow at the fastest CAGR

The segment of portfolio, accounting and trading management dominated the market in 2025, contributed a revenue share more than 22%. The rise in demand for portfolio management and trading solutions accounts for the major share of this segment. This platform provides trading managers with a chance to concentrate of teamwork and increase customer service. As increase in pressure develops to handle customer info, stockholders, portfolio managers as well as trading manager are very quickly moving adopting wealth management solutions.

Wealth managers are using these platforms to streamline financial data and help clients make decisions. Moreover, financial advice and management segment is estimated to expand at the highest CAGR over the forecast period. Digitization has been a common trend in enterprises across the globe owing to which businesses are focusing on digitizing business processes, improving operational efficiency and increasing customer relationship management thus shifting their focus towards financial advice & solutions., is expected to drive demand for Financial Advice Solution & services market.

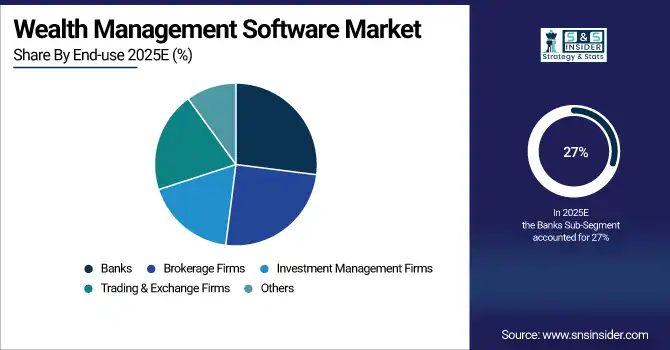

By End-use, Banks held the largest revenue share in 2025, with Trading & Exchange Firms projected to register the fastest growth

In 2025, the banks sector held the largest share of revenue in this market which accounted for more than 27% revenue share. When the world economy continues to grow at a slow pace, people's money and wealth are increasing assets and wealth of individuals. They are also adopting wealth management software to enhance their client-focused services. There are many other companies offering wealth management and processing solutions to address the changing landscape of banks, reduce cost-to-serve and effect low touch operations in global markets.

Trading & exchange firms is expected to be the fastest growing segment in this segment, over the forecast period. Technological advancements are opening up completely new dimensions in this area for wealth management software. With that in mind, trading and exchange firms have also begun to utilize these solutions more frequently for managing client assets. Moreover, the digitalization in trading firms is enabling clients to easily access their accounts and monitor their financial portfolios, which is driving further growth in this sector.

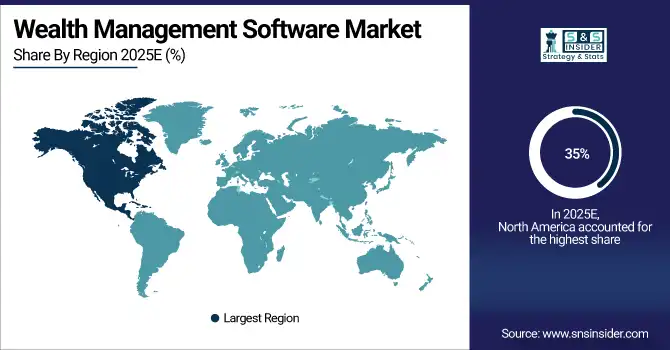

Wealth Management Software Market Regional Analysis

North America Wealth Management Software Market Insights

North America, in 2025 held a dominant position, accounting for over 35% of the revenue share. The region has seen an increase in High-Net-Worth Individuals (HNWIs), who have a growing appetite for more advanced financial advisory services. They are also home to a sizeable pool of well-established market players and rapidly digitalizing financial industry spread across multiple countries. Retail high value customers rely on wealth management services for retention and acquisition. Affluent mass customers in the region contribute significantly to the net income of retail banks.

Get More Information on Wealth Management Software Market - Enquiry Now

Asia Pacific Wealth Management Software Market Insights

In the regional markets, Asia Pacific is anticipated to grow with a faster annual growth rate during forecast period. The region has been identified as a lucrative environment for robo-advisors given higher rates of digital platform usage. Tech-savvy customers are increasingly adopting robo-advisory solutions that leverage sophisticated marginal analytics and high-end algorithms for optimizing their investment decisions more effectively. Moreover, rapid increase in small & medium enterprises (SMEs) across developing economies such as China and India is anticipated to offer numerous growth prospects for this market.

Europe Wealth Management Software Market Insights

Europe dominates the Wealth Management Software Market due to the presence of established financial institutions, advanced digital infrastructure, and strong regulatory frameworks promoting technology adoption. Growing demand for personalized investment solutions, automated portfolio management, and cloud-based platforms is driving market expansion. Increasing focus on compliance, risk management, and seamless client experiences further supports growth. Additionally, innovation by key regional software providers and rising adoption among banks and wealth advisors are fueling the market.

Middle East & Africa and Latin America Wealth Management Software Market Insights

The Middle East & Africa Wealth Management Software Market is growing as financial institutions adopt digital and cloud-based solutions to enhance investment advisory and portfolio management. Rising high-net-worth individuals and increasing demand for personalized wealth services drive growth. In Latin America, the market expands due to digital transformation in banking, regulatory modernization, and rising awareness of automated wealth management tools. Both regions are witnessing increased adoption of AI-driven platforms for efficient and secure financial management.

Wealth Management Software Market Competitive Landscape:

SS&C Technologies Holdings, Inc.

SS&C Technologies is a global provider of software and services for the financial services and healthcare industries. In wealth management, SS&C focuses on integrating portfolio management, trust, and financial planning solutions into unified platforms that streamline advisor workflows, improve client engagement, and enhance operational efficiency. The company leverages digital-first technology to modernize account access, reporting, and lifecycle management for wealth managers, supporting both advisors and end clients.

-

2025: Launched SS&C Black Diamond® Wealth Solutions, unifying wealth and trust tech into a single suite to streamline operations and client lifecycle tools.

-

2025: Powers Wesleyan’s digital-first wealth platform via SS&C Hubwise, modernizing adviser access to accounts and investments.

-

2023: Expanded Black Diamond Wealth Platform with RightCapital financial planning collaboration, enhancing advisor planning tools.

Broadridge Financial Solutions, Inc.

Broadridge provides technology-driven solutions for wealth management, capital markets, and investor communications. Its wealth management offerings include integrated platforms that enhance client engagement, streamline advisor workflows, and provide end-to-end investment lifecycle tools. The company emphasizes innovation and global expansion, acquiring complementary platforms to strengthen regional presence and ensure comprehensive solutions for advisors and institutions.

-

2024: Acquired Kyndryl’s SIS wealth tech platform, strengthening Canadian wealth management software footprint.

Fiserv, Inc.

Fiserv is a global provider of financial services technology solutions, including wealth management platforms. The company focuses on unifying managed account products, digital retirement planning, and advisory tools to help advisors deliver seamless, efficient, and personalized services. Fiserv integrates retirement planning, portfolio management, and client engagement solutions into a cohesive ecosystem for modern wealth management.

-

2025: Accelerated Unified Wealth Management Platform, integrating managed account products into a single service chassis for advisors.

-

2025: Added Vestwell digital retirement planning solution into its wealth management network, enhancing advisor planning capabilities.

Key Players

Some of the Wealth Management Software Market Companies

-

SS&C Technologies Holdings, Inc.

-

Fiserv, Inc.

-

Fidelity Information Services (FIS)

-

Broadridge Financial Solutions, Inc.

-

Temenos AG

-

SEI Investments Company

-

Profile Software S.A.

-

Objectway S.p.A.

-

Finantix

-

InvestEdge, Inc.

-

Comarch SA

-

Dorsum Ltd.

-

Avaloq Group AG

-

Envestnet, Inc.

-

InvestCloud

-

Morningstar, Inc.

-

Refinitiv

-

Charles River Development

-

SimCorp A/S

-

Addepar

| Report Attributes | Details |

| Market Size in 2025 | US$ 6.11 Bn |

| Market Size by 2033 | US$ 17.19 Bn |

| CAGR | CAGR of 13.8% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Advisory Mode (Human Advisory, Robo Advisory, Hybrid) • By Deployment (Cloud, On-premise) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By Application (Financial Advice & Management, Portfolio, Accounting, & Trading Management, Performance Management, Risk & Compliance Management, Reporting, Others) • By End-use (Banks, Investment Management Firms, Trading & Exchange Firms, Brokerage Firms, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | SS&C Technologies Holdings, Inc., Fiserv, Inc., Fidelity Information Services (FIS), Broadridge Financial Solutions, Inc., Temenos AG, SEI Investments Company, Profile Software S.A., Objectway S.p.A., Finantix, InvestEdge, Inc., Comarch SA, Dorsum Ltd., Avaloq Group AG, Envestnet, Inc., InvestCloud, Morningstar, Inc., Refinitiv, Charles River Development, SimCorp A/S, Addepar |