Advanced Malware Detection Market Report Scope & Overview:

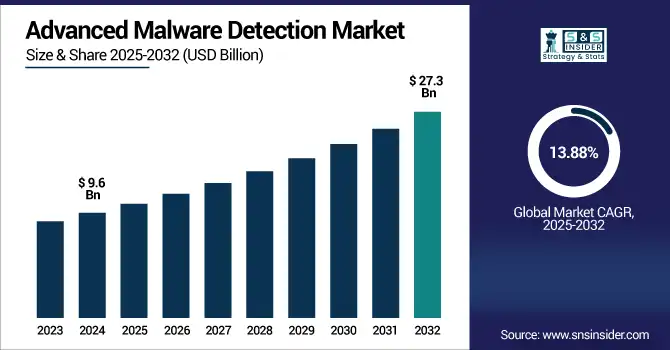

The advanced malware detection market size was valued at USD 9.6 billion in 2024 and is expected to reach USD 27.3 billion by 2032, growing at a CAGR of 13.88% during 2025-2032.

To Get more information on Advanced Malware Detection Market - Request Free Sample Report

The advanced malware detection (AMD) market growth is gaining strong momentum as cyber threats are becoming more advanced and are rapidly proliferating across digital ecosystems. With workforces across the globe returning to some sense of normality, organizations are quickly embracing AMD solutions to become proactive against zero-day attacks, ransomware, polymorphic malware, and advanced persistent threats by detecting, isolating, and mitigating these threats within minutes. Demand across crucial sectors such as BFSI, healthcare, and government is on the rise owing to high compliance pressure and the need to protect fiduciary data. The growth of cloud-based deployments and integration with AI/ML technologies is further contributing to the market growth by allowing real-time threat intelligence and automated response capabilities. The growing prevalence of remote work, IoT networks, and hybrid IT environments only makes the attack surface even wider and the need for advanced detection capabilities even more acute.

In the U.S. Advanced Malware Detection (AMD) Market trend is driven by rising Ransomware attacks, federal cybersecurity mandates, and accelerated digital transformation among enterprises. The market is expected to grow from USD 3.0 billion in 2024 to USD 8.3 billion by 2032, at a CAGR of 13.66%. Adoption of AI-powered threat detection and zero-trust frameworks will further accelerate market growth.

Market Dynamics:

Drivers:

-

Rising Cyberattack Sophistication Is Driving Increased Demand for AI-Powered Malware Detection Solutions

The huge volume of extremely sophisticated cyber threats, including polymorphic malware, ransomware-as-a-service, and advanced persistent threats, is a key factor boosting the AMD market. Such a situation makes it extremely hard to detect its presence by traditional security systems, providing enormous room for the market for modern malware detection tools based on AI, behavioral analytics, and sandboxing methods. The increased number of human-operated attacks only exacerbates this situation as more enterprises move to digital and remote work, so the need for early detection and active response is more than ever. The enterprises, particularly in high-growth segments such as BFSI, healthcare, and government sectors, are aggressively investing in AMD solutions to secure sensitive data, drive into compliance, and retain customer confidence.

In 2024, ransomware attacks increased by 37% globally, with an average of 1,900 attacks per day, according to Check Point Research.

Restraints:

-

High Deployment and Maintenance Costs Are Limiting Adoption Among Small and Mid-Sized Enterprises

Although this is advantageous, the deployment and operation of extensive malware detection systems demands considerable resources, restricting the use of advanced systems, especially for small and medium-sized enterprises (SMEs). These solutions, however, typically require the integration of your existing IT infrastructures and investment in high-performance hardware alongside skilled cybersecurity professionals to manage and respond. Then there are ongoing costs for updates and threat intelligence feeds. This consequently makes adoption difficult for many organisations in emerging markets or sectors with a constrained budget. Without more affordable, scaled, and SaaS-based AMD solutions offered on the market, the cost barrier will likely hamper its market potential.

In 2024, 62% of small and mid-sized enterprises (SMEs) reported that budget limitations were their primary barrier to adopting advanced cybersecurity tools like AI-based malware detection systems

Opportunities:

-

Integration of AI and Machine Learning Is Enabling Real-Time, Adaptive Threat Detection Capabilities

The use of artificial intelligence (AI) and machine learning (ML) in malware detection systems creates potential growth opportunities for the AMD market. This allows for improved threat detection through continual learning from previous cyberattacks and real-time adaptation to new forms of malware. AI-enabled analytics can lower false positives, automate threat hunting, and make cybersecurity postures more proactive with predictive capabilities. As cyber threats continue to grow in sophistication and evasiveness, the need for intelligent, adaptive security tools is increasing. With low latency and real-time, dynamic capabilities that AMD platforms enable, we are seeing vendors embedding AI/ML into their offerings as a way to both unlock new capabilities and create differentiation in the competitive landscape, especially for the regulated industries.

AI-enhanced malware detection tools achieved an average detection accuracy of 98.2% in 2024, compared to 89.5% for traditional signature-based systems

Challenges:

-

Advanced Evasion Techniques and Encrypted Malware Are Complicating Accurate and Timely Threat Detection

One of the core challenges facing the AMD market is the cybercriminals are using more evasion techniques and encryption to bypass detection systems. Enterprises have witnessed a rise in malware designed to sit quietly in wait or camouflaging itself by appearing as a normal file using encryption and other covertness techniques. This complicates detecting them, especially using signature-based or static analysis. Additionally, the increase in fileless malware and living-off-the-land attacks, where malware uses legitimate system tools, provides an additional challenge. To remain effective, AMD solutions need to evolve, implementing multi-layered detection, deep packet inspection, and behavioral detection, which increases technical complexity and drains resources.

Segmentation Analysis:

By Component:

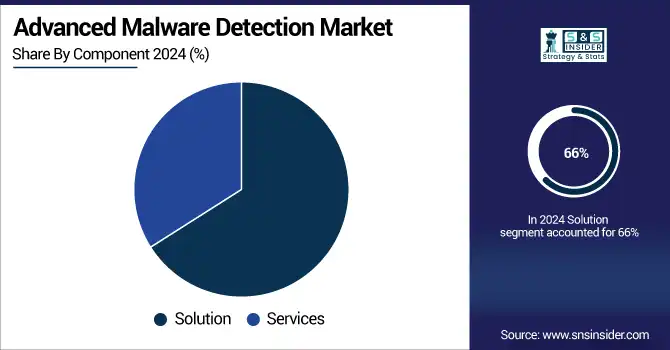

The Solution segment dominated the market in 2024 and accounted for 66% of the advanced malware detection market share. The segment led in adopting the rise of AI-enabled detection engine software, sandboxing technologies, and behavioral analytic platforms that provide end-to-end threat visibility. Solutions that can be brought into the existing infrastructure and scaled up are preferred by enterprises. As organizations demand automated and near real-time malware detection in a growing, complex IT infrastructure, this segment will persist to reign supreme.

In April 2024, CyTwist released a patented behavioral engine that identifies stealthy, AI-driven attack campaigns and malware in minutes, outperforming leading EDR/XDR tools

The Services segment is expected to register the fastest CAGR Due to the increasing demand for managed security, incident response, and continuous monitoring services to protect against new forms of malware attacks. Due to a shortage of talent in required technology stacks, SMEs and non-tech sectors are increasingly opting for outsourcing. The increased demand for subscription-based cybersecurity models and active threat intelligence provisioning from third-party providers powers the growth.

By Deployment:

The On-Premises segment dominated the advanced malware detection market in 2024 and accounted for a significant revenue share, due to high demand from highly regulated industries, such as government, BFSI, and defense, where data sovereignty, full control, and internal compliance are mandatory. Localized Deployment- Organizations that are sensitive about their data environment tend to choose localized deployment as compared to global deployment. Although there is a continuing move toward cloud models, this area is still critical for the integration of legacy systems and high-security operations.

In February 2025, Qualys introduced TotalAppSec, a risk-based solution offering AI-driven malware detection across on-premises, hybrid, and multi-cloud environments, enhancing threat visibility in internal infrastructures

The Cloud segment is expected to register the fastest CAGR, due to cost efficiency, scalability, and real-time threat intelligence capabilities. Organizations are moving towards the cloud-native AMD tools with AI/ML integrated features for real-time surveillance and automation. The trend of hybrid work models and rising deployment of SaaS-based cybersecurity solutions are driving the migration to the cloud among SMEs and large enterprises.

By Enterprise Size:

Large Enterprises dominated the advanced malware detection market in 2024 and accounted for 58% of revenue share, due to increasing IT infrastructure, high risk exposure, and compliance requirements with multiple regulations among large enterprises. Such organizations set aside large budgets to invest in next-generation AI threat detection tools and integrate them into enterprise-level security operations. Recent years have seen huge demands from larger corporations facing a myriad of increasingly complex threats from across the globe and multiple endpoints and networks.

SMEs are expected to register the fastest CAGR due to their exposure to increased cyberattacks, however, low traditional preventive capabilities. Increasing availability of cost-effective, cloud-based AMD solutions, along with managed security services, is propelling increasing adoption among SMEs. Across small business ecosystems globally, demand is further accelerated by government incentives, increasing digitalization, and growing awareness of zero-day threats.

BY Vertical:

The BFSI sector dominated the AMD market in 2024 and represented a significant revenue share, as its highly sensitive financial data is subject to strict regulatory compliance standards, and the sector suffers frequent ransomware and phishing campaigns. Financial institutions can use advanced malware detection solutions that protect against this type of menace in online banking, ATMs, and mobile transactions. BFSI will remain the highest AML spend sector as continuous digital transformation and cyber risk exposure drive the need for AMDs.

The Healthcare sector is expected to register the fastest CAGR, driven by attacks on hospitals from ransomware and the trend of digitizing patient data, and the expansion of telemedicine. Availability Management and Distribution (AMD) solutions help mitigate the risk of EHRs and IoT-enabled devices, increasingly embraced by healthcare facilities to secure protected health information (PHI) and comply with the Health Insurance Portability and Accountability Act (HIPAA) and global health data standards. increased cyber insurance adoption also drives proactive malware defense.

Regional Analysis:

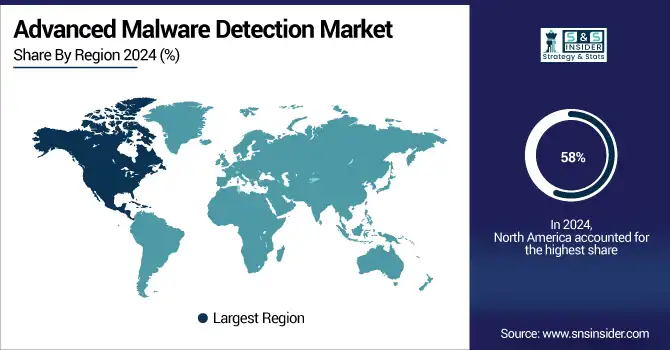

North America dominated the AMD market in 2024 and represented 58% of revenue share, owing to the early adoption of advanced cybersecurity technologies, the high volume of cyber threats being recorded in the region, and stringent regulatory frameworks like HIPAA and CCPA. The hubs for cybersecurity are in Northern California, with major players like Palo Alto Networks, CrowdStrike, and Microsoft having their headquarters here. So, due to its continuous investment in AI-based security and cloud infrastructure, this leader position will remain untouchable till 2032.

In 2024, the U.S. experienced over 2,700 ransomware attacks per week, making it the most targeted country globally for malware-based cyberattacks

According to an advanced malware detection market analysis, Asia-Pacific is expected to register the fastest CAGR due to rapid digitalization, owing to rising digitalization, increasing internet penetration, and rising cyberattacks, especially in developing economies. Corporate cybersecurity initiatives are getting more attention in the governments of China, India, and the Southeast Asia region. As IT network environments expand, SMEs and large enterprises are adopting advanced malware detection solutions to safeguard IT frameworks and adhere to new data protection legislation.

Europe's advanced malware detection market is growing due to increased enterprise digitalization, and the implementation of strict data privacy regulations (GDPR) has resulted in the growth of the advanced malware detection market in Europe. There is an increasing requirement for AI-powered malware detection. Adoption across the key sectors, such as BFSI, healthcare, and energy, will strengthen the cyber defense infrastructure in Europe as early as 2032.

Germany leads Europe’s AMD market due to the country having an additional powerful industrial base, robust compliance standards, and an elevated level of investment in cybersecurity across Merchandising & finance. This market growth would also be steady through 2032, owing to the country’s initiatives to go all Industry 4.0 driven and to have AI driven security platforms integrated into the business practices.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major advanced malware detection market companies are Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., FireEye (now Trellix), CrowdStrike Holdings, Inc., McAfee Corp., Trend Micro Incorporated, Symantec (a division of Broadcom), Sophos Ltd., Bitdefender, Kaspersky Lab, ESET, SentinelOne, Malwarebytes Inc., Cybereason, Proofpoint, Inc., Darktrace, Zscaler, Elastic N.V. and others.

Recent Developments:

-

In November 2024,Fortinet, Inc. Launched FortiSandbox 5.0 with advanced AI/ML-powered static and dynamic analysis, delivering 10× faster verdicts, 3× better detection accuracy, and reduced false positives .

-

In October 2024, Palo Alto revamped its certification portfolio, introducing new role-based credentials like “Network Security Generalist” to reflect its evolving security offerings .

-

In July 2024, Cisco patched a critical vulnerability (CVE‑2024‑20401) in Secure Email Gateway’s malware scanning engine, preventing root-level exploits through malicious attachments.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 9.6 Billion |

|

Market Size by 2032 |

US$ 27.3 Billion |

|

CAGR |

CAGR of 13.92% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solution, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., FireEye (now Trellix), CrowdStrike Holdings, Inc., McAfee Corp., Trend Micro Incorporated, Symantec (a division of Broadcom), Sophos Ltd., Bitdefender, Kaspersky Lab, ESET, SentinelOne, Malwarebytes Inc., Cybereason, Proofpoint, Inc., Darktrace, Zscaler, Elastic N.V. and others in the report |