Laboratory Centrifuges Market Report Scope & Overview:

Get More Information on Laboratory Centrifuges Market - Request Sample Report

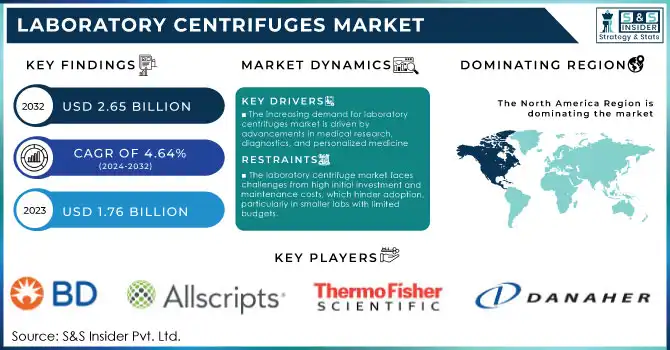

The Laboratory Centrifuges Market Size was valued at USD 1.76 Billion in 2023 and is expected to reach USD 2.65 Billion by 2032 and grow at a CAGR of 4.64% over the forecast period 2024-2032.

The Laboratory Centrifuges Market has experienced significant growth in recent years, driven by the increasing demand for laboratory equipment across various sectors such as healthcare, biotechnology, pharmaceuticals, and environmental sciences. Centrifuges play a crucial role in research and clinical laboratories by separating substances of different densities through centrifugal force. This is vital for tasks such as blood sample analysis, DNA/RNA extraction, and protein purification, which are fundamental in diagnostics and research. A key factor propelling the market is the rising demand for advanced centrifuges that offer enhanced precision, efficiency, and ease of use. Technological advancements have led to the development of automated and high-throughput centrifuges, which are more efficient in handling larger volumes of samples with improved reproducibility and accuracy. Additionally, innovations such as the integration of smart sensors and IoT capabilities for real-time monitoring and diagnostics have further expanded the scope of laboratory centrifuges in research and clinical applications.

The laboratory centrifuges market is also witnessing a growing focus on energy-efficient solutions, as laboratory operations look for ways to reduce operational costs and minimize their environmental footprint. Moreover, the increasing prevalence of chronic diseases and the rising focus on personalized medicine have led to higher investments in diagnostic research, further boosting the demand for centrifuge equipment. Trends in the market are largely centered on the customization of centrifuges to meet specific requirements across different laboratory settings. There is a shift towards the adoption of benchtop models in smaller labs due to their compact design and cost-effectiveness. Furthermore, the growing trend of outsourcing laboratory services and the expansion of diagnostic services in emerging economies have opened up new avenues for growth.

Laboratory Centrifuges Market Dynamics

DRIVERS

-

The increasing demand for laboratory centrifuges market is driven by advancements in medical research, diagnostics, and personalized medicine

The Laboratory Centrifuges Market is experiencing significant growth, driven primarily by advancements in medical research and diagnostics. As healthcare systems evolve, the demand for precise diagnostic tools and technologies increases, with centrifuges playing a key role. These machines are crucial for separating blood components, analyzing DNA/RNA, and performing various diagnostic tests, which are integral to research in personalized medicine. With a growing emphasis on tailored healthcare treatments, the need for centrifuges in molecular biology, genetics, and clinical diagnostics is expanding. As a result, there is a surge in laboratory-based research and clinical applications, pushing the demand for high-performance centrifuges.

Additionally, the biotechnology and pharmaceutical industries are contributing to the market’s expansion. Drug development, vaccine production, and genetic research require accurate sample preparation and separation, functions that centrifuges handle with efficiency. Governments and private organizations are investing heavily in medical research, healthcare infrastructure, and biotechnology, further bolstering the demand for laboratory centrifuges. However, the market faces some restraints, such as the high initial cost of centrifuge machines and their maintenance, which can be prohibitive for smaller labs. Space constraints also hinder adoption, particularly in compact or resource-limited environments. Additionally, emerging alternatives like microfluidics may provide cost-effective solutions, posing a challenge to traditional centrifuge usage. Despite these challenges, the increasing demand for diagnostic tools and advancements in medical research continues to drive the market’s growth, presenting substantial opportunities for innovation and expansion.

RESTRAIN

-

The laboratory centrifuge market faces challenges from high initial investment and maintenance costs, which hinder adoption, particularly in smaller labs with limited budgets.

The laboratory centrifuge market is experiencing significant growth driven by key factors such as increasing demand for medical research and diagnostics, advancements in technology, and the rise of biotechnology and pharmaceutical industries. The growing focus on personalized medicine and genetic research has made centrifuges indispensable in separating blood components, isolating DNA/RNA, and conducting various diagnostic tests. Technological innovations, including faster, energy-efficient, and automated systems, have enhanced the performance and efficiency of laboratory centrifuges, leading to wider adoption. Additionally, increasing government investments in healthcare and research facilities further contribute to the market's expansion.

However, despite the positive trends, the market faces some restraints. One of the key challenges is the high initial investment and maintenance costs associated with laboratory centrifuges. These machines require a significant upfront expenditure, which can be prohibitive for smaller laboratories and research centers, especially in developing regions. The maintenance and repair costs also add to the overall financial burden, further limiting their widespread adoption. As laboratory centrifuges are critical for various research applications, the high cost can hinder smaller facilities from accessing advanced equipment, potentially impacting the pace of scientific research and diagnostics.

Laboratory Centrifuges Market Segmentation

By Model Type

In 2023, the floor-standing centrifuge segment dominated the market with a significant share of 54.88%. This growth can be attributed to technological advancements and ongoing innovation in the field. Floor-standing centrifuges are increasingly sought after in both research and clinical laboratories due to their ability to handle larger sample volumes and provide highly accurate results. The demand for high-capacity and high-speed centrifugation is expanding as scientific research and diagnostic testing continue to evolve. Key drivers for the market's growth include improvements in rotor design, which enhance efficiency, as well as the increasing integration of automation into laboratory processes.

By Intended Use

In 2023, the clinical centrifuge segment dominated with the market share over 46%. Clinical centrifuges are indispensable in healthcare, playing a pivotal role in the separation of biological sample components such as blood, urine, and tissue which are crucial for diagnosing and treating a wide range of diseases. With advancements in molecular diagnostics and genetic testing, there has been a marked increase in the need for high-speed centrifuges. These devices must be capable of processing small sample volumes with exceptional precision and accuracy. As a result, the clinical centrifuge market is expanding rapidly, supported by technological innovations and the increasing focus on accurate diagnostics.

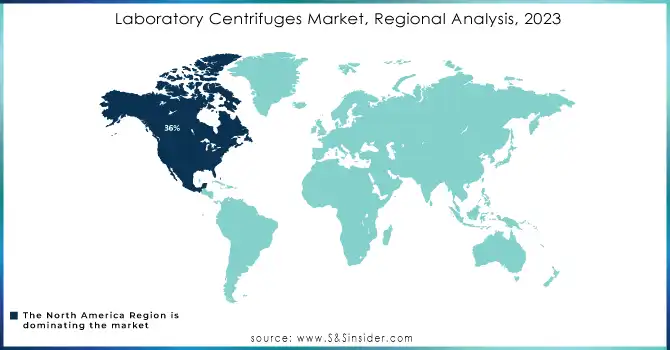

Laboratory Centrifuges Market Regional Analysis

North America region dominated with the market share over 36% in 2023. This leadership position is largely attributed to the region's ongoing technological advancements and innovations in product development. Key industry players in North America have consistently introduced state-of-the-art centrifuge models, integrating advanced features to meet the growing demands from research institutions and clinical laboratories. The region's strong market presence is further supported by its well-established healthcare and research infrastructure, which provides a solid foundation for the manufacturing and distribution of laboratory centrifuges. As the demand for efficient and high-performance laboratory equipment rises in scientific and medical fields, North American companies continue to play a pivotal role by developing products that meet the needs of a diverse range of applications.

The Asia Pacific laboratory centrifuge market is growing rapidly due to the increased focus of key industry players in the region. Companies are striving to expand their market presence by forming strategic partnerships, acquiring local businesses, and investing heavily in innovative technologies. These efforts aim to meet the rising demand for advanced laboratory centrifuges in research, healthcare, and biotechnology sectors. The region's expanding infrastructure and growing emphasis on scientific research and development contribute to this growth.

Need any customization research on Laboratory Centrifuges Market - Enquiry Now

Some of the major key players of Laboratory Centrifuges Market

-

Becton Dickinson and Company (BD FACSAria III Cell Sorter)

-

Danaher Corporation (Beckman Coulter Allegra X-12R Centrifuge)

-

Thermo Fisher Scientific, Inc. (Thermo Scientific Sorvall ST 16 Centrifuge)

-

QIAGEN (QIAGEN QIAcentrifuge)

-

Bio-Rad Laboratories, Inc. (Bio-Rad Microfuge 20)

-

Agilent Technologies, Inc. (Agilent 1300 Series Centrifuges)

-

Sigma Laborzentrifugen GmbH (Sigma 2-16P Benchtop Centrifuge)

-

Neuation (Neuation Scientific Centrifuge)

-

Hitachi Koki Co., Ltd. (HITACHI CS Series High-Speed Centrifuges)

-

Harvard Bioscience, Inc. (Harvard Apparatus Centrifuge 5424)

-

Eppendorf AG (Eppendorf 5810 R Refrigerated Centrifuge)

-

Beckman Coulter, Inc. (Beckman Coulter Avanti J-26S XP Centrifuge)

-

VWR International, LLC (VWR Microcentrifuge 5804R)

-

Labnet International, Inc. (Labnet Prism Mini Centrifuge)

-

Hettich Lab Technology (Hettich EBA 200 Bench-top Centrifuge)

-

Thermo Scientific (Thermo Scientific Heraeus Multifuge X1 Centrifuge)

-

Kubota Corporation (Kubota 5700 Series Centrifuges)

-

TOMY Digital Biology (TOMY DC-30R Benchtop Centrifuge)

-

Daihan Scientific (Daihan Labtech Centrifuge)

-

Sorvall (Thermo Fisher) (Sorvall ST 40R Refrigerated Centrifuge)

Suppliers for Known for providing a wide range of high-performance centrifuges with advanced features for diverse laboratory applications of Laboratory Centrifuges Market

-

Thermo Fisher Scientific

-

Eppendorf AG

-

Beckman Coulter

-

VWR International (Avantor)

-

Labnet International

-

Sigma Laborzentrifugen

-

Hettich Instruments

-

Sartorius AG

-

Siemens Healthineers

-

Ohaus Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 1.76 Billion |

| Market Size by 2032 | US$ 2.65 Billion |

| CAGR | CAGR of 4.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Equipment and Accessories) • by Rotor Design(Fixed-angle Rotors, Swinging-bucket Rotors, Vertical Rotors, Others ) • by Model Type (Benchtop Centrifuges and Floor-standing Centrifuges)By Intended Use (Preclinical Centrifuges, General Purpose Centrifuges, Clinical Centrifuges) • by Application(Diagnostics, Microbiology, Cell omics, Genomics, Proteomics, Blood Component Separation) • by End-User(Hospitals, Biotechnology & Pharmaceutical Companies, Academic & Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, Danaher Corporation, Thermo Fisher Scientific, Inc., QIAGEN, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., INC., Sigma Laborzentrifugen GmbH, Neuation, Hitachi Koki Co., Ltd., and Harvard Bioscience, Inc. |

| Key Drivers | • Reception of computerized pathology stages and arising countries decidedly laboratory centrifuge market. |

| RESTRAINTS | • Centrifuges are costly instruments and require huge use for standard upkeep. • High prices of these axes might reduce the development of this market. |