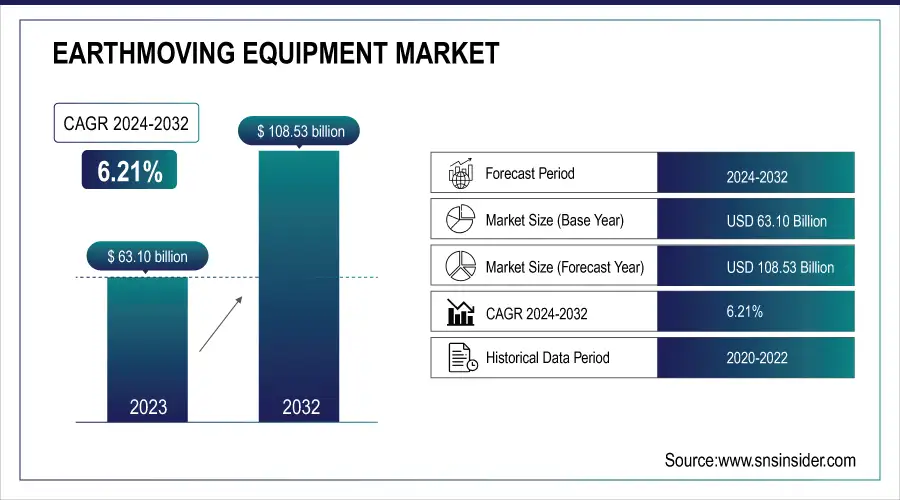

Earthmoving Equipment Market Size:

The Earthmoving Equipment Market size was USD 63.10 billion in 2023 and is expected to reach USD 108.53 billion by 2032 and grow at a CAGR of 6.21% over the forecast period of 2024-2032.

The earthmoving equipment market has seen significant advancements in recent years, driven by technological innovations, increasing infrastructure development, and urbanization. This sector encompasses a variety of heavy machinery used for construction, mining, and other excavation tasks, such as excavators, bulldozers, loaders, and backhoe loaders. The demand for these machines is largely fueled by the need for large-scale construction and mining projects, particularly in emerging economies. One of the key trends in the market is the adoption of automation and digitalization in earthmoving machinery. Equipment is increasingly being equipped with GPS, telematics, and other technologies to enhance efficiency, reduce fuel consumption, and improve overall performance. Automation and remote-control features also help in improving safety and productivity, as operators can monitor and control machines from a distance. Furthermore, the integration of electric and hybrid-powered machines is gaining momentum, as companies focus on reducing carbon emissions and adhering to stricter environmental regulations.

To Get more information on Earthmoving Equipment Market - Request Free Sample Report

Another notable trend is the shift toward rental services for Earthmoving equipment. With the high cost of purchasing these machines, many construction companies and contractors are opting for rentals, providing them with cost-effective and flexible solutions. This trend is especially prevalent in developing regions, where businesses prefer short-term equipment solutions rather than long-term investments. Additionally, the growing emphasis on sustainability is prompting manufacturers to design more energy-efficient and environmentally friendly equipment. The development of compact and versatile machines also caters to the increasing demand for equipment that can work in confined spaces, offering more flexibility for various construction and mining tasks.

Earthmoving Equipment Market Dynamics

DRIVERS

-

The growing demand for infrastructure development, urbanization, and mining activities is driving the earthmoving equipment market, with a shift towards eco-friendly, technologically advanced machinery to support large-scale projects and meet sustainability goals.

The growing demand for infrastructure development, including road construction, urban expansion, and mining activities, is a major driver for the earthmoving equipment market. As governments and private entities invest in large-scale infrastructure projects, the need for efficient machinery to support these developments has increased. Urbanization trends, particularly in emerging economies, are contributing to the construction of residential, commercial, and industrial buildings, requiring a wide range of earthmoving equipment like excavators, bulldozers, and loaders. In the mining sector, equipment is essential for tasks such as excavation, digging, and material handling. As the global population grows, so does the demand for better transportation networks and energy infrastructure, which in turn drives the demand for earthmoving machinery. Market trends indicate a shift towards technologically advanced and eco-friendly equipment, such as electric and hybrid models, to meet environmental regulations and reduce operational costs.

RESTRAINT

-

High operational costs, including substantial investment, maintenance, and rising fuel prices, create financial strain for companies, particularly small businesses, limiting their growth and competitiveness.

High operational costs are a significant challenge for companies in the earthmoving equipment market. Purchasing earthmoving machinery requires substantial capital investment, which can be a major hurdle, especially for small or medium-sized businesses with limited financial resources. Beyond the initial cost, maintaining these machines involves ongoing expenses, including regular servicing, repairs, and spare parts. Additionally, the rising fuel prices directly impact operational costs, as many earthmoving machines rely on diesel or other fuel sources for their operation. This creates a strain on businesses, as higher fuel prices lead to increased daily operating costs, reducing profitability. Companies are forced to either absorb these additional expenses or pass them on to customers, potentially affecting their competitiveness in the market. For businesses with tighter budgets, these costs can limit the ability to expand operations, invest in new equipment, or compete effectively in the industry.

Earthmoving Equipment Market Segmentation

By Industry

The construction segment dominated with the market share over 42% in 2023, construction, and mining machinery market. Construction machinery holds a significant share of the market, driven by growing infrastructure development, urbanization, and rising demand for residential and commercial properties. This sector benefits from advancements in machinery technology, improving efficiency and productivity on construction sites. The demand for heavy equipment, such as excavators, bulldozers, and cranes, is strong across both developed and emerging markets. Furthermore, trends such as automation, electric machinery, and sustainable construction practices are reshaping the industry. The market's expansion is also supported by government investments in infrastructure and the construction of new transportation, energy, and housing projects.

By Product Type

Excavators segment dominated with the market share over 51% in 2023, due to their versatility and essential role in a wide range of applications. They are used for tasks such as digging, trenching, demolition, and heavy lifting, making them indispensable in construction, mining, and infrastructure projects. Their ability to perform multiple functions, from excavating foundations to handling materials, has made them a staple on construction sites worldwide. The increasing global demand for urbanization, infrastructure development, and mining activities has significantly boosted the need for excavators. As cities expand, roads, bridges, and residential complexes are being built, all of which require excavators for site preparation and material handling. Additionally, their ability to operate in harsh conditions and adapt to various attachments further strengthens their dominance.

Earthmoving Equipment Market Regional Analysis

Asia-Pacific region dominated with the market share over 38% in 2023, accounting for the largest market share. This dominance is primarily driven by the rapid urbanization and industrialization in countries such as China and India. These nations are witnessing massive infrastructure development projects, including roads, bridges, and residential buildings, which require extensive use of earthmoving machinery. Additionally, the region is home to significant mining operations, particularly in China, which is a major producer of minerals like coal, iron ore, and rare earth metals. The growing demand for raw materials to support both industrial growth and urbanization further fuels the need for advanced earthmoving equipment.

North America is emerging as the fastest-growing region in the Earthmoving Equipment Market, driven primarily by the rapid development of infrastructure and advancements in construction technologies. Additionally, technological innovations in equipment, including the rise of electric and autonomous machinery, are enhancing efficiency and reducing operational costs. These innovations, along with the increasing demand for eco-friendly solutions, are contributing to the market's expansion. The construction and mining sectors, both vital to the economy, continue to drive demand for earthmoving equipment. Furthermore, government initiatives and private sector investments in infrastructure projects, particularly following the push for post-pandemic recovery, are expected to fuel further growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players of the Earthmoving Equipment Market

-

Yanmar Co. Ltd (Mini Excavators, Wheel Loaders)

-

J.C. Bamford Excavators Limited (Backhoe Loaders, Mini Excavators, Skid Steer Loaders)

-

SANY America (Excavators, Wheel Loaders, Crawler Cranes, Concrete Machinery)

-

Kubota Corporation (Mini Excavators, Tractors, Skid Steer Loaders)

-

Tadano Ltd (Cranes, Aerial Work Platforms, Crawler Cranes)

-

Komatsu Ltd (Hydraulic Excavators, Bulldozers, Wheel Loaders, Dump Trucks)

-

Liebherr Group (Excavators, Wheel Loaders, Bulldozers, Dump Trucks)

-

Doosan Infracore Co. Ltd (Excavators, Wheel Loaders, Skid Steer Loaders)

-

CASE Construction (Backhoe Loaders, Skid Steer Loaders, Wheel Loaders)

-

Terex Corporation (Cranes, Excavators, Wheel Loaders, Haul Trucks)

-

Hyundai Heavy Industries Co. Ltd (Excavators, Wheel Loaders, Crawler Dozers)

-

Doosan Bobcat (Skid Steer Loaders, Mini Excavators, Compact Track Loaders)

-

JLG Industries (Boom Lifts, Scissor Lifts, Telehandlers)

-

Caterpillar Inc. (Bulldozers, Excavators, Loaders, Graders)

-

New Holland Construction (Wheel Loaders, Backhoe Loaders, Excavators)

-

XCMG (Excavators, Loaders, Road Rollers, Cranes)

-

Hitachi Construction Machinery Co. Ltd (Excavators, Dump Trucks, Wheel Loaders)

-

Manitou Group (Telehandlers, Forklifts, Articulated Loaders)

-

CNH Industrial N.V (Case Construction Equipment: Wheel Loaders, Backhoe Loaders, Excavators)

-

AB Volvo (Excavators, Wheel Loaders, Articulated Haulers)

Suppliers for (earthmoving equipment, including excavators, bulldozers, wheel loaders, graders, and cranes) on Earthmoving Equipment Market

-

Caterpillar Inc. (USA)

-

Komatsu Ltd. (Japan)

-

XCMG Group (China)

-

Sany Heavy Industry (China)

-

John Deere (USA)

-

Volvo Construction Equipment (Sweden)

-

Liebherr Group (Germany)

-

Hitachi Construction Machinery (Japan)

-

JCB (UK)

-

Doosan Bobcat (South Korea)

RECENT DEVELOPMENT

In June 2024: JCB North America breaks ground on a USD 500 million manufacturing facility near San Antonio, Texas. The 720,000 square foot plant will be the company’s second-largest, enhancing its capacity to meet growing demand in North America's construction equipment market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 63.10 billion |

| Market Size by 2032 | USD 108.53 billion |

| CAGR | CAGR of 6.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment Type (Excavators [Mini Excavator, Crawler Excavator, Wheeled Excavator, Others (Dragline, Long Reach, etc.)], Loaders [Skid Steer, Backhoe, Wheeled, Crawler/Track, Mini Loaders], Dump Trucks [Articulated Trucks, Rigid Trucks, Others (Dumpers, Motor Graders, etc.)]) • By Industry (Mining, Construction, Agriculture & Forestry, Others (Oil & Gas, etc.)) • By Engine Capacity (Up to 250 HP, 250-500 HP, More than 500 HP) • By Equipment Type (ICE, Electric) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Yanmar Co. Ltd, J.C. Bamford Excavators Limited, SANY America, Kubota Corporation, Tadano Ltd, Komatsu Ltd, Liebherr Group, Doosan Infracore Co. Ltd, CASE Construction, Terex Corporation, Hyundai Heavy Industries Co. Ltd, Doosan Bobcat, JLG Industries, Caterpillar Inc., New Holland Construction, XCMG, Hitachi Construction Machinery Co. Ltd, Manitou Group, CNH Industrial N.V, AB Volvo. |

| Key Drivers | • The growing demand for infrastructure development, urbanization, and mining activities is driving the earthmoving equipment market, with a shift towards eco-friendly, technologically advanced machinery to support large-scale projects and meet sustainability goals. |

| Restraints | • High operational costs, including substantial investment, maintenance, and rising fuel prices, create financial strain for companies, particularly small businesses, limiting their growth and competitiveness. |