Laboratory Equipment Market Overview:

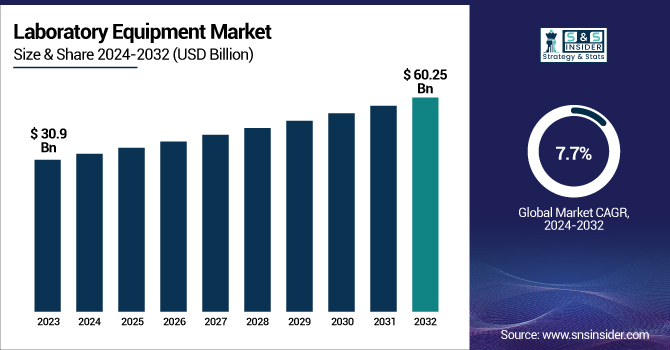

The Laboratory Equipment Market Size was valued at USD 30.9 billion in 2023 and is expected to reach USD 60.25 billion by 2032, growing at a CAGR of 7.7% over the forecast period 2024-2032. This report on the Laboratory Equipment Market offers important data analysis and new trends influencing the sector. It addresses the relationship between the increasing need for diagnostic technologies and the correlation between disease incidence/prevalence. Examining testing and diagnostic volume trends, the report shows development in automated and high-throughput systems. It describes geographical differences in equipment installation and use rates as well as healthcare spending pattern segmented by government, private, and out-of-pocket sources. Technological adoption, including smart lab systems and artificial intelligence-based diagnostics, as well as the degree of global regulatory standard compliance. These revelations provide a whole picture of the factors influencing the market, infrastructure projects, and prospects in the scene of laboratory equipment landscape. Government initiatives, increasing R&D spending, and expansion in healthcare and life sciences are driving a steady increase in the market for laboratory equipment.

To Get more information on Laboratory Equipment Market - Request Free Sample Report

U.S. Laboratory Equipment Market Size & Forecast

Reflecting a strong CAGR of 7.70%, the U.S. laboratory equipment market has exhibited constant increase from USD 10.00 billion in 2023 to USD 19.46 billion by 2032. Rising healthcare expenditure, developments in diagnostic technologies, and an increasing focus on early disease identification all help to support this upward trend. High acceptance of automated lab equipment and regulatory compliance helps to boost American market growth even further. Rising grants from American organizations such as the National Institutes of Health (NIH) have encouraged research and innovation, further fueling demand for advanced laboratory equipment.

Laboratory Equipment Market Dynamics

Drivers

-

Advances in research and development spending by pharmaceutical and biotechnology industries are increasing the need for specialized and automated laboratory equipment across regions.

The proactive investment in research and development among pharmaceutical and biotechnology sectors is positively impacting the increased requirement for advanced laboratory equipment. Highly specialized lab instruments capable of precise analysis and consistent performance are needed for drug discovery, clinical trials, vaccine development, and biologics manufacturing. Currently, there are pressing needs for breakthrough therapeutics for newly emerging diseases and complicated conditions, such as cancer and Alzheimer's, and autoimmune disorders. Consequently, this expansion is prompting pharmaceutical companies to make aggressive moves in growing their respective R&D pipelines. Thus, there is a need for upgraded setups in laboratories outfitted with next-generation technologies such as chromatography systems, spectrophotometers, incubators, and mass spectrometry tools. Additionally, as regulatory bodies require compliance and accuracy from labs in terms of data collection, many facilities are now seeking to introduce automation, digitization, and real-time monitoring equipment. These flexible, scalable lab solutions are increasingly being made possible by innovative collaborations between start-up and mid-sized biotech companies that have access to venture-funded and government grant support. The establishment of research hubs and innovation centers for advanced research enabled collaborations between industry and academia. Automated and throughput-centric equipment is adopted as competition among their number increases and allowing pharmaceutical companies to offset the clock on new therapies. The application of AI and IoT combined with laboratory operations also optimizes researchers' workflows and minimizes manual errors, thus justifying investing in high-end equipment.

Restrain

-

Adoption in low-resource laboratories and developing market areas is limited by high equipment procurement costs and maintenance charges.

The huge initial cost of acquiring sophisticated laboratory equipment, together with large maintenance and calibration costs, serves as a substantial barrier to market expansion. Many labs, especially in small-scale clinics, public institutions, and poor countries, and small-scale clinics—especially struggle to budget the required capital expenditure for equipment, including high-end analytical tools, automated systems, and digital lab systems. Even with initial investments, continuous operational expenses for equipment maintenance, spare parts, software upgrades, and international calibration standard compliance add more financial load. Many times, these ongoing expenses dissuade smaller facilities from adopting newer technologies, which results in the continued use of antiquated or less effective equipment. Further complicating problems are manufacturers not often providing substantial after-sales assistance or localized servicing in rural or undeveloped areas. Sensitive instruments frequently require regulated conditions and trained operation, so infrastructure constraints, including uneven power supply, insufficient storage, and lack of qualified personnel, aggravate the problem. Many times, depending on donated or second-hand equipment, public health labs and educational institutions in developing nations may not be compatible with modern uses or software integrations. This scenario widens the technological gap between resource-rich and resource-limited settings, hindering global market uniformity.

Opportunities

-

With the future of the laboratories looking to increase the digitization and introduction of IoT, possible opportunities are opened up for smart and connected lab environments.

Advancement of digital technology and increasing integration of IoT in laboratory environments are creating transformative opportunities for the laboratory equipment market. Modern laboratories are increasingly switching from manual operations to intelligent, automated workflows through connected devices, cloud computing, real-time data capture, and AI-driven analysis. Such intelligent devices and systems enable researchers and clinicians to manage much enormous amounts of data with much higher accuracy and speed, reduce human error, and improve reproducibility. An IoT-enabled lab instrument can also remotely show the temperature and humidity, as well as the equipment's condition status, which it may then alert and automatically respond to when parameters deviate. Not only can these laboratories automate functions and make them more efficient, but they also allow remote diagnosis and predictive maintenance, thus minimizing downtime and overhead. Thus, the research team in such countries will be able to merge data into shared clouds that ease research sharing and replication, results publications, and accelerated drug development cycles. Providing regulatory authorities accompanying this as digital health advances into a more progressive attitude towards secure digital infrastructures in laboratories. Upgradable plug-and-play systems and APIs will soon be offered by both startups and established companies, fitting seamlessly into LIMS (Laboratory Information Management Systems) and other artifacts in healthcare IT. Educational institutions and research bodies are being encouraged to digitalize their lab environments through government grants and techno partnerships.

Challenges

-

Many regions suffer from a skilled worker scarcity and training shortages that limit the ideal use and productivity of advanced laboratory equipment.

Laboratory equipment is becoming more complicated, thus, a technically competent workforce is required; nonetheless, a key obstacle is the general lack of qualified personnel. The demand for personnel and researchers with specific training becomes crucial as labs adopt ever advanced instruments ranging from genomics sequencers and mass spectrometers to robotic automation systems. Many educational institutions, particularly in developing and underfunded areas, nevertheless lack the technical courses needed to run or maintain such machinery efficiently. This results in underutilization, frequent errors, and increased downtime. Even in developed countries, the rapid pace of technological innovation often outpaces workforce training programs, leaving gaps in skillsets and reducing productivity. For laboratory managers, another major expense and logistical load is onboarding and ongoing upskilling. Furthermore, impeding the acceptance of smart laboratory solutions is ignorance of digital tools, software interfaces, and data analytics. In controlled environments, incorrect equipment handling or non-compliance resulting from inadequate training could cause failed audits and reputational risk.

Laboratory Equipment Market Segmentation Analysis

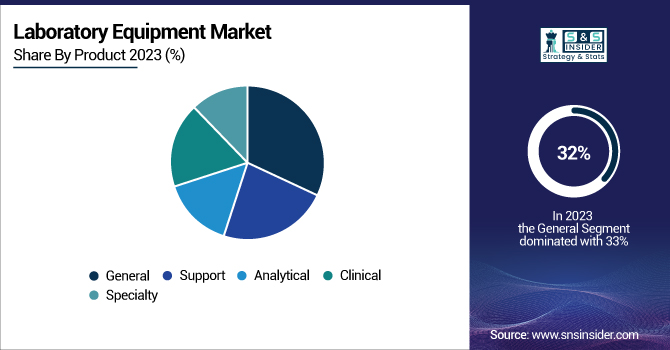

By Product

In general laboratory equipment, the largest market share of 32% would be held in 2023, mainly because of its broad versatility and applicability across various research fields. This dominance is attributed to the versatility and wide applicability of general laboratory instruments across various research fields. They cover almost all of the laboratory work with multiple applications, thus becoming an integral part of research as well as clinical laboratories. More evident qualities of general laboratory equipment proving its higher application in laboratories are cost-effectiveness and easy handling. Along with that, technology has increased its efficiency and functionalities according to the needs of laboratories demanding very high-throughput and precise operations. The sustained investment in R&D and laboratory infrastructure development is likely to continue with the global consumption of general laboratory equipment in future years.

By End-use

The healthcare segment held the largest revenue share of 42% in 2023 and is mainly driven by increasing demand for diagnostic tests, medical research, and the development of drugs. Laboratory equipment is important in a healthcare setup for experimentation, sample analysis, or studying various aspects of diseases and treatments. The rising prevalence of chronic diseases and the necessity for early and accurate diagnosis have also fueled the reliance on advanced laboratory instruments. Furthermore, the involvement of laboratory equipment in personalized medicine and genomics research has increased its application in the domain of healthcare. Development projects and government funding to improve healthcare services and infrastructure are other factors that have significantly enhanced the adoption of laboratory equipment in this segment. Ongoing laboratory technology improvements are projected to accelerate the growth of the healthcare segment further in the laboratory equipment market.

Laboratory Equipment Market Regional Insights

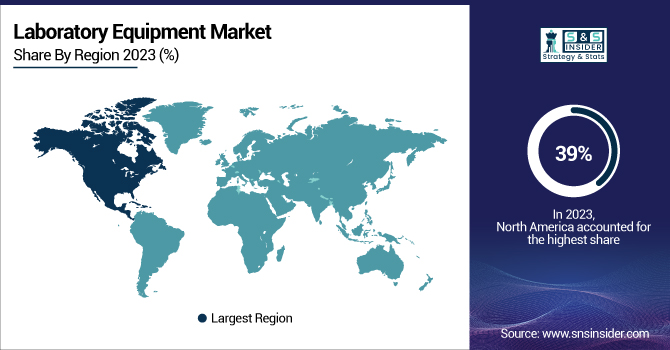

In 2023, North America emerged as the leading region in the laboratory equipment market, holding a substantial share of 39%. This dominance is due to an advanced healthcare infrastructure, heavy R&D investments in the region, and the presence of major pharmaceutical and biotechnology companies. The United States is also leading in the area of clinical laboratory testing and with an intense focus on early diagnosis of disease. In addition to that, the regulatory environment in North America, with stringent quality standards and regulations for diagnostic testing, is pushing for the adoption of high-quality lab equipment. Demand for lab equipment that meets specified manufacturing standards is influenced by regulatory compliance with FDA and CLIA requirements. The Asia Pacific region is projected to grow at the fastest CAGR 8.26% during this forecast period, owing to technological advancements in the healthcare sector and increasing government funding towards R&D. Countries, such as China and India, are experiencing tremendous growth in healthcare infrastructure and the pharmaceutical sector, which is accelerating market growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Laboratory Equipment Market

Key Service Providers/Manufacturers

-

Thermo Fisher Scientific (NanoDrop One, Orbitrap Exploris 480)

-

Agilent Technologies (Agilent 7890B Gas Chromatograph, Agilent 1260 Infinity II LC)

-

Shimadzu Corporation (LCMS-8060NX, UV-1900i)

-

Bruker Corporation (AVANCE NEO, MALDI Biotyper)

-

PerkinElmer Inc. (LAMBDA 365+, Avio 550 Max ICP-OES)

-

Beckman Coulter (Biomek i7, DxH 900)

-

Mettler Toledo (XPR Analytical Balance, TGA/DSC 3+)

-

Eppendorf AG (Centrifuge 5425, Mastercycler X50)

-

Sartorius AG (Cubis II Balance, Ambr 15 Bioreactor)

-

Waters Corporation (ACQUITY UPLC H-Class PLUS, Xevo TQ-XS)

-

Bio-Rad Laboratories (CFX96 Touch Real-Time PCR, ChemiDoc MP Imaging System)

-

GE Healthcare Life Sciences (ÄKTA Pure Chromatography System, Amersham Typhoon Imager)

-

Tecan Group Ltd. (Freedom EVO, Infinite 200 PRO)

-

Anton Paar GmbH (DMA 5000 M, MCR 302 Rheometer)

-

Hitachi High-Tech Corporation (SU5000 SEM, U-2900 Spectrophotometer)

-

Labconco Corporation (Purifier Logic+ Biosafety Cabinet, FreeZone 6 Liter Freeze Dryer)

-

Oxford Instruments plc (X-Pulse Benchtop NMR, X-MET8000 Handheld XRF)

-

HORIBA Scientific (LabRAM HR Evolution, Aqualog Spectrometer)

-

Jeol Ltd. (JSM-IT800 SEM, JNM-ECZL NMR)

-

Analytik Jena AG (Specord 210 Plus, qTOWER³ PCR Thermal Cycler)

Recent Developments

-

In January 2023, Siemens Healthineers opened a laboratory equipment immunoassay instrument research and development center in Swords, Ireland, with an emphasis on innovations in laboratory equipment for detecting cancer, blood disorders, and infectious diseases.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 30.9 Billion |

| Market Size by 2032 | USD 60.25 Billion |

| CAGR | CAGR of 7.7 From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (General, Support, Analytical, Clinical, Specialty) • By End-use (Research Institutions, Veterinary, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Agilent Technologies, Shimadzu Corporation, Bruker Corporation, PerkinElmer Inc., Beckman Coulter, Mettler Toledo, Eppendorf AG, Sartorius AG, Waters Corporation, Bio-Rad Laboratories, GE Healthcare Life Sciences, Tecan Group Ltd., Anton Paar GmbH, Hitachi High-Tech Corporation, Labconco Corporation, Oxford Instruments plc, HORIBA Scientific, Jeol Ltd., Analytik Jena AG |