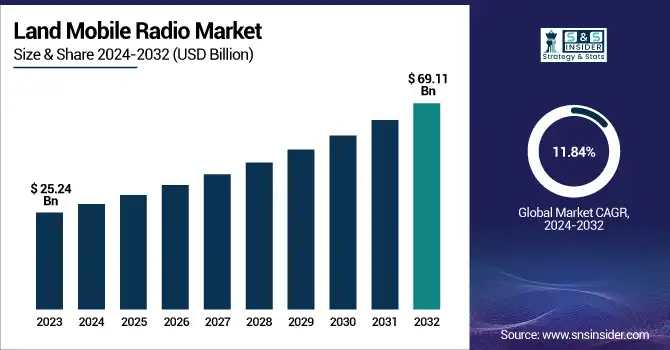

Land Mobile Radio Market Size & Growth:

The Land Mobile Radio Market was valued at USD 25.24 billion in 2023 and is projected to reach USD 69.11 billion by 2032, growing at a CAGR of 11.84% from 2024 to 2032. The market's growth is driven by rising adoption rates of digital LMR systems, particularly TETRA, DMR, and P25 technologies, replacing aging analog systems. Increasing security and encryption demands in public safety, defense, and critical infrastructure sectors are fueling demand for end-to-end encrypted communication solutions.

To Get more information on Land Mobile Radio Market - Request Free Sample Report

Additionally, frequency band trends indicate that UHF (450-470 MHz) dominates due to its superior urban penetration, while VHF (150-172 MHz) is experiencing rapid growth for long-range rural applications. The market is also witnessing significant advancements in interoperability and network evolution, with the integration of LMR and LTE networks enhancing cross-agency coordination. In the United States, the market was valued at USD 6.60 billion in 2023 and is expected to reach USD 15.56 billion by 2032, with a CAGR of 9.99%. Government investments in public safety communications, the expansion of smart city projects, and the need for resilient, mission-critical communication systems further drive market expansion.

Land Mobile Radio (LMR) Systems Market Dynamics:

Drivers:

-

Evolution of LMR with the Shift from Analog to Digital Communication

The transition from analog to digital Land Mobile Radio (LMR) systems is driven by the need for improved voice clarity, enhanced data capabilities, and advanced encryption in mission-critical communications. These digital standards clear away the unwanted sounds of the real world (TETRA, P25, DMR) and make it easier for people to hear each other distinctly. These systems are designed to enable integrated data transmission, enabling possibilities such as sharing text messages, GPS locations and other real-time information between users while they communicate using voice. Digital LMR also offers robust encryption and authentication mechanisms, minimizing the likelihood of unauthorized access and cyber threats. However, with digital networks meeting the demand for interoperability between agencies and industries, security needs are also growing, which is driving the transition.

Restraints:

-

Cybersecurity threats in digital LMR networks require continuous updates and security enhancements despite encryption advancements.

Despite advancements in encryption and security protocols, digital Land Mobile Radio (LMR) networks face persistent cyber threats, including hacking, unauthorized access, and data breaches. As these networks integrate with IP-based systems and cloud infrastructure, vulnerabilities increase, making them targets for cybercriminals. Public safety and defense sectors, which rely on LMR for mission-critical communication, require continuous updates, real-time threat detection, and multi-layered encryption to safeguard sensitive data. Additionally, interoperability with legacy systems can expose weaknesses, necessitating stringent security policies and regular penetration testing. As cyber threats evolve, investment in advanced encryption, network monitoring, and cybersecurity training becomes crucial to maintaining the integrity and reliability of LMR communication networks.

Opportunities:

-

Growing Adoption of Land Mobile Radio in Transportation and Utility Sectors for Enhanced Efficiency and Safety

The adoption of Land Mobile Radio (LMR) systems in transportation and utilities is rapidly increasing due to the need for seamless, secure, and real-time communication. LMR is crucial for train coordination, track maintenance, and emergency response in railways, safeguarding passengers and employees alike. LMR systems at airports facilitate coordination among ground crews, support synchronized air traffic, and aid security efforts, all of which boost overall efficiency. Utility companies in the energy space utilize LMR for grid management, remote monitoring, and response to outages, reducing downtime and increasing reliability. The formation of digital LMR, which has facilities such as GPS tracking, data integration, and encrypted communication, further supplements its adoption. LMR is still a critical element in ensuring operational efficiency across the industries as infrastructure modernization remains a work in progress.

Challenges:

-

Ensuring seamless communication across different LMR systems and agencies remains challenging due to varying standards and protocols.

Interoperability remains a significant challenge in the Land Mobile Radio (LMR) market, as different organizations and agencies use varying communication protocols such as P25, TETRA, and DMR. Diverse systems lead to communication gaps, especially in emergency response scenarios where coordination in real-time is vital. But public safety agencies, transportation networks and utility providers often have networks that can be incompatible, leading to inefficiencies when coordinating efforts or sharing resources in an emergency and to delays in getting vital services restored. Bridging these gaps will require significant investments in cross-band gateways, software-defined radios, and unified communication platforms. But, legacy systems and budget constraints slow the transition to fully interoperable systems. Compatibility across jurisdictions and private networks is another layer of complexity. Solving for these interoperability challenges will help improve operational efficiency, emergency preparedness, and public safety. These challenges can be addressed, such as, by standardizing regulations advances in multi-band radio technologies or by increased adoption of IP-based solutions that allow multi-technology communication networks.

LMR Systems Industry Segmentation Analysis:

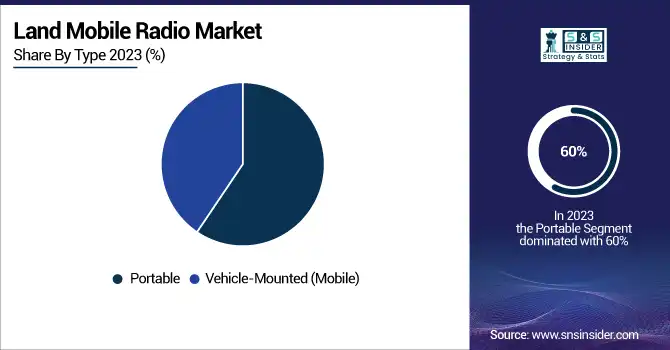

By Type

The portable segment dominated the Land Mobile Radio (LMR) market with the largest revenue share of approximately 60% in 2023, driven by its widespread adoption in defense, public safety, transportation, and commercial sectors. Portable LMR devices offer enhanced mobility, reliability, and real-time communication, making them essential for first responders, security personnel, and field operations. The growing demand for mission-critical communications, coupled with advancements in digital LMR technologies such as P25 and DMR, has further fueled adoption. Additionally, increasing investments in emergency response infrastructure and government initiatives to modernize public safety communication networks have contributed to the segment's dominance. The integration of features like GPS tracking, encryption, and interoperability with other communication systems enhances their utility across industries, ensuring continued market growth. With ongoing technological innovations, the portable LMR segment is expected to maintain its strong position throughout the forecast period.

The vehicle-mounted (mobile) segment is the fastest-growing in the Land Mobile Radio (LMR) market from 2024 to 2032, owing to the increased adoption of Land Mobile Radio (LMR) in emergency services, transportation, and military applications. They offer wide coverage, powerful transmission, and easy connectivity, so they are critical for law enforcement, fire departments, and logistics fleets. Adoption has also been quickened by the rise of smart transportation and fleet management solutions. Digital LMR technology evolution in P25, DMR and LTE interoperability enhances communication functionality. The rapid growth of this segment is further supported by government investment in public safety network modernization, and infrastructure development.

By Technology

The digital segment dominated the Land Mobile Radio (LMR) market with around 69% revenue share in 2023, driven by its superior voice clarity, data capabilities, and enhanced security features compared to analog systems. The adoption of technologies like TETRA, P25, and DMR has fueled this growth, offering better spectrum efficiency, encryption, and interoperability. Digital LMR systems are widely used in public safety, defense, and commercial applications, ensuring seamless communication even in challenging environments. Increasing demand for real-time data transmission, improved network reliability, and government initiatives to modernize communication infrastructure continue to boost the expansion of the digital segment.

The analog segment is the fastest-growing in the Land Mobile Radio (LMR) market over the forecast period from 2024 to 2032, owing to the affordability of the product and high usage rates in developing regions. Analog LMR, which has remained a popular choice in industries such as transportation, construction, and private security, is valued for its simplicity, ease of deployment, and lower upfront cost compared to digital systems. Moreover, SMEs prefer analog radios for basic communication needs without the need of advanced data features. Although regional digital adoption is ever-increasing, the continuing requirement for low-cost and reliable communication solutions is driving the growth of the analog segment.

By Frequency Band

The 450-470 MHz (UHF) segment dominated the Land Mobile Radio (LMR) market in 2023, accounting for approximately 59% of the total revenue. This dominance is driven by its superior signal penetration, making it highly effective in urban environments, underground facilities, and dense infrastructure areas where other frequency bands struggle. UHF radios are widely used in public safety, defense, transportation, and commercial sectors due to their ability to provide clear communication over long distances and in challenging terrains. Additionally, the segment benefits from increasing demand for mission-critical communication systems, particularly in law enforcement and emergency response applications. The continued expansion of industries such as logistics, construction, and manufacturing, where reliable communication is essential, further supports the strong market position of the 450-470 MHz band. Advancements in UHF technology, including better encryption and interoperability features, are also contributing to its sustained adoption, ensuring its dominance in the LMR market for years to come.

The 150-172 MHz (High VHF Band) segment is expected to experience the fastest growth in the Land Mobile Radio (LMR) market from 2024 to 2032. The growth of the market can be attributed to the growing adoption of the system in the public safety, transportation, and utility sectors for covering longer distances at lower power consumption compared to UHF frequencies. High VHF signal propagation is especially good in rural and suburban environments, so it's a great fit for emergency services, railway communications, and government agencies needing long-range connectivity with high reliability. Development of critical infrastructure projects and increasing investments to update communication networks are also maintaining robust demand for it. And better digital VHF technology, such as stronger encryption, enhanced interoperability, and greater spectrum efficiency, is making it increasingly appealing for organizations seeking to modernize their legacy systems. The High VHF Band segment is expected to witness noticeable growth during the forecast period as industries in search of cost-effective and efficient communication solutions.

By Application

The Defense and Public Safety segment dominated the Land Mobile Radio (LMR) market in 2023, accounting for around 45% of total revenue. he military, law enforcement, and emergency response/disaster management organizations are all dependent on secure, reliable, and real-time communication – and that dependence is what has pushed military use to the fore. LMR systems are critical for governments and defense agencies as they provide encrypted communication, perform in severe conditions, and function independent from commercial networks. Increasing global security threats, natural calamities, and homeland security initiatives have also added fuel to the demand for advanced LMR solutions. Furthermore, technological innovations, including AI-enabled dispatch systems, GPS monitoring, and interoperability capabilities, have helped improve operational performance. This segment benefits from ongoing investments in next-generation communication infrastructure and the shift from analog to digital land mobile radio (LMR) systems, including Project 25 (P25) and TETRA standards.

The Commercial segment is the fastest-growing segment in the Land Mobile Radio (LMR) market over the forecast period from 2024 to 2032. The rapid adoption of LMR systems across industries such as retail, hospitality, manufacturing, and private security is driving this growth. Businesses are increasingly prioritizing secure and efficient communication for workforce coordination, logistics management, and operational safety. The expansion of smart cities and large-scale infrastructure projects has further fueled demand, as commercial enterprises seek reliable communication solutions that ensure real-time connectivity in high-density environments. Additionally, advancements in digital LMR technology, including enhanced voice clarity, extended coverage, and integration with enterprise management systems, have made these solutions more attractive for businesses. The rise of e-commerce and supply chain networks has also led to increased deployment of LMR in warehousing, transportation, and logistics.

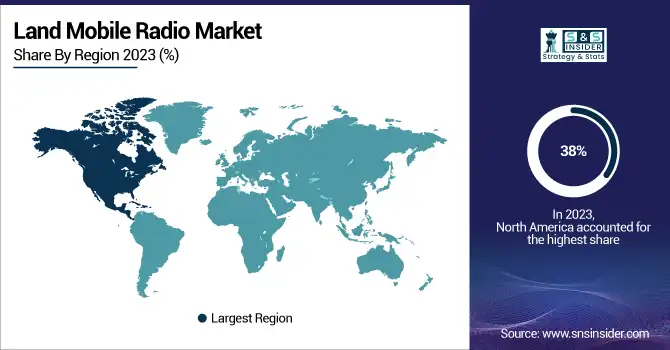

Land Mobile Radio Market Regional Analysis:

North America held the largest revenue share of around 38% in the Land Mobile Radio (LMR) market in 2023, due to the high demand for the product from defense organizations, public safety agencies, and commercial sectors in the region. The region's advanced infrastructure, high penetration of advanced communication technologies, and stringent regulatory requirements for emergency response systems have positioned it as the dominant regional market. OPEN: Government investment in mission-critical communication systems especially in the U.S. and Canada, to accelerate the deployment of digital LMR solutions. Furthermore, the growing acceptance of LMR systems in industries including but not being limited to, transportation, utilities, and private security can be attributed due to their ability to facilitate effective operational efficiency and ensuring worker safety. The transition from analog to digital LMR technologies, coupled with the growing focus on cybersecurity and interoperability, are other factors driving the market growth.

The Asia-Pacific region is the fastest-growing market for Land Mobile Radio (LMR) systems over the forecast period of 2024-2032, driven by increasing investments in public safety, transportation, and industrial communication networks. Countries like China, India, Japan, and South Korea are rapidly adopting digital LMR solutions to enhance emergency response, defense capabilities, and commercial operations. The expansion of smart cities, rising urbanization, and growing demand for reliable communication in critical sectors such as law enforcement and disaster management are key growth factors. Additionally, government initiatives to modernize communication infrastructure and the integration of LMR with advanced technologies like LTE and 5G are further accelerating market expansion. The region's rapidly evolving manufacturing sector and increasing defense budgets are also contributing to heightened adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Land Mobile Radio (LMR) Market are:

-

L3Harris Technologies, Inc. (USA) – LMR systems, tactical radios, public safety communication

-

Kenwood Corporation (Japan) – Two-way radios, professional communication solutions

-

Simoco Wireless Solutions Limited (UK) – Digital mobile radios, mission-critical communication

-

RELM Wireless Corporation (USA) – P25 radios, analog and digital portable radios

-

Motorola Solutions, Inc. (USA) – Two-way radios, P25, TETRA communication solutions

-

Leonardo SpA (Italy) – Secure communication, military-grade LMR solutions

-

Icom Inc. (Japan) – VHF/UHF radios, marine, aviation, and land mobile radios

-

Hytera Communications Corporation Ltd. (China) – DMR, TETRA radios, public safety solutions

-

JVC Tait Ltd. (New Zealand) – LMR systems, public safety and transport communication

-

Thales Group (France) – Secure communication, defense-grade radio solutions

-

Sepura Limited (UK) – TETRA radios, critical communications solutions

Some key suppliers for raw materials and components in the Land Mobile Radio (LMR) market:

-

Amphenol Corporation

-

Belden Inc.

-

CommScope Holding Company, Inc.

-

Huber+Suhner AG

-

Pasternack Enterprises, Inc.

-

RF Industries Ltd.

-

Times Microwave Systems

-

TE Connectivity Ltd.

-

Rosenberger Hochfrequenztechnik GmbH & Co. KG

-

Laird Connectivity

Recent Development:

-

23 JAN 2025, L3Harris Technologies secured a contract to upgrade the New York State Thruway Authority’s communications network to a P25 Phase 2 system, enhancing capacity and resilience. The project, spanning three years, will deploy 1,300 XL-200 radios and the Two47 base station for improved scalability and interoperability.

-

10 May 2024,Thales Defense and Security Inc. is ramping up radio production in its Maryland facility as the U.S. Army reassesses its network strategy. The company continues to manufacture critical communication and defense systems, including handheld radios and pilot helmet displays.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.24 Billion |

| Market Size by 2032 | USD 69.11 Billion |

| CAGR | CAGR of 11.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Portable, Vehicle-Mounted (Mobile)) • By Technology (Digital, Analog) • By Frequency Band (30-50 MHz (Low VHF Band), 150-172 MHz (High VHF Band), 450-470 (UHF)) • By Application (Defense and Public Safety, Commercial, Construction, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | L3Harris Technologies, Kenwood Corporation, Simoco Wireless Solutions, RELM Wireless Corporation, Motorola Solutions, Leonardo SpA, Icom Inc., Hytera Communications, JVC Tait, Thales Group, Sepura Limited. |