Legal AI Market Report Scope & Overview:

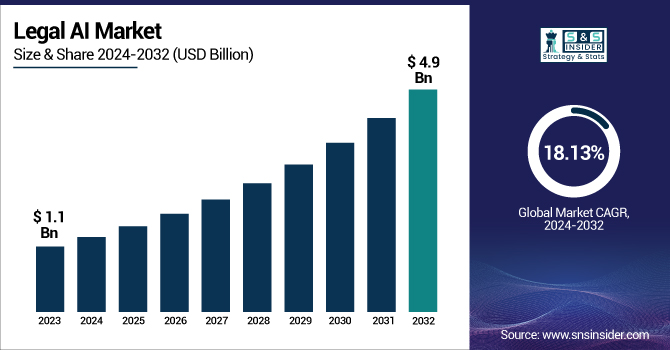

The Legal AI Market was valued at USD 1.1 billion in 2023 and is expected to reach USD 4.9 billion by 2032, growing at a CAGR of 18.13% from 2024-2032.

To Get more information on Legal AI Market - Request Free Sample Report

The adoption rates of Legal AI solutions by law firm size indicate that large and mid-sized firms lead in implementation, while small firms are rapidly increasing adoption driven by cost-efficiency and competitive pressure. Legal document automation usage by application type highlights growing deployment in contract drafting, e-discovery, and compliance management. AI-powered contract analytics deployments by region show North America and Europe at the forefront, with rising uptake in Asia Pacific. Legal AI investment trends by end user reflect a surge in corporate legal departments adopting AI for operational efficiency alongside traditional law firms. New in the report — detailed insights on AI-driven litigation prediction models, AI-powered IP portfolio management solutions, and evolving regulations on ethical AI usage in legal practices, alongside benchmarks for AI ROI and productivity gains in legal operations.

The U.S. Legal AI market was valued at USD 0.3 billion in 2023 and is projected to reach USD 1.6 billion by 2032, growing at a CAGR of 18.03% during 2024–2032. Growth is fueled by rising demand for AI-driven contract analysis, legal research automation, and litigation analytics. Increasing adoption by corporate legal departments and law firms for operational efficiency and risk management will drive future expansion.

Legal AI Market Dynamics

Driver

-

Rising demand for AI-powered contract analysis and document review is accelerating Legal AI adoption for operational efficiency.

With the ever-increasing complexity of legal data and demand for quicker and accurate results, legal-tech practitioners are increasingly relying on AI-based solutions in contract analysis, legal research, document review, etc. Human error is minimized, turnaround time is reduced, and the operational efficiency of legal workflows is improved by the best of AI tools. With the option to extract key provisions, highlight risks, and ensure regulatory compliance within seconds, across thousands of documents, AI is now a must-have tool for law firms and corporate legal teams alike. In the legal services sector, this increasing operational and strategic reliance on AI-based tools is one of the components driving the global growth in the market.

Restraint

-

Concerns around data privacy, confidentiality, and ethical compliance are limiting the widespread use of AI in legal workflows.

The growing concern over data privacy and confidentiality, and the ethical use of AI tools in sensitive legal matters are one of the crucial restraints for the Legal AI market. Lawyers have access to top-secret information in legal documents, so companies prefer not to even use AI tools from third-party vendors. Finally, regulatory uncertainty associated with the use of AI in legal decisions, as well as concerns of possible algorithmic bias, serve as obstacles to widespread adoption. Governance issues relating to client confidentiality, data ownership, and transparency of AI recommendations remain a significant barrier to the commercial acceleration of the technology, particularly in data governance-heavy regions such as Europe and the U.S.

Opportunity

-

Integration of generative AI and predictive analytics offers new value in litigation strategy, legal drafting, and risk assessment.

The combination of generative AI and complex predictive analytics tools that will be integrated into litigation strategy is a significant opportunity for the Legal AI market. These tools help law firms run simulations of possible total case outcomes, access relevant jury preferences, and use predictive analytics to get the most out of their resources for high-stakes litigation. Generative AI has the potential to automate parts of the drafting process for legal briefs, motions, and summaries, which in turn enhances operational efficiencies and minimizes the impact of manual work. The slow adoption of AI in courts and regulatory bodies to assist in case management and e-discovery creates a growing opportunity for vendors to fill the gap with tailor-made, ethically aligned, and court-admissible AI solutions, capable of conquering new horizons in the legal tech market.

Challenge

- Resistance from traditional legal professionals and firms toward technology adoption slows the market’s growth momentum.

Despite the evident traction of Legal AI, another significant hurdle challenges the Legal AI market — the resistance among traditional lawyers and firms unwilling to push complete manual work transformation through their decades-long manual process systems. AI adoption is throttled by qualms about job displacement, distrust in AI-generated legal recommendations, and the assumption that new technology cannot easily be integrated into existing legacy structures. Moreover, many legal practices do not have the AI literacy to train efficiently, and lack the right training resources to take full advantage of Legal AI platforms. Industry education, improving explainability of AI, and early adopters successfully showing ROI will all help overcome these cultural and operational barriers and will ultimately build confidence in the market.

Legal AI Market Segmentation Analysis

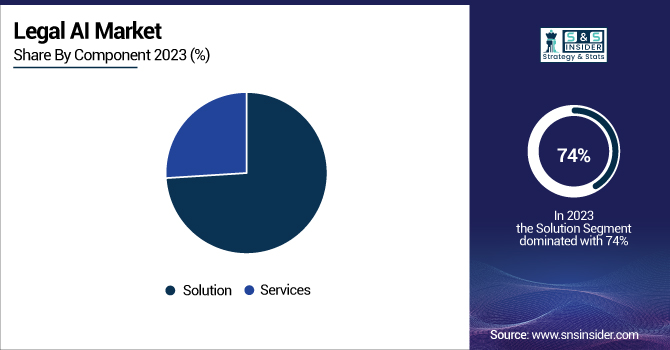

By Component

In 2023, the solutions segment held a larger market share of more than 74% of revenue due to the rising use of legal AI software to manage the workload of the legal department, increasing demand for AI-enabled software solutions to automate and speed up the routine, repetitive parts of legal practices. In addition, the introduction of advanced software solutions with functionalities like data analytics, machine learning, predictive modeling, and automation also enhances the need for legal AI solutions, which in turn propels the growth of this segment.

The services segment is expected to register the fastest CAGR from 2024 to 2032, owing to the growing demand for software integration and consulting services, increasing demand for periodic upgrades and maintenance, and growing demand for support services to effectively implement the processing and utilize.

By Application

The legal research segment dominated the market and held the largest share of the market in 2023 due to the increasing utilization of AI-based natural language processing tools to analyze and interpret dense legal language, enabling attorneys and other legal professionals to quickly locate pertinent case law, statutes, and regulations, and an increasing need to assess large volumes of legal data to forecast case outcomes, evaluate potential risks, and optimize legal strategies.

The legal chatbots segment is projected to grow at the fastest CAGR from 2024 to 2032, owing to increasing adoption of legal chatbots by law firms, technological advancements in legal chatbots, and growing focus of companies on innovations. By using chatbots, accessibility is enhanced, as it can provide answers for basic legal queries and take down initial information from clients 24/7.

By End-Use

The law firms segment dominated the market and accounted for the largest share in 2023 and is also anticipated to grow at a higher growth rate, owing to enlarged investments in AI technology by law firms. Law firms, being able to capitalize on vast amounts of legal data processing and analysis, found the growth of such AI systems so valuable that they exploded into the market. Moreover, the popularity of AI within law firms is based on advantageous effects like increased efficiency, reduced costs, greater decision-making, and improved client service.

Corporate legal department segment is anticipated to grow substantially between 2024 and 2032. A major driver of this growth is the rising need for legal AI solutions for contract review and contract lifecycle management, more specifically for organizing/tracking contracts and negotiating contracts.

By Technology

In 2023, the machine learning and deep learning technology segment dominated the market and accounted for the largest share of over 65% of the market because of the increasing penetration of machine learning and deep learning for building advanced algorithms, examining high volumes of legal data, extracting insights, and automating various legal processes. Machine learning algorithms have scrutinized a large number of documents dealing with law, such as case law, regulations, and statutes. This segment further continued its growth due to an increased use of ML technology in legal research platforms.

The natural language processing technology segment is projected to have the fastest CAGR from 2024–2032, as they largely automate the analysis and understanding of documents while reducing human error in the legal framework, and free up lawyers for more complex legal issues with growing demand to accelerate research, analysis, and document generation.

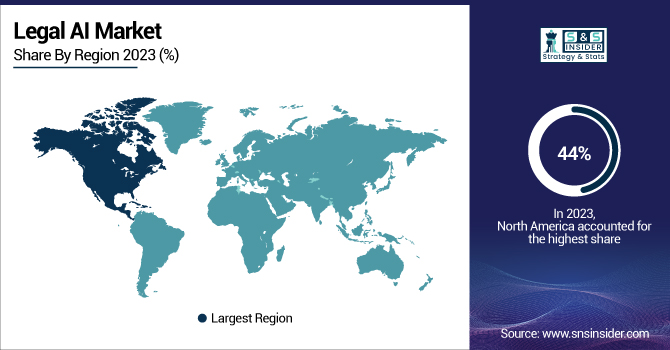

Regional Landscape

North America dominated the market and accounted for more than 44% of the market in 2024, owing to rising demand for improving operational efficiency and cost-effectiveness in legal processes, rising volume of legal data, and growing adoption of artificial intelligence and natural language processing technologies. Due to the increasing need for enhanced efficiency and productivity throughout the legal landscape, the local law firms and legal departments are being pushed to handle a great deal of data and documents, and research jobs.

Asia Pacific is expected to be the fastest-growing legal AI market. Factors such as the enabling environment of the legal sector, increased deployment and usage of legal AI tools, growing legal tech ecosystem with infocus on AIbased solutions in contract analysis and e-discovery applications, and rapid adoption of legal AI solutions for contract review and analysis of related aspects and patent analysis, which will contribute to enterprise growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM Corporation — IBM Watson Legal

-

Thomson Reuters — Westlaw Edge

-

LexisNexis — Lexis+

-

ROSS Intelligence — EVA

-

Luminance Technologies — Luminance Diligence

-

LawGeex — LawGeex Contract Review Automation

-

Casetext — CoCounsel

-

Cognitiv+ — Cognitiv+ Contract Analytics

-

Ayfie Group — Ayfie Inspector

-

Ravn Systems (iManage) — RAVN Extract

-

Kira Systems — Kira Contract Analysis

-

Evisort — Evisort Contract Management AI

-

Onna Technologies — Onna Data Discovery Platform

-

Legalsifter — LegalSifter Review

-

Veritone Inc. — Veritone Illuminate

Recent Developments

-

October 2024: Thomson Reuters introduced deeper integration of CoCounsel 2.0 into Westlaw and Practical Law, featuring new generative AI tools like Mischaracterization Identification and AI Jurisdictional Surveys to enhance legal research efficiency.

-

June 2024: Thomson Reuters launched Westlaw Edge Canada with CoCounsel, combining generative AI with Westlaw's content to expedite complex legal research tasks for Canadian legal professionals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.1 Billion |

| Market Size by 2032 | US$ 4.9 Billion |

| CAGR | CAGR of 18.13 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution,Services) • By Technology (Natural Language Processing Technology, Machine Learning and Deep Learning Technology) • By Application (E-Discovery, Legal Research, Analytics, Compliance and Regulatory Monitoring, Document Drafting and Review, Contract Management, Legal Chatbots, Others) • By End-Use (Law Firms, Corporate Legal Departments, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Thomson Reuters, LexisNexis, ROSS Intelligence, Luminance Technologies, LawGeex, Casetext, Cognitiv+, Ayfie Group, Ravn Systems (iManage), Kira Systems, Evisort, Onna Technologies, Legalsifter, Veritone Inc. |