Ligation Devices Market Report Scope & Overview:

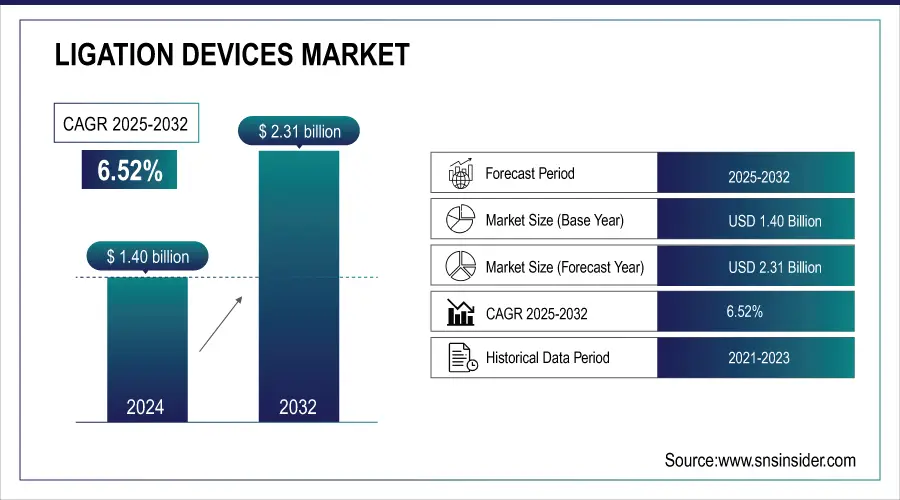

The Ligation Devices Market size was valued at USD 1.40 billion in 2024 and is expected to reach USD 2.31 billion by 2032, growing at a CAGR of 6.52% over the forecast period of 2025-2032.

The growth trend of the ligation devices market heavily depends on the rising number of elderly individuals, together with the increasing prevalence of diseases connected to lifestyle choices. The aging process makes people prone to multiple chronic health conditions, including colorectal cancer and diverticulitis and varicose veins, and gynecological disorders, which require surgical procedures involving ligation devices. The worldwide increase of lifestyle-related diseases, which stem from obesity, along with poor diet and sedentary lifestyles, leads to higher surgical requirements for hemorrhoidectomy and gallbladder removal and other gastrointestinal and urological surgical procedures. Surgical procedures for elderly patients need to be minimally invasive because their bodies show reduced resilience and they experience extended recovery periods when undergoing traditional open surgeries. Ligation devices have become more essential in surgical procedures because they serve the purpose of fastening blood vessels and tissues, which leads to increased demand. For instance, according to the WHO, global life expectancy increased to 74.8 years in 2024, with low- and middle-income countries showing the fastest gains. This is expected to increase the demand for age-related surgical interventions, many of which involve ligation.

To Get more information on Ligation Devices Market - Request Free Sample Report

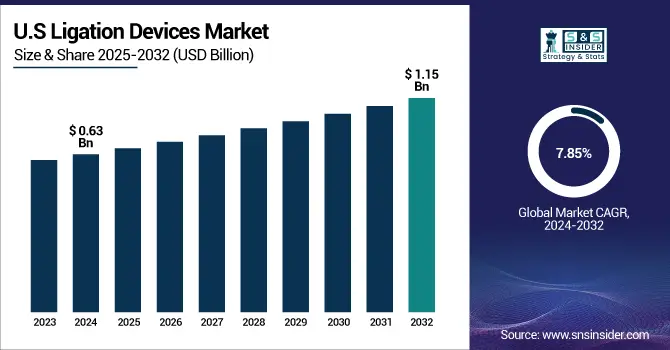

The U.S. Ligation Devices Market was valued at USD 0.63 billion in 2024 and is expected to reach USD 1.15 billion by 2032, growing at a CAGR of 7.85% from 2025-2032.

The U.S. leads the ligation devices market because it performs an extremely large number of surgical procedures every year. The U.S. leads worldwide in surgical interventions through its annual performance of 15 million major surgeries in 2024, specifically in gastrointestinal and gynecological and cardiovascular, and urological surgeries. Ligation devices market, including clip applicators, band ligators, and endoloops, are frequently needed during these procedures for blood vessel and tissue closure and bleeding control. The combination of modern hospital infrastructure and expanding ambulatory surgical centers (ASCs) has driven the rise of minimally invasive procedures, which leads to increased utilization of ligation instruments. The rise of robotic-assisted surgical procedures in the U.S. has generated an extra requirement for advanced ligation

Market Dynamics:

Drivers

-

Increasing Adoption of Minimally Invasive Surgeries (MIS) Is Driving the Ligation Devices Market Growth

The ligation devices market experiences substantial growth because patients now select minimally invasive surgeries (MIS) instead of conventional open surgery methods. The medical community adopts laparoscopy and robotic-assisted surgery throughout the world because these methods provide reduced incision sizes plus decreased blood loss alongside shortened hospital stays and faster recovery periods, and minimized complication risks. Ligation devices function as essential components in these surgical procedures. The medical devices, including endoscopic clip appliers together with ligature loops and banding devices, allow surgeons to close blood vessels and stop bleeding and secure internal tissues through small incisions. As MIS procedures become more prevalent, the need for precise and simple-to-use compact ligation instruments has experienced exponential growth.

For instance, the North American market had the largest revenue share of about 51% in 2024. Additionally, as of 2020, over 5,500 da Vinci systems were installed in hospitals across the United States. Over 2,000 hospitals now use robotic surgical systems, making the U.S. a significant, if not the largest, market for robotic surgical systems.

-

Increased Focus on Patient Safety and Surgical Precision is the Key Driver of the Ligation Devices Market Growth

The ligation devices market experiences growth because of worldwide medical attention on patient protection and surgical accuracy. Hospitals now face rising requirements to cut down surgical issues while controlling blood loss during operations and speeding up healing durations. The essential function of ligation devices, including clip appliers and band ligators, and vessel sealing instruments, helps doctors secure blood vessels and lower bleeding risks, and maintain clean surgical environments. New ligation tools feature precise operation alongside controlled application and dependable performance, which helps doctors prevent surgical errors and surgical site complications. These devices enhance surgical workflows through their support of minimally invasive and robotic procedures, where surgeons operate with limited visibility and control compared to open surgeries.

Restraints:

-

Risk of Side Effects and Allergic Reactions is Restraining the Ligation Devices Market Growth

The growing preference for non-surgical treatments represents a major obstacle to the expansion of the ligation devices market because these alternatives replace surgical procedures that traditionally used ligation methods. Medical science, along with pharmaceutical development, has enabled healthcare professionals to treat different medical conditions, including hemorrhoids and varicose veins, along with specific gastrointestinal disorders by using outpatient or non-surgical techniques.

For instance, this RCT found that endovenous laser ablation is clinically and cost-effective compared to surgery and foam sclerotherapy. The study findings are consistent with the guideline, which recommends endothermal ablation as first-line treatment, followed by foam sclerotherapy and surgery.

Doctors now use laser therapy together with infrared coagulation and sclerotherapy to treat hemorrhoids, which previously required ligation banding or surgical excision. The alternatives receive widespread preference from patients and physicians because they deliver less painful experiences and fewer complications and shorter recovery durations, and eliminate the requirement for anesthesia.

Segmentation Analysis:

By Product

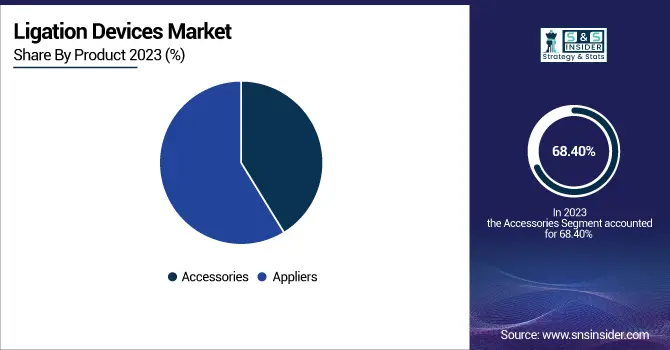

Accessories are the dominant segment in the global Ligation Devices Market, with a 68.40% market share in 2024. It also shows the fastest-growing CAGR of 6.78%. Instruments for accessories for ligation procedures—such as ligating clips, endoloops, suture bands, or disposable cartridges—are usually cheaper than the major ligation tools, such as a clip applier or energy base. When given cheaper unit prices, hospitals, ambulatory surgical centers (ASCs), and clinics find it cost-effective, especially for performing large volumes of procedures. Healthcare organizations buy these in bulk since the supplies are disposable or require frequent replacement to maintain operational readiness. Bulk buying offers two advantages: a lower price per item and an uninterrupted surgical supply chain without material shortages or process delays.

The surgical ligation devices market is differentiated into disposable and reusable accessories to serve different clinical needs and operational environments. Disposable accessories, such as clip cartridges, are preferred in modern surgical facilities in the context of infection control, regulatory compliance, and ease of use. They are considered premier products for healthcare facilities with large patient numbers, like hospitals and ambulatory surgical centers in the developed world, where speedy procedures and maximum patient protection are the requirements. Reusable accessories like metal clip appliers and ligature handles function through multiple cycles of sterilization, making them economical for long-term use and most beneficial to those surgical centers that have an extremely meager budget.

By Procedure

In 2024, the MIS segment dominated the Ligation Devices Market trend with a 78.80% market share. The ligation devices market is dominated by MIS devices as there is an increasing global demand for safer, quicker, and less traumatic surgical procedures. Unlike open surgery, MIS involves smaller incisions, less damage to tissues, less blood loss, shorter hospital stays, and faster recovery times. Because of these clinical advantages, MIS has become the standard of care in many specialties, including gastrointestinal, gynecological, urological, and cardiovascular surgeries. In MIS procedures, ligation devices are essential for sealing blood vessels, controlling bleeding, and securing tissues; direct manual access is limited with these procedures.

The Open Surgery is the fastest-growing segment in the Ligation Devices Market, with a CAGR of 6.95%. Honestly, open surgery is the go-to for trauma cases and those wild, complicated operations where resources are thin. If you’re dealing with a massive tumor or body parts that just don’t want to cooperate, forget about minimally invasive techniques—they’re pretty much useless in those scenarios, especially if things go sideways fast. Surgeons lean on ligation gadgets since they need something quick and reliable to clamp off blood flow, especially deep inside where you can’t see much and blood’s everywhere. You’ll see them juggling sutures, clips, and those fancy energy-sealing doohickeys—basically, all the stuff that keeps the bleeding in check and the whole operation from going off the rails.

By Application

Gastrointestinal & Abdominal Surgeries held a dominant Ligation Devices market share of 35.22% of the global Ligation Devices industry in 2024. Tablet and capsule dosage forms are preferred by both pharmaceutical and nutraceutical companies because they provide controlled doses, efficient regulatory compliance, as well as favorable costs in manufacturing and distribution at scale. They are also easier to store and ship, and more stable than liquids or powders. For customers, the association of capsules and tablets with traditional medicine also plays a role in the perception of trust and efficacy.

The Cardiovascular Surgeries segment is one of the fastest-growing markets in the Ligation Devices industry, growing at a CAGR of 7.04%. Because of the worldwide increase in cardiovascular diseases (CVDs), including aneurysms, valve disorders, and arrhythmias—all of which often need surgical intervention— Since CVDs are the top cause of worldwide mortality, they are motivating more funding for cutting-edge surgical therapy options, especially in aging populations and areas with great lifestyle-related risk factor. Precise vessel control is crucial in cardiovascular operations; therefore, devices for ligation, like vascular clips, endoscopic ligature systems, and energy-based sealing equipment, are essential for preventing bleeding, securing grafts, and isolating vessels during difficult procedures like coronary artery bypass grafting (CABG), aneurysm repairs, and valve replacements.

By End User

Because of their great surgical volume, access to sophisticated technologies, and varied case mix across specialties, hospitals are the most important and fastest expanding end-user sector in the ligation device market trend. Most invasive and complicated treatments—including oncological, cardiac, gastrointestinal, and trauma operations—are conducted in hospitals where ligation instruments are vital for vascular control, bleeding management, and tissue sealing. Typically equipped for open, laparoscopic, and robotic operations, all of which depend greatly on ligation instruments, including clip applicators, endoloops, and energy-based sealing equipment, hospitals have well-developed surgical divisions. Hospitals also have a reliable supply chain for disposable and reusable accessories, therefore guaranteeing constant acquisition and utilization of these devices.

Furthermore, adding to the faster need for ligation devices in hospital-based minimal invasive procedures (MIS), greater patient volume owing to aging populations, and the growing incidence of chronic diseases needing surgical intervention are all contributors. Especially in developing countries, increasing access to sophisticated care, government and private funds are more frequently aimed at hospital-based surgical infrastructure.

Regional Analysis:

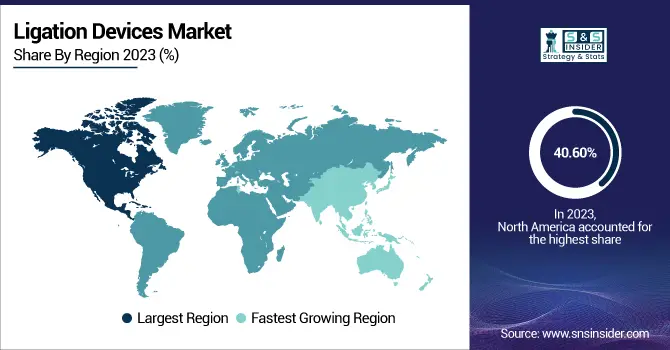

In 2024, the North American region holds the largest market share of the Ligation Devices market share and dominates the Ligation Device market with a market share of 40.60%. Early adopters of minimally invasive and robotic operations, which depend mostly on accurate ligation instruments, including clip appliers, endoloops, and vessel sealing equipment, North American hospitals and ambulatory surgical centers have sophisticated facilities. Furthermore, the existence of major worldwide medical device firms like Medtronic, Johnson and Johnson, and Teleflex—headquartered or strongly active in this area—helps with quick access, innovation, and consistent product availability. Favorable insurance and compensation systems in the U. S. and Canada also help widespread adoption of sophisticated surgical tools, including disposable ligation accessories, therefore motivating hospitals to keep high utilization rates. Fast adoption of next-generation ligation techniques is made possible in part by vigorous FDA authorization processes, surgeon training programs, and active clinical research.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe accounts for the second biggest market share of the ligation devices industry owing to its well-developed healthcare system, widespread acceptance of cutting-edge surgical methods, and a steadily growing elderly population that fuels demand for procedures using these instruments. With their sophisticated public and private hospital systems, countries such as Germany, France, the UK, and Italy routinely conduct surgeries—especially for cardiac, gastrointestinal, urological, and cancer-related disorders—utilizing ligation tools. Europe has also been among the first to embrace minimally invasive surgery (MIS) and robot-assisted operations, both of which depend heavily on exact ligation supplies and equipment. Moreover, the existence of regional and international med-tech businesses together with strict regulatory oversight (e.g., CE Mark certification) guarantees superior product quality and constant innovation in the surgical tool industry. Many European nations' government-financed universal healthcare systems help to ensure broad access and consistent surgical volume.

Asia-Pacific emerges as the fastest-growing region with the highest CAGR of 7.03%. Because of its quickly growing healthcare system, rising surgical rates, and growing investment in sophisticated medical technology. Driven by population growth, urbanization, and the growing incidence of chronic diseases, including cancer, cardiac diseases, and gastrointestinal illnesses, nations like China, India, Japan, South Korea, and Australia are seeing fast growth in minimally invasive and open surgical procedures. Demand for premium ligation devices and accessories, including disposable items complying with infection control requirements, rises as governments and private healthcare providers in the area spend money on modernizing hospitals and surgical facilities. Increasing healthcare spending, medical tourism, and public health campaigns targeted at improving surgical access in rural and semi-urban regions all help to drive growth.

Furthermore, the large and elderly population base, especially in China and Japan, is driving an increase in age-related procedures requiring ligation instruments for vessel sealing and bleeding management. Local manufacturing, increased knowledge among healthcare professionals, and speedier regulatory permissions are also enabling global and regional participants to grow their presence in this high-potential market.

In essence, the Asia-Pacific region is the fastest expanding market for ligation devices worldwide because it has a vast patient population, better access to surgical care, increasing investments in healthcare, and fast adoption of contemporary surgical procedures.

The Middle East & Africa (MEA) region holds a relatively small share of the global Ligation Devices Market, especially those used in advanced or minimally invasive surgical procedures. Economic volatility in nations like Argentina and Venezuela is one of the main obstacles that impact private hospital investments as well as public healthcare budgets. Many hospitals find it difficult to purchase modern surgical tools—including disposable accessories or high-quality ligation instruments—because of erratic currency and restricted government funding. Another important problem is split approval processes and bureaucratic delays. Every country in the area has its medical device approval process, which can be slow and erratic, and therefore challenging for foreign companies to introduce items quickly. This deters international suppliers from giving Latin American markets top priority for new or cutting-edge ligation equipment.

The Latin America region is experiencing steady growth in the Ligation Devices Market analysis. Rising disease burden, slow but steady growth in the ligating devices market in Latin America is being fueled by incremental enhancements to healthcare infrastructure and growing demand for surgical operations, especially in nations like Brazil, Mexico, Colombia, and Chile. More hospitals are including fundamental tools like ligation devices—used for vessel sealing, tissue management, and bleeding prevention across general, gynecological, gastrointestinal, and cardiovascular procedures as governments and private healthcare providers keep investing in hospital upgrading and surgical care. Among the main causes behind this consistent growth are the growing incidence of chronic diseases, including heart disease, cancer, and obesity, which call for both open and minimally invasive treatments.

Key Market Players

Ligation devices companies include Johnson & Johnson, Medtronic plc, B. Braun Melsungen AG, Teleflex Incorporated, CONMED Corporation, Olympus Corporation, Applied Medical Resources Corporation, Grena Ltd., Boston Scientific Corporation, and Purple Surgical.

Recent Developments

-

In Jun 2025, Johnson & Johnson Launches the ETHICON™ 4000 Stapler for an Elevated Surgical Experience and the Most Secure Staple Line. The stapling system features ETHICON™ 3D Reloads with proprietary 3D Stapling Technology and enhanced Gripping Surface Technology to manage tissue complexities and reduce potential leaks and bleeds at the staple line.

-

In March 2025, Olympus, a global medical technology company committed to making people’s lives healthier, safer, and more fulfilling, announced today the launch of a new hemostasis clip to help meet the needs of GI endoscopists.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.40 billion |

| Market Size by 2032 | USD 2.31 billion |

| CAGR | CAGR of 6.52% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Appliers,Disposable,Reusable, Accessories,Clips,Clip remover) • By Procedure(MIS, Open Surgery) • By Application (Gastrointestinal & Abdominal Surgeries, Gynecological Surgeries, Cardiovascular Surgeries, Urological Surgeries, Other Applications) •By End User(Hospitals, Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Johnson & Johnson, Medtronic plc, B. Braun Melsungen AG, Teleflex Incorporated, CONMED Corporation, Olympus Corporation, Applied Medical Resources Corporation, Grena Ltd., Boston Scientific Corporation, Purple Surgical |