Specialty Medical Chairs Market Insights

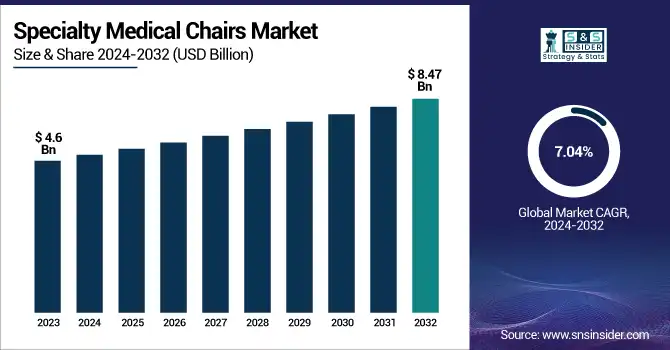

The Specialty Medical Chairs Market size was USD 4.6 billion in 2023 and is expected to reach USD 8.47 billion by 2032, growing at a CAGR of 7.04% over the forecast period of 2024-2032.

To Get more information on Specialty Medical Chairs Market - Request Free Sample Report

This report provides comprehensive statistical insights and emerging trends in the Specialty Medical Chairs Market. This includes the incidence and prevalence of medical conditions that bill itself into chairs, as well as regional demand and device volume trends. It examines utilization rates across care settings, from hospitals to home care, and considers spending on healthcare services by governments, private insurers, and out-of-pocket sources. It also offers patient demographic profiles and usage behaviour, with a focus on the geriatric and mobility-impaired populations. It also highlights technological trends and personalization trends, for example, electronic controls and ergonomic designs. These insights offer a data-driven view of market dynamics, procurement patterns, and innovation shaping the future of specialty medical chairs globally. The specialty medical chairs market is driven by the increasing prevalence of chronic diseases and the aging population, which necessitate advanced healthcare solutions.

U.S. Specialty Medical Chairs Market Trends

The United States Specialty Medical Chairs market is estimated to grow from USD 1.64 billion in 2023 to USD 2.99 billion by 2032, at a CAGR of 7.3% during the forecast period (2023-2032). This consistent upward trend reflects increasing healthcare infrastructure investments, a growing need for patient comfort and mobility solutions, and the aging population. The U.S. is a key contributor to global market revenues, providing continued opportunities for new innovative products and solution adoption. According to the World Health Organization (WHO), musculoskeletal conditions affected approximately 1.71 billion people globally in 2022, with older adults being particularly vulnerable. In addition, motorized control and ergonomic design features have promoted patient comfort and accessibility, thereby driving the market growth.

Specialty Medical Chairs Market Dynamics

Drivers:

-

Increasing demand for advanced mobility solutions in chronic disease care and elderly patient support boosts the adoption of specialty medical chairs globally.

Rising demand for patient-centric solutions in managing chronic conditions and supporting the elderly has significantly propelled the specialty medical chairs market. With the world population aging and chronic conditions such as arthritis, cardiovascular diseases, and cancer on the rise, there’s a growing need for specialized seating that provides comfort, safety, and therapeutic support. Designed for long procedures including dialysis, chemotherapy, and rehabilitation, these chairs enhance patient comfort while providing caregivers with ease of use. Additionally, hospitals, homecare environments, and rehabilitation facilities are progressively employing these types of devices as part of their care framework. Motorized control, ergonomic designs, and enhanced safety features are among the technological innovations that have further reinforced adoption. All these trends together are translating into a strong market growth trajectory for specialty chairs addressing higher levels of mobility and treatment needs.

Restraints

-

High cost associated with technologically advanced specialty medical chairs limits their accessibility among smaller clinics and emerging healthcare facilities.

The significant capital investment required for technologically advanced specialty medical chairs poses a barrier to adoption, particularly for small- and medium-sized clinics. While electronic/hydraulic chairs are convenient and comfortable, they also incur lots of production costs and maintenance costs. In developing economies, healthcare service providers typically work on a limited budget and it becomes really tough to spend on high-class hospital furniture. Moreover, there is no support from the government with subsidies or any other form of funding, making it even less accessible. A concern on the high price front trickles down to the homecare markets, where budget-centric consumers are reluctant to spend on premium models. As a result, cost is a critical barrier that states can limit the more widespread market adoption of novel specialty chair solutions despite their clear clinical benefits and increasing need.

Opportunities

-

Expansion of healthcare infrastructure in emerging markets opens avenues for increased deployment of specialty chairs in new medical setups.

Rising healthcare infrastructure in emerging economies such as India, Brazil, and Southeast Asian nations will serve as a very good opportunity for the specialty medical chairs market. In order to fulfill the increasing healthcare needs of their citizens, governments and private organizations are investing money in hospitals, diagnosis centers, and rehabilitation centers. Consequently, the need for affordable, durable, and user-friendly medical furniture, spanning specialty chairs, is at an all-time high. This market segment is also benefiting from increasing public health budgets and international collaborations that bring modern medical technologies to underserved areas. This creates opportunities for manufacturers with products priced to sell quickly and local distribution agreements to join these growing networks of distribution, which will fuel both market penetration and, with time, return on revenue.

Challenges

-

Stringent regulatory approval processes and product compliance standards delay product launches and increase time-to-market for specialty medical chairs.

Navigating the complex web of international and domestic regulatory requirements presents a formidable challenge for manufacturers of specialty medical chairs. These chairs must comply with strict health and safety standards, including ergonomic design validation, biocompatibility, and safety of electronic components. Acquiring certifications like FDA, CE Marking or ISO standards is a lengthy and expensive process that often increases the time-to-market of new products. These regulatory hurdles can be burdensome and stifle innovation, particularly for startups and SMEs. Also, changing standards require frequent design updates and documentation reviews, which add strain to product pipelines. As a result, these compliance pressures drive up operational costs and constrain some companies’ ability to rapidly respond to market demand or customize their offerings through rapid innovation.

Specialty Medical Chairs Market Segmentation Analysis

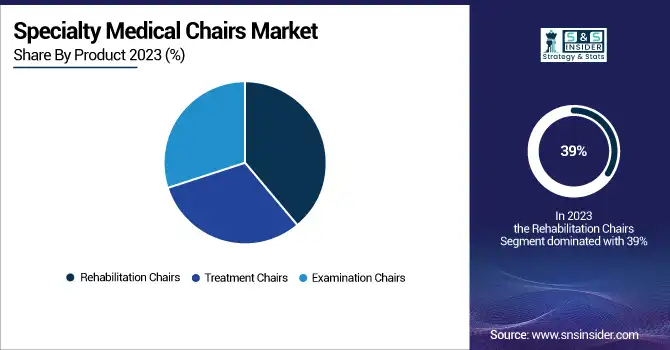

By Product

The rehabilitation chairs segment accounted for the highest market share of 39% in 2023, due to multiple factors. Rehabilitation chairs are used by patients who have had surgeries or injuries, and those with chronic conditions like neurological and musculoskeletal disorders. They often come with features such as ergonomic support and adjustable positioning, allowing them to play vital roles in patient recovery. This segment is expected to maintain its dominance due to the aging population. For instance, in India alone, the elderly population reached 153 million in 2023 and is projected to rise significantly by 2050. Neurological diseases caused over half a million deaths in the Americas alone in 2019, underlying the necessity of developing specialized rehabilitation solutions. Features like powered rehabilitation chairs have increased demand even more by providing enhanced mobility and comfort. Government statistics also underline this growth. Musculoskeletal disorders (MSDs) remain the most prevalent health condition in the U.S. and around the world, affecting more than one billion people globally in 2022. Such conditions usually necessitate long-term rehab processes with specialized chairs. Furthermore, increasing healthcare spending and better accessibility to advanced medical devices have fuelled the dominance of this segment.

By End-Use

The hospitals segment dominated the specialty medical chairs market share, in 2023, where hospitals are the primary healthcare providers for chronic disease and surgeries. These chairs are often used by hospitals for procedures including dialysis, dental care, and ophthalmology treatments, and for post-surgical recovery. For instance, dialysis chairs, are essential for patients who require regular treatments for kidney failure a condition that is on the rise in older populations. Likewise, the advent of imaging systems integrated into dental chairs has improved procedural efficiency in hospital settings. Government statistics reveal that hospitals remain central to healthcare delivery across regions. Specialty medical chairs pulled in more than USD 2.8 billion of revenue from their hospital market presence in North America alone in 2023. Hospital systems are also adopting innovative equipment such as motorized specialty chairs to enhance the patient experience which are also driving this growth due to a surge in outpatient services.

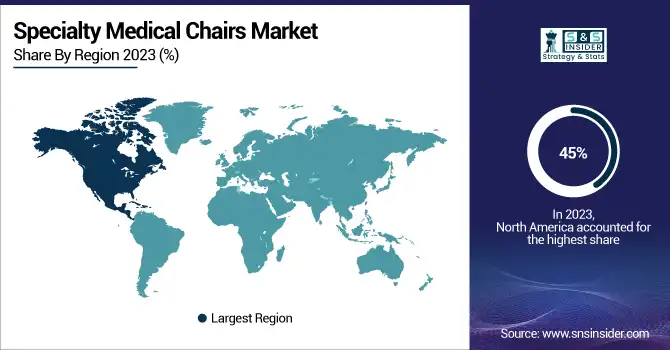

Specialty Medical Chairs Market Regional Overview

North America dominated the specialty medical chairs market in 2023, and held the largest share of 45% due to its advanced healthcare infrastructure, high healthcare expenditure, and significant aging population. According to the U.S. Census Bureau, the elderly population (65 years and older) in the U.S. grew to 58 million in 2022 and is expected to rise to 82 million by 2050, comprising 23% of the total population. This demographic shift has led to increased demand for specialty medical chairs for geriatric care, including recliners and mobility-assistance chairs. North American healthcare facilities prioritize patient comfort and safety which leads to high adoption of advanced specialty chairs with features such as pressure relief and ergonomic designs. The absence of stringent government regulations regarding the production and sale of medical equipment in the U.S. is predicted to augment the market demand.

In 2023, the fastest growth was experienced by the Asia-Pacific region, showcasing a tremendous compound annual growth rate (CAGR) for the forecast period. Growth in disposable incomes, developing healthcare infrastructure, and growing geriatric populations such as China and India are driving this boom. Moreover, increased healthcare access due to government plans to strengthen treatments and technology improvements, including motorized controls and ergonomic designs, is promoting growth of the Asia-Pacific market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Specialty Medical Chairs Market

Key Service Providers/Manufacturers

-

Danaher Corporation (KaVo ESTETICA E70, KaVo PHYSIO 500 Dental Chair)

-

A-dec Inc. (A-dec 500 Dental Chair, A-dec 300 Delivery System)

-

DentalEZ, Inc. (J/V-Generation Chair, NuSimplicity Chair)

-

Midmark Corporation (Midmark 641 Barrier-Free Chair, Midmark 647 Procedure Chair)

-

Hill Laboratories Company (Hill HA90 Power Chair, Hill HA90PT Tilt Table)

-

Topcon Corporation (OC-2400 Ophthalmic Chair, IS-1D Instrument Stand)

-

Dentsply Sirona (Intego Treatment Center, Sinius Treatment Center)

-

PLANMECA OY (Planmeca Sovereign Classic, Planmeca Compact i5)

-

Chattanooga Group (DJO Global) (Hydrocollator Table, ADP 400 Traction Table)

-

ActiveAid Inc. (ActiveAid 922 Shower Chair, ActiveAid 285 Rehab Shower Commode Chair)

-

Fresenius Medical Care (5008S CorDiax Dialysis Chair, FMC Dialysis Recliner)

-

Winco Mfg., LLC (Winco 6530 Blood Drawing Chair, Winco 6700 Series Dialysis Recliner)

-

REXMED Industries Co., Ltd. (RMS-3320 ENT Chair, RMS-3200 Gynae Chair)

-

UMF Medical (UMF 4010 Exam Chair, UMF 4070 Procedure Chair)

-

Hausted Patient Handling Systems (Hausted Horizon Eye Surgery Chair, Hausted Surgi-Stretcher)

-

Marco Ophthalmic, Inc. (Marco E-Z Tilt Exam Chair, Marco Encore Chair)

-

Takagi Seiko Co., Ltd. (ST-20 Ophthalmic Chair, ST-26 Instrument Stand)

-

Medical Positioning, Inc. (EchoOne Ultrasound Table, VascPro Vascular Table)

-

Biodex Medical Systems, Inc. (Biodex Multi-Purpose Chair, Biodex Ultra Pro Ultrasound Table)

-

Oakworks Medical (CFPM100 Imaging Table, PT400 Physical Therapy Table)

Recent Developments in the Specialty Medical Chairs Market

-

Stryker Corp launched ergonomic surgical chairs to improve patient comfort during procedures in Jan 2023.

-

In September 2024, Dentsply Sirona launched dental chairs equipped with digital imaging technology for better diagnostic accuracy and comfort to patients while performing treatment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.6 Billion |

| Market Size by 2032 | USD 8.47 Billion |

| CAGR | CAGR of 7.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Examination Chairs, Rehabilitation Chairs, Treatment Chairs) • By End-use (Hospitals, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Danaher Corporation, A-dec Inc., DentalEZ, Inc., Midmark Corporation, Hill Laboratories Company, Topcon Corporation, Dentsply Sirona, PLANMECA OY, Chattanooga Group (DJO Global), ActiveAid Inc., Fresenius Medical Care, Winco Mfg., LLC, REXMED Industries Co., Ltd., UMF Medical, Hausted Patient Handling Systems, Marco Ophthalmic, Inc., Takagi Seiko Co., Ltd., Medical Positioning, Inc., Biodex Medical Systems, Inc., Oakworks Medical |