Lithium-Ion Batteries (Li-Ion) Market Report Scope and Overview:

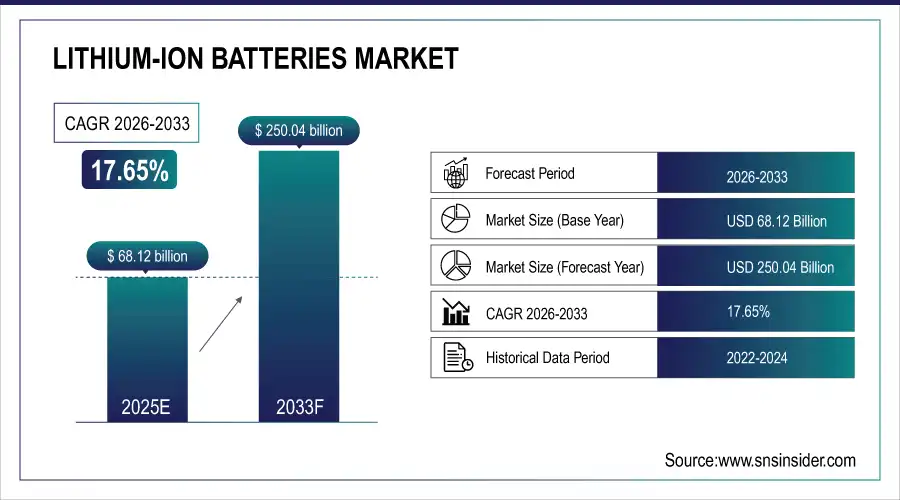

The Lithium-Ion Batteries (Li-Ion) Market size was valued at USD 68.12 billion in 2025 and is expected to grow to USD 250.04 billion by 2033 and grow at a CAGR of 17.65% over the forecast period of 2026-2033.

Lithium-ion batteries have gained immense popularity in recent years due to their exceptional energy density and extended lifespan. These rechargeable batteries are a type of power storage device that has revolutionized the way we use portable electronics. These batteries are commonly used in a variety of electronic devices, including smartphones, laptops, and electric vehicles. The technology behind lithium-ion batteries involves the use of lithium ions moving back and forth between two electrodes, which are typically made of graphite and a metal oxide. This movement of ions creates an electrical current that can be used to power devices.

Get More Information on Lithium-Ion Batteries (Li-Ion) Market - Request Sample Report

Lithium-ion batteries possess a significant advantage in their high energy density, allowing them to store a substantial amount of energy within a compact space. Limited space in portable devices makes them an ideal choice. Additionally, lithium-ion batteries have a long lifespan, which means they can be recharged and used for many years before needing to be replaced.

Lithium-Ion Batteries (Li-Ion) Market Highlights:

-

High manufacturing costs and safety risks as lithium ion batteries are expensive to produce and require careful handling to prevent overheating leakage or fire hazards

-

Growing demand from power grids and renewable storage as increasing integration of solar and wind energy drives the need for lithium ion batteries for grid stabilization peak load management and energy reliability

-

Advancements in technology and cost decline as innovations in energy density charging efficiency and declining battery prices are accelerating adoption across utility projects microgrids and commercial applications

-

Challenges in spent battery transportation and storage as improper handling of used batteries poses environmental and safety risks prompting stricter regulations for collection labeling and recycling

-

Surge in consumer electronics usage as rising demand for smartphones wearables tablets and portable gadgets is boosting the need for high capacity long lasting lithium ion batteries

-

Supportive government policies and circular economy initiatives as regulations promoting clean energy and recycling infrastructure are creating new opportunities for sustainable battery management

Although lithium-ion batteries offer numerous advantages, they do have a few drawbacks. One of the primary concerns is their manufacturing cost, which can be quite high. Additionally, if not handled with care, these batteries can overheat and even catch fire. Nevertheless, with proper maintenance and handling, lithium-ion batteries can provide dependable and long-lasting power for a broad range of electronic devices.

Lithium-Ion Batteries (Li-Ion) Market Drivers:

-

Growing demand for lithium-ion batteries in the power grid and renewable battery energy storage system

The growing demand for lithium-ion batteries in power grids and renewable battery energy storage systems is driven by the global shift toward clean energy, decarbonization, and grid modernization. Lithium-ion batteries offer high energy density, long cycle life, fast charging capabilities, and improved efficiency, making them ideal for integrating intermittent renewable sources like solar and wind. They enable peak load management, grid stabilization, and enhanced energy reliability while reducing dependency on fossil fuels. Advancements in battery technology, declining costs, and supportive government policies are accelerating large-scale deployments in utility projects, microgrids, and commercial applications, fostering sustainable and resilient energy infrastructure.

Lithium-Ion Batteries (Li-Ion) Market Restraints:

-

Rising concern about the transportation and storage of spent batteries

Rising concern about the transportation and storage of spent batteries is becoming a critical issue due to the increasing adoption of electric vehicles, portable electronics, and renewable energy storage systems. Improper handling of used batteries poses environmental risks, including soil and water contamination from hazardous chemicals, as well as safety hazards such as leakage, fire, or explosions during transit and storage. Regulatory bodies are implementing stricter guidelines to ensure safe collection, labeling, packaging, and recycling processes. The development of robust logistics networks, advanced recycling technologies, and standardized handling procedures is essential to minimize risks and promote sustainable battery waste management.

Lithium-Ion Batteries (Li-Ion) Market Opportunities:

-

Extreme surge in the use of smartphones and other electronic devices

The extreme surge in the use of smartphones and other electronic devices has significantly increased global demand for efficient, high-capacity, and long-lasting batteries. With the rapid adoption of advanced features such as high-resolution displays, 5G connectivity, AI-driven applications, and intensive multimedia usage, energy consumption in these devices has escalated. This trend drives continuous innovation in battery technology, focusing on enhanced energy density, faster charging, and longer life cycles to meet consumer expectations. Additionally, the rise of wearables, tablets, and portable gadgets further amplifies the need for reliable power solutions, contributing to the expansion of the global battery manufacturing and supply chain.

Lithium-Ion Batteries (Li-Ion) Market Segment Analysis:

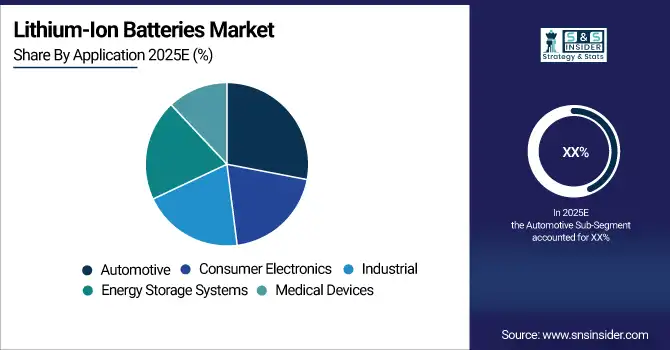

By Application

In 2025, automotive applications dominated the lithium-ion battery market, accounting for the largest share, driven by the rapid expansion of electric vehicles (EVs), government incentives, and growing investments in sustainable mobility solutions. Consumer electronics remained the second-largest segment, supported by the widespread use of smartphones, laptops, and portable devices. Energy storage systems (ESS) emerged as the fastest-growing segment, fueled by the integration of renewable energy sources and the need for grid stabilization. Industrial applications witnessed steady growth due to rising demand in backup power and manufacturing sectors, while medical devices contributed a smaller but stable share.

By Product Type

In 2025, Lithium Nickel Manganese Cobalt (NMC) batteries dominated the market, holding the largest share due to their high energy density and widespread use in electric vehicles and industrial applications. Automotive applications led the demand, driven by the rapid adoption of electric vehicles and supportive government policies promoting clean transportation. Lithium Iron Phosphate (LFP) batteries emerged as the fastest-growing product segment owing to their enhanced safety, cost-effectiveness, and long cycle life, making them increasingly popular in energy storage systems and commercial vehicles. This trend is expected to continue toward 2033, with NMC maintaining leadership and LFP witnessing robust expansion.

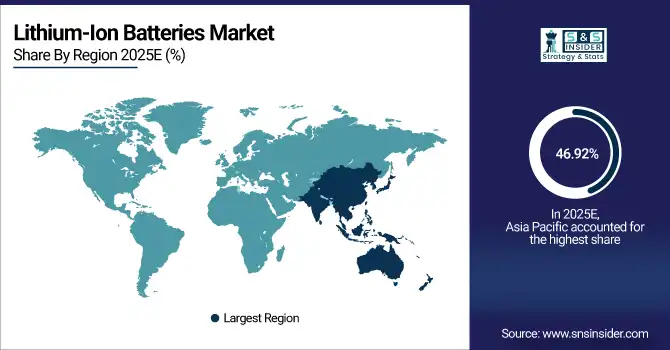

Lithium-Ion Batteries Market Regional Analysis:

Asia-Pacific Lithium-Ion Batteries (Li-Ion) Market Trends:

The Asia Pacific region dominated the market with a revenue share of about 46.92% in 2025. The Asia Pacific region, particularly India and China, is experiencing a significant surge in the demand for Li-ion batteries due to the rapidly growing market for electric vehicles. This trend is being driven by a heightened awareness of environmental issues, particularly in China, where the government has implemented a ban on conventional fossil fuel-powered scooters in major cities to reduce emissions. As a result, the sales of e-scooters have increased dramatically. This shift towards sustainable transportation is not only beneficial for the environment but also presents a lucrative opportunity for businesses operating in the Li-ion battery market.

Need any customization research on Lithium-Ion Batteries (Li-Ion) Market - Enquiry Now

North America Lithium-Ion Batteries (Li-Ion) Market Trends:

North America held a substantial share in 2025, driven by increasing adoption of electric vehicles (EVs), government incentives, and robust investments in renewable energy infrastructure. The United States leads the region with strong initiatives to reduce carbon emissions, including federal tax credits for EV purchases and expanding charging infrastructure. Demand from consumer electronics and energy storage systems is also on the rise, as industries shift towards sustainable and efficient power solutions. Furthermore, advancements in battery recycling programs in the U.S. and Canada are fostering a more circular economy, creating new opportunities for manufacturers and suppliers.

Europe Lithium-Ion Batteries (Li-Ion) Market Trends:

Europe accounted for a significant share in 2025, supported by stringent EU regulations targeting carbon neutrality and the accelerated transition towards electric mobility. Countries such as Germany, France, and Norway are at the forefront, driven by subsidies for EV adoption and investments in gigafactories. The region’s growing renewable energy sector, including large-scale wind and solar projects, is fueling demand for advanced energy storage solutions. Additionally, the EU’s focus on localizing battery supply chains and recycling capabilities is enhancing market stability and reducing dependency on imports from Asia.

Latin America Lithium-Ion Batteries (Li-Ion) Market Trends:

Latin America is witnessing moderate yet steady growth in the Li-ion battery market in 2025, primarily driven by the rising adoption of electric two-wheelers, hybrid vehicles, and renewable energy storage systems. Brazil and Mexico are leading the demand due to supportive government policies, urban electrification initiatives, and increasing investment in clean energy projects. The region is also exploring domestic battery production to reduce import reliance, presenting opportunities for partnerships and technological collaborations.

Middle East & Africa Lithium-Ion Batteries (Li-Ion) Market Trends:

The Middle East & Africa region is emerging as a developing market for Li-ion batteries in 2025, fueled by the growth of solar power projects, particularly in the Gulf countries, and increasing adoption of energy storage systems to support grid stability. South Africa and the UAE are showing notable progress in EV infrastructure deployment. While automotive penetration remains limited compared to other regions, the rapid expansion of renewable energy and smart city initiatives is expected to drive future demand for Li-ion batteries.

Lithium-Ion Batteries (Li-Ion) Market Key Players:

-

BYD Co. Ltd.

-

A123 Systems LLC

-

Hitachi, Ltd.

-

Johnson Controls

-

LG Chem

-

NEC Corp.

-

Panasonic Corp.

-

Narada Power Source Co., Ltd.

-

Toshiba Corp.

-

Saft

-

Samsung SDI Co. Ltd.

-

GS Yuasa International Ltd.

-

Contemporary Amperex Technology Co. Limited (CATL)

-

Exide Technologies

-

EnerSys

-

VARTA AG

-

Amperex Technology Limited (ATL)

-

EVE Energy Co., Ltd.

-

SK Innovation Co., Ltd.

-

Northvolt AB

Lithium-Ion Batteries (Li-Ion) Market Competitive Landscape:

BYD Co. Ltd. is a leading Chinese manufacturer of electric vehicles, lithium-ion batteries, and renewable energy solutions. Renowned for its Blade Battery technology, BYD integrates advanced energy storage with automotive innovation. The company plays a key role in global electrification, supplying batteries and EVs across Asia, Europe, and North America.

- July 24, 2025 – BYD’s Blade Battery is transforming the EV industry with superior safety, high energy density, and cost-effective lithium iron phosphate (LFP) technology.China now leads the global lithium-ion battery market, projected to produce 70% of the world’s supply by 2027, with major players like CATL, BYD, and EVE Energy driving this growth.

| Report Attributes | Details |

| Market Size in 2025 | USD 68.12 Billion |

| Market Size by 2033 | USD 250.04 Billion |

| CAGR | CAGR of 17.65% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate, and Lithium Nickel Manganese Cobalt (LMC)) • By Application (Automotive, Consumer Electronics, Industrial, Energy Storage Systems, and Medical Devices) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BYD Co. Ltd., A123 Systems LLC, Hitachi, Ltd., Johnson Controls, LG Chem, NEC Corp., Panasonic Corp., Narada Power Source Co., Ltd., Toshiba Corp., Saft, Samsung SDI Co. Ltd., GS Yuasa International Ltd., Contemporary Amperex Technology Co. Limited (CATL), Exide Technologies, EnerSys, VARTA AG, Amperex Technology Limited (ATL), EVE Energy Co., Ltd., SK Innovation Co., Ltd., Northvolt AB. |