Virtual Power Plant Market Report Scope & Overview:

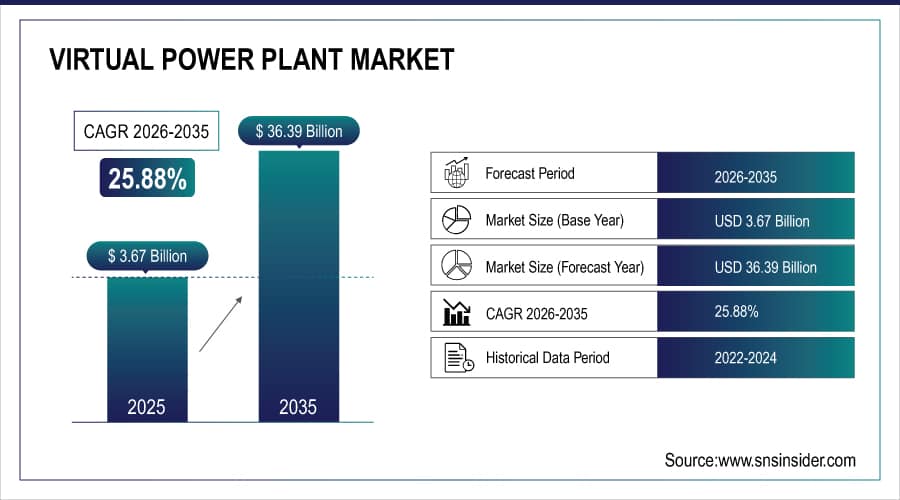

The Virtual Power Plant Market was valued at USD 3.67 billion in 2025 and is expected to reach USD 36.39 billion by 2035, growing at a CAGR of 25.88% from 2026-2035.

Virtual Power Plant Market is growing rapidly due to increasing deployment of renewable energy sources, rising adoption of distributed energy resources, and the need for efficient grid management. Advanced software platforms, energy storage integration, and demand-response programs enhance operational efficiency and cost savings. Supportive government policies, smart grid initiatives, and rising electricity demand across industrial, commercial, and residential sectors are further driving significant market expansion globally.

DOE analysis projects that tripling VPP capacity by 2030 to approximately 80–160 GW could support 10%–20% of peak electricity load while potentially saving over USD 10 billion per year in avoided grid costs by reducing reliance on traditional peak plants and infrastructure expansion.

Virtual Power Plant Market Size and Forecast

-

Virtual Power Plant Market Size in 2025: USD 3.67 Billion

-

Virtual Power Plant Market Size by 2035: USD 36.39 Billion

-

CAGR: 25.88% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get More Information On Virtual Power Plant Market - Request Free Sample Report

Virtual Power Plant Market Trends

-

Rising integration of distributed energy resources (DERs) like solar, wind, and battery storage is driving the virtual power plant (VPP) market.

-

Growing demand for grid flexibility, peak load management, and energy optimization is boosting market growth.

-

Expansion of renewable energy adoption and smart grid initiatives is fueling deployment.

-

Increasing focus on real-time monitoring, AI-based forecasting, and automated energy dispatch is shaping adoption trends.

-

Advancements in IoT, cloud platforms, and energy management software are enhancing operational efficiency.

-

Rising investments in decarbonization and sustainable energy solutions are supporting market expansion.

-

Collaborations between utilities, technology providers, and energy aggregators are accelerating innovation and global adoption.

The U.S. Virtual Power Plant Market was valued at USD 0.98 billion in 2025 and is expected to reach USD 9.46 billion by 2035, growing at a CAGR of 25.41% from 2026-2035.

U.S. Virtual Power Plant Market is growing due to high renewable energy adoption, advanced smart grid infrastructure, increasing demand for energy efficiency, and supportive government policies promoting distributed energy resources and demand-response programs across industrial, commercial, and residential sectors.

In the United States, existing VPP capacity is estimated at 30–60 GW, representing roughly 4%–8% of peak national electricity demand, reflecting substantial participation of aggregated DERs such as solar, storage, EVs, and controllable loads in grid operations.

Virtual Power Plant Market Growth Drivers:

-

Rapid adoption of distributed energy resources and demand-response technologies is driving Virtual Power Plant Market growth globally.

The increasing integration of renewable energy sources, such as solar PV and wind, into grids has created a need for efficient management of distributed energy resources. Virtual Power Plants (VPPs) enable real-time aggregation and optimization of these distributed assets, providing grid stability and balancing supply-demand fluctuations. Additionally, governments and utilities are incentivizing energy storage solutions and smart grid technologies, further accelerating VPP deployment. Rising electricity demand and the need for sustainable energy solutions are motivating industries and residential consumers to adopt VPPs, fueling substantial market growth worldwide.

Global Virtual Power Plant (VPP) Deployments and Key Metrics by Country

| Country / Region | VPP Projects and Key Metrics |

|---|---|

|

United Kingdom |

65+ active VPP projects aggregating 6.8 GW of distributed resources: 3.1 GW Solar PV, 2.4 GW Battery Storage, 1.3 GW Flexible Demand-Response; supports grid balancing and renewable integration |

|

United States |

Residential & utility VPP programs aggregating ~95 GW of solar, storage, and flexible loads; peak load reductions of 15–20%; 2.5 million+ households participating |

|

Canada |

VPP initiatives supporting 3.2 GW of distributed capacity; demand-response reduces peak grid stress by 11–16%, especially in winter |

|

China |

Shanghai VPP demand-response event achieved 1.163 million kWh load adjustment at peak; aggregated DERs include solar, EV chargers, and flexible industrial loads |

Virtual Power Plant Market Restraints:

-

High initial investment and technological complexity restrain the rapid deployment of Virtual Power Plant solutions worldwide.

Setting up a Virtual Power Plant (VPP) demands substantial investment in hardware, software, and communication systems. Integrating diverse distributed energy resources requires advanced control systems, data analytics, and strong cybersecurity. Small-scale producers and residential users face financial and technical barriers, while inconsistent interoperability protocols create operational challenges. These financial and technical constraints, especially in emerging markets with limited infrastructure and expertise, hinder large-scale VPP adoption and restrain overall market growth.

-

The cost to establish a medium-sized VPP including communication hardware, control systems, and software licenses ranges from USD 20,000 to USD 300,000, depending on scale, number of aggregated assets, and platform complexity.

-

In U.S. wholesale markets like PJM, installing utility-grade telemetry (RTUs) and real-time metering at DER sites can cost thousands of dollars per site, posing a barrier to aggregating smaller residential and commercial resources.

-

Despite these upfront costs, VPPs can be operationally cost-effective: a DOE-referenced analysis estimated the net cost of providing 400 MW of resource adequacy via a VPP at about USD 43 per kW‑year, outperforming utility-scale battery storage (≈USD 69/kW‑year) and conventional gas peaker plants (≈USD 99/kW‑year), highlighting the balance between high initial investment and long-term efficiency.

Virtual Power Plant Market Opportunities:

-

Increasing deployment of renewable energy and smart grids provides significant growth opportunities for Virtual Power Plant solutions.

The shift toward decarbonization and renewable integration creates a need for advanced energy management platforms. Virtual Power Plants can aggregate solar, wind, and storage assets to provide reliable, dispatchable power to the grid. As smart grid infrastructure expands globally, VPPs offer utilities a scalable solution to manage energy demand fluctuations efficiently. Emerging markets with growing renewable penetration present untapped opportunities for VPP service providers. Furthermore, advancements in AI, IoT, and predictive analytics enhance the efficiency and profitability of VPP operations, allowing both residential and commercial users to participate in energy markets.

For example, in ISO New England, VPP operations by companies like Sunrun reduced energy demand by 1.8 GWh during peak summer periods, demonstrating how aggregated distributed solar and storage can manage system stress.

Globally, AutoGrid-powered VPP platforms had ~5 GW of capacity and 37 GWh of energy across 15 countries as of summer 2021, and were dispatched multiple times to meet grid needs, highlighting the critical role of DER aggregation in enhancing grid reliability.

Virtual Power Plant Market Segment Highlights

-

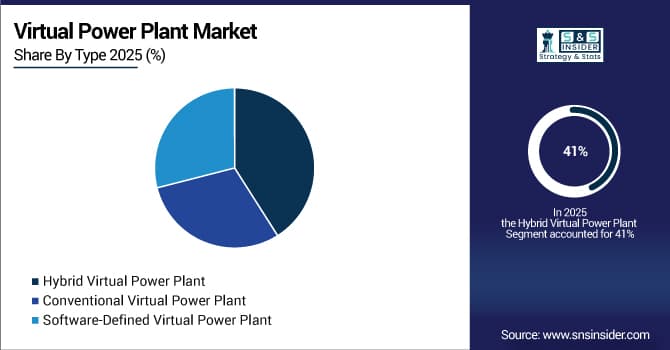

By Type, Hybrid Virtual Power Plant dominated the Virtual Power Plant Market with ~41% share in 2025; Software-Defined Virtual Power Plant fastest growing (CAGR).

-

By Technology, Distributed Energy Resource dominated the Virtual Power Plant Market with ~45% share in 2025; Mixed Asset fastest growing (CAGR).

-

By End Use, Industrial dominated the Virtual Power Plant Market with ~40% share in 2025; Commercial fastest growing (CAGR).

-

By Control Mechanism, Cloud Based Control dominated the Virtual Power Plant Market with ~46% share in 2025; Cloud Based Control fastest growing (CAGR).

Virtual Power Plant Market Segment Analysis

By Type, Hybrid Virtual Power Plant segment dominates the Market, Software-Defined Virtual Power Plant segment expected to grow fastest

Hybrid Virtual Power Plant segment dominated the Virtual Power Plant Market in 2025 because it efficiently integrates multiple energy sources, including renewable and conventional, allowing stable grid operations. Its ability to optimize energy production and distribution, combined with government incentives and industrial adoption, contributed to higher revenue generation and widespread implementation across various sectors.

Software-Defined Virtual Power Plant segment is expected to grow at the fastest CAGR from 2026-2035 due to its flexible and scalable deployment. Advanced software platforms enable real-time monitoring, predictive analytics, and automated control of distributed assets. Reduced infrastructure costs, enhanced interoperability, and adaptability to varying grid conditions make it highly attractive for residential, commercial, and industrial applications globally.

By Technology, Distributed Energy Resource segment dominates the Market, Mixed Asset segment expected to grow fastest

Distributed Energy Resource segment dominated the Virtual Power Plant Market in 2025 due to its capability to aggregate renewable energy assets efficiently. It improves grid reliability, reduces operational costs, and allows effective energy trading. Increasing deployment of solar, wind, and energy storage systems across industrial, commercial, and residential sectors further strengthened its adoption and market leadership.

Mixed Asset segment is expected to grow at the fastest CAGR from 2026-2035 as it combines various distributed energy resources and storage technologies. This integration optimizes performance, enhances energy flexibility, and supports grid balancing. The ability to manage multiple energy assets simultaneously attracts utilities and businesses seeking cost-efficient, reliable, and sustainable solutions for energy management.

By End Use, Industrial segment dominates the Market, Commercial segment expected to grow fastest

Industrial segment dominated the Virtual Power Plant Market in 2025 because of its high energy consumption and participation in demand-side management programs. Industrial users leverage VPPs for peak shaving, energy cost reduction, and revenue generation through energy trading. Strong incentives, advanced infrastructure, and operational benefits contributed to the segment’s dominance in terms of adoption and revenue.

Commercial segment is expected to grow at the fastest CAGR from 2026-2035 due to rising energy consumption, adoption of renewable and storage technologies, and increasing focus on cost optimization. Businesses use VPPs for load management, demand response, and enhanced energy efficiency, creating a favorable environment for rapid growth and widespread adoption in commercial establishments globally.

By Control Mechanism, Cloud-Based Control segment dominates the Market, expected to grow fastest

Cloud-Based Control segment dominated the Virtual Power Plant Market in 2025 due to its ability to provide centralized monitoring, real-time data analytics, and seamless integration of distributed energy resources. It enhances operational efficiency, reduces infrastructure costs, and enables remote management of assets across industrial, commercial, and residential applications. The segment is expected to grow at the fastest CAGR from 2026-2035 as cloud technologies advance, offering scalable, flexible, and cost-effective solutions that support predictive maintenance, automation, and optimized energy management.

Virtual Power Plant Market Regional Analysis

North America Virtual Power Plant Market Insights

North America dominated the Virtual Power Plant Market with the highest revenue share of about 38% in 2025 due to the presence of advanced energy infrastructure, high adoption of renewable energy sources, and supportive government policies promoting smart grids and distributed energy management. Strong investments in grid modernization, energy storage, and demand-response programs, along with established VPP service providers, contributed to rapid deployment across industrial, commercial, and residential sectors, driving significant market revenue and regional dominance.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Virtual Power Plant Market Insights

Asia Pacific segment is expected to grow at the fastest CAGR of about 27.54% from 2026-2035 due to increasing investments in renewable energy, rising electricity demand, and rapid industrialization. Expanding smart grid infrastructure, growing adoption of solar, wind, and energy storage systems, and favorable government initiatives to support distributed energy resources are driving market growth. The region’s focus on sustainable energy solutions and modernization of power networks makes it a highly attractive and fast-growing market for Virtual Power Plants.

The International Energy Agency (IEA) projects that Asia‑Pacific (excluding China) will add around 670 GW of new renewable capacity between 2025 and 2030, with solar PV accounting for nearly 75% of that growth, directly expanding the pool of distributed resources suitable for VPP aggregation.

In India, 48 GW of new renewable capacity was added in 2025, including 38 GW of solar PV, bringing total renewables to over 207 GW, further reinforcing the growing base of distributed solar that can be leveraged by VPPs.

Europe Virtual Power Plant Market Insights

Europe in the Virtual Power Plant Market is witnessing steady growth due to high renewable energy penetration, strong government policies supporting decarbonization, and advanced smart grid infrastructure. Countries are increasingly adopting VPPs to integrate solar, wind, and storage assets efficiently, enhance grid stability, and participate in energy trading. Growing focus on energy efficiency, demand-response programs, and sustainable energy solutions is driving market adoption across industrial, commercial, and residential sectors in the region.

Middle East & Africa and Latin America Virtual Power Plant Market Insights

Middle East & Africa and Latin America in the Virtual Power Plant Market are witnessing gradual growth due to rising investments in renewable energy and expanding grid infrastructure. Governments are promoting distributed energy resources and smart energy management solutions to meet increasing electricity demand. Adoption of solar and wind projects, along with demand-response initiatives, is driving VPP deployment across industrial, commercial, and residential sectors, creating opportunities for efficient energy optimization and reliable grid operations.

Virtual Power Plant Market Competitive Landscape:

Siemens AG

Siemens AG, headquartered in Germany, is a global technology powerhouse focused on electrification, automation, and digitalization solutions. Siemens delivers advanced energy, industrial, and infrastructure systems, including smart grids, renewable integration, and energy management technologies. Its expertise spans hardware, software, and consulting, enabling utilities and industries to optimize efficiency, sustainability, and resilience. Siemens is increasingly active in virtual power plant solutions, combining distributed energy resources, storage, and advanced analytics to balance grids and improve renewable energy utilization.

-

2023: Siemens partnered with Sinebrychoff to implement a virtual power plant at Helsinki operations, combining renewables, storage, and flexible loads to boost operational efficiency and sustainability.

Schneider Electric SE

Schneider Electric SE, based in France, specializes in energy management and automation solutions for buildings, industries, and utilities. Its portfolio includes distributed energy management, grid optimization, and software-enabled smart solutions. Schneider Electric integrates advanced analytics, AI, and energy storage technologies to modernize energy systems and support decarbonization. Through partnerships with platforms like AutoGrid Systems and Sunverge Energy, Schneider is expanding virtual power plant deployments worldwide, optimizing distributed energy resource usage, and enhancing grid flexibility for both commercial and utility applications.

-

2023: Schneider Electric teamed with Sunverge Energy to develop and deploy virtual power plants globally, integrating distributed energy resources and storage solutions.

ABB Ltd.

ABB Ltd., headquartered in Switzerland, is a global leader in electrification, robotics, and industrial automation. Its energy solutions include grid automation, smart storage, and distributed energy integration to enable efficient, resilient, and sustainable energy systems. ABB’s battery storage systems and energy management technologies support virtual power plants, microgrids, and renewable integration, helping utilities and industrial clients optimize grid performance, enable flexible loads, and increase renewable energy penetration across regions.

-

2023: ABB supplied its e‑mesh PowerStore battery storage to support Singapore’s first virtual power plant development, enabling distributed energy support and grid flexibility.

Tesla, Inc.

Tesla, based in Palo Alto, California, is a leading electric vehicle and energy solutions company. Beyond EVs, Tesla develops solar, battery storage, and energy software solutions, including the Powerwall, Megapack, and Autobidder platform. Its virtual power plants aggregate distributed residential and commercial battery storage to provide grid services, optimize energy consumption, and create revenue opportunities for participants. Tesla combines clean energy solutions with AI-driven energy management to scale renewable integration and stabilize power grids globally.

-

2024: Over 100,000 Powerwalls enrolled in Tesla’s virtual power plants by Q3 2024, providing grid support and financial value for participants.

-

2025: Tesla expanded VPP operations in Japan, partnering with Fuyo General Lease and Global Engineering to stabilize supply and demand nationwide using battery systems.

Next Kraftwerke GmbH

Next Kraftwerke GmbH, headquartered in Germany, operates one of Europe’s largest virtual power plant platforms. The company aggregates decentralized renewable energy producers, flexible loads, and storage systems to deliver grid balancing, energy trading, and peak-shaving services. By connecting thousands of distributed assets, Next Kraftwerke enhances grid reliability, enables energy market participation, and accelerates renewable integration. Its VPP solutions combine real-time monitoring, predictive analytics, and automated dispatch for efficient and scalable energy management across multiple European markets.

-

2024: Next Kraftwerke announced operational leadership and strategic power trading for its VPP platform, aggregating decentralized energy producers to stabilize European grids.

-

2025: Signed a seven-year tolling agreement for a large utility-scale storage facility, enhancing platform flexibility and market participation.

Key Players

Some of the Virtual Power Plant Market Companies

-

Siemens AG

-

Schneider Electric SE / AutoGrid Systems

-

Tesla, Inc.

-

General Electric (GE)

-

ABB Ltd.

-

Next Kraftwerke GmbH

-

Enel X

-

Statkraft

-

Sunrun

-

Sunnova Energy International

-

Enbala Power Networks

-

Bosch Global

-

Hitachi, Ltd.

-

Toshiba Corporation

-

Centrica plc

-

Shell / Shell Energy

-

Ørsted

-

Duke Energy

-

RWE

-

Engie

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.67 Billion |

| Market Size by 2035 | USD 36.39 Billion |

| CAGR | CAGR of 25.88% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Hybrid Virtual Power Plant, Conventional Virtual Power Plant, Software-Defined Virtual Power Plant) • By Technology(Distributed Energy Resource, Demand Response, Mixed Asset) • By End Use(Industrial, Commercial, Residential) • By Control Mechanism(Centralized Control, Decentralized Control, Cloud-Based Control) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens AG, Schneider Electric SE / AutoGrid Systems, Tesla, Inc., General Electric (GE), ABB Ltd., Next Kraftwerke GmbH, Enel X, Statkraft, Sunrun, Sunnova Energy International, Enbala Power Networks, Bosch Global, Hitachi, Ltd., Toshiba Corporation, Centrica plc, Shell / Shell Energy, Ørsted, Duke Energy, RWE, Engie |