Livestock Farm Equipment Market Report Scope & Overview:

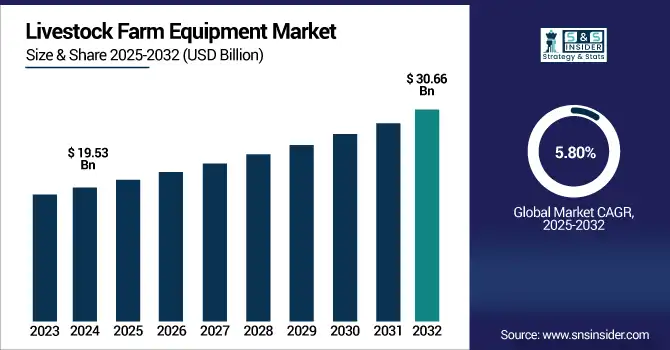

The Livestock Farm Equipment Market size was valued at USD 19.53 billion in 2024 and is expected to reach USD 30.66 billion by 2032, growing at a CAGR of 5.80% over the forecast period of 2025-2032.

To Get more information on Livestock Farm Equipment Market - Request Free Sample Report

The demand for efficiency, productivity, and automation in livestock farming is promoting the livestock farm equipment market growth. Farmers are integrating contemporary tools and mechanisms, automated feeding systems, milking machines, manure management systems, and livestock tracking technologies to reach better farm outcomes while cutting down manual labour. These changing factors are enhancing the livestock farm equipment market growth as a whole.

The key trends observed in the livestock farm equipment market are the smart farming solutions gaining traction, the inclusion of sensors and analytics in the monitoring of animal health, and the development of environment-friendly, energy-efficient equipment. The market is an integral part of the global farm equipment market and is a category within the global agricultural equipment market. Animal husbandry tools such as feeders, shearing machines, and ventilation systems, among others, are also contributing to the growth of the market. The growing awareness regarding precision livestock farming and sustainability also contributes to the growing uptake of this advanced equipment.

In June 2025, the University of Nebraska–Lincoln hosted the 3rd U.S. Precision Livestock Farming Conference from June 2–5, bringing together over 180 experts to explore smart technologies in animal agriculture. The event featured tours, 143 research presentations, and panels on sustainability, AI, and commercialization. Nebraska officials emphasized the role of tech in future livestock management, with the University of Georgia set to host the 2027 edition.

Livestock Farm Equipment Market Dynamics:

Drivers

-

Rising Protein Demand Fuels Adoption of Advanced Livestock Farm Equipment for Sustainable Production

The rising demand for animal protein is a significant driver propelling the adoption of modern livestock farm equipment. As the global population continues to increase, especially in emerging economies, there is a notable surge in the consumption of meat, milk, and eggs. This increase is driven by rising incomes, urbanization, and changing diets toward greater consumption of protein sources. The FAO estimates global meat consumption will increase by over 70% by 2050 relative to 2005. As a result, livestock producers are investing in sophisticated technology like automated feeders, robotic milking machines, and climate-controlled housing to meet this demand more efficiently. Not only do these technologies improve productivity, but they also ensure animal welfare, reduce dependence on labour, and ensure food safety. With the integration of such equipment, farms can achieve sustainability through scaling up production while achieving market expectations, ensuring that the world is able to add value to animal protein efficiently.

In January 2025, Deere & Co. expanded its investment in automation by unveiling two new autonomous tractors, an autonomous dump truck, and an electric mower at CES. These machines use AI and computer vision to operate without a driver, addressing labor shortages in farming and construction. Deere also introduced an upgraded autonomy kit that can retrofit existing machinery. This move highlights the company’s push toward fully automated, precision-driven equipment.

Restraint

-

High Capital and Maintenance Costs Hinder Livestock Equipment Adoption Among Small and Mid-Sized Farms

High initial purchase and operating costs continue as a restraint in the livestock farm equipment market. Automated devices like robotic milking systems and automated feeding equipment require additional up-front financial investments, often between USD 150,000 and higher for fully automated devices, upwards of USD 500,000. Compounding these capital costs are routine maintenance, software updates, and energy consumption, all taxing operating budgets. Such costs hit hardest for small- and mid-sized farms, which represent 70% of livestock operations worldwide. Estimates within the industry indicate that maintenance and operational costs can be up to 20–30% of total equipment cost on an annual basis. This leads to a situation in which many farmers postpone updating their processes, which constrains wider uptake and slows the progress of the market growth curve, even as technology is evolving quickly.

Livestock Farm Equipment Market Segmentation Analysis:

By Product Type

The feed equipment segment dominated the market and accounted for 32% of the livestock farm equipment market share. The dominance is due to the increasing focus on maximizing the production of livestock by means of sophisticated and automatic feeding systems, with minimal human assistance. Mechanized feeders, feed mixers, and automated ration dispensers are widely adopted due to their ability to maintain uniformity of the feed quality and health of the animals. In addition, increasing feed prices, as well as the growing demand for precision nutrition, are pushing farmers to invest in the latest state of feed technology. The segment is also gaining momentum, especially in large-scale operations that rely on consistency, efficiency, and cost management to remain competitive.

Housing equipment is the fastest-growing segment in the livestock farm equipment market owing to rising focus on adequate animal welfare, on biosecurity methods & the least space utilization. Farmers are spending on sophisticated housing systems, housing as temperature-controlled shelters, open or ventilated stalls, and cleaning mechanisms to enhance the health of livestock and reduce the rate of mortality. A shift toward modern housing infrastructure has been reflected by the increases in awareness around hygiene and disease prevention, particularly after a recent series of disease outbreaks. Moreover, the introduction of monitoring systems through IoT and smart housing designs is appealing to small- and large-scale farms, thereby promoting the segment to grow at a higher pace for every species of livestock.

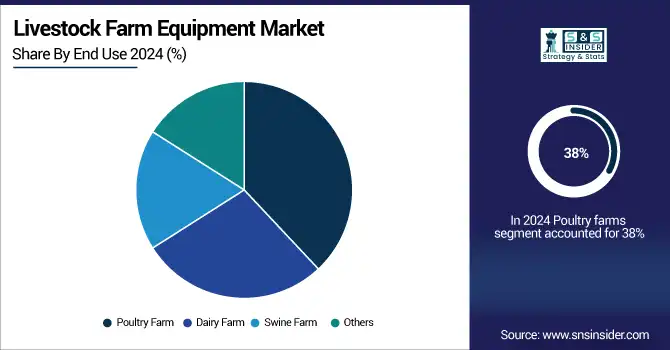

By End Use

Poultry farms dominated the livestock farm equipment market in 2024, capturing 38% of the share. The global demand for poultry meat and eggs is high, hence the nature of large-scale investments in poultry production in modern poultry farming systems. Automated feeders, climate and hygiene-controlled housing, egg collection systems, and waste management solutions are commonly used to improve efficiency, minimize labor dependence, and achieve hygienic production. Poultry farming needs frequent equipment replacements and upgrades in shorter production cycles with higher turnovers. The scalability and low-cost structure of poultry makes it a perfect candidate for adopting high-end machinery, which solidifies its top position in the market.

Dairy farms are the fastest-growing end-use segment due to rising global dairy consumption and the increasing adoption of automation to improve milk yield and quality. Robotic milking units, automated feed pushers, cow monitoring sensors, and manure equipment are all examples of technologies that are changing how dairy is done. These aid labor costs, real-time monitoring of the health of animals, and milking used to be the best. Additionally, changing regulations concerning animal welfare and sustainability are driving the dairy industry to adopt newer equipment. The dairy segment is experiencing rapid technology adoption and market growth, with many mid-sized farms shifting to semi-automated or fully automated systems.

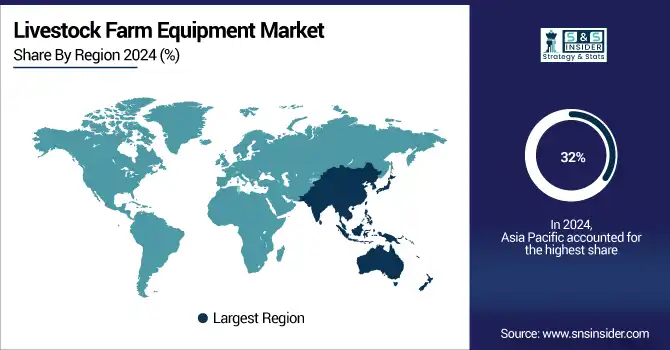

Livestock Farm Equipment Market Regional Outlook:

Asia-Pacific held the dominant position in the livestock farm equipment market in 2024, accounting for 32% of the global share. Large commercial farms are behind the numbers in most of the region's countries that will be home to the largest livestock populations, notably China, India, and Indonesia, where rising consumption of animal products is driving farms toward mechanization. Finally, Governments in the region promote modernization through subsidies and initiatives to persuade farmers to invest in modern feeding, housing, and milking systems. The increasing need for food security while maintaining sustainable practices in animal husbandry will also reinforce investments in farm machinery. In addition, with labour costs being low and increasing penetration of agritech startups, robotisation and automation are starting to be accessible in remote and semi-urban areas due to affordable, semi-automated tools and machines.

China dominates the Asia-Pacific livestock farm equipment market due to its massive livestock population and high meat consumption. Farm mechanization is being pushed by the government with subsidies and smart agriculture programs. Automated feeding, housing, as well as waste systems are being rapidly adopted across large-scale farms. This trend of modernization reinforces China’s domination in the regional market.

Latin America is emerging as the fastest-growing region in the livestock farm equipment market, driven by increasing livestock production and export demand, particularly in Brazil and Argentina. The region is witnessing rapid modernization of traditional farming, fast-tracked in the region, with rising productivity, efficiency, and disease management gaining prominence. This is due to government support, foreign investments, and developing awareness among farmers regarding the benefits of automation. In addition, the pasture-based livestock operations are expanding, and so are the exports of meat and dairy products, which drives the need for feeding systems, climate-controlled housing, and health-monitoring equipment. Increasing precision livestock farming technology adoption in the region as sustainability and operational efficiency become major objectives.

North America holds a significant share in the livestock farm equipment market, owing to sophisticated agricultural infrastructure and adoption of higher levels of technology. Robotics, sensors, and data analytics are integrated in livestock systems more extensively in the U.S. and Canada. Market growth has been supported by strong institutional backing, established supply chains, and a focus on animal welfare legislation. This is also attributed to the increasing number of large commercial livestock farms, which in turn creates demand for sophisticated machinery like automated feeding systems, ventilation, robotic milking units, etc. Even though growth is low in comparison to emerging regions, innovation and upgrades in existing farms keep strengthening local positions in the global market.

The U.S. livestock farm equipment market is projected to grow from USD 2.64 billion in 2024 to USD 4.12 billion by 2032, at a CAGR of 5.73%. Growth is driven by the rising adoption of automation, precision feeding, and milking technologies. High mechanization, labor cost concerns, and support for modern farming boost market expansion. The U.S. remains the largest contributor in North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Livestock Farm Equipment Market are:

Livestock farm equipment companies are Emerson Electric Co., Herrmann Ultraschall, Miller Weldmaster, Dukane Corp., Leister AG, LPKF Laser & Electronics, BAK Technology AG, WEGENER Welding, LLC, KING ULTRASONIC CO., LTD, MUNSCH Kunststoff-Schweißtechnik GmbH.

Recent Development:

-

In November 2024, Emerson launched its Energy Manager solution to help manufacturers monitor and optimize electricity usage in real time. The system tracks energy consumption and carbon emissions at the asset level, identifying inefficiencies like idle equipment. It promises up to 30% savings in energy costs and emissions. The tool integrates easily with existing meters and Emerson’s automation systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.53 Billion |

| Market Size by 2032 | USD 30.66 Billion |

| CAGR | CAGR of 5.80% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Milking Equipment, Cleaning Equipment, Egg Handling Equipment, Feed Equipment, Housing Equipment, Livestock Handling, Foggers, Coolers, and Heaters, Others) • By End Use (Poultry Farm, Dairy Farm, Swine Farm, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Emerson Electric Co., Herrmann Ultraschall, Miller Weldmaster, Dukane Corp., Leister AG, LPKF Laser & Electronics, BAK Technology AG, WEGENER Welding, LLC, KING ULTRASONIC CO., LTD, MUNSCH Kunststoff-Schweißtechnik GmbH. |