Smart Elevator Market Key Insights:

To get more information on Smart Elevator Market - Request Sample Report

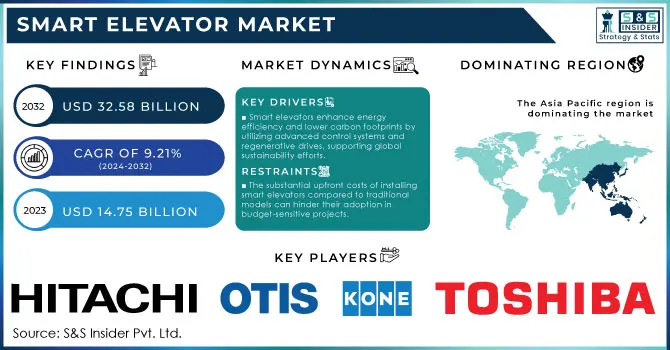

The Smart Elevator Market size was estimated at USD 14.75 billion in 2023 and is expected to reach USD 32.58 billion by 2032 at a CAGR of 9.21% during the forecast period of 2024-2032.

The smart elevator market is transforming rapidly due to the emergence of innovative technologies coupled with increased demand resulting from urbanization around the globe. With the rapid urbanization, it is essential for cities to incorporate advanced vertical transportation systems. A substantial share of new installations now comes from smart elevators, revealing an unmistakable trend among consumers towards increased automation and updated user experiences. Such predictive maintenance functionalities help these advanced systems significantly cut downtime cuts up to 50% by identifying potential failures before they happen. Some models transpire 30% less energy consumption. The importance of this efficiency cannot be overstated in an era that has begun to put sustainability at the forefront, as these elevators utilize green technologies with many focused on global efforts for reducing carbon footprints. Besides energy efficiency, smart elevators monitor surroundings in real-time and respond quickly to emergencies, boosting safety and making them the go-to option for modern buildings. Increased use of user-centric innovations in smart elevators, including personalized interfaces and better accessibility options, which address different needs of users also drives the growth of the market. With the constantly changing market, manufacturers are paying more attention to AI and IoT integration with their elevators for better operational capabilities and user interactions.

|

Type of Smart Elevator |

Description |

Commercial Products |

|---|---|---|

|

Machine Room-less Elevators |

Elevators that do not require a machine room, providing more usable building space. |

Otis Gen2, KONE EcoSpace |

|

Smart Control Elevators |

Elevators equipped with intelligent control systems that optimize performance and energy efficiency. |

Schindler 7000, Thyssenkrupp MULTI |

|

Destination Dispatch Elevators |

A system that assigns elevators based on passenger destinations to reduce wait times and improve efficiency. |

KONE MonoSpace, Otis CompassPlus |

|

IoT-enabled Elevators |

Elevators that utilize IoT technology for remote monitoring, predictive maintenance, and real-time data analytics. |

Mitsubishi Electric IoT Elevators |

|

Energy-efficient Elevators |

Elevators designed to consume less energy, often using regenerative drives to recover energy during operation. |

Schindler Green Star, KONE EcoDisc |

|

Smart Home Integration Elevators |

Elevators that can be integrated into smart home systems, allowing control through smartphones or voice commands. |

Thyssenkrupp Home Elevator |

|

Luxury Elevators |

High-end elevators featuring custom designs, advanced technology, and premium materials for residential or commercial buildings. |

Otis Infinity, KONE LUXURY |

|

Safety-enhanced Elevators |

Elevators with advanced safety features such as emergency communication systems and automatic rescue operations. |

Schindler 3300, Otis Skyway |

MARKET DYNAMICS

DRIVERS

- Technological advancements in IoT, AI, and machine learning are revolutionizing smart elevators by improving their efficiency, enabling predictive maintenance, and enhancing the overall user experience.

Technological advancements in the realms of Internet of Things (IoT), artificial intelligence (AI), and machine learning are fundamentally transforming the elevator industry by significantly enhancing the functionality and efficiency of smart elevators. IoT integration allows elevators to communicate in real time with users and building management systems, optimizing traffic flow and reducing wait times. The smart elevators can analyze passenger patterns and dynamically adjust their operation based on real-time data, resulting in a reduction in energy consumption by up to 50%. This efficiency not only cuts operational costs but also contributes to sustainability goals. AI and machine learning further enhance these capabilities by predicting maintenance needs and identifying potential issues before they escalate into costly repairs. According to the research indicates that predictive maintenance can reduce downtime by up to 30%, ensuring elevators remain operational and minimizing service disruptions. Additionally, these technologies enhance the overall user experience by providing personalized services, such as notifying users of their expected arrival times and enabling contactless access through mobile applications. According to research, approximately 70% of users prefer smart technologies that streamline their interactions with elevators. The convergence of these innovations boosts operational efficiency and promotes sustainability within the built environment, aligning with global efforts to reduce carbon footprints. As smart elevators become more prevalent, their capabilities will continue to evolve, making buildings not only more efficient but also more user-friendly and responsive to the needs of occupants.

- Smart elevators enhance energy efficiency and lower carbon footprints by utilizing advanced control systems and regenerative drives, supporting global sustainability efforts.

Smart elevators are increasingly recognized for their significant contributions to energy efficiency and sustainability, aligning with global environmental objectives. These elevators utilize advanced control systems that optimize their operation, effectively minimizing energy consumption during peak and off-peak hours. The regenerative drives enable elevators to convert kinetic energy into electrical energy during descent, which can be fed back into the building's power supply, resulting in energy savings of up to 50%. Additionally, smart elevators are equipped with sensors that detect passenger demand, allowing them to operate only, when necessary, thus reducing idle times and further enhancing energy efficiency.

According to research indicates that buildings equipped with smart elevators can achieve a reduction in overall energy consumption by approximately 30% compared to traditional systems. This energy efficiency not only helps lower operational costs but also significantly decreases carbon emissions, contributing to a smaller carbon footprint for both commercial and residential buildings. Moreover, the integration of these elevators into smart building systems facilitates better monitoring and management of energy usage, providing valuable data that can be used to optimize operational efficiency even further. The push for sustainability in urban environments is increasingly driven by regulatory frameworks and consumer demand for greener technologies. The International Energy Agency (IEA) reports that the building sector accounts for around 28% of global carbon emissions.

RESTRAIN

- The substantial upfront costs of installing smart elevators compared to traditional models can hinder their adoption in budget-sensitive projects.

The installation of smart elevators presents a notable challenge due to high initial costs compared to traditional elevators. These smart systems, equipped with advanced technology such as IoT connectivity, predictive maintenance, and energy-efficient operations, often necessitate substantial upfront investments. While a standard elevator installation might range from USD 20,000 to USD 50,000, smart elevators can exceed USD 100,000 depending on their features and integration complexity. Such costs can deter budget-sensitive projects, particularly in residential and smaller commercial developments. Moreover, organizations may hesitate to allocate a larger portion of their budgets toward these systems, especially when the benefits, such as reduced energy consumption and maintenance costs, may take years to offset the initial investment.

The smart elevators can save up to 30% in energy consumption compared to conventional models, translating into substantial long-term savings for building owners. Additionally, the integration of smart technology can reduce elevator downtime by approximately 20%, enhancing overall efficiency and user experience. However, despite these long-term benefits, the high upfront costs remain a significant barrier, particularly in an era where budgets are increasingly constrained.

KEY SEGMENTATION ANALYSIS

By Component

In 2023, communication systems emerged as the leading segment of the market, accounting for a substantial revenue share of 36.09%. The integration of Internet of Things (IoT) technology has played a crucial role in revolutionizing these systems, facilitating seamless connections that allow for real-time monitoring, data collection, and analysis. This interconnectedness significantly enhances operational predictability, making it easier to diagnose issues and streamline processes. Furthermore, the implementation of advanced communication systems in smart elevators has bolstered safety and security measures. Enhanced threat detection capabilities, coupled with efficient emergency response mechanisms, ensure that users are better protected in the event of unforeseen circumstances. As a result, the role of communication systems extends beyond mere functionality; it is now central to the operational efficiency and safety of modern infrastructure. The ongoing advancements in technology promise to further enhance these benefits, positioning communication systems at the forefront of innovation in the industry.

By Application

In 2023, the commercial segment was the leading force in the smart elevator market, capturing 47.6% of total revenue. This segment encompasses a wide variety of properties, including office buildings, shopping malls, hotels, and other large-scale facilities. Nearly 30% of commercial buildings are now equipped with high-capacity elevators featuring advanced technologies, such as destination control systems, which significantly streamline traffic management and improve the overall user experience. These systems not only optimize elevator operations but also enhance tenant satisfaction and productivity. The integration of energy-efficient components and occupancy sensors has become increasingly prevalent, contributing to a reduction in operational costs.

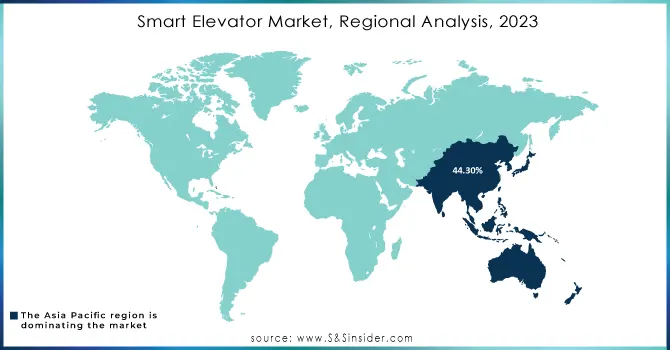

KEY REGIONAL ANALYSIS

The Asia Pacific smart elevator market has emerged as a leader in the global landscape, capturing a substantial revenue share of 44.30% in 2023. This dominance can be attributed to several factors, including rapid urbanization, a growing population, and extensive infrastructure development in countries such as China, India, and Japan. The region's increasing urban population drives the demand for high-rise buildings, leading to a heightened need for advanced elevator solutions that optimize space and enhance efficiency. In China, for instance, the government’s focus on urbanization and industrialization has spurred significant construction activity, particularly in metropolitan areas, resulting in a surge of high-rise developments.

The North American is the fastest growing region in the smart elevator market is experiencing a transformative phase in 2024 to 2032, propelled by a combination of economic vitality, urban expansion, and technological advancements. As metropolitan areas grow and population densities increase, the demand for efficient vertical transportation systems is intensifying. The region's commitment to sustainability is evident in the rising number of buildings incorporating smart elevators, which are designed to reduce energy consumption and enhance accessibility. In fact, studies indicate that elevators account for a significant portion of a building's energy use, prompting regulatory bodies to enforce energy-efficient designs that align with green building certifications.

Do You Need any Customization Research on Smart Elevator Market - Inquire Now

KEY PLAYERS

Some of the major key players of Smart Elevator Market

-

KONE Corporation: (KONE MonoSpace, KONE UltraRope, KONE People Flow Intelligence)

-

Otis Elevator Company: (Gen2 elevator, Otis ONE IoT Service, CompassPlus Destination Dispatch)

-

Schindler Group: (Schindler PORT Technology, Schindler Ahead IoT, Schindler 5500)

-

Thyssenkrupp Elevator Technology: (TWIN elevators, AGILE Destination Controls, MAX predictive maintenance)

-

Hitachi Ltd.: (NEXIEZ-MRL elevator, Hi-Rise IoT solutions, Hitachi Building IoT)

-

Mitsubishi Electric Corporation: (e-Factory IoT, NEXIEZ-MRL, Mitsubishi Destination Oriented Allocation System)

-

Bosch Security Systems: (Elevator Control System, IoT Solutions, Bosch Security Control Systems)

-

Fujitec Co. Ltd.: (elevator-INOVANCE, FUJITEC iLift IoT, Fujitec u-Cruz)

-

Toshiba Elevator and Building Systems Corporation: (ELEXIA Series, SPACEL-GR IoT Solutions, Toshiba Smart Building Solutions)

-

HYUNDAI ELEVATOR CO., LTD.: (HYUNDAI Green Elevator, Smart Elevators with IoT Connectivity, Destination Control System)

-

Johnson Controls: (Metasys Smart Building System, Building Automation & Control)

-

Sigma Elevator Company: (Sigma AI Destination Control, SIGMA S1000 series)

-

Orona Group: (Orona 3G Smart, Orona i3 Solutions)

-

Savaria Corporation: (Vuelift Round Elevator, Smart Home Integration)

-

Express Lifts Ltd.: (Express Smart Solutions, E-View Elevator Monitoring)

-

Kleemann Group: (KLEEMANN Digital Platform, KLEEMANN iControl)

-

Motion Control Engineering: (MCE) (iControl Elevator Control Systems, MCE3000 IoT-enabled solutions)

-

Shanghai Mechanical & Electrical Industry Co., Ltd.: (Quick Intelligent Elevators, WiFi Control Systems)

-

Thames Valley Controls: (TVCSmart IoT Elevator Control, Remote Monitoring Solutions)

-

ZIEHL-ABEGG: (ZAtop Elevator Motors, ZAsmart IoT Solutions)

Suppliers for Specializes in sustainable elevator solutions, 24/7 predictive maintenance services, and integrated building management with smart, eco-friendly technology of Smart Elevator Market:

-

Otis Elevator Company

-

KONE Corporation

-

Schindler Group

-

Thyssenkrupp AG

-

Mitsubishi Electric Corporation

-

Hitachi Ltd.

-

Hyundai Elevator Co., Ltd.

-

Fujitec Co., Ltd.

-

Toshiba Elevator and Building Systems Corporation

RECENT DEVELOPMENTS

-

In October 2024: Otis Elevators launched its Gen3 elevators in Thailand, a significant development aimed at enhancing smart city infrastructures. The Gen3 elevators are designed to improve efficiency and passenger experience, incorporating advanced technology such as AI-driven performance analytics and a user-friendly interface.

-

In July 2024: Hitachi Elevator Asia Pte. Ltd. secured a major contract in Singapore, where it will supply and install 450 lifts in high-rise residential buildings. This contract, awarded by the Housing & Development Board, marks the largest order to date in Singapore's residential sector.

-

In April 2024: Bosch presented its visual and audio intelligence solutions at ISC West 2024. These solutions enhance elevator security, safety, and operational efficiency. Bosch showcased edge-based analytics, video cameras, and its Intelligent Video Analytics Pro (IVA Pro) to support secure perimeters, building safety, and data-driven management in smart building infrastructures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.75 billion |

| Market Size by 2032 | USD 32.58 billion |

| CAGR | CAGR of 9.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Control System, Maintenance System, Communication System, Others) • By Application (Residential, Commercial, Institutional, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KONE Corporation, Otis Elevator Company, Schindler Group, Thyssenkrupp Elevator Technology, Hitachi Ltd., Mitsubishi Electric Corporation, Bosch Security Systems, Fujitec Co. Ltd., Toshiba Elevator and Building Systems Corporation, HYUNDAI ELEVATOR CO., LTD., Johnson Controls, Sigma Elevator Company, Orona Group, Savaria Corporation, Express Lifts Ltd., Kleemann Group, Motion Control Engineering, Shanghai Mechanical & Electrical Industry Co., Ltd., Thames Valley Controls, ZIEHL-ABEGG |

| Key Drivers | • Technological advancements in IoT, AI, and machine learning are revolutionizing smart elevators by improving their efficiency, enabling predictive maintenance, and enhancing the overall user experience. • Smart elevators enhance energy efficiency and lower carbon footprints by utilizing advanced control systems and regenerative drives, supporting global sustainability efforts. |

| RESTRAINTS | • The substantial upfront costs of installing smart elevators compared to traditional models can hinder their adoption in budget-sensitive projects. |