Locknut Market Report Scope & Overview:

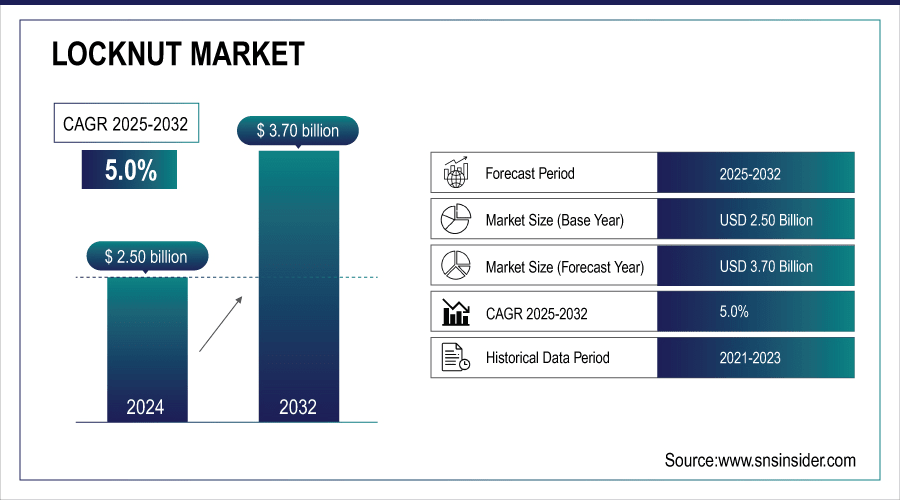

The Locknut Market Size was valued at USD 2.50 billion in 2024 and is expected to reach USD 3.70 billion by 2032 and grow at a CAGR of 5.0% over the forecast period 2025-2032.

The locknut market is experiencing steady growth, fueled by increasing demand across automotive, aerospace, construction, and industrial applications. Locknuts are vital for ensuring secure fastening, preventing loosening from vibration or stress, and enhancing safety and reliability. Rising infrastructure projects, technological advancements in fastening solutions, and growth in manufacturing industries are boosting market expansion. According to a study, a 12 % surge in automotive production triggered heightened locknut adoption, as installations requiring vibration resistance climbed by 30 % in key industrial sectors, improving assembly integrity.

To Get More Information On Locknut Market - Request Free Sample Report

Key Locknut Market Trends

-

Automotive and aerospace industries are driving demand for vibration-resistant locknuts to improve safety and performance.

-

Advancements in lightweight and corrosion-resistant materials are boosting adoption across sectors.

-

Infrastructure and construction projects worldwide are fueling steady market growth.

-

Automation and robotics are increasing locknut usage in precision machinery and industrial equipment.

-

Renewable energy installations like wind turbines and solar projects are creating new demand.

-

Customization and smart fastening solutions are gaining traction among manufacturers.

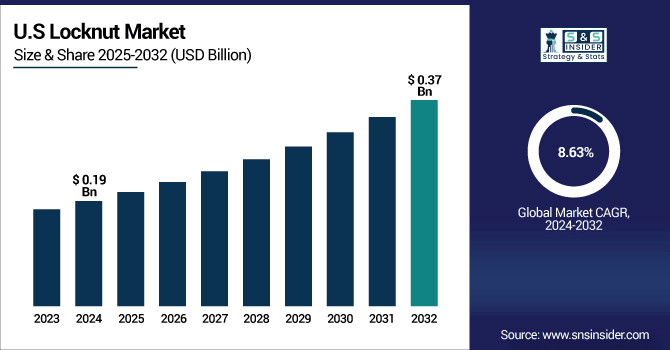

The U.S. Locknut Market size was USD 0.19 billion in 2024 and is expected to reach USD 0.37 billion by 2032, growing at a CAGR of 8.63% over the forecast period of 2025-2032. Strong automotive and aerospace production drives U.S. locknut demand, and because advanced manufacturing infrastructure ensures high-quality output, the U.S. dominates North America, strengthening market leadership through innovation and industrial expansion.

The U.S. market is witnessing strong growth, driven by rising demand in automotive and aerospace industries where vibration-resistant fastening is critical. Expanding infrastructure projects, including bridges and highways, further boost adoption. Increasing automation and robotics are fueling precision fastening needs, while renewable energy installations like wind turbines and solar panels create new applications. Additionally, the use of lightweight, corrosion-resistant alloys and the emergence of customized smart fasteners are shaping industry advancements.

Locknut Market Growth Drivers:

-

Growing automotive and aerospace demand drives global locknut market expansion with new advanced fastening technologies.

The market is driven by rising demand from automotive and aerospace industries, where vibration-resistant and durable fastening solutions are essential. With vehicle production growing about 8% annually and aircraft manufacturing rising nearly 5% year-on-year, stricter safety standards require high-quality locknuts to prevent loosening under stress. This cause, expanding production in key industries, effects higher adoption of reliable fastening solutions. Companies are introducing advanced technologies, improving materials, and enhancing design. Recent innovations boost torque performance by 20% and reduce weight by 15%, increasing efficiency, durability, and market growth.

In March 2024, a major manufacturer launched a titanium-based locknut series for electric vehicles, offering superior vibration resistance and reduced component weight, directly enhancing vehicle safety and reliability.

Locknut Market Growth Restraints:

-

High Raw Material Costs and Supply Chain Disruptions Restrain Global Locknut Market Growth

The market faces notable restraints due to rising raw material costs and ongoing supply chain disruptions. When steel and aluminum prices increase by 12% annually, production costs for locknuts rise, making manufacturers cautious about expanding output. This cause, higher raw material and logistics costs, effects delayed projects, limited adoption in cost-sensitive industries, and slower overall market growth. Additionally, transportation delays of up to 20% create bottlenecks, reducing production efficiency and slowing deliveries. Consequently, companies must carefully manage procurement, production, and inventory, increase operational complexity and restrict rapid market expansion. A fastener producer reported production delays due to international steel shortages, forcing adjustments in delivery schedules and affecting revenue across multiple regions.

Locknut Market Growth Opportunities:

-

Increasing Renewable Energy Installations Provide New Opportunities For Locknut Market with Advanced Wind Turbine Fasteners

The expansion of renewable energy projects, including wind and solar, is creating new opportunities for the locknut market. As turbines and solar panels requiring 15 high-torque fasteners per installation increase globally by 10% annually, demand for specialized locknuts rises. The growth of renewable energy infrastructure, effects higher adoption of advanced fasteners designed for durability, corrosion resistance, and ease of installation. Manufacturers are developing locknuts tailored to these applications, improving efficiency, reducing maintenance cycles by up to 20%, and increasing operational reliability, further driving adoption across global energy sectors.

In January 2025, a manufacturer introduced a corrosion-resistant locknut line for offshore wind turbines, helping operators reduce maintenance cycles and enhance structural safety.

Locknut Market Segment Highlights:

-

By Application, Automotive led with ~27% share in 2024; Construction fastest growing (CAGR 7.51%).

-

By Type, Nylon Insert Lock Nuts dominated ~29% in 2024; All-Metal Lock Nuts fastest growing (CAGR 8.17%).

-

By Material, Metal held ~37% share in 2024; Plastic (Nylon) fastest growing (CAGR 9.03%).

-

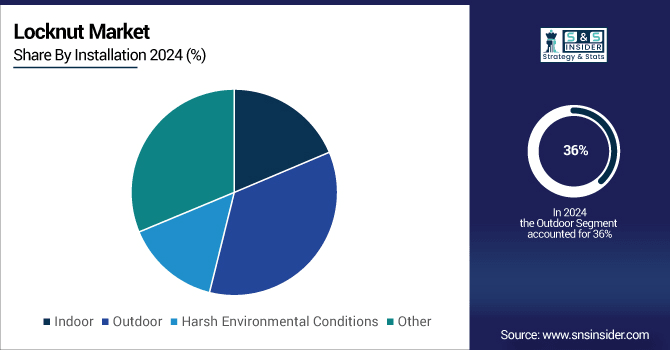

By Installation, Outdoor segment led with ~36% share in 2024; Harsh Environmental Conditions fastest growing (CAGR 8.37%).

Locknut Market Segment Analysis:

-

By Installation, Outdoor Leads Market While Harsh Environmental Conditions Registers Fastest Growth

In 2024, the Outdoor segment held the largest share in the locknut market, driven by extensive use in infrastructure, energy, and construction projects exposed to environmental stress. Corrosion-resistant coatings and specialized designs extend service life and reliability, reducing maintenance in outdoor conditions. The Harsh Environmental Conditions segment is expected to grow fastest, as industrial and energy projects in extreme temperatures, humidity, and chemical exposure require high-strength, specialized locknuts. Innovations in materials and coatings enhance torque retention, durability, and operational safety, driving adoption in challenging environments.

-

By Application, Automotive Leads Market While Construction Registers Fastest Growth

In 2024, the Automotive segment dominated the locknut market, driven by increasing demand for vibration-resistant and durable fastening solutions in vehicles. Rising vehicle production is encouraging the adoption of advanced locknuts, including corrosion-resistant and lightweight variants, enhancing torque performance, operational efficiency, and assembly safety. The Construction segment is expected to record the fastest growth, as expanding infrastructure projects and heavy machinery installations create demand for high-strength locknuts. Optimized designs improve load-bearing capacity and reduce maintenance, positioning construction as a key growth driver in the locknut market.

-

By Type, Nylon Insert Lock Nuts Lead Market While All-Metal Lock Nuts Register Fastest Growth

In 2024, the Nylon Insert Lock Nuts segment held the largest share of the locknut market, driven by superior vibration resistance and reusability for vehicles and industrial machinery. Enhanced material composition and insert designs improve torque retention and reliability, supporting operational efficiency across applications. The All-Metal Lock Nuts segment is anticipated to grow fastest, as heavy-duty and extreme-condition applications in automotive, aerospace, and industrial machinery drive adoption. Innovations in high-strength alloys and precision threading further improve performance and assembly safety, accelerating market penetration.

-

By Material, Metal Leads Market While Plastic (Nylon) Registers Fastest Growth

In 2024, the Metal segment dominated the locknut market due to strong demand for durable and corrosion-resistant fastening solutions in automotive and industrial sectors. Improved alloy composition and heat treatment enhance torque retention and service life, supporting operational reliability and reducing replacement cycles. The Plastic (Nylon) segment is expected to grow fastest, driven by rising demand for lightweight, non-corrosive fastening solutions. Advanced polymer formulations and insert designs improve torque performance, enabling reliable usage across applications and expanding market opportunities.

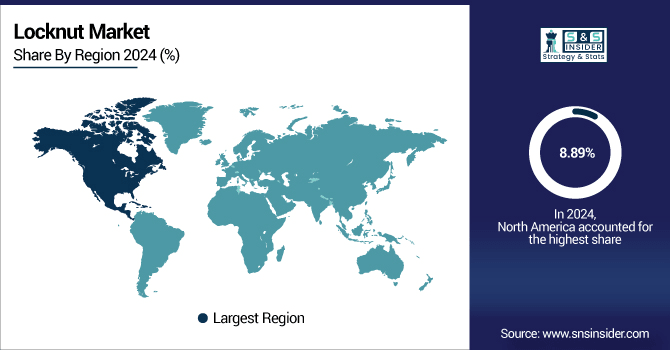

North America Locknut Market Insights

In 2024, North America is the fastest-growing region with a CAGR 8.89%, in the locknut market, driven by rising automotive and aerospace production, high demand for vibration-resistant fastening solutions, and advanced manufacturing infrastructure. The region benefits from robust industrial standards, strong R&D investment, and well-established supply chains, reinforcing rapid adoption of innovative locknut designs and enhancing operational efficiency.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Leads Locknut Market in North America

The U.S. dominates with the market share 62%. The North American market due to extensive automotive and aerospace industries, advanced manufacturing capabilities, and a focus on precision-engineered fastening solutions. Investment in high-quality, corrosion-resistant locknuts and continuous product innovation strengthens operational reliability and secures its leadership position.

Asia Pacific Locknut Market Insights

Asia Pacific represents the dominant region in the locknut market in 2024, supported by expanding automotive, construction, and industrial projects. The region benefits from rapid industrialization, infrastructure development, and growing adoption of high-strength, durable fastening solutions, driving widespread market penetration.

China Leads Locknut Market Growth in Asia Pacific

China leads the regional market due to large-scale infrastructure projects, a booming automotive sector, and government support for industrial and energy development. Adoption of advanced vibration-resistant and high-strength locknuts improves operational efficiency, reduces maintenance, and positions China as the key contributor to Asia Pacific market growth.

Europe Locknut Market Insights

In 2024, Europe holds a significant share in the locknut market, driven by a strong focus on automotive, aerospace, and industrial applications. Regulatory support for high-quality manufacturing, precision engineering, and durability standards strengthens regional adoption of advanced fastening solutions.

Germany Dominates Europe’s Locknut Market

Germany leads the European market with its robust automotive and aerospace sectors, advanced industrial infrastructure, and continuous R&D investment. Precision-engineered locknuts, corrosion-resistant materials, and innovation in high-strength designs reinforce Germany’s leading position within Europe.

Latin America and Middle East & Africa Locknut Market Insights

The locknut market in Latin America and MEA is witnessing steady growth, driven by rising automotive production, expanding infrastructure, and industrial modernization projects. Demand for durable, corrosion-resistant fastening solutions is increasing across diverse applications, supporting regional market expansion.

Regional Leaders in LATAM and MEA

In MEA, Saudi Arabia leads with large-scale industrial and energy projects and adoption of advanced locknuts for harsh conditions. In LATAM, Brazil dominates due to its automotive sector, growing infrastructure development, and focus on high-strength, reliable fastening solutions that drive operational efficiency and market growth.

Competitive Landscape for the Locknut Market:

JAKOB Antriebstechnik GmbH, headquartered in Germany, is a leading provider of mechanical power transmission and safety technology. The company specializes in precision couplings, safety clutches, and locking systems used in machinery and automation industries. With decades of engineering expertise, JAKOB emphasizes innovation, reliability, and safety in high-performance applications. Their products ensure secure torque transmission and overload protection, supporting industries like robotics, packaging, and manufacturing. JAKOB’s solutions are widely recognized for efficiency, quality craftsmanship, and durability in demanding industrial environments worldwide.

-

In February 2025, JAKOB released news about a new product in their locknut line: the hexagonal locknut series (e.g., 50.2xx and 2xx variants), highlighting an expanded portfolio of locknut accessories and components.

HYTORC, established in 1968 and headquartered in New Jersey, USA, is a global leader in industrial bolting systems. The company designs and manufactures advanced torque and tension tools, including hydraulic, pneumatic, and electric systems. HYTORC focuses on enhancing worker safety, efficiency, and joint integrity, offering innovative solutions such as the HYTORC Washer and J-Gun series. Serving industries like oil and gas, power generation, and construction, HYTORC is trusted worldwide for precision fastening, reduced downtime, and safety-driven engineering in bolted joint applications.

-

In May 2025, HYTORC introduced its Washer System, a safer and more efficient alternative to traditional reaction arms. While not specifying "locknut," it's directly tied to bolting technology and fastening solutions, making it highly relevant to the locknut market.

Ruland Manufacturing Co., Inc., founded in 1937 in Massachusetts, USA, is a family-owned precision manufacturer of shaft collars and couplings. Known for high-quality, carefully engineered products, Ruland serves industries including automation, robotics, packaging, and medical devices. The company emphasizes strict quality control, in-house production, and innovative design. Its product line spans rigid couplings, beam couplings, and motion-control fastening components. With a strong focus on reliability and customization, Ruland has built a global reputation as a trusted supplier in the fastening and power transmission markets.

-

In March 2025, Ruland Manufacturing acquired the assets of RoCom Couplings, a Santa Maria, California based company specializing in beam couplings, machined springs, and custom-beamed components. This acquisition significantly expands Ruland’s coupling offerings, enabling broader precision-engineered solutions that indirectly support locknut applications in motion-control and fastening systems

Locknut Market Key Players:

Some of the Locknut Market Companies

-

AMECA

-

HYTORC

-

Schaeffler Technologies

-

Bollhoff

-

NTN-SNR

-

Arconic

-

AMF Andreas Maier

-

JAKOB

-

INSERCO

-

PANOZZO S.R.L.

-

KVT-Fastening AG

-

Stanley Engineered Fastening

-

DLM srl

-

Nadella

-

Lederer

-

PENN Engineering

-

Nuova Bellodi TIBI srl

-

HARDLOCK Industry Co., Ltd.

-

Ruland Manufacturing Co., Inc.

-

Nord-Lock Group

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.50 Billion |

| Market Size by 2032 | USD 3.70 Billion |

| CAGR | CAGR of 5.0% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Automotive, Aerospace, Machinery / Industrial Equipment, Construction, Electronics, Others) • By Type (Nylon Insert Lock Nuts, All-Metal Lock Nuts, Flange Lock Nuts, Castellated Nuts, Others) • By Material (Metal, Plastic [Nylon], Rubber, Others) • By Installation (Indoor, Outdoor, Harsh Environmental Conditions, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AMECA, HYTORC, Schaeffler Technologies, Bollhoff, NTN-SNR, Arconic, AMF Andreas Maier, JAKOB, INSERCO, PANOZZO S.R.L., KVT-Fastening AG, Stanley Engineered Fastening, DLM srl, Nadella, Lederer, PENN Engineering, Nuova Bellodi TIBI srl, HARDLOCK Industry Co., Ltd., Ruland Manufacturing Co., Inc., Nord-Lock Group, and Others. |