Business Rules Management System Market Report Scope & Overview:

The Business Rules Management System Market was valued at USD 1.48 billion in 2023 and is expected to reach USD 3.35 billion by 2032, growing at a CAGR of 9.52% from 2024-2032.

To Get more information on Business Rules Management System Market - Request Free Sample Report

This report includes comprehensive insights into key factors such as security and compliance features, implementation timeframes, employee productivity gains, and integration with other enterprise systems. It highlights the significant cost savings post-implementation and the growing demand for automated decision-making processes. As organizations increasingly adopt BRMS to streamline business operations, ensure regulatory compliance, and improve overall efficiency, the market is witnessing rapid growth. This market expansion is driven by the need for better business rule management capabilities, enabling companies to remain agile and competitive in a rapidly evolving business environment.

U.S. Business Rules Management System Market was valued at USD 0.39 billion in 2023 and is expected to reach USD 0.87 billion by 2032, growing at a CAGR of 9.40% from 2024-2032.

This growth can be attributed to the increasing adoption of automation in business operations, as companies seek to streamline decision-making processes and improve efficiency. The rising demand for compliance with evolving regulations, along with the need for better control and agility in operations, is driving BRMS implementation across industries. Furthermore, advancements in artificial intelligence and machine learning are enhancing BRMS capabilities, making them more attractive for businesses to integrate into their existing systems, contributing to the market's expansion.

Business Rules Management System Market Dynamics

Drivers

-

Growing need for real-time decision-making capabilities is driving widespread adoption of Business Rules Management Systems across industries.

The increasing demand for real-time, data-driven decisions across sectors such as finance, healthcare, and retail has made Business Rules Management Systems (BRMS) a critical component of enterprise IT infrastructure. As organizations seek to automate decision-making and respond instantly to changing conditions, BRMS provides a framework to centralize, manage, and update complex business rules with ease. This agility empowers companies to maintain compliance, minimize risks, and improve customer satisfaction by delivering faster, accurate outcomes. Moreover, the integration of BRMS with AI and machine learning tools further strengthens decision automation, making it more predictive and adaptive. As businesses compete in volatile markets, the ability to implement dynamic rule changes in real-time becomes a strategic advantage driving the BRMS market forward.

Restraints

-

High implementation and maintenance costs limit the widespread adoption of Business Rules Management Systems among small and medium enterprises.

Implementing Business Rules Management Systems often requires significant upfront investment in software, hardware, skilled personnel, and training. For small and medium-sized enterprises (SMEs), this financial burden can outweigh the potential benefits, especially when operating with limited IT budgets. Moreover, ongoing costs associated with maintenance, rule updates, and system integration further strain resources. The complexity of deploying BRMS solutions within existing IT ecosystems can also delay implementation timelines, impacting return on investment. Despite the long-term operational advantages, many SMEs hesitate to adopt BRMS due to fears of cost overruns and lack of immediate ROI. These financial and technical hurdles restrict market penetration in the SME segment, which comprises a significant portion of the global business landscape.

Opportunities

-

Integration with artificial intelligence and machine learning presents vast opportunities to enhance Business Rules Management Systems with adaptive intelligence.

The integration of BRMS with AI and machine learning technologies opens up new frontiers in intelligent decision automation. By combining static business rules with dynamic, data-driven insights, organizations can build adaptive systems that evolve based on real-time information and patterns. This fusion enables predictive decision-making, anomaly detection, and self-learning rule optimization. Sectors such as finance, retail, and healthcare can benefit significantly from this synergy, improving customer engagement, fraud detection, and operational efficiency. Additionally, AI-enhanced BRMS can simplify complex rule configurations by recommending updates or flagging outdated rules. As AI capabilities continue to mature, businesses are increasingly looking toward BRMS as a foundational layer for deploying next-generation automation and decision intelligence platforms, creating robust market growth opportunities.

Challenges

-

Complexity in integrating Business Rules Management Systems with legacy IT infrastructures creates deployment delays and technical inconsistencies.

Many organizations still rely on legacy systems that were not designed to support modern rule engines or decision automation tools. Integrating BRMS into such environments can be technically challenging, often requiring extensive customization, middleware, and skilled IT resources. Incompatibilities in data formats, communication protocols, and system architectures lead to longer implementation timelines and increased costs. Additionally, the risk of disrupting existing operations or degrading performance discourages some companies from embracing BRMS fully. Without seamless interoperability, the effectiveness of BRMS in delivering consistent, centralized decision-making may be compromised. These technical hurdles complicate adoption, particularly in industries with deeply entrenched legacy infrastructure, posing an ongoing challenge for market expansion and system optimization.

Business Rules Management System Market Segment Analysis

By Component

The software segment dominated the Business Rules Management System market in 2023 with a revenue share of approximately 63% due to the growing demand for customizable, scalable, and easily upgradable rule engines. Organizations increasingly prefer software solutions that offer centralized rule management, seamless integration with enterprise systems, and advanced automation features. These software tools enable businesses to implement changes swiftly and ensure compliance with minimal manual intervention, making them a crucial component of decision-making infrastructure across various industries.

The services segment is expected to grow at the fastest CAGR of about 10.68% from 2024 to 2032 due to rising demand for consulting, implementation, training, and support services. As organizations look to adopt BRMS platforms, they often lack in-house expertise, increasing reliance on specialized service providers. These services help businesses optimize deployment, ensure smooth integration, and maintain long-term performance of rule-based systems.

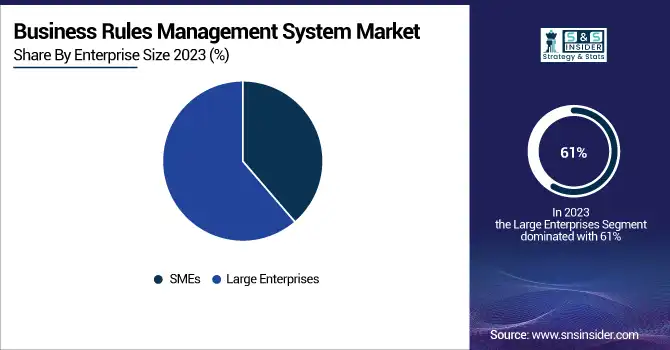

By Enterprise Size

Large enterprises dominated the Business Rules Management System market in 2023 with a revenue share of about 61% due to their complex operations, regulatory needs, and extensive IT capabilities. These organizations require robust, scalable solutions to manage vast rule sets and streamline decision-making across departments and geographies. With larger budgets and dedicated IT teams, they can implement and maintain comprehensive BRMS platforms to enhance compliance, agility, and operational efficiency, making them the primary adopters and contributors to the market’s revenue dominance.

SMEs are expected to grow at the fastest CAGR of about 10.49% from 2024 to 2032 due to increasing accessibility of affordable, cloud-based BRMS solutions. These platforms allow smaller businesses to automate operations, improve decision-making, and remain competitive without heavy infrastructure investments. As digital transformation becomes a necessity, more SMEs are turning to BRMS to optimize workflows, reduce manual errors, and scale efficiently, driving significant growth in this segment over the forecast period.

By End Use

The BFSI segment held the largest revenue share of about 26% in the Business Rules Management System market in 2023 due to its heavy reliance on rule-based processing and strict regulatory requirements. Financial institutions use BRMS to automate risk assessments, fraud detection, and policy enforcement. The need for transparency, real-time decision-making, and auditability makes BRMS essential in banking and insurance operations, enabling them to ensure compliance, enhance service delivery, and efficiently manage complex, high-volume transactions.

The retail and consumer goods segment is expected to grow at the fastest CAGR of about 11.53% from 2024 to 2032 driven by the increasing demand for personalized customer experiences and agile supply chain management. BRMS enables retailers to automate pricing, promotions, inventory management, and customer engagement strategies. With the rapid growth of e-commerce and omnichannel operations, companies are adopting BRMS to stay responsive to market trends, enhance operational efficiency, and deliver faster, more accurate decisions in real time.

By Deployment

The cloud segment dominated the Business Rules Management System market with the highest revenue share of approximately 58% in 2023 and is also projected to grow at the fastest CAGR of around 10.07% from 2024 to 2032. This dominance is attributed to the scalability, cost-efficiency, and flexibility offered by cloud deployments, allowing businesses to implement and update rule sets in real time across geographies. Cloud BRMS enables seamless integration with other cloud-native tools, supports remote work environments, and reduces infrastructure overhead. The subscription-based pricing models and lower upfront investment further attract both large enterprises and SMEs. Additionally, the growing trend of digital transformation, combined with a global shift toward hybrid and multi-cloud environments, continues to fuel demand for cloud-based BRMS solutions, making it the most attractive deployment model for the future.

Regional Analysis

North America dominated the Business Rules Management System market in 2023 with the highest revenue share of about 37% due to early technology adoption, strong presence of key market players, and high regulatory compliance requirements. The region’s mature IT infrastructure and focus on operational efficiency have driven widespread BRMS deployment across industries such as BFSI, healthcare, and retail. Additionally, North American enterprises actively invest in digital transformation initiatives, leveraging BRMS to streamline complex business processes and ensure consistent, automated decision-making.

Asia Pacific is expected to grow at the fastest CAGR of about 11.18% from 2024 to 2032 due to rapid digitalization, expanding economies, and increasing awareness of automation technologies. Governments and enterprises in countries like China, India, and Southeast Asia are embracing IT modernization, driving demand for efficient decision-support systems. The growing presence of SMEs and tech startups, coupled with investments in cloud infrastructure, is further accelerating BRMS adoption across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

IBM (Operational Decision Manager, Automation Decision Services)

-

FICO (FICO Blaze Advisor, FICO Decision Management Suite)

-

PEGASYSTEMS (Pega Decision Management, PegaRULES Process Commander)

-

Oracle (Oracle Business Rules, Oracle Policy Automation)

-

Progress Software (Corticon, DataDirect)

-

SAP (SAP Business Rules Framework, SAP Decision Service Management)

-

Broadcom (CA Aion Business Rules Expert, CA Process Automation)

-

ACTICO (ACTICO Rules, ACTICO Platform)

-

SAS (SAS Decision Manager, SAS Intelligent Decisioning)

-

InRule Technology (InRule Decision Platform, irAuthor)

-

Software AG (webMethods Business Rules, Apama)

-

OpenText (OpenText BRMS, OpenText AppWorks)

-

Newgen Software (Newgen Decision Management, Newgen OmniFlow iBPS)

-

Fujitsu (Interstage Business Process Manager, iFlow)

-

Experian (PowerCurve Strategy Management, Experian Decision Analytics)

-

Sparkling Logic (SMARTS Decision Manager, RedPen)

-

Business Rule Solutions (RuleGuide, Proteus)

-

Decisions LLC (Decisions Platform, Decisions Studio)

-

TIBCO (TIBCO BusinessEvents, TIBCO Rules Management Server)

-

Intellileap (Decision Management Suite, IntelliDecisions)

-

Agiloft (Agiloft Workflow Rules Engine, Agiloft Contract Lifecycle Management)

-

Signavio (Signavio Process Manager, Signavio Business Transformation Suite)

-

Decision Management Solutions (Decision Requirements Modeling Tool, DMN Method and Style Training)

-

CNSI (eCAMS, evoBrix X)

Recent Developments:

-

In May 2024, FICO partnered with IT consultancy firm Net.Bit to enhance operational efficiency, security, and regulatory compliance for financial institutions across Europe, the Middle East, and Africa. This collaboration offers FICO Blaze Advisor as a SaaS solution, hosted in Net.Bit’s data centers, providing integrated decision management and fraud detection capabilities.

-

In December 2023, Software AG released webMethods.io Integration 11.0, enhancing multi-cloud integration with features like hybrid connectivity, AI-powered orchestration, and unified deployment across environments. The update empowers developers and business technologists to collaborate seamlessly.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.48 Billion |

| Market Size by 2032 | US$ 3.35 Billion |

| CAGR | CAGR of 9.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (Cloud, On-Premise) • By Enterprise Size (SMEs, Large Enterprises) • By End Use (BFSI, Government & Defense, Healthcare, IT & Telecom, Manufacturing, Retail and Consumer Goods, Transportation & Logistics, Energy & Utilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, FICO, PEGASYSTEMS, Oracle, Progress Software, SAP, Broadcom, ACTICO, SAS, InRule Technology, Software AG, OpenText, Newgen Software, Fujitsu, Experian, Sparkling Logic, Business Rule Solutions, Decisions LLC, TIBCO, Intellileap, Agiloft, Signavio, Decision Management Solutions, CNSI |