Wireless 6 GHz Robot Router Market Report Scope & Overview:

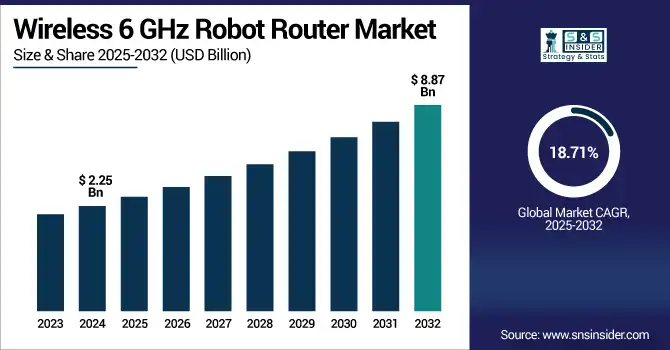

The Wireless 6 GHz Robot Router Market size was valued at USD 2.25 billion in 2024 and is expected to reach USD 8.87 billion by 2032, expanding at a CAGR of 18.71% over the forecast period of 2025-2032.

The wireless 6 GHz robot routers market growth can be attributed to the increasing demand for high-speed and low-latency wireless connectivity in smart homes, enterprises, and industrial automation networks. The adoption of Wi-Fi 6E and Wi-Fi 7 enables faster data transfer and reduced interference, ideal for robotic applications. Mobile AI-enabled routers scale coverage on the fly. Heavyweights like Cisco, TP-Link, NETGEAR, and others are coming up with mesh-based intelligent solutions. North America leads the way, while Asia Pacific is the fastest-growing market because of urbanization and Internet of Things (IOT) implementation. Smart infrastructure and the Wireless 6 GHz robot router market trend to digitize will continue to drive growth in this developing connectivity ecosystem.

To Get more information on Wireless 6 GHz Robot Router Market - Request Free Sample Report

According to The Robot Report, the global stock of industrial robots reached 4.28 million by 2023, with 541,302 installations that year alone 70% in Asia, 17% in Europe, and 10% in the Americas, reflecting rapid global automation growth.

The U.S. Wireless 6 GHz Robot Router Market size reached USD 0.58 billion in 2024 and is expected to reach USD 2.10 billion by 2032 at a CAGR of 17.42% from 2025 to 2032.

The U.S. Wireless 6 GHz Robot Router Market will continue to grow due to early penetrations of next-gen wireless technologies, robust smart home sales penetration, and strong enterprise digital infrastructure. With the broad deployment of Wi-Fi 6E/7 wireless networks blossoming, the US takes the lead in rolling out high-bandwidth, low-latency networking ideal for autonomous systems and robotics. The growing demand for seamless connectivity in smart homes, AI-powered enterprises, and industrial automation is driving the market. Innovation is fueled by major domestic players such as Cisco, NETGEAR, and Aruba. 5G spectrum and government investments additionally reinforce the ecosystem, which has led to the US being considered the most commercialised and profitable market within this area.

Wireless 6 GHz Robot Router Market Dynamics

Drivers:

-

Rising Demand for Seamless High-Bandwidth Connectivity Across Smart Homes and Enterprises Drives Market Growth.

The increasing reliance on smart devices, automation systems, and AI-powered appliances in both residential and enterprise environments is propelling the demand for robust, low-latency wireless connectivity. The 6 GHz frequency band offers broader channels and reduced interference, making it ideal for robot routers supporting high-speed, multi-device environments. Mesh systems and AI-based traffic optimization are becoming standard. Recent innovations, such as TP-Link’s Wi-Fi 7-enabled Archer series and NETGEAR’s Orbi 970 series, reflect the trend toward advanced smart networking.

According to data from Wi-Fi.org and Arxiv.org, approximately 4.1 billion Wi-Fi devices are expected to ship in 2024, contributing to 45.9 billion devices in use, while 30 billion IoT devices connected globally signal rising demand for high-speed, reliable connectivity.

Restraints:

-

High Hardware Costs and Infrastructure Limitations Impede Market Adoption in Price-Sensitive Regions.

While the benefits of 6 GHz robot routers are clear, their adoption is hindered by high initial costs and the need for compatible infrastructure. These routers typically require advanced chipsets, tri-band capabilities, and smart navigation systems, which elevate production and retail costs. Additionally, older buildings or rural areas lacking upgraded electrical and broadband infrastructure present challenges for widespread deployment. Many small businesses and households in developing regions still depend on affordable legacy systems. Without sufficient awareness and financial incentives, these segments are reluctant to transition to premium wireless technologies, thereby limiting the market’s penetration and slowing global adoption rates.

Opportunities:

-

Integration of AI and Motion-Aware Routing Technologies Creates New Commercial Expansion Opportunities.

The convergence of artificial intelligence with motion-sensing technologies is creating substantial opportunities for next-generation wireless routers. Robot routers equipped with spatial mapping and autonomous movement features can optimize signal coverage dynamically, offering superior connectivity in variable-use spaces such as offices, retail zones, and manufacturing floors. Recent developments, including Cisco's investment in AI-native routing platforms and experimental models by ASUS with robotic chassis, highlight the commercial viability of mobile routers.

Challenges:

-

Sustaining User Engagement Amidst Privacy Concerns and Technical Complexity Poses a Significant Market Challenge.

Despite their potential, robot routers face user resistance due to concerns over data privacy, cybersecurity, and operational complexity. These devices often collect usage data and utilize cloud-based AI to optimize performance, raising apprehensions about surveillance and unauthorized access. Furthermore, users with limited technical knowledge may struggle with setup, firmware updates, and device interoperability, leading to dissatisfaction. The market must balance innovation with user-friendly design and transparent data policies. Lack of standardization across manufacturers also complicates integration with third-party smart ecosystems.

Wireless 6 GHz Robot Router Market Segmentation Analysis

By Product Type

The standalone router segment held the largest share in 2024 with 49.58% of market revenue, driven by demand for high-speed, cost-effective, and user-friendly connectivity solutions. Wireless 6 GHz robot router market companies such as NETGEAR and TP-Link have introduced advanced standalone routers leveraging Wi-Fi 6E, such as the Nighthawk RAXE300 and Archer AXE75, offering better throughput and coverage. These routers cater to home users and small businesses, forming the backbone of the Wireless 6 GHz Robot Router Market.

Mesh routers are expected to register the fastest CAGR of 19.49% through 2032 due to their ability to eliminate dead zones and maintain uninterrupted connectivity in large and complex spaces. Leading brands like TP-Link (Deco XE75) and ASUS (ZenWiFi ET12) are pushing Wi-Fi 6E-enabled mesh systems with high-performance antennas and smart roaming. This segment is vital to the Wireless 6 GHz Robot Router Market as it enables dynamic and self-adjusting networks, supporting autonomous positioning and signal optimization by robotic routers in home and enterprise environments.

By Application

The residential segment accounted for 45.63% of total revenue in 2024, driven by growing smart home adoption, remote work culture, and demand for seamless video streaming and gaming. Devices such as Ubiquiti's UniFi Dream Router and NETGEAR's Orbi AXE11000 cater to these needs with powerful 6 GHz capabilities. In the Wireless 6 GHz Robot Router Market, the residential application forms a major base for AI-powered router robots, as they offer intelligent coverage, parental control, and real-time diagnostics, tailored for multi-device home environments.

The industrial segment is anticipated to grow at the fastest CAGR of 19.83% over the forecast period, driven by increased automation and smart manufacturing trends. Companies like Cisco and Aruba are deploying rugged Wi-Fi 6E routers to support real-time data transmission and machine-to-machine communication. In the Wireless 6 GHz Robot Router Market, industrial applications thrive as robotic routers enable mobile coverage, edge computing, and seamless connectivity across dynamic industrial environments.

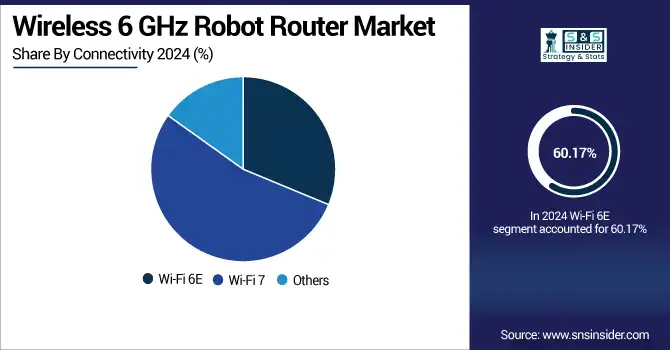

By Connectivity

Wi-Fi 6E leads the market with a 60.17% share in 2024, owing to its ability to reduce latency and manage high device density. Routers like TP-Link Archer AXE75 and ASUS RT-AXE7800 offer enhanced bandwidth in the 6 GHz band with OFDMA and MU-MIMO technologies. As the backbone of the market, Wi-Fi 6E supports AI-powered routers with high-speed data routing, low interference, and optimized battery performance, key for both fixed and mobile smart networking systems.

Wi-Fi 7 is poised for the fastest wireless 6 GHz robot router market growth with a 19.89% CAGR, enabled by innovations like Multi-Link Operation and 320 MHz channels. ASUS (ROG Rapture GT-BE98) and TP-Link (Archer BE800) introduced Wi-Fi 7 routers capable of achieving over 30 Gbps speeds. These advancements pave the way for ultra-low latency and real-time responsiveness in robot routers. Within the market, Wi-Fi 7 will drive the next generation of intelligent mobility, empowering autonomous devices to manage ultra-reliable and bandwidth-intensive tasks.

By End-User

Smart homes held a 40.27% share in 2024, driven by the adoption of smart TVs, security systems, and IoT appliances. Routers from companies like Eero (by Amazon) and TP-Link are optimized for home automation platforms, offering built-in voice assistant compatibility and adaptive QoS. This segment is crucial for the Wireless 6 GHz Robot Router Market, as smart homes are ready for mobile, AI-based routers that dynamically move to provide optimal coverage and energy efficiency throughout connected living spaces.

Manufacturing is the fastest-growing end-user segment with a 20.07% CAGR, powered by the wireless 6 GHz robot router industry 4.0, IIoT, and real-time robotics. Cisco’s Catalyst and Juniper’s Mist systems have seen deployment in large factories to ensure uninterrupted production and network uptime. Robot routers enable location-aware connectivity, track autonomous machinery, and optimize mobile data flow, positioning them as key enablers of intelligent, future-ready manufacturing environments.

By Distribution Channel

Online channels dominated 69.38% of wireless 6 GHz robot router market share in 2024, driven by broad accessibility, digital marketing, and direct-to-consumer sales strategies. Brands like ASUS and NETGEAR offer exclusive bundles and early releases through Amazon, Best Buy online, and brand websites. Online platforms play a critical role in the Wireless 6 GHz Robot Router Market by facilitating rapid product deployment, user education, and firmware updates, supporting early adopters who value innovation and convenience in connected home and business environments.

Offline sales are expected to grow at a CAGR of 19.49%, fueled by in-store demonstrations, live setup support, and personalized consultations at electronics retailers. Retailers like Croma, Micro Center, and B&H offer physical experiences that build consumer trust. For the Wireless 6 GHz Robot Router Market, brick-and-mortar outlets are key for showcasing intelligent robotic capabilities, letting users test mobility features, understand smart coverage, and receive real-time technical advice prior to investing in next-generation connectivity solutions.

Wireless 6 GHz Robot Router Market Regional Outlook

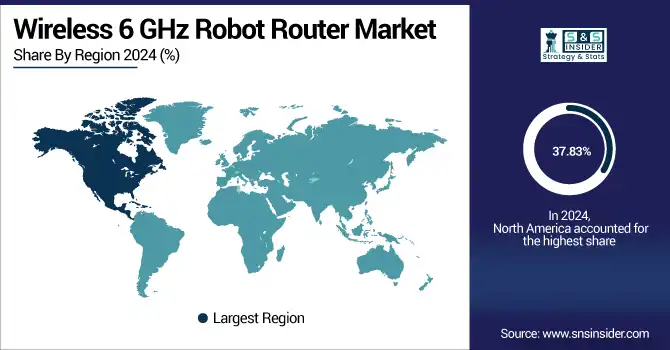

North America held the largest market share of 37.83% in 2024, owing to early adoption of next-generation Wi-Fi technologies, rising demand for smart home automation, and strong investment in AI-driven consumer tech. Robust infrastructure, tech-savvy consumers, and a well-established e-commerce ecosystem further accelerate the market’s momentum across residential, enterprise, and industrial applications. The U.S. leads the region due to strong R&D activities, rapid 6 GHz spectrum deployment, and widespread uptake of AI-integrated routers by consumers and enterprises.

Europe demonstrates steady growth driven by increasing digitization, the adoption of smart manufacturing, and rising demand for advanced networking across homes and enterprises. Government policies supportive smart infrastructure, coupled with strong broadband connectivity standards, make Europe a favorable environment for 6 GHz router innovations. Germany dominates the European market owing to its focus on Industry 4.0, the advanced consumer electronics sector, and the widespread deployment of intelligent Wi-Fi networks in both residential and industrial sectors.

Asia Pacific is the fastest-growing region, with a 24.47% market share in 2024, driven by growing smartphone penetration, smart city developments, and increased adoption of connected home and industrial automation devices. The region benefits from massive urbanization, expanding middle-class populations, and strong tech manufacturing capabilities. China leads the region due to large-scale consumer electronics creation, government support for smart connectivity, and growing demand for intelligent home networking solutions among urban households.

The Middle East & Africa and Latin America regions are experiencing steady growth in the Wireless 6 GHz Robot Router Market, fueled by smart city initiatives, broadband expansion, and increased adoption of advanced Wi-Fi technologies. The UAE leads in MEA due to digitization investments, while Brazil dominates Latin America with growing tech-savviness and expanding urban connectivity infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Wireless 6 GHz Robot Router Market are Cisco Systems, Inc., Aruba Networks (Hewlett Packard Enterprise), NETGEAR, Inc., TP Link Technologies Co., Ltd., ASUSTeK Computer Inc., D Link Corporation, Ubiquiti Inc., Huawei Technologies Co., Ltd., Zyxel Communications Corp., Juniper Networks, Inc. and others.

Key Developments

-

In April 2025, Cisco unveiled its first outdoor Catalyst 6 GHz access point with Automated Frequency Coordination (AFC) and GPS-enabled antennas, delivering standard-power 6 GHz wireless coverage tailored for enterprise and industrial environments.

-

In November 2024, Cisco launched AI-native, secure Wi‑Fi 7 access points featuring adaptive, location-aware configurations and unified licensing, enabling streamlined, intelligent connectivity for seamless hybrid deployments across enterprise and smart infrastructure environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.25 Billion |

| Market Size by 2032 | USD 8.87 Billion |

| CAGR | CAGR of 18.71% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Standalone Routers, Mesh Routers, Integrated Robot Routers) •By Application (Residential, Commercial, Industrial, Others) •By Connectivity (Wi-Fi 6E, Wi-Fi 7, Others) •By End-User (Smart Homes, Enterprises, Manufacturing, Healthcare, Others) •By Distribution Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc., Aruba Networks (Hewlett Packard Enterprise), NETGEAR, Inc., TP Link Technologies Co., Ltd., ASUSTeK Computer Inc., D Link Corporation, Ubiquiti Inc., Huawei Technologies Co., Ltd., Zyxel Communications Corp., Juniper Networks, Inc. |