3D Audio Market Report Scope & Overview:

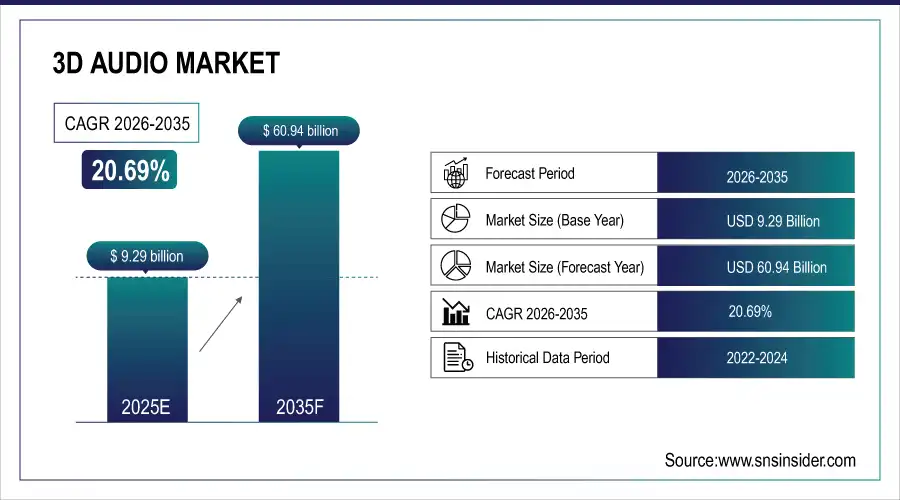

The 3D Audio Market was valued at USD 9.29 billion in 2025 and is expected to reach USD 60.94 billion by 2035, growing at a CAGR of 20.69% from 2026-2035.

The growth of the 3D audio market is being driven by increasing demand for immersive sound experiences across sectors such as gaming, media & entertainment, and augmented/virtual reality. Consumers are seeking more lifelike and spatially accurate audio, prompting widespread integration of 3D audio in smart devices, soundbars, and home theaters.

-

According to Apple and Dolby, over 90% of Apple Music listeners have experienced Spatial Audio, with listens to songs in this format having more than tripled over the past two years.

-

Dolby reports there are now over 1,200 Atmos‑ready studios in 50+ countries, and in 2024, 93 of the Billboard Top 100 songs were mixed in Dolby Atmos. The expansion of 3D audio is also evident in the 130+ Atmos-enabled automotive models available globally including vehicles from Cadillac, Mercedes-Benz, Volvo, Rivian, and NIO highlighting its rising importance in infotainment systems.

3D Audio Market Size and Forecast

-

Market Size in 2025: USD 9.29 Billion

-

Market Size by 2035: USD 60.94 Billion

-

CAGR: 20.69% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On 3D Audio Market - Request Free Sample Report

3D Audio Market Trends

-

Rising demand for immersive audio experiences in gaming, VR/AR, and entertainment is driving the 3D audio market.

-

Growing adoption across headphones, smart speakers, cinemas, and mobile devices is boosting market growth.

-

Expansion of virtual reality, augmented reality, and metaverse applications is fueling deployment.

-

Increasing focus on spatial sound, personalized audio, and realistic soundscapes is shaping adoption trends.

-

Advancements in AI, HRTF processing, and object-based audio technologies are enhancing performance and user experience.

-

Rising consumption of streaming services, gaming content, and immersive media is supporting market expansion.

-

Collaborations between audio technology providers, gaming studios, and consumer electronics manufacturers are accelerating innovation and global adoption.

The U.S. 3D Audio Market was valued at USD 2.28 billion in 2025 and is expected to reach USD 14.38 billion by 2035, growing at a CAGR of 20.24% from 2026-2035.

The U.S. 3D Audio Market is growing due to rising demand for immersive sound in gaming, streaming, and VR applications, along with increased adoption in smart devices, automotive systems, and home entertainment, supported by continuous advancements in audio processing technologies.

3D Audio Market Growth Drivers:

-

Rising demand for immersive audio experiences in gaming, cinema, and virtual reality is transforming the entertainment industry's sound standards.

The rapid growth of the gaming industry and cinematic VR experiences is fueling demand for 3D audio solutions that enhance immersion and realism. Game developers and filmmakers increasingly incorporate spatial soundscapes to provide users with heightened sensory engagement. This shift is driven by consumer expectations for lifelike, interactive experiences. Additionally, virtual concerts and AR/VR-based training simulations are adopting 3D audio to mimic real-world sound environments, further driving uptake. As consumer technology becomes more advanced, the desire for richer, more enveloping audio becomes a decisive purchasing factor.

-

Apple’s official Newsroom announced a VR Metallica concert for Apple Vision Pro (launching March 14, 2025), combining ultra‑high‑resolution 180° video with spatial audio. Fans can preview the experience at Apple stores and stream the new EP M72 World Tour: Mexico City in Spatial Audio on Apple Music.

-

Similarly, Sony Interactive Entertainment announced the global release of PlayStation VR2 with built‑in 3D Audio, eye tracking, haptic feedback, and support from first-party developers. The headset aims to raise immersive gaming standards and enable heightened sensory interaction in VR titles.

3D Audio Market Restraints

-

High cost of 3D audio equipment and production tools limits accessibility for small-scale developers and budget-sensitive industries.

Implementing 3D audio technology often requires specialized microphones, advanced audio engines, and powerful processors, all of which increase development costs. For small content creators, indie developers, or educational institutions, these financial barriers restrict entry into the 3D audio space. Additionally, post-production tools for spatial audio require trained professionals and complex workflows, making it resource-intensive. As a result, many potential adopters in low-resource settings are unable to integrate or experiment with the technology. Until affordable, user-friendly solutions become mainstream, high costs will remain a significant constraint on wider adoption.

-

According to a Reddit discussion on the cost of hiring a sound designer for a game, budgets can range from USD 10,000 to USD 30,000 depending on the game's scope. This cost includes not only the designer's fees but also the necessary tools and equipment for creating high-quality audio.

3D Audio Market Opportunities

-

Integration of 3D audio in automotive entertainment and driver-assist systems unlocks future growth beyond traditional consumer tech markets.

Automotive OEMs are exploring spatial audio for in-car infotainment, navigation prompts, and advanced driver-assistance systems (ADAS). Luxury car brands are collaborating with audio technology providers to deliver premium 3D sound experiences, creating new value propositions. Spatial sound can improve safety by simulating directional audio cues, guiding driver attention more effectively. Moreover, autonomous vehicles will rely heavily on immersive media for passenger entertainment, where 3D audio will play a central role. This convergence of automotive and audio innovation opens a promising frontier for market expansion beyond consumer electronics.

3D Audio Market Challenges

-

Technical complexity in real-time rendering and synchronization of spatial audio presents development hurdles for content creators.

Creating realistic 3D audio environments requires precise sound source positioning, head tracking, and latency-free rendering. Synchronizing these elements in real time, especially for interactive applications like gaming or AR/VR, remains a major technical challenge. Developers must also account for individual ear shape variations and room acoustics, adding to complexity. Errors in spatial audio rendering can cause disorientation or diminish immersion. This technical burden slows development cycles and demands high expertise, deterring many from adopting the technology. Unless rendering tools become more intuitive and robust, complexity will limit broader creative integration.

3D Audio Market Segment Analysis

By Deployment Mode

On-premise deployment dominated the 3D audio market in 2025 with a 54% revenue share due to its ability to offer greater control over audio processing, latency management, and data security. Professional studios, gaming developers, and entertainment enterprises prefer on-premise systems to fine-tune audio rendering with low-latency environments and proprietary hardware. This setup ensures precision and customization, especially where real-time spatial sound manipulation is critical for immersive experiences.

Cloud-based deployment is projected to grow at the fastest CAGR of 21.72% from 2026 to 2035, driven by rising demand for scalable, remote-accessible audio solutions across media streaming, gaming, and AR/VR platforms. Cloud enables real-time updates, multi-platform support, and integration with virtual collaboration tools, making it ideal for modern workflows. As 5G and edge computing improve latency issues, cloud-based 3D audio will gain rapid adoption.

By Application

The consumer segment led the 3D audio market with a 30% revenue share in 2025, largely due to widespread adoption of immersive audio in personal entertainment devices. Consumers increasingly use 3D-enabled headphones, smart TVs, and mobile apps to enhance gaming, music, and video experiences. Streaming platforms and consumer electronics brands have fueled this shift by integrating spatial sound features into mass-market products, making immersive audio widely accessible.

The AR/VR segment is expected to grow at the highest CAGR of 23.50% from 2026 to 2035, owing to its dependency on spatial audio for realistic, immersive environments. Whether in virtual training, education, or gaming, accurate 3D audio enhances depth perception and user engagement. With expanding use cases across enterprise simulations, remote collaboration, and metaverse platforms, demand for real-time spatial sound in AR/VR ecosystems is surging.

By Device Type

Headphones accounted for 37% of the 3D audio market revenue in 2025, as they serve as the primary medium for delivering immersive sound to consumers. With increasing integration of spatial audio in premium headphones by brands like Apple, Sony, and Bose, users experience theater-like audio in personal settings. Portable, affordable, and widely adopted, headphones have become the most convenient interface for 3D audio applications.

VR devices and drones are expected to grow at the fastest CAGR of 25.19% from 2026 to 2035 due to their rising role in interactive and immersive experiences. VR hardware depends on spatial sound to replicate lifelike surroundings, while drones are now being used for entertainment, surveillance, and mapping with audio-based navigation. These emerging applications are accelerating adoption of 3D audio in both consumer and industrial markets.

By Component

Hardware led the 3D audio market with a 44% revenue share in 2025 because it forms the foundation for delivering spatial sound across headphones, speakers, VR gear, and gaming consoles. Consumers and professionals rely on dedicated hardware to ensure low-latency audio processing, better rendering accuracy, and real-time sound localization. Hardware remains indispensable for supporting performance-intensive applications across media, gaming, and simulation environments.

Software is projected to grow at the highest CAGR of 21.99% from 2026 to 2035, driven by the surge in demand for audio rendering engines, spatialization algorithms, and virtual sound mixers. As content creators seek flexibility and scalability, software-based 3D audio tools enable cross-platform deployment and real-time customization. Cloud integration, AI-based sound mapping, and increased SDK availability are pushing software adoption in gaming, AR/VR, and streaming services.

3D Audio Marke Regional Analysis

North America 3D Audio Market Insights

North America held the highest revenue share of approximately 34% in the 3D audio market in 2025, primarily due to its advanced entertainment ecosystem, high consumer spending, and widespread adoption of immersive technologies. The region is home to major players in gaming, music, and cinema who are early adopters of 3D audio. Strong infrastructure, high-end hardware availability, and innovation in AR/VR further drive market dominance in this region.

The United States is dominating the 3D audio market due to its strong tech ecosystem, major industry players, and high consumer adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific 3D Audio Market Insights

Asia Pacific is projected to grow at the fastest CAGR of 23.13% from 2026 to 2035, fueled by rapid digital transformation, expanding smartphone penetration, and rising popularity of mobile gaming and virtual experiences. Countries like China, Japan, and South Korea are investing in immersive technologies and 5G networks, making spatial audio more accessible. The region’s large youth population and booming entertainment industry are accelerating market expansion.

China is dominating the 3D audio market in Asia Pacific due to its large consumer base, strong manufacturing capabilities, and rapid tech integration.

Europe 3D Audio Market Insights

Europe is a significant player in the 3D audio market, driven by a strong presence of audio technology companies, rising demand for immersive media, and increasing adoption of AR/VR applications across sectors such as entertainment, automotive, and gaming industries.

The United Kingdom is dominating the 3D audio market in Europe, driven by its advanced media sector, gaming industry, and early tech adoption.

Middle East & Africa and Latin America 3D Audio Market Insights

In the 3D audio market, the Middle East & Africa and Latin America are emerging regions, witnessing gradual adoption driven by growing entertainment industries, increasing smartphone penetration, and rising interest in immersive technologies across gaming, music, and virtual experiences.

3D Audio Market Competitive Landscape:

Apple Inc.

Apple designs, manufactures, and markets consumer electronics, software, and services, emphasizing seamless integration, innovation, and premium user experiences. Its audio and wearable devices, including AirPods and Apple Watch, deliver advanced health, fitness, and immersive media capabilities. Apple continues to advance spatial audio, adaptive sound technologies, and ecosystem-wide device interconnectivity. The company invests heavily in AI-driven personalization and accessibility, offering products that integrate hardware, software, and services to provide high-quality, immersive experiences for music, entertainment, and everyday communication.

-

2025: Apple announced the AirPods Pro 3 with next‑generation adaptive audio architecture, widening soundstage and delivering a more immersive spatial listening experience for music and media consumption.

Auro Technologies (Auro‑3D)

Auro‑3D develops advanced immersive audio technologies for cinema, home entertainment, streaming, and gaming. Its scalable 3D audio codecs, spatial rendering engines, and audio ecosystem solutions enhance depth, directionality, and realism in sound experiences. Auro‑3D collaborates with OEMs, software developers, and content creators to integrate multi-dimensional audio standards, supporting various formats and devices. The company’s focus on immersive, high-fidelity audio positions it as a key player in next-generation entertainment, spatial audio, and immersive content distribution markets.

-

2024: AURO‑3D showcased its AURO‑CX immersive audio codec and ecosystem at CES 2024, supporting scalable 3D sound for cinema, home, and streaming entertainment formats globally.

Dolby Laboratories, Inc.

Dolby Laboratories develops audio, imaging, and voice technologies enhancing cinematic, gaming, home, and automotive experiences. Its Dolby Atmos and Dolby Vision platforms deliver immersive, spatial, and HDR content with precision. Dolby collaborates with hardware manufacturers, content creators, and software developers to integrate its technologies into devices, media production, and streaming platforms. The company focuses on innovation, immersive media experiences, and adaptive technologies that enhance audio fidelity, visual quality, and end-user engagement across multiple industries worldwide.

-

2023: Dolby released native Dolby Atmos and Dolby Vision plug-ins for Unreal Engine, enabling developers to create immersive 3D audio and HDR experiences in gaming and simulations.

-

2025: Dolby announced integration of Dolby Atmos in multiple Audi car models, delivering immersive in‑vehicle audio experiences and enhancing spatial sound quality for drivers and passengers.

Google LLC

Google develops software, cloud services, AI solutions, and hardware, spanning search, advertising, productivity, and entertainment platforms. It invests in spatial audio, immersive media, and AI-powered technologies to enhance content creation, playback, and personalization. Google collaborates with technology partners to standardize next-generation audio formats, improve user experiences, and expand adoption of immersive entertainment solutions. Its efforts focus on scalability, innovation, and cross-device integration for consumers, enterprises, and developers globally.

- 2025: Google and Samsung jointly launched Eclipsa Audio, a royalty-free 3D spatial audio format built on IAMF, powering next-generation 3D sound for Samsung 2025 TVs and soundbars.

Samsung Electronics Co., Ltd.

Samsung Electronics designs and manufactures consumer electronics, semiconductors, and digital media devices, leading innovations in smart TVs, wearables, and home entertainment. Its Galaxy and audio device portfolios integrate AI, spatial audio, and immersive media technologies. Samsung collaborates with Google and other partners to advance 3D audio, Dolby Atmos, and IAMF standards. The company emphasizes enhancing user experience through intelligent audio features, sleep/wellness monitoring, and high-fidelity sound, targeting global consumers, homes, and entertainment environments.

-

2023: Samsung Research announced development of advanced 3D audio and IAMF standard, co-developed with Google, expanding immersive audio capabilities beyond traditional playback and home devices.

-

2025: Samsung integrated Eclipsa Audio 3D technology across its 2025 TV and soundbar lineup, enabling immersive playback and spatial sound experiences for home entertainment consumers.

Key Players

Some of the 3D Audio Market Companies

-

Apple Inc.

-

Auro Technologies

-

Bang & Olufsen

-

Blue Ripple Sound

-

BOSE Corporation

-

Dolby Laboratories, Inc.

-

DTS, Inc.

-

Google LLC

-

Magic Leap, Inc.

-

Qualcomm Technologies, Inc.

-

SAMSUNG

-

Sennheiser Electronic GmbH & Co. KG

-

Sony Corporation

-

VisiSonics Corporation

-

Waves Audio Ltd.

-

Dirac Research AB

-

Ceva, Inc.

-

Fraunhofer Institute for Integrated Circuits

-

Sound Particles S.A.

-

BarcoPIX

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 9.29 Billion |

| Market Size by 2035 | USD 60.94 Billion |

| CAGR | CAGR of 20.69% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Application (Consumer, Gaming, Media & Entertainment, AR/VR, Automotive, Others) • By Device Type (Headphones, Speakers, Soundbars, VR Devices, Smartphones, Others) • By Deployment Mode (On-Premise, Cloud-Based) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Apple Inc., Auro Technologies (Auro‑3D), Bang & Olufsen, Blue Ripple Sound, BOSE Corporation, Dolby Laboratories, Inc., DTS, Inc., Google LLC, Magic Leap, Inc., Qualcomm Technologies, Inc., SAMSUNG, Sennheiser Electronic GmbH & Co. KG, Sony Corporation, VisiSonics Corporation, Waves Audio Ltd., Dirac Research AB, Ceva, Inc., Fraunhofer Institute for Integrated Circuits (Fraunhofer IIS), Sound Particles S.A., BarcoPIX (Barco NV) |