Lutein Market Report Scope & Overview:

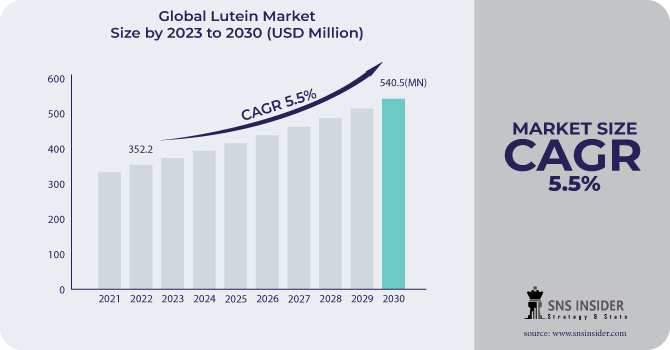

The Lutein Market size was USD 352.2 Million in 2022 and is expected to Reach USD 540.5 million by 2030 and grow at a CAGR of 5.5 % over the forecast period of 2023-2030.

Lutein is a carotenoid, which is a type of pigment that gives plants their vibrant colors. Lutein is abundant in the macula, a small area of the retina at the back of the eye. the demand for lutein is increasing in dietary supplements especially for eye care. Also, we can intake lutein naturally by regular consumption of variety of fruits and vegetables.

Based on application, the lutein market is segmented into dietary supplements, Functional Foods food & beverage, pharmaceuticals, animal feed, and others based on applications. The segment of dietary supplements is anticipated to observe gains at nearly 5.5% up to 2030 during the forecast period as a result of rising demand and numerous benefits for healthy growth.

MARKET DYNAMICS

KEY DRIVERS

-

Potential health benefits of lutein

Lutein is a carotenoid that is essential for eye health. It has also been shown to have a number of other health benefits, including reducing the risk of age-related macular degeneration, cataracts, and heart disease. As consumers become more aware of the health benefits of lutein, demand for lutein supplements and food products fortified with lutein is expected to increase.

-

The increasing consumption of health and Nutritional foods

RESTRAIN

-

Side effects of high doses and prolonged consumption of lutein

Consumers are becoming more knowledgeable of the possible dangers of consuming large quantities of lutein supplements. This is because there is an expanding corpus of research on the subject and because some of the adverse effects that have been recorded have received media attention. High dosages of lutein have specific negative effects, including crystal formation in the eyes and carotenodermia. Additionally, supplements containing lutein may interact with some medicines, including blood thinners and cholesterol-lowering medications. This might make certain drugs more likely to have unwanted side effects.

OPPORTUNITY

-

Huge Consumption of Dietary Supplements

Due to its high concentration of minerals, vitamins, and fatty acids, dietary supplements accounted for the largest portion of the lutein market. Consumers can maintain their health and safeguard themselves against dangerous diseases. One of the main factors influencing the market is the rising occurrences of vision impairment and the myopic population, which are caused by an increase in screen usage and participation in virtual meetings while working from home. The industry is also being driven by an increase in older people's and millennials' interest for eye health supplements, who are particularly vulnerable to digital eye strain and myopia.

CHALLENGES

-

Concerns about lutein's stability

Climate and environmental factors can impact lutein's natural properties. Therefore, when food and beverage products containing these colorants are cooked and processed at high temperatures, changes in odor, taste, or texture may take place. Lutein also has a short shelf life. It tends to change both its internal fragrance and color when kept in storage for an extended period of time or when exposed to sunlight, moisture, and high temperatures. Food items may become unpleasant as a result of lutein's natural color fading over time and other natural qualities changing. Color and visual appeal of food goods are crucial customer purchasing factors. As a result, modifications to a food product's inherent qualities can seriously impede the expansion of the world lutein market.

-

Government regulations

IMPACT OF RUSSIA UKRAINE WAR

Russia Ukraine war has significantly impacted the lutein market. As a result of the war, medical facilities have been destroyed, and there have been several casualties. The general populace, children, and others have not received the necessary nutrition for their bodies. Ukraine is a big producer of sunflower oil, which is used to make lutein supplements. The war has affected Ukrainian sunflower oil production and export, causing shortages and higher costs in the worldwide lutein market. Since the beginning of the war, the price of lutein has risen by an average of 15%. The quantity of lutein has been estimated to have fallen by 10%.

IMPACT OF ONGOING RECESSION

Recession has a significant impact on lutein market. As the general population grows, particularly as a result of the Russia-Ukraine conflict casualties, there is an increase in demand for lutein dietary supplements. However, as the price of sunflower and other materials used in supplements has risen, so have the prices of supplements. As a result, demand for lutein supplements has decreased by 5% on average, and the worldwide lutein market is predicted to shrink by 3% in 2023 as a result of the recession.

MARKET SEGMENTATION

By Form

-

Powder Lutein

-

Beadlet Lutein

-

Emulsion Lutein

-

Oil Suspension Lutein

By Source

-

Natural

-

Synthetic

By Application

-

Dietary Supplements

-

Functional Foods

-

Pharmaceuticals

-

Animal Feed

.png)

REGIONAL ANALYSIS

During the forecasted period, Europe is dominate the market by contributing of 36.4% to the growth in world. The region benefits from thriving end-user businesses such as pharmaceutical, food and beverage and animal feed, these all generate significant demand. Furthermore, the presence of a big consumer base and multiple manufacturers contribute to market growth. The region's increased use of lutein in supplements, food, and eye health products is being driven by the region's aging population and rising incidence of eye-related health disorders.

The Asia-Pacific is the fastest-growing regional market for lutein, owing to the presence of pharmaceutical companies in the region and subsequent growth in the consumer markets of India, China, and Japan. These countries represent for approximately 61% of the lutein market. Some of the drivers boost the lutein market in India are increased awareness of the benefits of lutein, an increase in the health-conscious population, higher disposable income, and an increase in the middle-class population. The Asia-Pacific region has the most drug supply and the largest pharmaceutical sector, with ample raw materials widely accessible to lutein producers, boosting market expansion.

The North American market is expected to grow at the high CAGR. The U.S has the market share of USD 85 million in 2022. The growth is due to the health benefits of lutein and an increase in the demand for organic and plant-based ingredients in the food & beverage, and Nutraceuticals industries. The growing trends of clean labeling and natural products are also driving consumer demand for lutein in North America.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Lutein Market are BASF SE, Koninklijke DSM NV, Kemin Industries Inc., Chr. Hansen Holding AS, Allied Biotech Corporation, Chenguang Biotech Group Co., Ltd, FMC Corporation, OmniActive Health Technologies, KATRA GROUP, Synthite Industries Ltd, Nature’s Bounty., Döhler Group, E.I.D. - Parry (India) Limited, and other key players.

Koninklijke DSM NV-Company Financial Analysis

RECENT DEVELOPMENTS

In 2022, Cohort found that Lutein and zeaxanthin are more effective in reducing the frequently fatal effects of age-related macular degeneration (AMD) than omega-3 fatty acids or beta-carotene.

In 2021, Ashland introduced a soy-free GPM lutein that includes novel eye health components to relieve eye strain caused by excessive screen time. Additionally, N-dur xr caffeine and melatonin for powdered drink items were introduced.

In 2021, OmniActive Health Technologies has launched Integrative Actives, a technology that enables the delivery of several actives in concentrated lower doses. OmniActive's Integrative Actives platform was used to generate the first product, Nutritears. It had a clinically proven blend of chemicals, including curcuminoids, lutein and zeaxanthin isomers, and vitamin D3.

| Report Attributes | Details |

| Market Size in 2022 | US$ 352.2 Billion |

| Market Size by 2030 | US$ 540.5 Billion |

| CAGR | CAGR of 5.5 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Form (Powder Lutein, Beadlet Lutein, Emulsion Lutein, Oil Suspension Lutein) • By Source (Natural, Synthetic) • By Application (Dietary Supplements, Functional Foods, Pharmaceuticals, Animal Feed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BASF SE, Koninklijke DSM NV, Kemin Industries Inc., Chr. Hansen Holding AS, Allied Biotech Corporation, Chenguang Biotech Group Co., Ltd, FMC Corporation, OmniActive Health Technologies, KATRA GROUP, Synthite Industries Ltd, Nature’s Bounty., Döhler Group, E.I.D. - Parry (India) Limited |

| Key Drivers | • Potential health benefits of lutein • The increasing consumption of health and Nutritional foods |

| Market Restrain | • Side effects of high doses and prolonged consumption of lutein |