Energy Balls Market Report Scope & Overview:

Get More Information on Energy Balls Market - Request Sample Report

The Energy Balls Market size was USD 359.5 million in 2023, is expected to Reach USD 633.72 million by 2032, and grow at a CAGR of 6.5% over the forecast period of 2024-2032.

Protein and other essential nutrients found in energy balls can help your body heal and replenish itself after exercise. In between meals: Keep a nutritious snack on hand, such as energy balls, to help you satisfy your appetite without feeling guilty. Snacking might be dangerous at times.

Based on Flavor, In the energy balls market, the nut-based category had the biggest revenue share of 30.03% and was estimated at USD 99.6 Million in 2022. Nut-based energy balls are popular because they are a good source of protein, fiber, and healthy fats. They are also typically low in sugar and carbohydrates. Also, the chocolate-based segment is expected to grow at the fastest CAGR of 9% during the forecast period.

Energy balls are a favorite snack among athletes and fitness aficionados. Eaten before, during, or after exercise, energy balls can help fuel workouts and speed up recovery. Additionally, you can substitute energy balls for breakfast, lunch, or dinner. Calories, protein, fiber, and beneficial fats can all be found in plenty in energy balls. They can also be altered to accommodate special dietary requirements.

MARKET DYNAMICS

KEY DRIVERS

-

Rising health consciousness

Customers are looking more and more for wholesome, nourishing snacks that will give them energy without compromising their health goals. As they are frequently packed with nutrient-rich components including nuts, seeds, dried fruits, and natural sweeteners, energy balls are the ideal solution for this demand. Another crucial aspect for consumers who are concerned about their health is that energy balls are a portable and convenient snack alternative. Energy balls are a terrific alternative for folks who are constantly on the go because they are simple to eat on the go.

RESTRAIN

-

Disruption of the supply chain

Some of the basic resources used to make energy balls, like nuts, seeds, and dried fruits, are in short supply. This is caused by several things, including weather-related incidents, pest problems, and a lack of labor. Due to issues with the supply chain and a lack of personnel, energy ball producers are experiencing production delays. Energy balls may become scarce on store shelves as a result of this. Challenges in the global supply chain may affect the availability of ingredients and packaging for energy balls.

OPPORTUNITY

-

Various flavors of energy ball

Energy balls have a dessert-like flavor, but they are healthy. For diabetics, energy balls produced with low-glycemic index foods like nuts, seeds, and whole grains are utilized. Prebiotic and probiotic substances including chicory root fiber and kefir powder are used for people with digestive disorders. Vegan dieters can create plant-based energy balls using nuts, seeds, dried fruit, and plant-based protein powder as the main ingredients. Consumers with particular dietary demands and preferences are increasingly being catered to by energy ball manufacturers. Manufacturers may reach a larger spectrum of consumers and increase their market share by creating new flavors and ingredients that are customized to particular ailments and diets.

-

Demand for naturally sourced ingredients

CHALLENGES

-

High cost of energy ball

High-quality, nutrient-rich foods including nuts, seeds, dried fruits, and protein powder are frequently used to make energy balls. The cost of these components might be high, which raises the price of energy balls. Consumers who are concerned about costs could choose less expensive options like granola bars or trail mix. Additionally, the energy ball market is becoming more and more competitive, which is driving prices down. However, many producers are hesitant to significantly reduce the cost of their energy balls because they want to keep their profits and product standards high.

IMPACT OF RUSSIAN-UKRAINE WAR

Russia's invasion of Ukraine has impacted the energy ball market. Ingredients of energy balls are nuts, dry fruit, oats, seeds, and protein bars. The war has disrupted the global supply chain of raw materials used in energy balls, which has made it more difficult for manufacturers to obtain the ingredients and packaging they need to produce energy balls. A recent survey found that 60% of consumers have increased their energy ball purchases since the war began. In the first half of 2023, shipments of energy balls from the United States climbed by 15%. Since the commencement of the war, the price of nuts, seeds, and dried fruit has climbed by 10% on average.

IMPACT OF ONGOING RECESSION

Recession has increased the prices of ingredients used in protein bars. The rising health concerns of consumers, and sports fitness people are driving the demand for energy bars. Customers are to reach a wider spectrum of consumers during a recession, energy ball makers may increase their distribution channels, such as selling energy balls in grocery shops and convenience stores. An energy ball's average price has risen by 5%. According to a recent NPD Group survey, energy ball sales fell 5% in the first quarter of 2023 compared to the same period in 2022.

MARKET SEGMENTATION

By Nature

-

Conventional

-

Organic

By Flavour

-

Nut-based

-

Chocolate-based

-

Fruit-based

-

Others

By Distribution Channel

-

Hypermarket/Supermarket

-

Specialty Stores

-

Online Retail

-

Convenience Stores

By Application

-

Sports & Fitness

-

Snacks

-

Meal Replacement

REGIONAL ANALYSIS

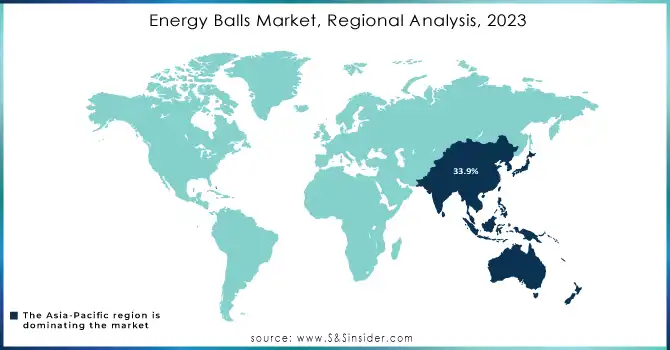

Asia-Pacific emerged as the global market leader for energy balls in 2022, with a 33.9% share and a projected value of USD 115.71 million. The growth of the market is a result of several factors, including increasing disposable income per capita and rising demand for nutrient-rich food products in nations such as China and India. It is also a result of millennials' increased health awareness.

North America is a significant market for the energy ball. This growth is attributed to consumers' demand for healthy protein balls with nutritional value. The United States dominates North America for energy balls. Manufacturers of energy balls are creating brand-new, cutting-edge items to satisfy consumer demand. New tastes, textures, and ingredients are now entering the market as a result of this.

Europe is expected to increase at a CAGR of 7% during the forecast period. This expansion can be linked to rising awareness of the potential health benefits of energy balls. Energy balls are often made with organic and natural ingredients, which is appealing to consumers who are looking for healthy and sustainable snacks.

South America, the Middle East and Africa have emerged as energy ball markets, accounting for less than 5% of the global market. This expansion is linked to the region's increasing disposable income and the growing desire for nutritious and handy snacks which drive the energy balls market.

Need Any Customization Research On Energy Balls Market - Inquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Energy Balls Market are Bounce Foods Ltd, Betty Lou's Inc., Made in Nature, Inc., Nutri-Brex, Boostball, Windmill Organics, DELICIOUSLY ELLA LTD., JV Foodworks Pvt Ltd., Koa Natural Foods, Bonbite NYC, Nomz, Nutrilicious Food Products, and other key players.

RECENT DEVELOPMENTS

In 2023 Scott's® Protein Balls will introduce its newest flavor, Cinnamon Bun, which is produced entirely of organic ingredients, at Natural Products Expo East, one of the largest food exhibits showcasing all-organic and natural goods. The newest taste has the wonder ingredient cinnamon, which is a consumer favorite and has been shown to have numerous health advantages.

In 2023, Bounce Foods Ltd, one of the leading protein ball companies in Australia. It has entered voluntary administration.

| Report Attributes | Details |

| Market Size in 2023 | USD 359.5 Million |

| Market Size by 2032 | USD 633.72 Million |

| CAGR | CAGR of 6.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Nature (Conventional, Organic) • By Flavour (Nut-based, Chocolate-based, Fruit-based, Others) • By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail, Convenience Stores) • By Application (Sports & Fitness, Snacks, Meal Replacement) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Bounce Foods Ltd, Betty Lou's Inc., Made in Nature, Inc., Nutri-Brex, Boostball, Windmill Organics, DELICIOUSLY ELLA LTD., JV Foodworks Pvt Ltd., Koa Natural Foods, Bonbite NYC, Nomz, Nutrilicious Food Products |

| Key Drivers | • Rising health consciousness |

| Market Restrain | • Disruption of the supply chain |