Malonic Acid Market Report Scope & Overview:

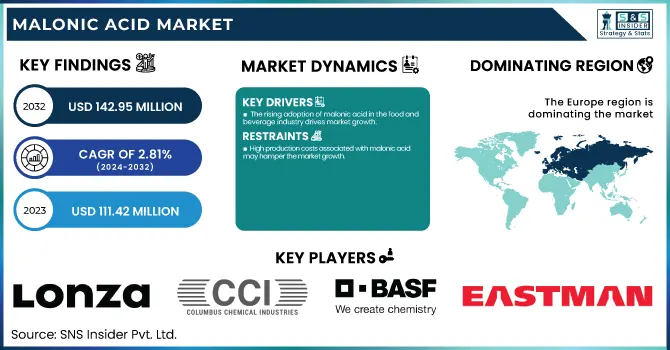

The Malonic Acid Market size was valued at USD 111.42 Million in 2023 and is expected to reach USD 142.95 Million by 2032, growing at a CAGR of 2.81% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Malonic Acid Market - Request Sample Report

This report gives a comprehensive overview of the recent pricing patterns, supply chain challenges, and investments by the key players in the malonic acid market. Depending on the use case, it provides insight into production capacity and utilization rates by country, as well as feedstock pricing and the regulatory landscape by country. It provides insights into the current market size and future projections, analyzing production and consumption patterns across various sectors.

Drivers

-

The rising adoption of malonic acid in the food and beverage industry drives market growth.

Increasing usage of malonic acid in the food & beverages industry as acidulants, preservatives, and pH regulators is a key growth factor for the market. Malonic acid and its derivatives have broad food applications with application functions in flavor stability, shelf-life extension, and product consistency. Such an overarching shift towards more natural and clean-label ingredients has driven additional demand as malonic acid being bio-based (natural) can prove to be a more suitable substitute over synthetic additives. Moreover, the expanding food processing sector, especially behind several end-use application industries such as bakery, dairy, and beverages in the developing regions across Asia-Pacific and Latin America, has driven the demand for efficient acidity regulators in the finished products and is expected to achieve hydrophilic balance during the forecast period.

Various regulatory bodies, including the US FDA and the EFSA, have prepared guidelines for the safe limits of organic acids, providing guidelines for compliance with the safe use of organic acids in food. The growing demand for malonic acid due to the change of trend in manufacturers to ensure higher standards of food safety regulations and learning functional food icing ingredients has led to the great ball rolling of new systems consumed in the malonic acid market. In addition, improved bio-based production techniques with increased sustainability and reduced production costs are attracting malonic acid as a food and beverage additive. Over the forecast period, this trend is expected to strengthen further and gain traction boosting the market growth.

Restraint

-

High production costs associated with malonic acid may hamper the market growth.

The high cost associated with the manufacturing of malonic acid is a major restraint and challenge in terms of market growth, which can mainly be attributed to the complicated manufacturing process and its expensive raw materials. In traditional chemical synthesis, malonic acid is constructed from chloroacetic acid through a series of cyanation and hydrolysis steps, which demand rigorous handling protocols and high energy consumption. This dependency on petrochemical feedstocks increases production costs, now the entire process is not cost-effective relative to other organic acids. Moreover, increases in feedstock prices and supply chain disruptions may have a bearing on the production costs and margins of manufacturers.

Opportunities

-

The growing trend of using bio-based chemicals in various industries creates an opportunity for the market.

An increase in the usage of bio-based chemicals in various end-use industries is an opportunity for the malonic acid market, as the trend continues for the manufacturers to seek for greener alternatives to petrochemical-based chemicals. Malonic acid, one of the major platform chemicals, has been historically produced from fossil resources but is now a good candidate for sustainable chemical applications to biotechnological fermentative production methods from a variety of renewable feedstocks, such as sugar and biomass. Pharmaceuticals, food & beverages, personal care, and specialty chemicals industries are increasingly integrating bio-based ingredients to conform with the global sustainability agenda. Malonic acid is an important building block in the production of green solvents, biodegradable coatings, and bio-based polymers, which are expected to witness a surge in demand. Moreover, with rising investments in bio-manufacturing facilities and advanced biorefinery technologies, costs are expected to be diminished in the time to come, making bio-based malonic acid even more of an attractive option. The movement towards bio-based chemicals is likely to include new sources of growth for the malonic acid market in the forecast period as companies try to meet their carbon-neutral and circular economy targets.

Challenges

-

The availability of alternative products in the market may challenge the market.

Alternative products available in market act as a major threat to the malonic acid market as there are many organic acids performing similar functions with lower price range. Citric acid, succinic acid, and tartaric acid are the most commonly used compounds for different applications in food & beverages, pharmaceuticals and specialty chemicals industries as acidulants, pH regulators and intermediates in chemical synthesis. Such substitutes are generally cheaper and more abundant, which make them more desirable by manufacturers who want to minimize production costs.

Market segmentation

By Application

Flavor enhancers held the largest market share of about 32% in 2023. It is widely used in the food and beverage industry. Malonic acid also and its derivatives have been used extensively as a pH regulator, acidity enhancer, and buffering agent, especially because it can stabilize and improve the taste of processed foods, confectionery, and beverages. The adoption of malonic acid is further driven due to increasing consumer preference for clean-label and natural flavoring agents as it fits industry trends for bio-based and non-synthetic additives.

By End-Use Industry

Food & Beverage held the largest market share around 34% in 2023. This is owing to malonic acid being a key component for maintaining the quality, flavor, and preservation of products. Malonic acid is an effective acidulant that is used in a wide range of food and beverages, including carbonated beverages, fruit juices, bakery goods, dairy products, and desserts and confections. This regulation is critical for pH, flavor stability, and shelf life of processed foods to ensure consumers have needs for associated freshness and consistency. Due to the shift of consumers towards clean-label products, malonic acid, owing to its natural properties, has also garnered popularity as an alternative to synthetic additives, in concordance with increasing demand for more natural and healthier food products.

Regional Analysis

Europe held the largest market share around 42% in 2023. The growth can largely be attributed to the rise in consumption of malic acid across end-use segments. Sectors like food & beverages, pharmaceuticals, and cosmetics have realized the multidimensional advantages of malic acid, and this has given rise to its increasing deployment. They are of interest to the pharmaceutical industry for their potential pharmacological properties. It has been discovered to help in the making of drugs, especially for diseases like kidney stones and fibromyalgia. The demand for malic acid in the pharmaceutical sector has witnessed a surge due to the escalating incidence of such diseases and rising knowledge regarding the merits of malic acid. Even the cosmetic industry has identified the importance of malic acid in skin and hair products. With remarkable exfoliating and skin-nurturing properties and the potential to contribute to improved hair, it has earned its place in some beauty formulations. A constant increase in sales of malic acid is anticipated shortly, as the European cosmetic business grows larger. With a whopping number of $4.65 billion, Germany is at the top of the national cosmetics and personal care market in Europe.

North America is the fastest growing region in the market. Malonic acid is used as a chemical intermediate in multiple chemicals including acetic acid, and North America has a strong industrial base that utilizes these chemicals. A large, prepared infrastructure, technological know-how, and ambiance favorable to doing business have created markets ready for growth in the region. Moreover, the rising awareness and progressive adoption of sustainable practices also play a role in the expansion of the market within North America. Malonic Acid is an eco-friendly product which perfectly fits with the sustainability vision of the region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Shanghai Nanxiang Reagent Co. Ltd. (Malonic Acid, Sodium Malonate)

-

Lonza Group (Malonic Acid, Biocatalysts)

-

Wuhan Kemi-Works Chemical Co. Ltd. (Malonic Acid, Potassium Malonate)

-

Columbus Chemical Industries Inc. (Malonic Acid, Sodium Malonate)

-

Trace Zero LLC (Malonic Acid, Green Chemicals)

-

J&K Scientific Ltd. (Malonic Acid, Reagents)

-

Medical Chem (Yancheng) Manufacturing Co. Ltd. (Malonic Acid, Dimethyl Malonate)

-

Hefei TNJ Chemical Industry Co. Ltd. (Malonic Acid, Dimethyl Malonate)

-

Lygos Inc. Co. Ltd. (Malonic Acid, Bio-based Chemicals)

-

Tateyama Kasei Co. Ltd. (Malonic Acid, Acidulants)

-

Wuhan Fortuna Chemical Co. Ltd. (Malonic Acid, Malonates)

-

Sigma-Aldrich Co. (Malonic Acid, Malonic Ester)

-

Kraton Polymers (Malonic Acid, Polymers)

-

Suzhou Taiyue Chemical Co. Ltd. (Malonic Acid, Biochemical Products)

-

Hunan Huaxia Shenzhou New Material Co. Ltd. (Malonic Acid, Malonate Esters)

-

Hubei Jusheng Technology Co. Ltd. (Malonic Acid, Solvents)

-

Eastman Chemical Company (Malonic Acid, Chemical Intermediates)

-

BASF SE (Malonic Acid, Specialty Chemicals)

-

Shandong Xindongfang Chemical Co. Ltd. (Malonic Acid, Organic Acids)

-

Zhejiang Yangfan New Materials Co. Ltd. (Malonic Acid, Chemical Products)

Recent Development:

-

In 2023, Lonza Group announced the expansion of its biotechnology-based production capabilities for bio-based chemicals, including malonic acid derivatives, to meet the growing demand for sustainable ingredients in industries such as food, pharmaceuticals, and specialty chemicals.

-

In 2023, Wuhan Kemi-Works Chemical Co. launched a new line of high-purity malonic acid with improved bio-based synthesis methods, aligning with global demand for greener and cost-effective production

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 111.42 Million |

| Market Size by 2032 | USD 142.95 Million |

| CAGR | CAGR of2.81% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (API, Flavor Enhancer, pH Controller, Additive, Precursor, and Other) • By End-use (Pharmaceuticals, Food & Beverage, Agriculture, Paints & Coatings, Plastics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shanghai Nanxiang Reagent Co. Ltd., Lonza Group, Wuhan Kemi-Works Chemical Co. Ltd., Columbus Chemical Industries Inc., Trace Zero LLC, J&K Scientific Ltd., Medical Chem (Yancheng) Manufacturing Co. Ltd., Hefei TNJ Chemical Industry Co. Ltd., Lygos Inc. Co. Ltd., Tateyama Kasei Co. Ltd., Wuhan Fortuna Chemical Co. Ltd., Sigma-Aldrich Co., Kraton Polymers, Suzhou Taiyue Chemical Co. Ltd., Hunan Huaxia Shenzhou New Material Co. Ltd., Hubei Jusheng Technology Co. Ltd., Eastman Chemical Company, BASF SE, Shandong Xindongfang Chemical Co. Ltd., Zhejiang Yangfan New Materials Co. Ltd. |